See more : Fresenius Medical Care AG & Co. KGaA (FMCQF) Income Statement Analysis – Financial Results

Complete financial analysis of Accuray Incorporated (ARAY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Accuray Incorporated, a leading company in the Medical – Specialties industry within the Healthcare sector.

- KAYAC Inc. (3904.T) Income Statement Analysis – Financial Results

- Danske Invest Europa Small Cap (DKIEUSC.CO) Income Statement Analysis – Financial Results

- Scatec ASA (0R3I.L) Income Statement Analysis – Financial Results

- Kontoor Brands, Inc. (KTB) Income Statement Analysis – Financial Results

- The Victoria Mills Limited (VICTMILL.BO) Income Statement Analysis – Financial Results

Accuray Incorporated (ARAY)

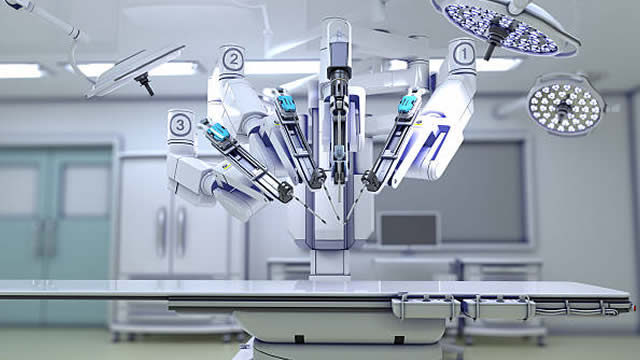

About Accuray Incorporated

Accuray Incorporated designs, develops, manufactures, and sells radiosurgery and radiation therapy systems for the treatment of tumors in the United States, Canada, Latin America, Australia, New Zealand, Europe, the Middle East, India, Africa, Japan, China, and rest of the Asia Pacific region. It offers the CyberKnife System, a robotic stereotactic radiosurgery and stereotactic body radiation therapy system used for the treatment of primary and metastatic tumors outside the brain, including tumors on or near the spine and in the breast, kidney, liver, lung, pancreas, and prostate. The company also provides the TomoTherapy System, including the Radixact System, which allows for integrated radiation treatment planning, delivery, and data management, enabling clinicians to deliver ultra-precise treatments to approximately 50 patients per day; iDMS data management system, a fully integrated treatment planning and data management systems; and Accuray precision treatment planning system, a treatment planning and data management systems. In addition, it offers post-contract customer support, installation, training, and other professional services. The company primarily markets its products directly to customers, including hospitals and stand-alone treatment facilities through its sales organization, as well as to customers through sales agents and group purchasing organizations in the United States; and to customers directly and through distributors and sales agents internationally. Accuray Incorporated was incorporated in 1990 and is headquartered in Madison, Wisconsin.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 446.55M | 447.61M | 429.91M | 396.29M | 382.93M | 418.79M | 404.90M | 383.41M | 398.80M | 379.80M | 369.42M | 315.97M | 409.22M | 222.28M | 221.63M | 233.60M | 210.38M | 140.45M | 52.90M | 22.38M | 19.57M | 2.71M | 19.35M |

| Cost of Revenue | 303.63M | 293.65M | 269.95M | 236.78M | 233.06M | 256.13M | 243.20M | 242.07M | 240.09M | 234.40M | 226.62M | 218.33M | 271.95M | 115.04M | 117.61M | 118.31M | 103.43M | 60.41M | 27.49M | 11.12M | 0.00 | 3.03M | 0.00 |

| Gross Profit | 142.92M | 153.96M | 159.96M | 159.51M | 149.87M | 162.65M | 161.70M | 141.34M | 158.71M | 145.40M | 142.80M | 97.64M | 137.27M | 107.24M | 104.02M | 115.29M | 106.95M | 80.04M | 25.41M | 11.26M | 19.57M | -317.00K | 19.35M |

| Gross Profit Ratio | 32.01% | 34.40% | 37.21% | 40.25% | 39.14% | 38.84% | 39.93% | 36.86% | 39.80% | 38.28% | 38.66% | 30.90% | 33.54% | 48.25% | 46.93% | 49.35% | 50.84% | 56.99% | 48.03% | 50.33% | 100.00% | -11.70% | 100.00% |

| Research & Development | 49.73M | 57.13M | 57.75M | 52.73M | 49.78M | 56.49M | 57.25M | 49.92M | 56.65M | 55.75M | 53.72M | 66.20M | 87.11M | 41.69M | 31.52M | 35.99M | 32.88M | 26.78M | 17.79M | 11.66M | 0.00 | 5.84M | 0.00 |

