See more : SK Gas Co., Ltd. (018670.KS) Income Statement Analysis – Financial Results

Complete financial analysis of Harmonic Drive Systems Inc. (6324.T) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Harmonic Drive Systems Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- New World Brands, Inc. (NWBD) Income Statement Analysis – Financial Results

- Get Nice Holdings Limited (0064.HK) Income Statement Analysis – Financial Results

- Gencell Ltd (GNCLF) Income Statement Analysis – Financial Results

- Dragon Capital Group, Corp. (DRGV) Income Statement Analysis – Financial Results

- Pulse Oil Corp. (PUL.V) Income Statement Analysis – Financial Results

Harmonic Drive Systems Inc. (6324.T)

About Harmonic Drive Systems Inc.

Harmonic Drive Systems Inc. produces and sells precision control equipment and components worldwide. It offers speed reducers, rotary actuators, linear actuators, AC servo motors, and other mechatronics products, as well as HarmonicDrive, a speed reducer for space. The company also provides high-precision planetary-gear speed reducers under the AccuDrive and Harmonic Planetary brands; galvano mirror type optical scanners under the BEAM SERVO brand; and incremental encoders under the Harmonicsyn name. Its products are used in industrial robots, semiconductor manufacturing equipment, and other systems. Harmonic Drive Systems Inc. was founded in 1970 and is headquartered in Tokyo, Japan.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 55.80B | 71.53B | 57.09B | 37.03B | 37.49B | 67.81B | 54.34B | 30.07B | 28.28B | 25.95B | 21.08B | 18.13B | 20.16B | 22.00B | 12.06B | 16.17B | 19.21B | 18.77B | 14.45B | 14.11B |

| Cost of Revenue | 40.19B | 45.74B | 34.66B | 24.45B | 25.48B | 37.36B | 28.64B | 16.20B | 14.99B | 13.83B | 11.97B | 10.76B | 11.86B | 12.07B | 7.53B | 9.71B | 10.52B | 10.05B | 7.67B | 7.82B |

| Gross Profit | 15.61B | 25.79B | 22.43B | 12.58B | 12.00B | 30.45B | 25.70B | 13.87B | 13.29B | 12.12B | 9.12B | 7.37B | 8.30B | 9.93B | 4.53B | 6.46B | 8.69B | 8.71B | 6.78B | 6.29B |

| Gross Profit Ratio | 27.97% | 36.05% | 39.28% | 33.98% | 32.02% | 44.90% | 47.30% | 46.12% | 46.98% | 46.71% | 43.25% | 40.64% | 41.16% | 45.14% | 37.57% | 39.96% | 45.24% | 46.43% | 46.90% | 44.61% |

| Research & Development | 3.61B | 3.27B | 3.01B | 2.44B | 2.20B | 2.48B | 2.11B | 1.38B | 1.40B | 1.31B | 1.24B | 1.15B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 9.31B | 9.97B | 8.36B | 6.97B | 7.88B | 9.54B | 8.73B | 4.59B | 4.27B | 3.77B | 3.24B | 2.81B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 2.56B | 141.52M | 279.13M | 469.43M | 327.22M | 279.81M | 132.34M | -32.85M | -26.70M | -3.21M | -53.87M | -16.86M | 70.60M | 55.20M | 61.04M | 78.35M | 53.07M | -13.38M | 65.19M | 12.94M |

| Operating Expenses | 15.48B | 15.56B | 13.69B | 11.72B | 11.94B | 13.54B | 13.10B | 6.05B | 5.67B | 5.05B | 4.45B | 3.93B | 3.96B | 4.08B | 3.46B | 4.03B | 4.28B | 4.21B | 3.57B | 3.42B |

| Cost & Expenses | 55.67B | 61.30B | 48.35B | 36.17B | 37.42B | 50.91B | 41.74B | 22.26B | 20.66B | 18.88B | 16.42B | 14.69B | 15.83B | 16.15B | 10.99B | 13.74B | 14.80B | 14.26B | 11.25B | 11.23B |

| Interest Income | 96.86M | 14.95M | 12.98M | 38.57M | 33.36M | 24.54M | 17.91M | 10.23M | 8.84M | 8.42M | 5.78M | 15.54M | 12.35M | 15.20M | 14.68M | 17.38M | 44.48M | 52.04M | 8.51M | 2.69M |

| Interest Expense | 177.07M | 166.98M | 138.18M | 106.29M | 113.17M | 22.79M | 42.33M | 6.70M | 11.13M | 5.52M | 43.36M | 57.16M | 35.26M | 36.64M | 48.07M | 19.30M | 7.23M | 23.93M | 4.99M | 43.26M |

| Depreciation & Amortization | 10.36B | 9.57B | 8.25B | 7.39B | 7.73B | 6.53B | 6.13B | 1.77B | 1.52B | 1.31B | 1.17B | 1.12B | 1.01B | 740.14M | 744.27M | 797.62M | 648.56M | 534.68M | 518.77M | 513.70M |

| EBITDA | -17.07B | 19.94B | 17.40B | 8.52B | 7.71B | 23.51B | 18.12B | 23.66B | 9.34B | 8.78B | 5.99B | 4.41B | 4.92B | 6.08B | 1.82B | 3.29B | 5.33B | 5.30B | 3.86B | 3.40B |

