See more : Burtech Acquisition Corp. (BRKHW) Income Statement Analysis – Financial Results

Complete financial analysis of Barnes Group Inc. (B) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barnes Group Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- WAAREE RENEWABLE TECHNOLOGIES (WAAREERTL.BO) Income Statement Analysis – Financial Results

- GEOSTR Corporation (5282.T) Income Statement Analysis – Financial Results

- Nvni Group Limited Warrants (NVNIW) Income Statement Analysis – Financial Results

- Modern Times Group MTG AB (publ) (MTG-A.ST) Income Statement Analysis – Financial Results

- WisdomTree Battery Metals ETC (AMPS.L) Income Statement Analysis – Financial Results

Barnes Group Inc. (B)

About Barnes Group Inc.

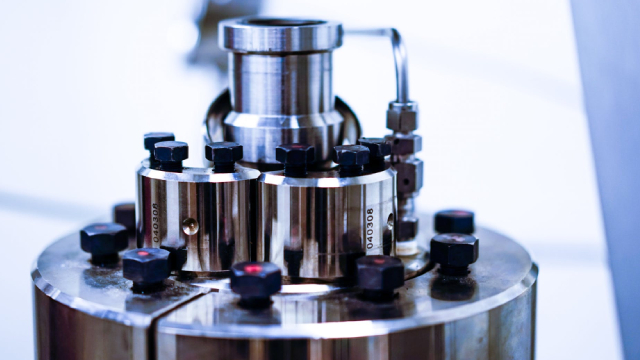

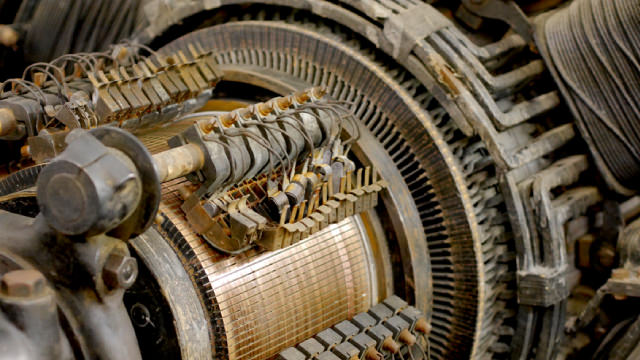

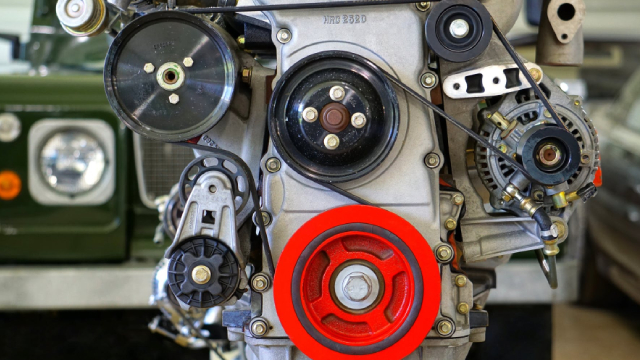

Barnes Group Inc. provides engineered products, industrial technologies, and solutions in the United States and internationally. It operates in two segments: Industrial and Aerospace. The Industrial segment offers precision components, products, and systems used by various customers in end-markets, such as mobility, industrial equipment, automation, personal care, packaging, electronics, and medical devices. This segment also designs and manufactures hot runner systems, mold cavity sensors and process control systems, and precision high cavitation mold assemblies for injection molding applications; provides force and motion control solutions for various metal forming and other industrial markets; and designs and develops robotic grippers, end-of-arm tooling systems, sensors, and other automation components for intelligent robotic handling solutions and industrial automation applications. In addition, it manufactures and supplies precision mechanical products, including mechanical springs, and high-precision punched and fine-blanked components used in transportation and industrial applications. This segment sells its products primarily through its direct sales force and distribution channels. The Aerospace segment produces fabricated and precision machined components and assemblies for turbine engines; and nacelles and structures for commercial and defense-related aircraft. It also provides aircraft engine component maintenance, repair, and overhaul services for turbine engine manufacturers, commercial airlines, and defense market; and manufactures and delivers aerospace aftermarket spare parts. This segment serves original equipment manufacturing industry. Barnes Group Inc. was founded in 1857 and is headquartered in Bristol, Connecticut.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.45B | 1.26B | 1.26B | 1.12B | 1.49B | 1.50B | 1.44B | 1.23B | 1.19B | 1.26B | 1.09B | 1.23B | 1.17B | 1.13B | 1.03B | 1.36B | 1.44B | 1.26B | 1.10B | 994.71M | 890.82M | 784.04M | 768.82M | 740.03M | 622.40M | 651.20M | 642.70M | 595.00M | 592.50M | 569.20M | 502.30M | 529.10M | 535.70M | 545.90M | 511.20M | 496.10M | 458.00M | 439.70M | 431.80M |

