See more : Douglas AG (DOU.F) Income Statement Analysis – Financial Results

Complete financial analysis of Lumentum Holdings Inc. (LITE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lumentum Holdings Inc., a leading company in the Communication Equipment industry within the Technology sector.

- PrairieSky Royalty Ltd. (PSK.TO) Income Statement Analysis – Financial Results

- TRADE WORKS Co., Ltd (3997.T) Income Statement Analysis – Financial Results

- AgileThought, Inc. (AGILW) Income Statement Analysis – Financial Results

- Tungkong Inc. (002117.SZ) Income Statement Analysis – Financial Results

- Brompton Lifeco Split Corp. (LCS.TO) Income Statement Analysis – Financial Results

Lumentum Holdings Inc. (LITE)

About Lumentum Holdings Inc.

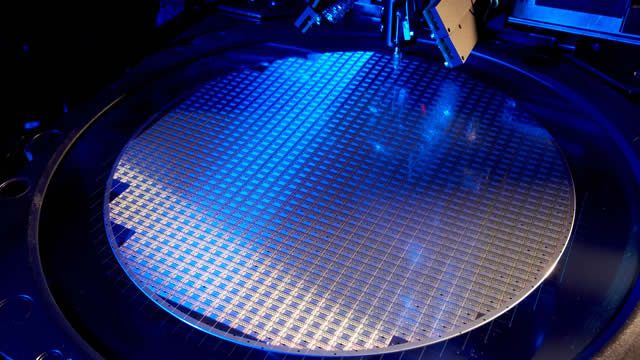

Lumentum Holdings Inc. manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates in two segments, Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables. It offers tunable transponders, transceivers, and transmitter modules; tunable lasers, receivers, and modulators; transport products, such as reconfigurable optical add/drop multiplexers, amplifiers, and optical channel monitors, as well as components, including 980nm, multi-mode, and Raman pumps; and switches, attenuators, photodetectors, gain flattening filters, isolators, wavelength-division multiplexing filters, arrayed waveguide gratings, multiplex/de-multiplexers, and integrated passive modules. This segment also provides Super Transport Blade, which integrates optical transport functions into a single-slot blade; vertical-cavity surface-emitting lasers; directly modulated and electro-absorption modulated lasers; and laser illumination sources for 3D sensing systems. It serves customers in telecommunications, data communications, and consumer and industrial markets. The Commercial Lasers segment offers diode-pumped solid-state, fiber, diode, direct-diode, and gas lasers for use in original equipment manufacturer applications. It serves customers in markets and applications, such as sheet metal processing, general manufacturing, biotechnology, graphics and imaging, remote sensing, and precision machining. Lumentum Holdings Inc. was incorporated in 2015 and is headquartered in San Jose, California.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.36B | 1.77B | 1.71B | 1.74B | 1.68B | 1.57B | 1.25B | 1.00B | 903.00M | 837.10M | 817.90M | 769.90M | 727.90M |

| Cost of Revenue | 1.11B | 1.20B | 924.00M | 959.70M | 1.03B | 1.14B | 815.60M | 683.50M | 625.70M | 579.20M | 561.30M | 547.10M | 523.00M |

| Gross Profit | 251.50M | 569.00M | 788.60M | 783.10M | 650.20M | 425.90M | 432.10M | 318.10M | 277.30M | 257.90M | 256.60M | 222.80M | 204.90M |

| Gross Profit Ratio | 18.50% | 32.20% | 46.05% | 44.93% | 38.73% | 27.21% | 34.63% | 31.76% | 30.71% | 30.81% | 31.37% | 28.94% | 28.15% |

| Research & Development | 302.20M | 307.80M | 220.70M | 214.50M | 198.60M | 184.60M | 156.80M | 148.30M | 141.10M | 140.80M | 134.90M | 113.70M | 107.00M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 310.70M | 348.80M | 265.70M | 241.40M | 235.20M | 200.30M | 128.20M | 110.20M | 117.30M | 128.90M | 108.20M | 102.60M | 101.60M |

| Other Expenses | 72.60M | 48.80M | 12.00M | 2.80M | 31.40M | 2.50M | 300.00K | 1.70M | -200.00K | -100.00K | -300.00K | -300.00K | 400.00K |

| Operating Expenses | 685.50M | 656.60M | 486.40M | 455.90M | 433.80M | 384.90M | 285.00M | 258.50M | 258.40M | 269.70M | 243.10M | 216.30M | 208.60M |

| Cost & Expenses | 1.79B | 1.85B | 1.41B | 1.42B | 1.46B | 1.52B | 1.10B | 942.00M | 884.10M | 848.90M | 804.40M | 763.40M | 731.60M |