| EBITDA Ratio | -30.59% | 28.66% | 30.66% | 23.93% | 21.55% | 35.04% | 33.35% | 32.39% | 33.01% | 34.05% | 28.63% | 26.22% | 27.00% | 30.64% | 15.41% | 21.86% | 28.09% | 28.35% | 27.03% | 24.73% |

| Operating Income | 124.58M | 10.22B | 8.74B | 865.92M | 67.55M | 16.90B | 12.60B | 7.81B | 7.62B | 7.07B | 4.67B | 3.44B | 4.33B | 5.85B | 1.07B | 2.43B | 4.42B | 4.50B | 3.20B | 2.88B |

| Operating Income Ratio | 0.22% | 14.29% | 15.31% | 2.34% | 0.18% | 24.93% | 23.19% | 25.99% | 26.94% | 27.23% | 22.14% | 18.95% | 21.50% | 26.58% | 8.89% | 15.02% | 22.99% | 24.00% | 22.18% | 20.38% |

| Total Other Income/Expenses | -27.73B | -30.19M | 271.85M | 153.43M | 58.11M | 332.78M | -377.00M | 14.06B | 185.64M | 402.72M | 103.63M | -206.81M | -458.25M | -547.71M | -51.72M | 43.14M | 256.11M | 238.81M | 128.31M | -34.25M |

| Income Before Tax | -27.61B | 10.19B | 9.01B | 1.02B | 125.67M | 17.24B | 12.22B | 21.87B | 7.80B | 7.47B | 4.77B | 3.23B | 3.88B | 5.30B | 1.02B | 2.47B | 4.67B | 4.74B | 3.33B | 2.84B |

| Income Before Tax Ratio | -49.48% | 14.25% | 15.79% | 2.75% | 0.34% | 25.42% | 22.49% | 72.75% | 27.60% | 28.78% | 22.63% | 17.81% | 19.22% | 24.09% | 8.46% | 15.28% | 24.32% | 25.28% | 23.06% | 20.14% |

| Income Tax Expense | -2.80B | 2.60B | 2.29B | 465.72M | 752.00M | 4.73B | 3.90B | 1.98B | 2.61B | 2.58B | 1.76B | 1.17B | 1.58B | 2.06B | 394.70M | 871.77M | 1.81B | 1.83B | 1.20B | 988.11M |

| Net Income | -24.81B | 7.60B | 6.64B | 662.50M | -832.50M | 11.60B | 8.06B | 19.73B | 5.00B | 4.83B | 2.99B | 1.96B | 2.14B | 2.95B | 498.62M | 1.52B | 2.74B | 2.81B | 2.11B | 1.84B |

| Net Income Ratio | -44.46% | 10.62% | 11.64% | 1.79% | -2.22% | 17.11% | 14.83% | 65.62% | 17.69% | 18.63% | 14.20% | 10.82% | 10.61% | 13.42% | 4.14% | 9.40% | 14.27% | 14.98% | 14.63% | 13.05% |

| EPS | -261.00 | 79.67 | 69.02 | 6.88 | -8.65 | 120.52 | 86.90 | 215.42 | 54.60 | 52.77 | 32.68 | 21.41 | 23.36 | 32.23 | 1.63K | 16.58 | 29.93 | 30.72 | 72.47 | 64.33 |

| EPS Diluted | -261.00 | 79.67 | 69.02 | 6.88 | -8.65 | 120.52 | 86.90 | 215.42 | 54.60 | 52.77 | 32.68 | 21.41 | 23.36 | 32.23 | 1.63K | 16.58 | 29.93 | 30.72 | 66.68 | 60.99 |

| Weighted Avg Shares Out | 95.05M | 95.34M | 96.26M | 96.26M | 96.26M | 96.26M | 92.75M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 94.98M | 91.60M |

| Weighted Avg Shares Out (Dil) | 95.05M | 95.34M | 96.26M | 96.26M | 96.26M | 96.26M | 92.75M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 91.60M | 94.98M | 91.60M |

NAVYA : Bilan semestriel du contrat de liquidité contracté avec Natixis ODDO BHF

2019 NAB Show Exhibitor Profiles: EditShare to Moonlighting

Maxon to Exhibit at 2019 NAB Show

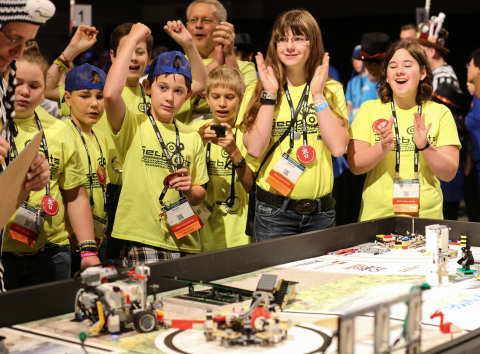

FIRST® Caps Off World’s Largest Celebration of Science, Technology, Engineering, and Math for Students

MAXON Computer, Inc. to Exhibit at 2017 NAB Show

Total and Corbion Form a Joint Venture in Bioplastics

Mechanics Bank Joins Napa Chamber of Commerce as Founding Member of Community Leader Alliance

Research and Markets: 2014 Worldwide Health & Medical Insurance Carriers Industry - Industry & Market Report

Research and Markets: 2013 Worldwide Health & Medical Insurance Carriers Industry-Industry & Market Report

Research and Markets: 2013 U.S. Health & Medical Insurance Carriers Industry-Industry & Market Report

Source: https://incomestatements.info

Category: Stock Reports