| General & Administrative | 50.07M | 48.27M | 44.39M | 41.72M | 40.97M | 49.58M | 48.14M | 43.77M | 50.12M | 46.38M | 45.34M | 57.73M | 58.60M | 56.66M | 35.47M | 36.22M | 32.28M | 23.92M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 42.62M | 46.18M | 49.66M | 42.82M | 47.25M | 56.00M | 60.11M | 57.48M | 56.81M | 62.44M | 61.89M | 54.37M | 54.55M | 37.18M | 34.19M | 45.49M | 42.73M | 37.89M | 0.00 | 0.00 | 0.00 | 6.71M | 0.00 |

| SG&A | 92.69M | 94.45M | 94.06M | 84.54M | 88.22M | 105.58M | 108.24M | 101.24M | 106.93M | 108.82M | 107.22M | 112.10M | 113.15M | 93.84M | 69.66M | 81.72M | 75.01M | 61.80M | 41.11M | 24.49M | 0.00 | 6.71M | 0.00 |

| Other Expenses | 0.00 | -11.74M | -10.39M | -27.67M | -6.70M | -14.93M | -19.22M | -18.72M | -18.30M | -18.62M | -14.22M | -13.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.02M | -24.75M |

| Operating Expenses | 142.42M | 151.58M | 151.81M | 137.27M | 138.00M | 162.07M | 165.49M | 151.16M | 163.59M | 164.57M | 160.94M | 178.30M | 200.26M | 135.53M | 101.18M | 117.71M | 107.89M | 88.58M | 58.90M | 36.15M | 0.00 | 15.57M | -24.75M |

| Cost & Expenses | 446.05M | 445.22M | 421.76M | 374.05M | 371.06M | 418.20M | 408.69M | 393.24M | 403.67M | 398.97M | 387.56M | 396.63M | 472.21M | 250.57M | 218.79M | 236.02M | 211.32M | 148.99M | 86.39M | 47.26M | 0.00 | 18.60M | -24.75M |

| Interest Income | 0.00 | 10.63M | 8.13M | 16.89M | 18.08M | 15.08M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 360.00K | 543.00K | 1.00K | 3.08M | 7.68M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 11.62M | 10.63M | 8.13M | 16.89M | 18.08M | 15.08M | 14.96M | 17.30M | 17.46M | 16.52M | 14.29M | 10.38M | 7.81M | 23.00K | 32.00K | 10.00K | 173.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.91M | 4.53M | 5.51M | 6.39M | 7.54M | 10.49M | 9.73M | 18.00M | 18.30M | 19.49M | 20.56M | 25.56M | 32.59M | 7.57M | 7.12M | 6.65M | 7.69M | 6.25M | 3.81M | 2.08M | 0.00 | 0.00 | 24.75M |

| EBITDA | 5.71M | 9.61M | 13.66M | 28.62M | 20.08M | 11.07M | 1.67M | 6.80M | 12.59M | -1.78M | 2.49M | -57.85M | -35.46M | -18.43M | 9.99M | 7.33M | 14.11M | 1.39M | -29.69M | -22.80M | 19.57M | -15.89M | 19.35M |

| EBITDA Ratio | 1.28% | 0.53% | 1.90% | 5.61% | 3.10% | 0.14% | -0.94% | -2.56% | -1.22% | -5.05% | -4.91% | -25.53% | -12.25% | -9.08% | 1.28% | -1.04% | 3.21% | -1.36% | -56.12% | -101.90% | 100.00% | -586.20% | 100.00% |

| Operating Income | 504.00K | 2.38M | 2.64M | 15.85M | 4.33M | -9.91M | -3.80M | -9.82M | -4.87M | -19.17M | -18.14M | -80.66M | -62.99M | -28.28M | 2.84M | -2.42M | -934.00K | -8.54M | -33.49M | -24.88M | 19.57M | -15.89M | -5.40M |

| Operating Income Ratio | 0.11% | 0.53% | 0.61% | 4.00% | 1.13% | -2.37% | -0.94% | -2.56% | -1.22% | -5.05% | -4.91% | -25.53% | -15.39% | -12.72% | 1.28% | -1.04% | -0.44% | -6.08% | -63.32% | -111.20% | 100.00% | -586.20% | -27.89% |