| Cost of Revenue | 1.01B | 840.00M | 803.85M | 721.24M | 944.15M | 963.52M | 939.29M | 790.30M | 782.82M | 829.65M | 738.17M | 812.19M | 772.40M | 724.04M | 671.11M | 847.64M | 892.69M | 797.47M | 705.49M | 654.57M | 576.84M | 530.00M | 519.54M | 452.76M | 394.30M | 407.50M | 398.50M | 358.10M | 355.40M | 342.80M | 300.90M | 312.30M | 314.20M | 322.90M | 302.10M | 293.80M | 264.20M | 254.60M | 251.80M |

| Gross Profit | 442.09M | 421.87M | 455.00M | 403.15M | 546.96M | 532.37M | 497.21M | 440.46M | 411.16M | 432.36M | 353.40M | 417.77M | 396.96M | 409.16M | 363.05M | 514.45M | 546.82M | 462.18M | 396.69M | 340.14M | 313.98M | 254.03M | 249.29M | 287.27M | 228.10M | 243.70M | 244.20M | 236.90M | 237.10M | 226.40M | 201.40M | 216.80M | 221.50M | 223.00M | 209.10M | 202.30M | 193.80M | 185.10M | 180.00M |

| Gross Profit Ratio | 30.47% | 33.43% | 36.14% | 35.86% | 36.68% | 35.59% | 34.61% | 35.79% | 34.44% | 34.26% | 32.38% | 33.97% | 33.95% | 36.11% | 35.11% | 37.77% | 37.99% | 36.69% | 35.99% | 34.19% | 35.25% | 32.40% | 32.42% | 38.82% | 36.65% | 37.42% | 38.00% | 39.82% | 40.02% | 39.78% | 40.10% | 40.98% | 41.35% | 40.85% | 40.90% | 40.78% | 42.31% | 42.10% | 41.69% |

| Research & Development | 13.92M | 15.77M | 22.93M | 16.95M | 15.67M | 16.19M | 14.77M | 12.91M | 12.69M | 15.78M | 14.71M | 8.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 295.18M | 286.72M | 246.08M | 239.99M | 252.38M | 226.55M | 278.83M | 269.40M | 322.63M | 302.53M | 366.51M | 394.44M | 345.15M | 309.99M | 284.22M | 261.98M | 209.19M | 208.97M | 188.45M | 152.20M | 160.00M | 150.30M | 155.00M | 161.60M | 166.10M | 165.80M | 185.80M | 160.30M | 159.70M | 156.90M | 141.90M | 133.20M | 127.60M | 125.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.42M | 210.00K | 2.19M | 2.77M | 0.00 | 3.64M | 2.38M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 353.09M | 296.56M | 304.98M | 279.78M | 310.52M | 300.60M | 286.93M | 248.28M | 242.76M | 252.38M | 230.20M | 281.21M | 269.40M | 322.63M | 302.53M | 366.51M | 394.44M | 345.15M | 309.99M | 284.22M | 261.98M | 209.19M | 208.97M | 188.45M | 152.20M | 160.00M | 150.30M | 155.00M | 161.60M | 166.10M | 165.80M | 185.80M | 160.30M | 159.70M | 156.90M | 141.90M | 133.20M | 127.60M | 125.70M |

