See more : MDX Public Company Limited (MDX.BK) Income Statement Analysis – Financial Results

Complete financial analysis of Genscript Biotech Corporation (1548.HK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Genscript Biotech Corporation, a leading company in the Biotechnology industry within the Healthcare sector.

- AstraZeneca PLC (ZEG.DE) Income Statement Analysis – Financial Results

- FREYR Battery, Inc. WT (FREY-WT) Income Statement Analysis – Financial Results

- Stereotaxis, Inc. (STXS) Income Statement Analysis – Financial Results

- Global PVQ SE (QCLSF) Income Statement Analysis – Financial Results

- Huida Sanitary Ware Co., Ltd. (603385.SS) Income Statement Analysis – Financial Results

Genscript Biotech Corporation (1548.HK)

About Genscript Biotech Corporation

Genscript Biotech Corporation, an investment holding company, engages in the manufacture and sale of life science research products and services in North America, Europe, the People's Republic of China, Japan, the other Asia Pacific regions, and internationally. It operates through four segments: Life Science Services and Products, Biologics Development Services, Industrial Synthetic Biology Products, and Cell Therapy. The Life Science Services and Products segment provides research services in various categories, including gene synthesis and molecular cloning, oligonucleotide synthesis, protein engineering, peptide synthesis, antibody development, molecular diagnostics tools, and genome editing materials for use in basic biology studies, pharmaceutical and drug discovery, disease diagnostics and vaccine, agriculture, environmental studies, and food industry. The Biologics Development Services segment offers various services, such as antibody drug discovery, antibody drug pre-clinical and clinical development, plasmid and virus pre-clinical development, and plasmid and virus clinical development for therapeutic antibodies, as well as gene and cell therapy development and biologics discovery and development services for pharmaceutical, biotech, government, and academic customers. The Industrial Synthetic Biology Products segment constructs non-pathogenic microbial strains; and develops and produces industrial enzymes for food processing, feed, pharmaceutical, and chemical industries. The Cell Therapy segment discovers and develops chimeric antigen receptor T-cell therapies for the treatment of liquid and solid tumors. Genscript Biotech Corporation was founded in 2002 and is headquartered in Nanjing, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 839.53M | 625.70M | 490.10M | 390.85M | 273.35M | 231.02M | 152.65M | 114.74M | 86.71M | 69.99M | 60.10M |

| Cost of Revenue | 429.98M | 321.62M | 207.58M | 134.95M | 93.06M | 72.48M | 48.06M | 38.51M | 29.63M | 25.90M | 21.97M |

| Gross Profit | 409.55M | 304.08M | 282.52M | 255.89M | 180.29M | 158.54M | 104.59M | 76.23M | 57.08M | 44.10M | 38.13M |

| Gross Profit Ratio | 48.78% | 48.60% | 57.65% | 65.47% | 65.95% | 68.63% | 68.52% | 66.44% | 65.83% | 63.00% | 63.45% |

| Research & Development | 432.83M | 390.10M | 358.40M | 263.40M | 186.02M | 74.08M | 18.06M | 9.47M | 7.11M | 5.59M | 6.06M |

| General & Administrative | 213.44M | 182.46M | 134.51M | 90.34M | 55.26M | 40.58M | 22.04M | 30.43M | 28.54M | 21.45M | 16.38M |

| Selling & Marketing | 174.30M | 168.35M | 167.97M | 107.34M | 70.36M | 38.77M | 24.91M | 20.87M | 17.64M | 15.54M | 12.81M |

| SG&A | 387.74M | 352.10M | 303.41M | 197.04M | 125.61M | 79.35M | 46.95M | 51.30M | 46.18M | 36.98M | 29.19M |

| Other Expenses | -411.01M | -21.47M | -12.16M | -94.31M | -384.00K | -36.00K | -7.35M | -60.00K | -290.00K | -327.00K | 0.00 |

| Operating Expenses | 409.55M | 735.72M | 804.06M | 544.38M | 301.55M | 145.79M | 67.06M | 43.99M | 34.35M | 36.14M | 30.44M |