| Total Other Income/Expenses | -12.32M | -9.17M | -10.15M | -26.79M | -6.85M | -14.93M | -19.22M | -18.72M | -18.30M | -18.62M | -14.22M | -13.13M | -12.87M | 2.29M | 1.00K | 3.08M | 7.18M | 3.53M | 56.00K | -238.00K | -19.57M | 46.00K | -399.00K |

| Income Before Tax | -11.82M | -6.79M | -2.00M | -4.56M | 5.02M | -14.34M | -23.02M | -28.54M | -23.17M | -37.79M | -32.36M | -93.79M | -75.86M | -26.00M | 2.84M | 664.00K | 6.25M | -5.01M | -33.44M | -25.12M | 0.00 | -15.84M | -5.80M |

| Income Before Tax Ratio | -2.65% | -1.52% | -0.47% | -1.15% | 1.31% | -3.43% | -5.69% | -7.44% | -5.81% | -9.95% | -8.76% | -29.68% | -18.54% | -11.69% | 1.28% | 0.28% | 2.97% | -3.57% | -63.21% | -112.26% | 0.00% | -584.50% | -29.95% |

| Income Tax Expense | 3.73M | 2.49M | 3.35M | 1.75M | 1.86M | 2.09M | 878.00K | 1.04M | 2.34M | 2.42M | 3.09M | 3.57M | 2.60M | 1.12M | -4.00K | 55.00K | 867.00K | 1.44M | 258.00K | 68.00K | 11.70M | 0.00 | -5.80M |

| Net Income | -15.55M | -9.28M | -5.35M | -6.31M | 3.83M | -16.43M | -23.90M | -29.58M | -25.50M | -40.21M | -35.45M | -103.22M | -72.04M | -26.68M | 2.84M | 609.00K | 5.38M | -5.62M | -33.69M | -25.19M | -11.70M | -15.84M | 0.00 |

| Net Income Ratio | -3.48% | -2.07% | -1.24% | -1.59% | 1.00% | -3.92% | -5.90% | -7.71% | -6.40% | -10.59% | -9.60% | -32.67% | -17.60% | -12.00% | 1.28% | 0.26% | 2.56% | -4.00% | -63.70% | -112.57% | -59.77% | -584.50% | 0.00% |

| EPS | -0.16 | -0.10 | -0.06 | -0.07 | 0.04 | -0.19 | -0.28 | -0.36 | -0.32 | -0.51 | -0.47 | -1.41 | -1.02 | -0.44 | 0.05 | 0.01 | 0.10 | -0.18 | -2.11 | -1.76 | -1.00 | -1.49 | -1.21 |

| EPS Diluted | -0.16 | -0.10 | -0.06 | -0.07 | 0.04 | -0.19 | -0.28 | -0.36 | -0.32 | -0.51 | -0.47 | -1.41 | -1.02 | -0.44 | 0.05 | 0.01 | 0.09 | -0.18 | -2.11 | -1.76 | -1.00 | -1.49 | -1.21 |

| Weighted Avg Shares Out | 98.27M | 94.88M | 92.10M | 92.03M | 89.87M | 87.47M | 84.89M | 82.50M | 80.51M | 78.28M | 75.42M | 73.20M | 70.89M | 60.09M | 57.56M | 55.41M | 54.53M | 30.76M | 16.00M | 14.28M | 11.74M | 10.61M | 10.56M |

| Weighted Avg Shares Out (Dil) | 98.27M | 94.88M | 92.10M | 92.03M | 90.62M | 87.47M | 84.89M | 82.50M | 80.51M | 78.28M | 75.80M | 73.28M | 70.89M | 60.09M | 60.19M | 58.73M | 60.43M | 30.76M | 16.00M | 14.28M | 11.74M | 10.61M | 10.56M |

Accuray Incorporated Reports Inducement Award Under NASDAQ Listing Rules

Accuray Q1 Earnings Meet Estimates, Sales Beat, Gross Margin Shrinks

Accuray Incorporated (ARAY) Q1 2025 Earnings Call Transcript

Accuray (ARAY) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

Accuray (ARAY) Reports Q1 Loss, Tops Revenue Estimates

Accuray Reports Fiscal 2025 First Quarter Financial Results

Accuray to Report First Quarter Fiscal 2025 Financial Results on November 6, 2024

Accuray Appoints Michael Murphy as VP, Corporate Controller

Here's Why You Should Retain Accuray Stock in Your Portfolio Now

Accuray President and Chief Executive Officer Suzanne Winter Returns from Medical Leave of Absence

Source: https://incomestatements.info

Category: Stock Reports