See more : Verano Holdings Corp. (VRNOF) Income Statement Analysis – Financial Results

Complete financial analysis of Metromile, Inc. (MILE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Metromile, Inc., a leading company in the Insurance – Property & Casualty industry within the Financial Services sector.

- GFL Environmental Inc. (GFLU) Income Statement Analysis – Financial Results

- HomeTrust Bancshares, Inc. (HTBI) Income Statement Analysis – Financial Results

- Time Technoplast Limited (TIMETECHNO.BO) Income Statement Analysis – Financial Results

- Ikonisys S.A. (ALIKO.PA) Income Statement Analysis – Financial Results

- Leef Brands Inc. (ICAN.CN) Income Statement Analysis – Financial Results

Metromile, Inc. (MILE)

Industry: Insurance - Property & Casualty

Sector: Financial Services

Website: https://www.metromile.com

About Metromile, Inc.

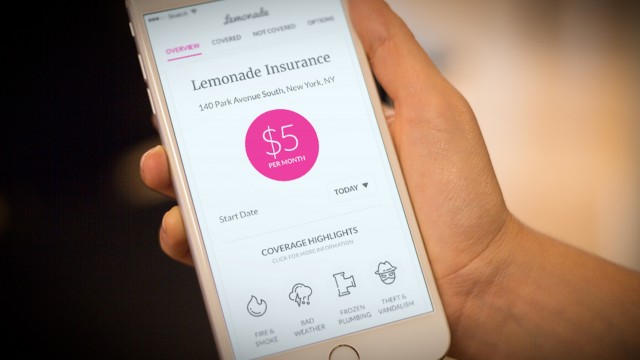

Metromile, Inc. provides insurance policies for automobile owners in the United States. It operates through two segments, Insurance Services and Enterprise Business Solutions. The company offers pay-per-mile auto insurance policies. It also provides The Pulse, a device that plugs into the diagnostic port of its customer's car and transmits data, such as miles driven, driving habits, phone use, speeding, hard braking, accelerating, cornering, and location over wireless cellular networks. In addition, the company offers access to its technology under software as a service arrangement, as well as professional services to third-party customers. Metromile, Inc. was founded in 2011 and is headquartered in San Francisco, California. As of July 28, 2022, Metromile, Inc. operates as a subsidiary of Lemonade, Inc..

| Metric | 2021 | 2020 | 2019 |

|---|---|---|---|

| Revenue | 102.30M | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 |

| Gross Profit | 102.30M | 0.00 | 0.00 |

| Gross Profit Ratio | 100.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 102.99M | 0.00 | 0.00 |

| SG&A | 102.99M | 0.00 | 0.00 |

| Other Expenses | -405.78M | -571.09K | -976.00 |

| Operating Expenses | -302.79M | -571.09K | -976.00 |

| Cost & Expenses | 318.76M | 571.09K | 976.00 |

| Interest Income | 0.00 | 7.18K | 0.00 |

| Interest Expense | 15.97M | 0.00 | 0.00 |

| Depreciation & Amortization | 17.22M | 206.30K | 171.86K |

| EBITDA | -183.26M | -571.09K | -976.00 |

| EBITDA Ratio | -179.14% | 0.00% | 0.00% |

| Operating Income | -200.49M | -571.09K | -976.00 |

| Operating Income Ratio | -195.98% | 0.00% | 0.00% |

| Total Other Income/Expenses | -15.97M | 0.00 | 0.00 |

| Income Before Tax | -216.46M | -571.09K | -976.00 |

| Income Before Tax Ratio | -211.59% | 0.00% | 0.00% |

| Income Tax Expense | 15.97M | 0.00 | 0.00 |

| Net Income | -232.43M | -571.09K | -976.00 |

| Net Income Ratio | -227.21% | 0.00% | 0.00% |

| EPS | -1.83 | -0.06 | 0.00 |

| EPS Diluted | -1.83 | -0.06 | 0.00 |

| Weighted Avg Shares Out | 126.69M | 8.89M | 126.73M |

| Weighted Avg Shares Out (Dil) | 126.69M | 8.89M | 126.73M |

Embedded Insurance Industry Worth Over $700 Billion by 2029 - Lemonade, Metromile, Slice, Hippo, and Root Insurance Dominate the Competitive Landscape

Motto Mortgage Franchisees Honored at Annual National Awards Ceremony

Lemonade Sells Metromile Enterprise Business Solutions Platform

Lemonade closes on acquisition of insurtech Metromile, promptly lays off about 20% of its staff

Metromile, Inc. (MILE) Reports Q1 Loss, Tops Revenue Estimates

Here's What Metromile Can Do for Lemonade

Check These 3 Penny Stocks For Your Watchlist This Week

Why Are Lemonade and Metromile Plunging on Monday?

What's the Deal With Lemonade's Acquisition of Metromile?

SPACs in 2021: From Boom to Bust

Source: https://incomestatements.info

Category: Stock Reports