See more : Sambu Engineering & Construction Co., Ltd (001470.KS) Income Statement Analysis – Financial Results

Complete financial analysis of Pond Technologies Holdings Inc. (PNDHF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Pond Technologies Holdings Inc., a leading company in the Agricultural Farm Products industry within the Consumer Defensive sector.

- Zhejiang Taimei Med Tech Co (2576.HK) Income Statement Analysis – Financial Results

- Vortex Metals Inc. (VMSSF) Income Statement Analysis – Financial Results

- Shanxi Huayang New Material Co.,Ltd. (600281.SS) Income Statement Analysis – Financial Results

- Maj Invest Globale Obligationer (MAJGO.CO) Income Statement Analysis – Financial Results

- Stratasys Ltd. (SSYS) Income Statement Analysis – Financial Results

Pond Technologies Holdings Inc. (PNDHF)

About Pond Technologies Holdings Inc.

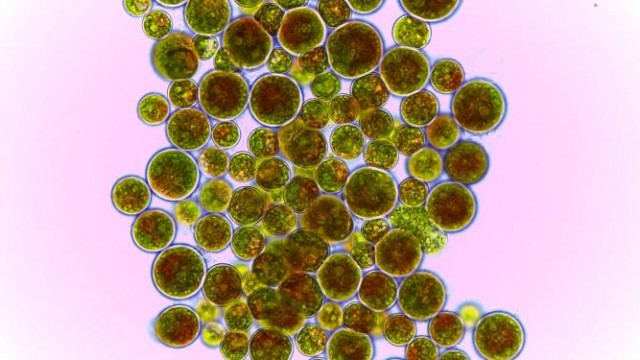

Pond Technologies Holdings Inc. engages in the cultivation of microalgal biomass using available sources of carbon dioxide (CO2) rich emission sources from industrial plants in Canada. Its resultant algae are used in the supply of nutraceuticals, aquaculture, and animal feeds, as well as algae strains for the expression of complex proteins used in diagnostics and therapeutic treatments, and other algae derived product markets. The company also licenses its technology. Pond Technologies Holdings Inc. is headquartered in Markham, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.55M | 5.14M | 5.13M | 4.80M | 6.14M | 3.54M | 2.52M | 1.73M | 3.34M | 1.43M | 1.59M | 2.05M | 7.83M | 10.94M | 9.39M | 17.97M | 9.03M | 2.71M | 493.62K | 389.52K | 120.32K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 3.55M | 3.87M | 3.69M | 3.83M | 4.97M | 2.74M | 1.75M | 1.35M | 1.26M | 226.00K | 418.00K | 527.00K | 2.45M | 2.30M | 3.66M | 7.79M | 3.41M | 1.41M | 211.36K | 61.93K | 20.45K | 0.00 | 0.00 | 0.00 |

| Gross Profit | 993.00K | 1.27M | 1.44M | 970.00K | 1.17M | 798.27K | 765.00K | 379.00K | 2.09M | 1.20M | 1.17M | 1.53M | 5.38M | 8.63M | 5.73M | 10.18M | 5.62M | 1.30M | 282.25K | 327.60K | 99.87K | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 21.84% | 24.63% | 28.05% | 20.21% | 19.04% | 22.55% | 30.42% | 21.89% | 62.37% | 84.18% | 73.71% | 74.33% | 68.67% | 78.94% | 60.99% | 56.66% | 62.25% | 48.00% | 57.18% | 84.10% | 83.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 3.43M | 3.91M | 4.40M | 3.25M | 5.21M | 4.66M | 716.00K | 427.00K | 688.00K | 473.00K | 949.00K | 1.58M | 2.92M | 2.38M | 1.72M | 1.87M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 25.00K | 69.00K | 55.00K | 70.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.46M | 3.98M | 4.40M | 3.25M | 5.21M | 4.66M | 716.00K | 427.00K | 688.00K | 473.00K | 949.00K | 1.58M | 2.92M | 2.38M | 1.72M | 1.87M | 2.12M | 844.09K | 417.79K | 150.20K | 56.98K | 115.70K | 204.86K | 76.68K |

