See more : Franklin Street Properties Corp. (FSP) Income Statement Analysis – Financial Results

Complete financial analysis of Li-FT Power Ltd. (LIFFF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Li-FT Power Ltd., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Jiayuan International Group Limited (2768.HK) Income Statement Analysis – Financial Results

- People’s United Financial, Inc. (PBCTP) Income Statement Analysis – Financial Results

- Al Kathiri Holding Company (3008.SR) Income Statement Analysis – Financial Results

- Crossroads Impact Corp. (CRSS) Income Statement Analysis – Financial Results

- Gores Technology Partners II, Inc. (GTPBW) Income Statement Analysis – Financial Results

Li-FT Power Ltd. (LIFFF)

About Li-FT Power Ltd.

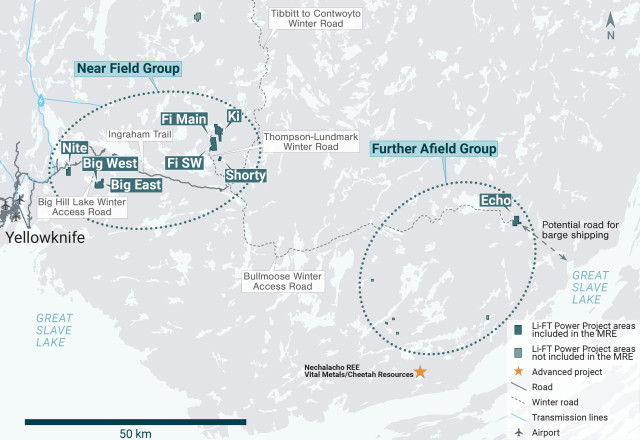

Li-FT Power Ltd., a mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada. The company primarily explores for lithium. The company's principal property is the Yellowknife Lithium Project located in Northwest Territories, Canada. It also holds three early-stage exploration properties in Quebec, Canada; and the Cali Project in Northwest Territories within the Little Nahanni Pegmatite Field. The company was incorporated in 2021 and is headquartered in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 |

|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 52.00K | 0.00 | 0.00 |

| Gross Profit | -52.00K | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.70M | 547.62K | 87.40K |

| Selling & Marketing | 1.14M | 206.47K | -9.75K |

| SG&A | 2.84M | 754.09K | 77.65K |

| Other Expenses | 1.21M | 0.00 | 0.00 |

| Operating Expenses | 4.05M | 754.09K | 77.65K |

| Cost & Expenses | 4.05M | 754.09K | 77.65K |

| Interest Income | 1.06M | 15.60K | 0.00 |

| Interest Expense | 266.00K | 740.00 | 0.00 |

| Depreciation & Amortization | 52.00K | 753.00K | 155.30K |

| EBITDA | -2.84M | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% |

| Operating Income | -4.05M | -754.09K | -77.65K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 778.00K | 15.50K | 348.00 |

| Income Before Tax | -3.27M | -738.50K | -77.30K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -6.82M | -753.00K | -155.30K |

| Net Income | 3.55M | -738.50K | -77.30K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% |

| EPS | 0.10 | -0.04 | 0.00 |

| EPS Diluted | 0.10 | -0.04 | 0.00 |

| Weighted Avg Shares Out | 36.23M | 18.47M | 17.54M |

| Weighted Avg Shares Out (Dil) | 36.23M | 18.47M | 17.54M |

LIFT Files NI 43-101 Technical Report on the Yellowknife Lithium Project, NWT, Canada

Lift Announces the Closing of Its Strategic $21.3 Million Private Placement

Li-FT Power: Transportation Costs Could Make Or Break The Economic Viability Of The Yellowknife Project

Lift Announces a Strategic $21.3 Million Private Placement

LIFT Announces Initial Mineral Resource of 50.4 Million Tonnes at 1.00% Li2O, at the Yellowknife Lithium Project, NWT, Canada

LIFT reports laboratory metallurgical recoveries averaging 79% producing a high-quality spodumene concentrate grading 5.83% Li2O at the Yellowknife Lithium Project

LIFT quadruples the size of the Cali Property through staking

Infinity Stone Ventures to sell Shorty West lithium claim to Li-FT Power

LIFT To Acquire Shorty West Lithium Claim

LIFT intersects 25 m at 1.21% Li2O at its Shorty pegmatite, Yellowknife Lithium Project, NWT

Source: https://incomestatements.info

Category: Stock Reports