| Other Expenses | 0.00 | -4.31M | -5.99M | -5.93M | -8.98M | -7.43M | -8.00K | 2.33M | 248.00K | -2.08M | -2.54M | -2.67M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 270.25M | 35.87M | 30.60M | 28.40M | 28.10M | 26.60M | 26.80M | 23.70M | 23.10M | 23.70M | 23.20M | 22.00M | 18.20M | 16.60M | 15.50M | 14.50M | 13.50M |

| Operating Expenses | 353.09M | 296.56M | 304.98M | 279.78M | 310.52M | 300.60M | 286.93M | 248.28M | 242.76M | 252.38M | 230.20M | 281.21M | 269.40M | 322.63M | 302.53M | 366.51M | 394.44M | 345.15M | 309.99M | 284.22M | 261.98M | 209.19M | 479.22M | 224.32M | 182.80M | 188.40M | 178.40M | 181.60M | 188.40M | 189.80M | 188.90M | 209.50M | 183.50M | 181.70M | 175.10M | 158.50M | 148.70M | 142.10M | 139.20M |

| Cost & Expenses | 1.36B | 1.14B | 1.11B | 1.00B | 1.25B | 1.26B | 1.23B | 1.04B | 1.03B | 1.08B | 968.37M | 1.09B | 1.04B | 1.05B | 973.64M | 1.21B | 1.29B | 1.14B | 1.02B | 938.80M | 838.82M | 739.20M | 998.75M | 677.08M | 577.10M | 595.90M | 576.90M | 539.70M | 543.80M | 532.60M | 489.80M | 521.80M | 497.70M | 504.60M | 477.20M | 452.30M | 412.90M | 396.70M | 391.00M |

| Interest Income | 0.00 | 14.62M | 16.21M | 15.94M | 20.63M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 30.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 58.17M | 14.62M | 16.21M | 15.94M | 20.63M | 16.84M | 14.57M | 11.88M | 10.70M | 11.39M | 13.09M | 12.24M | 10.27M | 20.01M | 22.60M | 19.52M | 25.14B | 23.69B | 17.55B | 15.39B | 15.84B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 115.82M | 104.67M | 104.53M | 100.50M | 99.05M | 94.13M | 89.91M | 80.15M | 78.24M | 81.40M | 65.05M | 57.36M | 58.90M | 52.77M | 57.41M | 52.40M | 50.61M | 42.23M | 34.86M | 34.18M | 34.57M | 33.63M | 37.05M | 35.87M | 30.60M | 28.40M | 28.10M | 26.60M | 26.80M | 23.70M | 23.10M | 23.70M | 23.20M | 22.00M | 18.20M | 16.60M | 15.50M | 14.50M | 13.50M |

| EBITDA | 207.25M | 158.12M | 246.71M | 216.62M | 326.87M | 318.19M | 299.63M | 274.52M | 253.61M | 267.37M | 202.39M | 191.25M | 186.06M | 136.82M | 114.03M | 198.02M | 202.91M | 159.37M | 112.24M | 84.61M | 86.41M | 78.47M | 26.00K | 98.82M | 75.90M | 83.70M | 93.90M | 81.90M | 75.50M | 60.30M | 35.60M | 31.00M | 61.20M | 63.30M | 52.20M | 60.40M | 60.60M | 57.50M | 54.30M |

| EBITDA Ratio | 14.28% | 16.89% | 18.68% | 18.24% | 21.90% | 21.30% | 20.91% | 22.32% | 20.68% | 20.55% | 17.01% | 15.55% | 15.95% | 12.29% | 7.31% | 10.86% | 14.11% | 12.65% | 10.18% | 8.97% | 9.47% | 9.61% | -25.00% | 13.25% | 11.63% | 12.32% | 14.05% | 13.43% | 12.42% | 10.17% | 6.89% | 4.54% | 11.46% | 11.78% | 10.35% | 12.54% | 14.24% | 13.26% | 12.64% |