| Interest Income | 61.30M | 40.80M | 6.10M | 5.70M | 15.80M | 13.90M | 8.50M | 1.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 33.80M | 35.50M | 80.20M | 66.70M | 61.20M | 36.30M | 18.20M | 5.50M | 100.00K | 700.00K | 200.00K | 1.00M | 900.00K |

| Depreciation & Amortization | 290.30M | 234.30M | 167.10M | 177.10M | 191.90M | 157.50M | 77.20M | 61.00M | 54.60M | 51.00M | 44.80M | 46.00M | 42.00M |

| EBITDA | -110.70M | 167.40M | 482.40M | 706.90M | 419.40M | 160.50M | 224.80M | 6.70M | 64.30M | 27.20M | 54.80M | 50.70M | 38.70M |

| EBITDA Ratio | -8.14% | -2.20% | 18.35% | 18.94% | 14.76% | 6.06% | 12.43% | 17.55% | 2.98% | 4.67% | 7.09% | 6.78% | 5.32% |

| Operating Income | -434.00M | -115.70M | 147.10M | 152.90M | 55.90M | -62.70M | 139.90M | 47.60M | 11.50M | -23.40M | 8.70M | 3.90M | -4.50M |

| Operating Income Ratio | -31.93% | -6.55% | 8.59% | 8.77% | 3.33% | -4.01% | 11.21% | 4.75% | 1.27% | -2.80% | 1.06% | 0.51% | -0.62% |

| Total Other Income/Expenses | 28.30M | 13.30M | -68.20M | -63.90M | -66.00M | -11.70M | -10.50M | -107.40M | -1.80M | -1.10M | -3.70M | -200.00K | 8.50M |

| Income Before Tax | -405.70M | -102.40M | 235.10M | 463.10M | 174.30M | -33.30M | 129.40M | -59.80M | 9.70M | -24.50M | 9.80M | 3.70M | 4.00M |

| Income Before Tax Ratio | -29.85% | -5.80% | 13.73% | 26.57% | 10.38% | -2.13% | 10.37% | -5.97% | 1.07% | -2.93% | 1.20% | 0.48% | 0.55% |

| Income Tax Expense | 140.80M | 29.20M | 36.20M | 65.80M | 38.80M | 3.10M | -118.70M | 42.70M | 400.00K | -21.10M | -900.00K | -2.80M | 1.40M |

| Net Income | -546.50M | -131.60M | 198.90M | 397.30M | 135.50M | -36.40M | 248.10M | -102.50M | 9.30M | -3.40M | 10.70M | 6.50M | 2.60M |

| Net Income Ratio | -40.21% | -7.45% | 11.61% | 22.80% | 8.07% | -2.33% | 19.88% | -10.23% | 1.03% | -0.41% | 1.31% | 0.84% | 0.36% |

| EPS | -8.12 | -1.93 | 2.79 | 5.27 | 1.79 | -0.51 | 3.98 | -1.70 | -0.05 | -0.06 | 0.18 | 0.11 | 0.04 |

| EPS Diluted | -8.12 | -1.93 | 2.68 | 5.07 | 1.75 | -0.51 | 3.92 | -1.69 | -0.05 | -0.06 | 0.18 | 0.11 | 0.04 |

| Weighted Avg Shares Out | 67.30M | 68.30M | 71.20M | 75.40M | 75.90M | 70.70M | 62.30M | 60.47M | 59.10M | 56.67M | 58.00M | 58.00M | 58.00M |

| Weighted Avg Shares Out (Dil) | 67.30M | 68.30M | 74.20M | 78.40M | 77.60M | 70.70M | 63.30M | 60.60M | 61.20M | 58.41M | 58.00M | 58.00M | 58.00M |

Hunting For Magnificent Growth Next Year? Check Out These 7 Stocks.

OMNI-LITE INDUSTRIES ANNOUNCES DEBT REPAYMENT FROM CALIFORNIA NANOTECHNOLOGIES

Lumentum Stock, AAOI Drive Telecom-Fiber Optics Group Rebound

Lumentum Analysts Increase Their Forecasts Following Upbeat Earnings

3 Takeaways From Lumentum's Q1 Report (Reaffirm Buy Rating)

Lumentum Holdings Inc. (LITE) Q3 2024 Earnings Call Transcript

Lumentum (LITE) Beats Q1 Earnings and Revenue Estimates

OMNI-LITE INDUSTRIES REPORTS THIRD QUARTER AND YEAR-TO-DATE FISCAL 2024 RESULTS

Lumentum Releases Fiscal 2024 Corporate Sustainability Report

Lumentum Holdings Inc (LITE) Shares Up 5.2% on Oct 2

Source: https://incomestatements.info

Category: Stock Reports