See more : Thames Ventures VCT 1 plc (TV1.L) Income Statement Analysis – Financial Results

Complete financial analysis of Accuray Incorporated (ARAY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Accuray Incorporated, a leading company in the Medical – Specialties industry within the Healthcare sector.

- Dezhan Healthcare Company Limited (000813.SZ) Income Statement Analysis – Financial Results

- New Zealand Rural Land Company Limited (NZL.NZ) Income Statement Analysis – Financial Results

- SILICON RENTAL SOLUTIONS LIMIT (SRSOLTD.BO) Income Statement Analysis – Financial Results

- Ficont Industry (Beijing) Co., Ltd. (605305.SS) Income Statement Analysis – Financial Results

- Finder Energy Holdings Limited (FDR.AX) Income Statement Analysis – Financial Results

Accuray Incorporated (ARAY)

About Accuray Incorporated

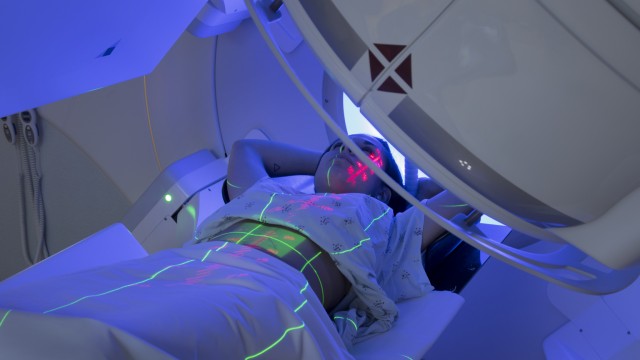

Accuray Incorporated designs, develops, manufactures, and sells radiosurgery and radiation therapy systems for the treatment of tumors in the United States, Canada, Latin America, Australia, New Zealand, Europe, the Middle East, India, Africa, Japan, China, and rest of the Asia Pacific region. It offers the CyberKnife System, a robotic stereotactic radiosurgery and stereotactic body radiation therapy system used for the treatment of primary and metastatic tumors outside the brain, including tumors on or near the spine and in the breast, kidney, liver, lung, pancreas, and prostate. The company also provides the TomoTherapy System, including the Radixact System, which allows for integrated radiation treatment planning, delivery, and data management, enabling clinicians to deliver ultra-precise treatments to approximately 50 patients per day; iDMS data management system, a fully integrated treatment planning and data management systems; and Accuray precision treatment planning system, a treatment planning and data management systems. In addition, it offers post-contract customer support, installation, training, and other professional services. The company primarily markets its products directly to customers, including hospitals and stand-alone treatment facilities through its sales organization, as well as to customers through sales agents and group purchasing organizations in the United States; and to customers directly and through distributors and sales agents internationally. Accuray Incorporated was incorporated in 1990 and is headquartered in Madison, Wisconsin.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 446.55M | 447.61M | 429.91M | 396.29M | 382.93M | 418.79M | 404.90M | 383.41M | 398.80M | 379.80M | 369.42M | 315.97M | 409.22M | 222.28M | 221.63M | 233.60M | 210.38M | 140.45M | 52.90M | 22.38M | 19.57M | 2.71M | 19.35M |

| Cost of Revenue | 303.63M | 293.65M | 269.95M | 236.78M | 233.06M | 256.13M | 243.20M | 242.07M | 240.09M | 234.40M | 226.62M | 218.33M | 271.95M | 115.04M | 117.61M | 118.31M | 103.43M | 60.41M | 27.49M | 11.12M | 0.00 | 3.03M | 0.00 |

| Gross Profit | 142.92M | 153.96M | 159.96M | 159.51M | 149.87M | 162.65M | 161.70M | 141.34M | 158.71M | 145.40M | 142.80M | 97.64M | 137.27M | 107.24M | 104.02M | 115.29M | 106.95M | 80.04M | 25.41M | 11.26M | 19.57M | -317.00K | 19.35M |

| Gross Profit Ratio | 32.01% | 34.40% | 37.21% | 40.25% | 39.14% | 38.84% | 39.93% | 36.86% | 39.80% | 38.28% | 38.66% | 30.90% | 33.54% | 48.25% | 46.93% | 49.35% | 50.84% | 56.99% | 48.03% | 50.33% | 100.00% | -11.70% | 100.00% |

| Research & Development | 49.73M | 57.13M | 57.75M | 52.73M | 49.78M | 56.49M | 57.25M | 49.92M | 56.65M | 55.75M | 53.72M | 66.20M | 87.11M | 41.69M | 31.52M | 35.99M | 32.88M | 26.78M | 17.79M | 11.66M | 0.00 | 5.84M | 0.00 |

