See more : Affirm Holdings, Inc. (AFRM) Income Statement Analysis – Financial Results

Complete financial analysis of CDK Global, Inc. (CDK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of CDK Global, Inc., a leading company in the Software – Application industry within the Technology sector.

- Ballard Power Systems Inc. (BLDP.TO) Income Statement Analysis – Financial Results

- Winsan (Chengdu) Medical Science and Technology Co., Ltd. (600767.SS) Income Statement Analysis – Financial Results

- Fuji Corporation (6134.T) Income Statement Analysis – Financial Results

- Rimoni Industries Ltd. (RIMO.TA) Income Statement Analysis – Financial Results

- Bullpen Parlay Acquisition Company (BPACU) Income Statement Analysis – Financial Results

CDK Global, Inc. (CDK)

About CDK Global, Inc.

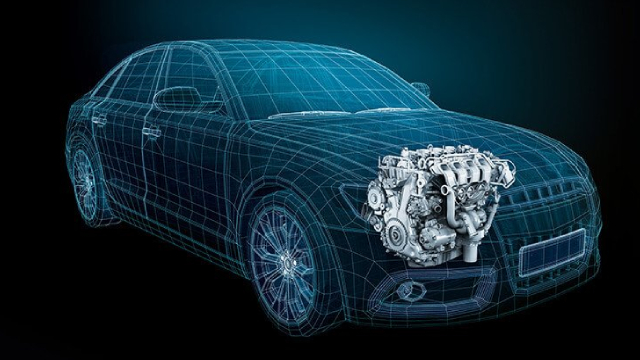

CDK Global, Inc., together with its subsidiaries, provides integrated data and technology solutions to the automotive, heavy truck, recreation, and heavy equipment industries in the United States and internationally. It offers subscription-based software and technology solutions to automotive retailers, as well as to retailers and manufacturers of heavy trucks, construction and agricultural equipment, motorcycles, boats, and other marine and recreational vehicles. The company's flagship Dealer Management System provides software solutions that facilitates the sale of new and used vehicles, consumer financing, repair and maintenance services, and vehicle and parts inventory management. It also provides a portfolio of layered software applications and services to address the needs of automotive retail workflows. In addition, the company offers data management and business intelligence solutions to automotive retailers and original equipment manufacturers through its Neuron intelligent data platform. Further, it offers professional services, custom programming, consulting, implementation, and training solutions, as well as customer support solutions. The company serves approximately 15,000 retail locations. CDK Global, Inc. was incorporated in 2014 and is headquartered in Hoffman Estates, Illinois.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.67B | 1.96B | 1.91B | 2.27B | 2.22B | 2.11B | 2.06B | 1.97B | 1.84B | 1.70B | 1.56B |

| Cost of Revenue | 875.00M | 966.50M | 899.80M | 1.18B | 1.23B | 1.24B | 1.27B | 1.20B | 1.10B | 1.02B | 943.30M |

| Gross Profit | 798.20M | 993.60M | 1.02B | 1.09B | 985.30M | 871.20M | 790.30M | 772.10M | 736.60M | 674.70M | 620.30M |

| Gross Profit Ratio | 47.70% | 50.69% | 53.01% | 48.00% | 44.38% | 41.20% | 38.30% | 39.12% | 40.05% | 39.77% | 39.67% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 444.70M | 475.80M | 477.70M | 448.50M | 431.10M | 419.40M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 444.70M | 475.80M | 477.70M | 448.50M | 431.10M | 419.40M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 360.90M | 429.90M | 90.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 422.90M | 423.70M | 396.00M |

| Operating Expenses | 360.90M | 429.90M | 534.70M | 475.80M | 477.70M | 448.50M | 431.10M | 419.40M | 422.90M | 423.70M | 396.00M |

| Cost & Expenses | 1.24B | 1.40B | 1.43B | 1.66B | 1.71B | 1.69B | 1.70B | 1.62B | 1.53B | 1.45B | 1.34B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.30M | 2.40M | 3.10M | 2.60M |

