See more : KebNi AB (publ) (KEBNI-B.ST) Income Statement Analysis – Financial Results

Complete financial analysis of Inflection Point Acquisition Corp. (IPAX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Inflection Point Acquisition Corp., a leading company in the Shell Companies industry within the Financial Services sector.

- PT Jakarta Setiabudi Internasional Tbk (JSPT.JK) Income Statement Analysis – Financial Results

- Beijing LongRuan Technologies Inc. (688078.SS) Income Statement Analysis – Financial Results

- Tattooed Chef, Inc. (TTCFQ) Income Statement Analysis – Financial Results

- Village Farms International, Inc. (VFF.TO) Income Statement Analysis – Financial Results

- Independent Tankers Corporation Limited (ITKSF) Income Statement Analysis – Financial Results

Inflection Point Acquisition Corp. (IPAX)

Industry: Shell Companies

Sector: Financial Services

Website: https://inflectionpointacquisition.com/home/default.aspx

About Inflection Point Acquisition Corp.

Inflection Point Acquisition Corp. does not have significant operations. It intends to effect a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses. The company was incorporated in 2021 and is based in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 79.52M | 85.95M | 72.55M | 44.26M |

| Cost of Revenue | 100.47M | 75.51M | 100.31M | 42.56M |

| Gross Profit | -20.95M | 10.43M | -27.76M | 1.70M |

| Gross Profit Ratio | -26.35% | 12.14% | -38.26% | 3.84% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 32.95M | 14.87M | 9.29M | 5.52M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 32.95M | 14.87M | 9.29M | 5.52M |

| Other Expenses | 2.34M | 1.07M | 840.00K | 578.00K |

| Operating Expenses | 35.29M | 15.94M | 10.13M | 6.09M |

| Cost & Expenses | 135.76M | 91.45M | 110.44M | 48.65M |

| Interest Income | 0.00 | 4.83M | 0.00 | 73.00K |

| Interest Expense | 823.00K | 836.00K | 224.00K | 0.00 |

| Depreciation & Amortization | 32.58M | 44.37M | 840.00K | 578.00K |

| EBITDA | 48.46M | 38.78M | -37.05M | -3.82M |

| EBITDA Ratio | 60.94% | -5.15% | -50.88% | -8.62% |

| Operating Income | -56.24M | -5.51M | -37.89M | -4.39M |

| Operating Income Ratio | -70.72% | -6.41% | -52.22% | -9.93% |

| Total Other Income/Expenses | 71.30M | -921.00K | 2.24M | 73.00K |

| Income Before Tax | 15.06M | -6.43M | -35.65M | -4.32M |

| Income Before Tax Ratio | 18.94% | -7.48% | -49.13% | -9.76% |

| Income Tax Expense | 40.00K | -23.00K | 2.00K | 8.00K |

| Net Income | 62.80M | -6.41M | -35.65M | -4.33M |

| Net Income Ratio | 78.98% | -7.45% | -49.14% | -9.78% |

| EPS | 3.43 | -0.05 | -1.97 | -0.24 |

| EPS Diluted | 2.37 | -0.05 | -1.97 | -0.24 |

| Weighted Avg Shares Out | 17.65M | 18.07M | 18.07M | 18.07M |

| Weighted Avg Shares Out (Dil) | 25.56M | 18.07M | 18.07M | 18.07M |

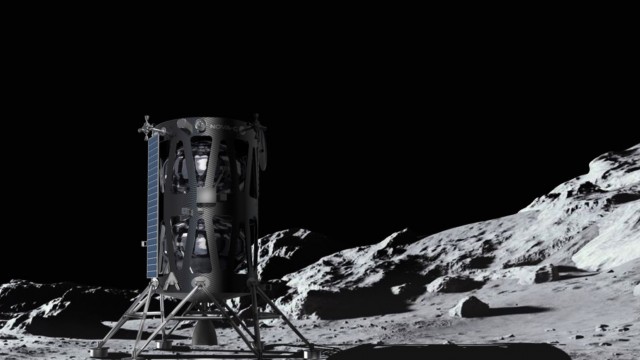

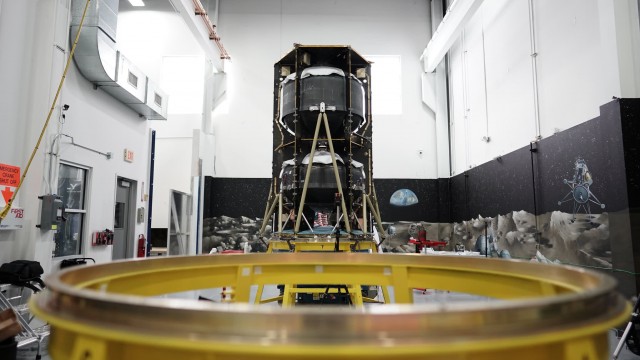

Space SPAC Intuitive Machines Just Went Public: Should You Buy In?

Intuitive Machines (LUNR) Stock Skyrockets 160% Following SPAC Merger

Intuitive Machines stock skyrockets, has tripled in 3 days after SPAC merger completed

Intuitive Machines' post-SPAC war chest depleted by shareholder redemptions

Intuitive Machines Teams with Jacobs to Support NASA JETS II Contract

Space Tech Startup Intuitive Machines Shoots for the Stars With IPO

Intuitive Machines to go public in SPAC deal

Lunar tech company Intuitive Machines to go public via SPAC at near $1 billion valuation

Intuitive Machines to go public as a space exploration company after merger with SPAC Inflection Point Acquisition

Intuitive Machines, a Leading Space Exploration Company, to List on Nasdaq Through Merger with Inflection Point Acquisition Corp.

Source: https://incomestatements.info

Category: Stock Reports