| General & Administrative | 50.07M | 48.27M | 44.39M | 41.72M | 40.97M | 49.58M | 48.14M | 43.77M | 50.12M | 46.38M | 45.34M | 57.73M | 58.60M | 56.66M | 35.47M | 36.22M | 32.28M | 23.92M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 42.62M | 46.18M | 49.66M | 42.82M | 47.25M | 56.00M | 60.11M | 57.48M | 56.81M | 62.44M | 61.89M | 54.37M | 54.55M | 37.18M | 34.19M | 45.49M | 42.73M | 37.89M | 0.00 | 0.00 | 0.00 | 6.71M | 0.00 |

| SG&A | 92.69M | 94.45M | 94.06M | 84.54M | 88.22M | 105.58M | 108.24M | 101.24M | 106.93M | 108.82M | 107.22M | 112.10M | 113.15M | 93.84M | 69.66M | 81.72M | 75.01M | 61.80M | 41.11M | 24.49M | 0.00 | 6.71M | 0.00 |

| Other Expenses | 0.00 | -11.74M | -10.39M | -27.67M | -6.70M | -14.93M | -19.22M | -18.72M | -18.30M | -18.62M | -14.22M | -13.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.02M | -24.75M |

| Operating Expenses | 142.42M | 151.58M | 151.81M | 137.27M | 138.00M | 162.07M | 165.49M | 151.16M | 163.59M | 164.57M | 160.94M | 178.30M | 200.26M | 135.53M | 101.18M | 117.71M | 107.89M | 88.58M | 58.90M | 36.15M | 0.00 | 15.57M | -24.75M |

| Cost & Expenses | 446.05M | 445.22M | 421.76M | 374.05M | 371.06M | 418.20M | 408.69M | 393.24M | 403.67M | 398.97M | 387.56M | 396.63M | 472.21M | 250.57M | 218.79M | 236.02M | 211.32M | 148.99M | 86.39M | 47.26M | 0.00 | 18.60M | -24.75M |

| Interest Income | 0.00 | 10.63M | 8.13M | 16.89M | 18.08M | 15.08M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 360.00K | 543.00K | 1.00K | 3.08M | 7.68M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 11.62M | 10.63M | 8.13M | 16.89M | 18.08M | 15.08M | 14.96M | 17.30M | 17.46M | 16.52M | 14.29M | 10.38M | 7.81M | 23.00K | 32.00K | 10.00K | 173.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.91M | 4.53M | 5.51M | 6.39M | 7.54M | 10.49M | 9.73M | 18.00M | 18.30M | 19.49M | 20.56M | 25.56M | 32.59M | 7.57M | 7.12M | 6.65M | 7.69M | 6.25M | 3.81M | 2.08M | 0.00 | 0.00 | 24.75M |

| EBITDA | 5.71M | 9.61M | 13.66M | 28.62M | 20.08M | 11.07M | 1.67M | 6.80M | 12.59M | -1.78M | 2.49M | -57.85M | -35.46M | -18.43M | 9.99M | 7.33M | 14.11M | 1.39M | -29.69M | -22.80M | 19.57M | -15.89M | 19.35M |

| EBITDA Ratio | 1.28% | 0.53% | 1.90% | 5.61% | 3.10% | 0.14% | -0.94% | -2.56% | -1.22% | -5.05% | -4.91% | -25.53% | -12.25% | -9.08% | 1.28% | -1.04% | 3.21% | -1.36% | -56.12% | -101.90% | 100.00% | -586.20% | 100.00% |

| Operating Income | 504.00K | 2.38M | 2.64M | 15.85M | 4.33M | -9.91M | -3.80M | -9.82M | -4.87M | -19.17M | -18.14M | -80.66M | -62.99M | -28.28M | 2.84M | -2.42M | -934.00K | -8.54M | -33.49M | -24.88M | 19.57M | -15.89M | -5.40M |

| Operating Income Ratio | 0.11% | 0.53% | 0.61% | 4.00% | 1.13% | -2.37% | -0.94% | -2.56% | -1.22% | -5.05% | -4.91% | -25.53% | -15.39% | -12.72% | 1.28% | -1.04% | -0.44% | -6.08% | -63.32% | -111.20% | 100.00% | -586.20% | -27.89% |