| Interest Expense | 124.60M | 144.30M | 139.10M | 95.90M | 57.20M | 40.20M | 28.80M | 1.00M | 900.00K | 1.00M | 900.00K |

| Depreciation & Amortization | 98.70M | 99.60M | 89.80M | 79.10M | 70.30M | 64.00M | 76.50M | 67.90M | 63.60M | 59.90M | 59.60M |

| EBITDA | 1.35B | 571.80M | 415.10M | 679.10M | 555.90M | 465.80M | 397.30M | 412.50M | 378.90M | 313.50M | 285.50M |

| EBITDA Ratio | 80.81% | 29.17% | 21.68% | 29.87% | 25.04% | 22.03% | 19.25% | 20.90% | 20.60% | 18.48% | 18.26% |

| Operating Income | 425.30M | 549.50M | 452.30M | 594.50M | 489.20M | 402.50M | 322.20M | 352.70M | 313.70M | 251.00M | 224.30M |

| Operating Income Ratio | 25.42% | 28.03% | 23.62% | 26.15% | 22.03% | 19.03% | 15.61% | 17.87% | 17.06% | 14.80% | 14.35% |

| Total Other Income/Expenses | -140.60M | -125.30M | -148.40M | -82.50M | -53.90M | -33.40M | -22.30M | -9.10M | 700.00K | 1.60M | 700.00K |

| Income Before Tax | 284.70M | 424.20M | 303.90M | 512.00M | 435.30M | 369.10M | 299.90M | 343.60M | 314.40M | 252.60M | 225.00M |

| Income Before Tax Ratio | 17.02% | 21.64% | 15.87% | 22.52% | 19.61% | 17.45% | 14.53% | 17.41% | 17.09% | 14.89% | 14.39% |

| Income Tax Expense | 94.50M | 120.40M | 62.20M | 123.30M | 132.80M | 122.30M | 113.60M | 116.70M | 115.00M | 91.80M | 90.00M |

| Net Income | 1.03B | 207.50M | 124.00M | 380.80M | 295.60M | 239.30M | 178.40M | 226.90M | 199.40M | 160.80M | 135.00M |

| Net Income Ratio | 61.82% | 10.59% | 6.48% | 16.75% | 13.31% | 11.32% | 8.65% | 11.50% | 10.84% | 9.48% | 8.63% |

| EPS | 8.44 | 1.70 | 0.98 | 2.78 | 2.01 | 1.52 | 1.11 | 1.42 | 1.24 | 1.00 | 0.84 |

| EPS Diluted | 8.44 | 1.70 | 0.98 | 2.78 | 1.99 | 1.51 | 1.10 | 1.42 | 1.24 | 1.00 | 0.84 |

| Weighted Avg Shares Out | 122.60M | 122.10M | 126.40M | 136.80M | 146.70M | 157.00M | 160.60M | 160.26M | 160.26M | 160.26M | 160.26M |

| Weighted Avg Shares Out (Dil) | 122.60M | 122.10M | 126.40M | 136.80M | 148.20M | 158.00M | 161.60M | 160.26M | 160.26M | 160.26M | 160.26M |

Asbury Automotive Wins Preliminary Injunction Against CDK Global LLC

CDK Extends Relationship With Sonic Automotive

Asbury Automotive Group: Looking Past The CDK Outage

CDK Expects to Have Hacked Systems Restored by July 4

CDK Global says some U.S. car dealerships are back up after last week's cyberattack

CDK Cyberattack Throws Auto Retailers Into Operational Chaos

Asbury Automotive Group Provides Update on Service Impacts Related to the CDK Cyber Incident

Group 1 Automotive says CDK cyberattack had disrupted business applications and processes at U.S. operations that rely on its systems

Group 1 Automotive Provides Statement on CDK Cybersecurity Incident

These Stocks Could Benefit From the CDK Cyberattack

Source: https://incomestatements.info

Category: Stock Reports