Complete financial analysis of Global Indemnity Limited SUB NT 47 (GBLIL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Global Indemnity Limited SUB NT 47, a leading company in the industry within the sector.

You may be interested

- Murata Manufacturing Co., Ltd. (MRAAY) Income Statement Analysis – Financial Results

- DMS Imaging SA (0RGO.L) Income Statement Analysis – Financial Results

- Sanritsu Corporation (9366.T) Income Statement Analysis – Financial Results

- FutureChem Co.,Ltd (220100.KQ) Income Statement Analysis – Financial Results

- Zane Interactive Publishing Inc. (ZNAE) Income Statement Analysis – Financial Results

Global Indemnity Limited SUB NT 47 (GBLIL)

| Metric | 2020 |

|---|---|

| Revenue | 583.55M |

| Cost of Revenue | 0.00 |

| Gross Profit | 583.55M |

| Gross Profit Ratio | 100.00% |

| Research & Development | 0.00 |

| General & Administrative | 0.00 |

| Selling & Marketing | 0.00 |

| SG&A | 0.00 |

| Other Expenses | 612.66M |

| Operating Expenses | 612.66M |

| Cost & Expenses | 612.66M |

| Interest Income | 0.00 |

| Interest Expense | -15.79M |

| Depreciation & Amortization | 7.03M |

| EBITDA | -37.88M |

| EBITDA Ratio | -6.49% |

| Operating Income | -29.11M |

| Operating Income Ratio | -4.99% |

| Total Other Income/Expenses | 0.00 |

| Income Before Tax | -29.11M |

| Income Before Tax Ratio | -4.99% |

| Income Tax Expense | -8.11M |

| Net Income | -21.01M |

| Net Income Ratio | -3.60% |

| EPS | -1.20 |

| EPS Diluted | -1.20 |

| Weighted Avg Shares Out | 17.56M |

| Weighted Avg Shares Out (Dil) | 17.56M |

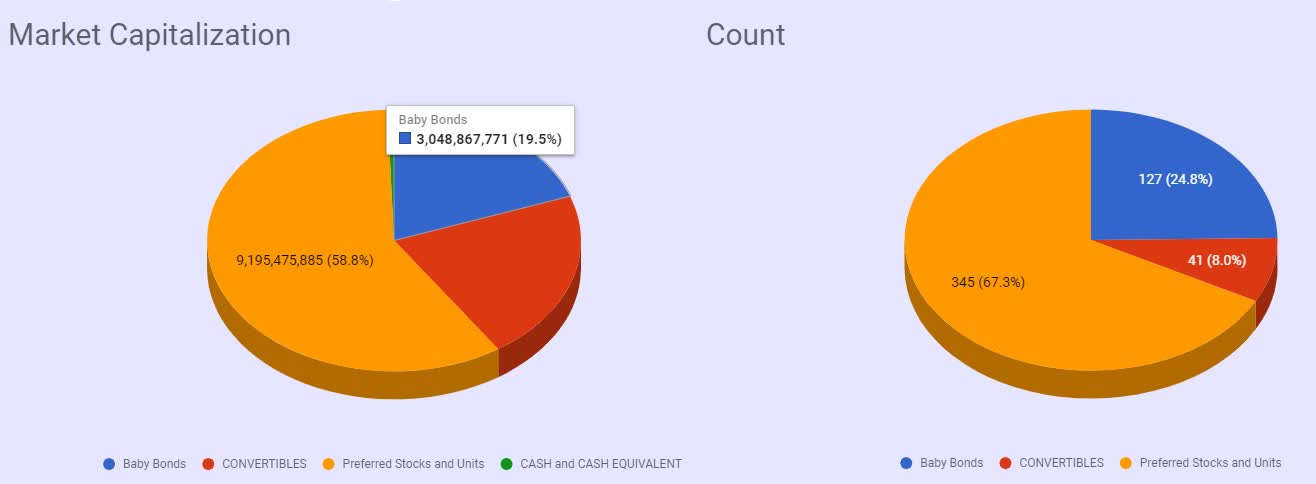

Baby Bonds Complete Review

A review of all baby bonds. All the baby bonds sorted in categories.

Source: https://incomestatements.info

Category: Stock Reports