| Other Expenses | 766.00K | -17.00K | 0.00 | 0.00 | 300.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 4.22M | 5.13M | 4.98M | 3.81M | 6.11M | 5.47M | 1.52M | 1.02M | 3.35M | 1.28M | 1.85M | 3.38M | 4.46M | 9.65M | 7.27M | 7.38M | 6.39M | 2.30M | 464.56K | 235.73K | 104.84K | 116.75K | 206.29K | 77.51K |

| Cost & Expenses | 7.77M | 9.01M | 8.67M | 7.64M | 11.08M | 8.21M | 3.27M | 2.37M | 4.61M | 1.50M | 2.27M | 3.91M | 6.91M | 11.95M | 10.93M | 15.16M | 9.80M | 3.71M | 675.92K | 297.66K | 125.30K | 116.75K | 206.29K | 77.51K |

| Interest Income | 0.00 | 555.00K | 1.00K | 25.00K | 9.91K | 49.03K | 25.00K | 18.00K | 0.00 | 0.00 | -7.00K | -5.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.06K |

| Interest Expense | 575.00K | 555.00K | 843.00K | 818.00K | 444.36K | 591.71K | 600.16K | 3.00K | 0.00 | 0.00 | 247.00K | 375.00K | 739.00K | 725.00K | 440.00K | 544.00K | 308.34K | 11.52K | 0.00 | 0.00 | 0.00 | 0.00 | 83.00 | 149.00 |

| Depreciation & Amortization | 559.00K | 556.00K | 579.00K | 558.00K | 515.00K | 863.03K | 360.82K | 593.00K | 1.48M | 473.00K | 898.00K | 1.71M | 1.50M | 5.36M | 5.55M | 5.51M | 4.26M | 1.46M | 46.76K | 85.52K | 47.86K | 1.05K | 1.44K | 830.00 |

| EBITDA | -2.34M | -3.35M | -3.10M | -2.77M | -7.75M | -3.92M | -1.89M | -48.00K | -912.16K | 635.00K | 223.00K | -42.00K | 2.42M | 4.39M | 4.01M | 8.31M | 3.51M | 456.54K | -135.54K | 177.39K | 42.89K | -115.70K | -204.86K | -76.68K |

| EBITDA Ratio | -51.47% | -65.06% | -58.02% | -47.75% | -61.39% | -106.12% | 172.56% | 43.27% | 198.95% | 44.44% | 13.58% | -7.26% | 30.87% | 39.76% | 42.64% | 46.25% | 38.73% | 16.85% | -27.46% | 45.54% | 35.65% | 0.00% | 0.00% | 0.00% |

| Operating Income | -3.23M | -3.87M | -3.66M | -3.32M | -8.92M | -4.67M | 3.60M | 638.00K | 1.26M | 72.00K | 2.13M | 1.86M | 913.00K | 1.02M | -1.54M | 2.80M | 762.86K | 1.00M | 182.30K | 91.87K | 4.98K | -116.75K | 206.29K | 77.51K |

| Operating Income Ratio | -71.01% | -75.27% | -71.24% | -69.17% | -145.35% | -131.88% | 143.22% | 36.86% | 37.78% | 5.04% | 133.84% | 90.36% | 11.66% | 9.29% | -16.42% | 15.60% | 8.45% | 37.05% | 36.93% | 23.58% | 4.13% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -246.00K | -586.00K | -863.00K | -826.00K | -855.12K | -704.77K | -600.04K | -2.06M | -8.95M | -365.00K | -4.51M | -3.98M | -214.00K | -4.50M | -440.00K | -544.00K | -1.83M | -1.96M | -307.72K | -88.18K | -4.98K | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -3.47M | -4.46M | -4.52M | -4.15M | -9.09M | -5.37M | -5.09M | -1.42M | -7.69M | -293.00K | -2.38M | -2.12M | 699.00K | -1.74M | -1.98M | 2.26M | -1.06M | -958.07K | -125.41K | 3.68K | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -76.42% | -86.67% | -88.06% | -86.38% | -148.18% | -151.79% | -202.54% | -82.03% | -230.00% | -20.50% | -149.81% | -103.41% | 8.93% | -15.92% | -21.10% | 12.57% | -11.77% | -35.36% | -25.41% | 0.95% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 539.00K | 822.00K | 2.82M | -3.50M | 542.68K | 1.03M | -384.00K | -1.97M | -72.00K | -669.00K | -1.23M | 482.00K | -500.00K | -487.00K | 672.00K | -250.98K | -225.25K | -460.89K | 0.00 | 0.00 | 27.55K | 83.00 | -1.91K |