| Total Other Income/Expenses | -12.32M | -9.17M | -10.15M | -26.79M | -6.85M | -14.93M | -19.22M | -18.72M | -18.30M | -18.62M | -14.22M | -13.13M | -12.87M | 2.29M | 1.00K | 3.08M | 7.18M | 3.53M | 56.00K | -238.00K | -19.57M | 46.00K | -399.00K |

| Income Before Tax | -11.82M | -6.79M | -2.00M | -4.56M | 5.02M | -14.34M | -23.02M | -28.54M | -23.17M | -37.79M | -32.36M | -93.79M | -75.86M | -26.00M | 2.84M | 664.00K | 6.25M | -5.01M | -33.44M | -25.12M | 0.00 | -15.84M | -5.80M |

| Income Before Tax Ratio | -2.65% | -1.52% | -0.47% | -1.15% | 1.31% | -3.43% | -5.69% | -7.44% | -5.81% | -9.95% | -8.76% | -29.68% | -18.54% | -11.69% | 1.28% | 0.28% | 2.97% | -3.57% | -63.21% | -112.26% | 0.00% | -584.50% | -29.95% |

| Income Tax Expense | 3.73M | 2.49M | 3.35M | 1.75M | 1.86M | 2.09M | 878.00K | 1.04M | 2.34M | 2.42M | 3.09M | 3.57M | 2.60M | 1.12M | -4.00K | 55.00K | 867.00K | 1.44M | 258.00K | 68.00K | 11.70M | 0.00 | -5.80M |

| Net Income | -15.55M | -9.28M | -5.35M | -6.31M | 3.83M | -16.43M | -23.90M | -29.58M | -25.50M | -40.21M | -35.45M | -103.22M | -72.04M | -26.68M | 2.84M | 609.00K | 5.38M | -5.62M | -33.69M | -25.19M | -11.70M | -15.84M | 0.00 |

| Net Income Ratio | -3.48% | -2.07% | -1.24% | -1.59% | 1.00% | -3.92% | -5.90% | -7.71% | -6.40% | -10.59% | -9.60% | -32.67% | -17.60% | -12.00% | 1.28% | 0.26% | 2.56% | -4.00% | -63.70% | -112.57% | -59.77% | -584.50% | 0.00% |

| EPS | -0.16 | -0.10 | -0.06 | -0.07 | 0.04 | -0.19 | -0.28 | -0.36 | -0.32 | -0.51 | -0.47 | -1.41 | -1.02 | -0.44 | 0.05 | 0.01 | 0.10 | -0.18 | -2.11 | -1.76 | -1.00 | -1.49 | -1.21 |

| EPS Diluted | -0.16 | -0.10 | -0.06 | -0.07 | 0.04 | -0.19 | -0.28 | -0.36 | -0.32 | -0.51 | -0.47 | -1.41 | -1.02 | -0.44 | 0.05 | 0.01 | 0.09 | -0.18 | -2.11 | -1.76 | -1.00 | -1.49 | -1.21 |

| Weighted Avg Shares Out | 98.27M | 94.88M | 92.10M | 92.03M | 89.87M | 87.47M | 84.89M | 82.50M | 80.51M | 78.28M | 75.42M | 73.20M | 70.89M | 60.09M | 57.56M | 55.41M | 54.53M | 30.76M | 16.00M | 14.28M | 11.74M | 10.61M | 10.56M |

| Weighted Avg Shares Out (Dil) | 98.27M | 94.88M | 92.10M | 92.03M | 90.62M | 87.47M | 84.89M | 82.50M | 80.51M | 78.28M | 75.80M | 73.28M | 70.89M | 60.09M | 60.19M | 58.73M | 60.43M | 30.76M | 16.00M | 14.28M | 11.74M | 10.61M | 10.56M |

3 Cutting-Edge Healthcare Stocks That Can Pay Off Big Time

Accuray (ARAY) Q2 Earnings and Revenues Top Estimates

Why Shares of Accuray Jumped Thursday

Accuray Achieves Record Product Revenue, But There's Much Work Still To Be Done

Accuray Incorporated (ARAY) Q2 2023 Earnings Call Transcript

Accuray (ARAY) Reports Q2 Loss, Tops Revenue Estimates

Accuray's (ARAY) Q1 Earnings and Revenues Lag Estimates

Accuray Incorporated (ARAY) Q1 2023 Earnings Call Transcript

Accuray (ARAY) Reports Q1 Loss, Misses Revenue Estimates

GE Healthcare and Accuray Collaborate to Expand Access, Advance the Practice of Precision Radiation Therapy

Source: https://incomestatements.info

Category: Stock Reports