| Operating Income | 88.99M | 121.00M | 150.02M | 123.37M | 236.45M | 231.76M | 210.28M | 192.18M | 168.40M | 179.97M | 123.20M | 136.56M | 127.56M | 86.53M | 60.52M | 147.94M | 152.37M | 117.04M | 86.70M | 55.91M | 52.00M | 44.84M | 40.32M | 62.95M | 45.30M | 55.30M | 65.80M | 55.30M | 48.70M | 36.60M | 12.50M | 7.30M | 38.00M | 41.30M | 34.00M | 43.80M | 45.10M | 43.00M | 40.80M |

| Operating Income Ratio | 6.13% | 9.59% | 11.92% | 10.97% | 15.86% | 15.49% | 14.64% | 15.61% | 14.10% | 14.26% | 11.29% | 11.10% | 10.91% | 7.64% | 5.85% | 10.86% | 10.59% | 9.29% | 7.87% | 5.62% | 5.84% | 5.72% | 5.24% | 8.51% | 7.28% | 8.49% | 10.24% | 9.29% | 8.22% | 6.43% | 2.49% | 1.38% | 7.09% | 7.57% | 6.65% | 8.83% | 9.85% | 9.78% | 9.45% |

| Total Other Income/Expenses | -55.73M | -18.93M | -22.20M | -21.88M | -29.60M | -24.27M | -10.75M | -11.68M | -10.45M | -13.47M | -15.63M | -14.91M | -10.67M | -22.49M | -20.57M | -21.84M | -25.22M | -23.79M | -8.23M | -14.56M | -13.47M | -11.73M | -16.86M | -14.36M | -2.60M | -600.00K | -1.30M | -3.00M | -3.20M | -2.70M | -4.10M | 300.00K | -9.20M | -11.30M | -10.90M | -10.70M | -10.60M | -7.70M | -7.20M |

| Income Before Tax | 33.26M | 38.19M | 127.82M | 101.50M | 206.84M | 207.50M | 195.70M | 182.62M | 157.95M | 166.50M | 107.57M | 121.65M | 116.89M | 64.04M | 39.95M | 126.10M | 127.16M | 93.24M | 78.46M | 41.36M | 38.37M | 33.11M | 23.46M | 48.59M | 42.70M | 54.70M | 64.50M | 52.30M | 45.50M | 33.90M | 8.40M | 7.60M | 28.80M | 30.00M | 23.10M | 33.10M | 34.50M | 35.30M | 33.60M |

| Income Before Tax Ratio | 2.29% | 3.03% | 10.15% | 9.03% | 13.87% | 13.87% | 13.62% | 14.84% | 13.23% | 13.19% | 9.86% | 9.89% | 10.00% | 5.65% | 3.86% | 9.26% | 8.83% | 7.40% | 7.12% | 4.16% | 4.31% | 4.22% | 3.05% | 6.57% | 6.86% | 8.40% | 10.04% | 8.79% | 7.68% | 5.96% | 1.67% | 1.44% | 5.38% | 5.50% | 4.52% | 6.67% | 7.53% | 8.03% | 7.78% |

| Income Tax Expense | 17.27M | 24.71M | 27.94M | 38.12M | 48.49M | 41.31M | 136.28M | 47.02M | 36.57M | 45.96M | 35.25M | 23.35M | 25.32M | 10.76M | 945.00K | 29.01M | 25.82M | 19.40M | 17.55M | 7.96M | 5.35M | 5.96M | 4.34M | 12.93M | 14.10M | 20.20M | 24.10M | 19.70M | 18.00M | 13.60M | 4.00M | 1.80M | 12.90M | 13.20M | 10.70M | 14.30M | 16.70M | 18.70M | 17.20M |

| Net Income | 16.00M | 13.48M | 99.87M | 63.38M | 158.35M | 166.19M | 59.42M | 135.60M | 121.38M | 118.37M | 270.53M | 95.25M | 64.72M | 53.28M | 39.00M | 86.98M | 101.34M | 73.85M | 60.52M | 33.40M | 33.02M | 27.15M | 19.12M | 35.67M | 28.60M | 34.50M | 40.40M | 32.60M | 27.50M | 20.30M | 4.40M | -34.90M | 15.90M | 16.80M | 12.40M | 18.80M | 17.80M | 16.60M | 12.10M |