| Net Income | -3.47M | -4.46M | -5.07M | -6.62M | -9.09M | -5.37M | -6.12M | -1.04M | -5.72M | -221.00K | -1.71M | -889.00K | 217.00K | -1.24M | -1.50M | 1.59M | -812.15K | -732.82K | 335.48K | 3.68K | -4.98K | -144.31K | -206.38K | -75.61K |

| Net Income Ratio | -76.42% | -86.69% | -98.85% | -137.83% | -148.18% | -151.79% | -243.34% | -59.85% | -171.07% | -15.47% | -107.74% | -43.30% | 2.77% | -11.35% | -15.92% | 8.83% | -8.99% | -27.04% | 67.96% | 0.95% | -4.13% | 0.00% | 0.00% | 0.00% |

| EPS | -0.05 | -0.08 | -0.12 | -0.25 | -0.42 | -0.28 | -0.54 | -0.26 | -1.42 | -0.05 | -0.42 | -0.22 | 0.07 | -0.32 | -0.47 | 0.55 | -0.29 | -0.28 | 0.21 | 0.00 | 0.00 | -0.17 | -0.29 | -0.24 |

| EPS Diluted | -0.05 | -0.08 | -0.12 | -0.25 | -0.42 | -0.28 | -0.53 | -0.26 | -1.42 | -0.05 | -0.42 | -0.22 | 0.07 | -0.32 | -0.47 | 0.55 | -0.29 | -0.28 | 0.21 | 0.00 | 0.00 | -0.17 | -0.29 | -0.24 |

| Weighted Avg Shares Out | 72.81M | 57.44M | 42.46M | 25.95M | 21.44M | 18.93M | 11.41M | 4.04M | 4.04M | 4.04M | 4.04M | 4.04M | 4.04M | 3.89M | 3.19M | 2.93M | 2.81M | 2.66M | 1.62M | 1.29M | 1.29M | 826.13K | 715.59K | 310.76K |

| Weighted Avg Shares Out (Dil) | 72.81M | 57.44M | 42.46M | 25.95M | 21.44M | 18.93M | 11.50M | 4.04M | 4.04M | 4.04M | 4.04M | 4.04M | 4.04M | 3.89M | 3.19M | 2.93M | 2.81M | 2.66M | 1.62M | 1.29M | 1.29M | 826.13K | 715.59K | 310.76K |

Benton Stakes Strategic Land at Great Burnt and Provides Exploration Update - Channel Sample Assays 3.79 g/t Gold, 0.68% Copper & 4.10 g/t Silver Over 5.10 m at South Pond

Across the Pond: Global ETF Flows Going Strong

Pond Technologies to Participate in the Lytham Partners Spring 2022 Investor Conference

Pond Technologies to Present at LD Micro Movers Virtual Event on December 1, 2021

Pond Technologies Launches 3-Pronged Approach to Make Combating Climate Change Profitable

Pond Tech Revolutionizes Carbon Capture Market with Scalable Algae Platform

Pond Technologies to Present at the 2021 LD Micro Main Event on October 12, 2021 and Provides Correction to Prior Release

Pond Technologies Engages Independent Trading Group and Integral Wealth Securities as Market Makers

Pond Technologies Responds to Request by OTC Markets

Pond Technologies Adds Information Regarding Insider Participation in Recently Completed Private Placement

Source: https://incomestatements.info

Category: Stock Reports