See more : Entertainment Network (India) Limited (ENIL.NS) Income Statement Analysis – Financial Results

Complete financial analysis of DermTech, Inc. (DMTK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of DermTech, Inc., a leading company in the Medical – Diagnostics & Research industry within the Healthcare sector.

- LabGenomics Co., Ltd. (084650.KQ) Income Statement Analysis – Financial Results

- Impel Pharmaceuticals Inc. (IMPL) Income Statement Analysis – Financial Results

- Jerónimo Martins, SGPS, S.A. (JRONF) Income Statement Analysis – Financial Results

- Halliburton Company (HAL.DE) Income Statement Analysis – Financial Results

- Investview, Inc. (INVU) Income Statement Analysis – Financial Results

DermTech, Inc. (DMTK)

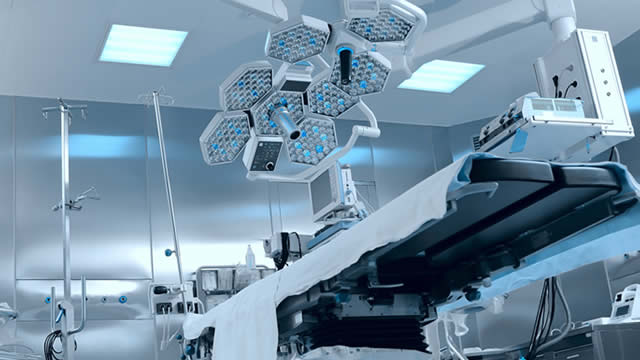

About DermTech, Inc.

DermTech, Inc., a molecular diagnostic company, develops and markets novel non-invasive genomics tests to diagnosis skin cancer, inflammatory diseases, and aging-related conditions in the United States. It offers DermTech Melanoma Test (DMT), a gene expression test that enhances early detection of genomic atypia and helps rule out melanoma and the need for a surgical biopsy of atypical pigmented lesions. The company also provides adhesive skin sample collection kits, as well as gene expression assays for the Th1, Th2, IFN-gamma, and Th17 inflammatory pathways. In addition, it is developing UV damage DNA risk assessment products, as well as non-melanoma skin cancer diagnostic and cutaneous T-cell lymphoma rule out test products, as well as offering health-related and information services through electronic information and telecommunication technologies. The company sells its products primarily to pathology and oncology practitioners. DermTech, Inc. is headquartered in La Jolla, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 15.30M | 14.52M | 11.84M | 5.89M | 3.36M | 0.00 | 0.00 |

| Cost of Revenue | 15.02M | 13.87M | 10.56M | 5.98M | 3.30M | 306.24K | 0.00 |

| Gross Profit | 276.00K | 647.00K | 1.27M | -96.00K | 60.00K | -306.24K | 0.00 |

| Gross Profit Ratio | 1.80% | 4.46% | 10.76% | -1.63% | 1.78% | 0.00% | 0.00% |

| Research & Development | 15.24M | 24.05M | 16.26M | 5.29M | 2.50M | 0.00 | 0.00 |

| General & Administrative | 43.78M | 36.09M | 24.84M | 13.82M | 8.87M | 0.00 | 0.00 |

| Selling & Marketing | 45.00M | 58.67M | 37.58M | 16.08M | 6.30M | 0.00 | 0.00 |

| SG&A | 88.78M | 94.76M | 62.41M | 29.90M | 15.17M | 0.00 | 0.00 |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | -355.00K | 306.24K | 60.00 |

| Operating Expenses | 104.02M | 118.81M | 78.67M | 35.19M | 17.67M | 306.24K | 60.00 |

| Cost & Expenses | 119.04M | 132.68M | 89.24M | 41.17M | 20.97M | 306.24K | 60.00 |

| Interest Income | 2.85M | 1.34M | 151.00K | 40.00K | 0.00 | 1.09M | 0.00 |

| Interest Expense | 0.00 | 1.34M | 0.00 | 40.00K | 2.66M | 0.00 | 0.00 |

| Depreciation & Amortization | 5.85M | -141.00K | 1.09M | 486.00K | -355.00K | 45.42K | 52.52K |

| EBITDA | -97.89M | -118.31M | -76.31M | -35.29M | -17.96M | -260.83K | -60.00 |

| EBITDA Ratio | -639.99% | -814.89% | -644.62% | -599.64% | -533.89% | 0.00% | 0.00% |

| Operating Income | -103.74M | -118.17M | -77.40M | -35.29M | -17.61M | -306.24K | -60.00 |

| Operating Income Ratio | -678.21% | -813.92% | -653.81% | -599.64% | -523.34% | 0.00% | 0.00% |

| Total Other Income/Expenses | 2.85M | 1.48M | -937.00K | -1.19M | -2.08M | 1.56M | 306.18K |

| Income Before Tax | -100.89M | -116.68M | -78.34M | -35.25M | -19.69M | 856.41K | -60.00 |

| Income Before Tax Ratio | -659.57% | -803.71% | -661.72% | -598.96% | -585.29% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -2.96M | -1.36M | -526.00K | 2.21M | -1.16M | 0.00 |

| Net Income | -100.89M | -113.72M | -76.98M | -34.72M | -21.90M | 856.41K | -60.00 |

| Net Income Ratio | -659.57% | -783.30% | -650.24% | -590.03% | -651.07% | 0.00% | 0.00% |

| EPS | -3.09 | -3.79 | -2.66 | -2.05 | -3.13 | 0.36 | 0.00 |

| EPS Diluted | -3.09 | -3.79 | -2.66 | -2.05 | -3.13 | 0.36 | 0.00 |

| Weighted Avg Shares Out | 32.64M | 30.04M | 28.88M | 16.98M | 7.01M | 2.36M | 1.82M |

| Weighted Avg Shares Out (Dil) | 32.64M | 30.04M | 28.88M | 16.98M | 7.01M | 2.36M | 8.07M |

Why Is DermTech (DMTK) Stock Down 26% Today?

Crude Oil Rises 1%; DermTech Shares Plummet

DermTech Files for Voluntary Chapter 11 Protection

DermTech Reports First-Quarter 2024 Financial Results

DermTech to Explore Strategic Alternatives and Implement Restructuring Plan

DermTech Presents Research Abstracts at the 2024 American Academy of Dermatology (AAD) Annual Meeting and New Research Published in the Journal of Investigative Dermatology

DermTech, Inc. (DMTK) Q4 2023 Earnings Call Transcript

DermTech, Inc. (DMTK) Reports Q4 Loss, Misses Revenue Estimates

DermTech Reports Fourth-Quarter 2023 Financial Results

DermTech Announces Release Date for Fourth-quarter 2023 Financial Results

Source: https://incomestatements.info

Category: Stock Reports