See more : Kids Smile Holdings Inc. (7084.T) Income Statement Analysis – Financial Results

Complete financial analysis of Gelesis Holdings, Inc. (GLS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gelesis Holdings, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- SDCL EDGE Acquisition Corporation (SEDA-UN) Income Statement Analysis – Financial Results

- Shalag Industries Ltd (SALG.TA) Income Statement Analysis – Financial Results

- Bank of Montreal (BMO) Income Statement Analysis – Financial Results

- Carney Technology Acquisition Corp. II (CTAQ) Income Statement Analysis – Financial Results

- Gecoss Corporation (9991.T) Income Statement Analysis – Financial Results

Gelesis Holdings, Inc. (GLS)

About Gelesis Holdings, Inc.

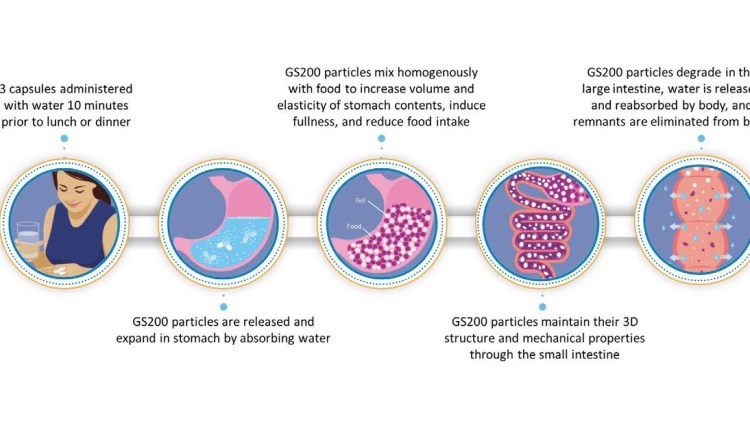

Gelesis Holdings Inc., a commercial stage biotherapeutics company, developing a biomimicry to treat the genesis of obesity and GI-related chronic diseases. The company also provides PLENITY, an orally administered, non-stimulant, and non-systemic aid for weight management. In addition, it offers a product for obesity and overweight and a pipeline with potential therapies for non-alcoholic fatty liver disease/non-alcoholic steatohepatitis, type 2 diabetes, and GS500 for Functional Constipation. Gelesis Holdings Inc. was incorporated in 2006 and is headquartered in Boston, Massachusetts.

| Metric | 2022 | 2021 |

|---|---|---|

| Revenue | 25.77M | 11.19M |

| Cost of Revenue | 27.56M | 9.98M |

| Gross Profit | -1.79M | 1.20M |

| Gross Profit Ratio | -6.95% | 10.75% |

| Research & Development | 18.61M | 12.87M |

| General & Administrative | 42.21M | 18.26M |

| Selling & Marketing | 56.92M | 52.78M |

| SG&A | 99.14M | 71.04M |

| Other Expenses | 2.27M | 2.27M |

| Operating Expenses | 120.02M | 86.18M |

| Cost & Expenses | 147.57M | 96.16M |

| Interest Income | 0.00 | 0.00 |

| Interest Expense | 991.00K | 1.36M |

| Depreciation & Amortization | 7.59M | 4.44M |

| EBITDA | -121.81M | -80.53M |

| EBITDA Ratio | -443.25% | -719.97% |

| Operating Income | -121.81M | -84.97M |

| Operating Income Ratio | -472.72% | -759.70% |

| Total Other Income/Expenses | 66.51M | -8.36M |

| Income Before Tax | -55.30M | -93.33M |

| Income Before Tax Ratio | -214.62% | -834.42% |

| Income Tax Expense | 480.00K | 17.00K |

| Net Income | -55.78M | -93.35M |

| Net Income Ratio | -216.48% | -834.57% |

| EPS | -0.79 | -16.34 |

| EPS Diluted | -0.79 | -16.34 |

| Weighted Avg Shares Out | 70.30M | 5.71M |

| Weighted Avg Shares Out (Dil) | 70.30M | 5.71M |

Royal Mail's sister business GLS to buy 20% stake in Greece's ACS for $80 million

Royal Mail, GLS need sizable investments soon, billionaire suitor Kretinsky says

Cell Reports Medicine Publication Demonstrates How Gelesis' Oral Therapeutic Hydrogel Promotes Weight Loss and Metabolic Health by Targeting the Gut-Liver Axis in Pre-Clinical Studies

Gelesis Holdings, Inc. (GLS) Q3 2022 Earnings Call Transcript

Gelesis Reports Third Quarter 2022 Results

Dr. Frank Greenway to Present Data from the LIGHT-UP Study with Gelesis' Oral Hydrogel Treatment GS200 at Obesity Week

Clinical Data from the LIGHT-UP Study Presented at the International Congress of Endocrinology Suggests New Gelesis Oral Hydrogel May Improve Insulin Sensitivity and Favorably Impact Metabolic Syndrome

Gelesis Holdings, Inc. (GLS) CEO Yishai Zohar on Q2 2022 Results - Earnings Call Transcript

Gelesis Reports Second Quarter 2022 Results

Gelesis Holdings' (GLS) CEO Yishai Zohar on Q1 2022 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports