See more : Centum Electronics Limited (CENTUM.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Mitsubishi Heavy Industries, Ltd. (MHVYF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Mitsubishi Heavy Industries, Ltd., a leading company in the Industrial – Machinery industry within the Industrials sector.

- OptiCept Technologies AB (publ) (OPTZF) Income Statement Analysis – Financial Results

- Beijing Sanyuan Foods Co., Ltd. (600429.SS) Income Statement Analysis – Financial Results

- Fonciere Atland (FATL.PA) Income Statement Analysis – Financial Results

- Global Partners LP (GLP-PA) Income Statement Analysis – Financial Results

- Falcon Oil & Gas Ltd. (FOG.L) Income Statement Analysis – Financial Results

Mitsubishi Heavy Industries, Ltd. (MHVYF)

About Mitsubishi Heavy Industries, Ltd.

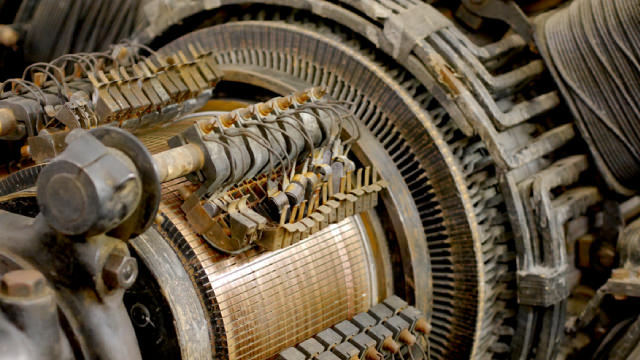

Mitsubishi Heavy Industries, Ltd. manufactures and sells heavy machinery worldwide. It operates through Energy Systems; Plants & Infrastructure Systems; Logistics, Thermal & Drive Systems; and Aircraft, Defense & Space segments. The company offers thermal, renewable energy, nuclear power generation, and engine power plants; oil and gas production plants; lithium-ion battery products and fuel cells; civil aircrafts and engines, aviation equipment, and maintenance, repair, and overhaul of aircrafts; and launch vehicles and services, rocket engines, reaction control systems, space stations, rocket launchers, rocket engine combustion test facilities, and electronic parts. It also provides passenger and commercial ships, LNG and LPG carriers, special purpose vessels, and IT services and systems; marine machineries, boilers, turbines, engines, and structures; and intelligent transport systems products and solutions, such as electronic toll collection system, road user charging system, highway traffic management system, EV management system, and development system. In addition, the company offers organic solvent exhaust gas treatment system, waste-to-energy system, sludge treatment system, air quality control system, and bio-treatment system; turbochargers, car air-conditioning and refrigeration systems, rubber and tire machinery, and testing equipment; forklift trucks; and printing, paper converting, and metals, and food & packaging machinery, pumps, compressors & mechanical turbines, hydraulic components. Further, it provides gas holders, vibration control systems, water pipes, tunnel excavation machinery, and cybersecurity solutions for industrial control systems; special vehicles, naval ship and maritime systems, defense aircrafts, helicopters, defense aeroengines, and guided weapon systems; CO2 capture plants; and after-sales services. The company was founded in 1884 and is headquartered in Tokyo, Japan.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4,657.15B | 4,202.80B | 3,860.28B | 3,699.95B | 4,041.38B | 4,078.34B | 4,085.68B | 3,914.02B | 4,046.81B | 3,992.11B | 3,349.60B | 2,817.89B | 2,820.93B | 2,903.77B | 2,940.89B | 3,375.67B | 3,203.09B | 3,068.50B | 2,792.11B | 2,590.73B | 2,373.44B | 2,593.89B | 2,863.99B | 3,045.02B | 2,875.04B |

| Cost of Revenue | 3,727.03B | 3,462.39B | 3,226.67B | 3,150.34B | 3,368.72B | 3,344.19B | 3,280.43B | 3,180.90B | 3,184.60B | 3,161.16B | 2,695.90B | 2,297.07B | 2,375.16B | 2,461.86B | 2,537.26B | 2,945.34B | 2,753.95B | 2,681.87B | 2,460.82B | 2,300.90B | 2,041.25B | 2,203.90B | 2,494.49B | 2,707.84B | 2,624.91B |

| Gross Profit | 930.11B | 740.41B | 633.61B | 549.60B | 672.66B | 734.15B | 805.25B | 733.12B | 862.21B | 830.95B | 653.70B | 520.82B | 445.77B | 441.91B | 403.63B | 430.33B | 449.13B | 386.64B | 331.29B | 289.84B | 332.20B | 389.99B | 369.50B | 337.18B | 250.13B |

| Gross Profit Ratio | 19.97% | 17.62% | 16.41% | 14.85% | 16.64% | 18.00% | 19.71% | 18.73% | 21.31% | 20.81% | 19.52% | 18.48% | 15.80% | 15.22% | 13.72% | 12.75% | 14.02% | 12.60% | 11.87% | 11.19% | 14.00% | 15.04% | 12.90% | 11.07% | 8.70% |

| Research & Development | 77.64B | 75.29B | 72.07B | 68.38B | 73.67B | 59.82B | 176.82B | 106.73B | 89.03B | 77.54B | 64.62B | 56.54B | 48.95B | 58.91B | 61.13B | 54.87B | 46.80B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 497.88B | 623.64B | 556.73B | 531.38B | 583.87B | 538.21B | 545.07B | 429.39B | 419.99B | 415.78B | 348.16B | 268.93B | 124.21B | 120.93B | 123.19B | 121.49B | 115.92B | 277.72B | 260.38B | 275.07B | 265.57B | 274.68B | 290.84B | 262.29B | 273.93B |

| Selling & Marketing | 52.79B | 53.04B | 50.61B | 50.17B | 52.69B | 51.44B | 51.37B | 46.46B | 43.68B | 41.50B | 34.80B | 31.83B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 550.67B | 523.74B | 462.36B | 429.12B | 472.83B | 443.55B | 454.89B | 475.85B | 463.68B | 457.27B | 382.96B | 300.76B | 124.21B | 120.93B | 123.19B | 121.49B | 115.92B | 277.72B | 260.38B | 275.07B | 265.57B | 274.68B | 290.84B | 262.29B | 273.93B |

| Other Expenses | 67.04B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.22B | -9.97B | -10.03B | -12.27B | -11.69B | -9.09B | -7.28B | -6.91B | -20.18B | -8.13B | -10.75B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 695.34B | 599.03B | 534.43B | 497.50B | 546.49B | 503.37B | 631.71B | 582.58B | 552.71B | 534.81B | 447.58B | 357.30B | 333.81B | 182.63B | 191.54B | 178.65B | 167.16B | 277.73B | 260.38B | 275.07B | 265.57B | 274.68B | 290.84B | 262.29B | 273.93B |

| Cost & Expenses | 4,422.38B | 4,061.42B | 3,761.10B | 3,647.85B | 3,915.21B | 3,847.56B | 3,912.13B | 3,763.47B | 3,737.30B | 3,695.97B | 3,143.48B | 2,654.37B | 2,708.97B | 2,644.49B | 2,728.80B | 3,123.99B | 2,921.11B | 2,959.59B | 2,721.20B | 2,575.96B | 2,306.81B | 2,478.59B | 2,785.33B | 2,970.14B | 2,898.84B |

| Interest Income | 49.95B | 10.36B | 5.71B | 5.39B | 7.06B | 5.23B | 4.16B | 3.80B | 6.60B | 7.32B | 3.48B | 2.72B | 3.64B | 4.03B | 3.65B | 5.58B | 7.07B | 13.00B | 13.80B | 9.91B | 10.46B | 13.44B | 16.55B | 20.08B | 21.24B |

| Interest Expense | 17.30B | 25.54B | 14.82B | 11.56B | 13.03B | 10.95B | 9.92B | 11.46B | 13.34B | 15.37B | 15.63B | 17.26B | 20.52B | 22.47B | 22.63B | 20.22B | 20.29B | 17.81B | 15.77B | 15.50B | 16.79B | 21.84B | 25.96B | 27.79B | 28.85B |

| Depreciation & Amortization | 155.90B | 148.55B | 135.79B | 238.26B | 144.64B | 135.66B | 173.74B | 189.33B | 170.12B | 168.95B | 140.76B | 119.49B | 123.96B | 132.16B | 138.05B | 152.99B | 128.26B | 106.61B | 100.81B | 99.18B | 99.82B | 97.02B | 95.96B | 99.35B | 105.87B |

| EBITDA | 418.65B | 328.86B | 247.50B | 265.06B | 306.05B | 411.01B | 347.29B | 339.87B | 479.63B | 465.09B | 346.88B | 292.20B | 236.39B | 194.13B | 188.81B | 238.14B | 249.92B | 208.13B | 168.96B | 131.08B | 166.73B | 236.41B | 169.95B | 122.02B | -82.96B |

| EBITDA Ratio | 8.99% | 6.90% | 6.09% | 7.85% | 6.70% | 8.99% | 8.50% | 8.68% | 11.85% | 12.09% | 14.36% | 10.30% | 8.38% | 13.11% | 11.26% | 11.68% | 12.61% | 7.73% | 6.72% | 5.77% | 7.71% | 9.11% | 6.97% | 5.02% | 7.02% |

| Operating Income | 234.77B | 141.38B | 99.19B | 52.10B | 126.16B | 230.78B | 173.55B | 150.54B | 309.51B | 296.14B | 206.12B | 163.52B | 111.96B | 101.22B | 65.66B | 105.86B | 136.03B | 108.91B | 70.91B | 14.77B | 66.63B | 115.31B | 78.66B | 74.89B | -23.80B |

| Operating Income Ratio | 5.04% | 3.36% | 2.57% | 1.41% | 3.12% | 5.66% | 4.25% | 3.85% | 7.65% | 7.42% | 6.15% | 5.80% | 3.97% | 3.49% | 2.23% | 3.14% | 4.25% | 3.55% | 2.54% | 0.57% | 2.81% | 4.45% | 2.75% | 2.46% | -0.83% |

| Total Other Income/Expenses | 80.42B | -15.70B | 13.44B | -4.73B | -158.82B | -5.51B | -134.31B | 19.17B | -176.82B | -63.44B | 8.30B | -8.07B | -42.13B | -61.72B | -37.52B | -40.94B | -34.66B | -25.20B | -18.53B | 1.63B | -16.51B | -49.15B | -30.63B | -80.01B | -193.88B |

| Income Before Tax | 315.19B | 177.62B | 156.82B | 34.20B | -32.66B | 195.06B | 39.23B | 169.72B | 132.68B | 232.70B | 214.42B | 155.45B | 69.83B | 39.50B | 28.14B | 64.92B | 101.38B | 83.71B | 52.38B | 16.40B | 50.12B | 66.16B | 48.03B | -5.12B | -217.67B |

| Income Before Tax Ratio | 6.77% | 4.23% | 4.06% | 0.92% | -0.81% | 4.78% | 0.96% | 4.34% | 3.28% | 5.83% | 6.40% | 5.52% | 2.48% | 1.36% | 0.96% | 1.92% | 3.16% | 2.73% | 1.88% | 0.63% | 2.11% | 2.55% | 1.68% | -0.17% | -7.57% |

| Income Tax Expense | 71.62B | 44.82B | 48.03B | 6.15B | -139.95B | 57.67B | 22.64B | 64.44B | 56.03B | 101.14B | 49.44B | 59.14B | 45.18B | 10.48B | 18.23B | 41.06B | 38.28B | 36.25B | 21.17B | 11.47B | 27.71B | 31.70B | 20.93B | 14.16B | -81.20B |

| Net Income | 222.02B | 130.45B | 113.54B | 40.64B | 87.12B | 110.27B | -7.32B | 87.72B | 63.83B | 110.41B | 160.43B | 97.33B | 24.54B | 30.12B | 14.16B | 24.22B | 61.33B | 48.84B | 29.82B | 4.05B | 21.79B | 34.33B | 26.45B | -20.35B | -137.01B |

| Net Income Ratio | 4.77% | 3.10% | 2.94% | 1.10% | 2.16% | 2.70% | -0.18% | 2.24% | 1.58% | 2.77% | 4.79% | 3.45% | 0.87% | 1.04% | 0.48% | 0.72% | 1.91% | 1.59% | 1.07% | 0.16% | 0.92% | 1.32% | 0.92% | -0.67% | -4.77% |

| EPS | 66.04 | 38.84 | 33.82 | 12.09 | 25.94 | 328.52 | -21.79 | 261.24 | 190.20 | 329.00 | 478.10 | 290.10 | 73.10 | 73.10 | 42.20 | 72.20 | 182.80 | 142.60 | 88.50 | 12.00 | 64.60 | 101.40 | 78.40 | -60.30 | -406.20 |

| EPS Diluted | 66.05 | 38.83 | 33.81 | 12.08 | 25.91 | 328.01 | -21.75 | 260.71 | 189.70 | 328.20 | 477.10 | 289.50 | 73.00 | 73.10 | 42.20 | 72.10 | 182.70 | 142.60 | 88.30 | 12.00 | 64.60 | 101.40 | 78.20 | -60.30 | -406.20 |

| Weighted Avg Shares Out | 3.36B | 3.36B | 3.36B | 3.36B | 3.36B | 335.66M | 335.93M | 335.78M | 335.68M | 335.56M | 335.53M | 335.51M | 335.51M | 335.51M | 335.62M | 335.61M | 335.59M | 342.49M | 336.92M | 337.50M | 337.26M | 338.57M | 337.33M | 337.50M | 337.29M |

| Weighted Avg Shares Out (Dil) | 3.36B | 3.36B | 3.36B | 3.36B | 3.36B | 336.18M | 336.54M | 336.46M | 336.44M | 336.42M | 336.26M | 336.20M | 336.16M | 335.51M | 335.62M | 335.88M | 335.70M | 342.49M | 337.68M | 337.50M | 337.26M | 338.57M | 338.20M | 337.50M | 337.29M |

Mitsubishi Heavy Industries Reinvents Growth For A Sustainable Future

Are Industrial Products Stocks Lagging Mitsubishi Heavy Industries (MHVYF) This Year?

Mitsubishi Heavy Industries, Ltd. (MHVYF) Q2 2025 Earnings Call Transcript

Mitsubishi Heavy Industries discusses its role in Indonesia's energy transition

Pockets Of Value On The Long Side Despite Markets Sitting Near All-Time Highs

Recent Price Trend in Mitsubishi Heavy Industries (MHVYF) is Your Friend, Here's Why

Mitsubishi Heavy Industries (MHVYF) Is a Great Choice for 'Trend' Investors, Here's Why

Mitsubishi Heavy Industries, Ltd (MHVYF) Q1 2024 Earnings Call Transcript

Is Mitsubishi Heavy Industries (MHVYF) Stock Undervalued Right Now?

Here's Why Momentum in Mitsubishi Heavy Industries (MHVYF) Should Keep going

Source: https://incomestatements.info

Category: Stock Reports