| Cost & Expenses | 1.26B | 1.06B | 1.01B | 679.33M | 394.61M | 218.27M | 115.12M | 82.49M | 63.98M | 62.04M | 52.41M |

| Interest Income | 73.19M | 51.00K | 4.17M | 6.59M | 7.57M | 9.95M | 988.00K | 266.00K | 248.00K | 118.00K | 169.00K |

| Interest Expense | 27.51M | 13.27M | 2.38M | 1.42M | 781.00K | 52.00K | 0.00 | 10.00K | 0.00 | 411.00K | 0.00 |

| Depreciation & Amortization | 74.05M | 64.25M | 47.78M | 32.90M | 20.64M | 12.93M | 7.00M | 5.39M | 4.69M | 4.70M | 4.49M |

| EBITDA | -249.42M | -389.04M | -341.57M | -174.71M | -112.36M | 17.44M | 46.20M | 29.98M | 15.59M | 11.82M | 13.08M |

| EBITDA Ratio | -29.71% | -62.18% | -69.69% | -44.70% | -41.10% | 7.55% | 30.27% | 26.13% | 17.98% | 16.88% | 21.77% |

| Operating Income | -415.79M | -438.11M | -379.29M | -204.55M | -131.35M | 5.11M | 39.59M | 24.93M | 10.90M | 7.11M | 8.59M |

| Operating Income Ratio | -49.53% | -70.02% | -77.39% | -52.33% | -48.05% | 2.21% | 25.93% | 21.73% | 12.57% | 10.16% | 14.29% |

| Total Other Income/Expenses | 64.81M | -3.93M | -138.08M | -77.35M | 9.69M | 17.59M | -1.07M | 7.58M | 12.08M | 722.00K | 4.65M |

| Income Before Tax | -350.98M | -431.69M | -517.36M | -281.90M | -113.69M | 22.70M | 38.52M | 32.51M | 22.98M | 7.84M | 7.53M |

| Income Before Tax Ratio | -41.81% | -68.99% | -105.56% | -72.13% | -41.59% | 9.83% | 25.24% | 28.33% | 26.50% | 11.20% | 12.53% |

| Income Tax Expense | 4.14M | 3.72M | 964.00K | 477.00K | 3.83M | 1.94M | 11.52M | 5.97M | 5.47M | 1.66M | 1.53M |

| Net Income | -95.48M | -226.85M | -358.71M | -204.95M | -96.91M | 21.22M | 26.12M | 26.17M | 17.50M | 6.18M | 6.00M |

| Net Income Ratio | -11.37% | -36.26% | -73.19% | -52.44% | -35.45% | 9.18% | 17.11% | 22.81% | 20.19% | 8.82% | 9.98% |

| EPS | -0.05 | -0.11 | -0.18 | -0.11 | -0.05 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.00 |

| EPS Diluted | -0.05 | -0.11 | -0.18 | -0.11 | -0.05 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.00 |

| Weighted Avg Shares Out | 2.11B | 2.10B | 2.03B | 1.90B | 1.85B | 1.79B | 1.71B | 1.67B | 1.19B | 1.21B | 0.00 |

| Weighted Avg Shares Out (Dil) | 2.11B | 2.10B | 2.03B | 1.90B | 1.85B | 1.84B | 1.73B | 1.71B | 1.23B | 1.22B | 0.00 |

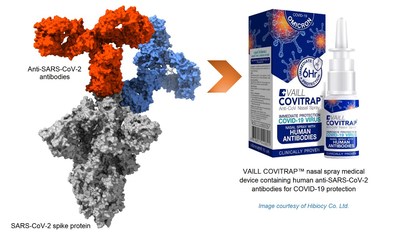

GenScript Supported Nasal Spray Development for COVID-19 Protection with GMP-grade Antibodies and Subsequently Planned for Long-Term Collaboration with Biogenexis

Source: https://incomestatements.info

Category: Stock Reports