| Net Income Ratio | 1.10% | 1.07% | 7.93% | 5.64% | 10.62% | 11.11% | 4.14% | 11.02% | 10.17% | 9.38% | 24.78% | 7.74% | 5.53% | 4.70% | 3.77% | 6.39% | 7.04% | 5.86% | 5.49% | 3.36% | 3.71% | 3.46% | 2.49% | 4.82% | 4.60% | 5.30% | 6.29% | 5.48% | 4.64% | 3.57% | 0.88% | -6.60% | 2.97% | 3.08% | 2.43% | 3.79% | 3.89% | 3.78% | 2.80% |

| EPS | 0.31 | 0.26 | 1.96 | 1.25 | 3.09 | 3.18 | 1.10 | 2.50 | 2.21 | 2.16 | 5.02 | 1.74 | 1.17 | 0.96 | 0.72 | 1.61 | 1.90 | 1.46 | 1.15 | 0.65 | 0.68 | 0.73 | 0.52 | 0.96 | 0.74 | 0.86 | 1.00 | 0.82 | 0.70 | 0.53 | 0.12 | -0.94 | 0.44 | 0.46 | 0.33 | 0.51 | 0.47 | 0.43 | 0.28 |

| EPS Diluted | 0.31 | 0.26 | 1.96 | 1.24 | 3.07 | 3.15 | 1.09 | 2.48 | 2.19 | 2.12 | 4.92 | 1.72 | 1.16 | 0.95 | 0.72 | 1.56 | 1.76 | 1.39 | 1.10 | 0.63 | 0.66 | 0.71 | 0.51 | 0.95 | 0.73 | 0.85 | 0.98 | 0.82 | 0.70 | 0.53 | 0.12 | -0.94 | 0.44 | 0.46 | 0.33 | 0.51 | 0.47 | 0.43 | 0.28 |

| Weighted Avg Shares Out | 51.05M | 50.96M | 50.93M | 50.88M | 51.21M | 52.30M | 54.07M | 54.19M | 55.03M | 54.79M | 53.86M | 54.63M | 55.21M | 55.26M | 53.88M | 53.99M | 53.30M | 50.70M | 47.20M | 46.21M | 42.95M | 37.50M | 37.01M | 37.14M | 38.84M | 40.19M | 40.40M | 39.85M | 39.28M | 38.12M | 38.26M | 37.33M | 36.55M | 36.52M | 34.15M | 32.75M | 38.06M | 38.60M | 43.21M |

| Weighted Avg Shares Out (Dil) | 51.21M | 51.08M | 51.08M | 51.10M | 51.63M | 52.83M | 54.61M | 54.63M | 55.51M | 55.72M | 54.97M | 55.22M | 55.93M | 55.93M | 54.21M | 55.81M | 57.53M | 52.94M | 49.02M | 47.94M | 44.21M | 38.37M | 37.86M | 37.54M | 39.18M | 40.83M | 41.22M | 40.34M | 39.28M | 38.12M | 38.26M | 37.33M | 36.55M | 36.52M | 34.15M | 32.75M | 38.06M | 38.60M | 43.21M |

SHAREHOLDER INVESTIGATION: Johnson Fistel Investigates the Merger of Barnes Group Inc – B

Barnes & Noble Education: A Maturing Turnaround Story

Here's Why You Should Avoid Investing in Barnes Stock Right Now

Barnes & Noble Education Continues its Strong Expansion of First Day® Affordable Access Programs

North Carolina A&T Returns to Barnes & Noble College to Manage its Campus Bookstore

Barnes & Noble College Announces Strategic Partnership with Syracuse University

Barnes & Noble Education Reports Second Quarter Preliminary Fiscal Year 2025 Unaudited Financial Results

International Markets and Barnes Group (B): A Deep Dive for Investors

B2Gold Announces Appointment of Greg Barnes and Basie Maree to its Board of Directors

Barnes Group's Q3 Earnings Miss Estimates, Sales Rise Y/Y

Source: https://incomestatements.info

Category: Stock Reports