See more : Hubei Goto Biopharm Co.,Ltd. (300966.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of AST SpaceMobile, Inc. (ASTS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of AST SpaceMobile, Inc., a leading company in the Communication Equipment industry within the Technology sector.

- Agricultural Bank of China Limited (ACGBY) Income Statement Analysis – Financial Results

- PT Capitalinc Investment Tbk (MTFN.JK) Income Statement Analysis – Financial Results

- Sparebanken Vest (0G67.L) Income Statement Analysis – Financial Results

- CarePayment Technologies, Inc. (CPYT) Income Statement Analysis – Financial Results

- X2M Connect Limited (X2M.AX) Income Statement Analysis – Financial Results

AST SpaceMobile, Inc. (ASTS)

About AST SpaceMobile, Inc.

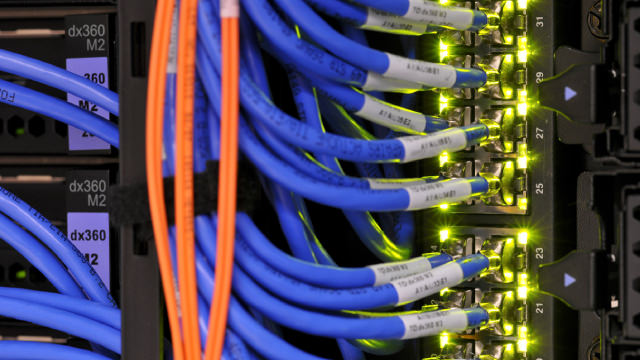

AST SpaceMobile, Inc. operates space-based cellular broadband network for mobile phones. Its SpaceMobile service provides mobile broadband services for users traveling in and out of areas without terrestrial mobile services on land, at sea, or in flight. The company is headquartered in Midland, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 24.34M | 13.83M | 12.41M | 5.97M | 1.41M | 356.00K |

| Cost of Revenue | 54.47M | 6.71M | 7.56M | 3.03M | 954.00K | 163.00K |

| Gross Profit | -30.13M | 7.11M | 4.84M | 2.94M | 460.00K | 193.00K |

| Gross Profit Ratio | -123.77% | 51.44% | 39.03% | 49.30% | 32.53% | 54.21% |

| Research & Development | 126.30M | 99.83M | 53.04M | 14.09M | 5.94M | 2.28M |

| General & Administrative | 37.40M | 48.33M | 35.64M | 12.32M | 5.40M | 2.46M |

| Selling & Marketing | 4.21M | 0.00 | 0.00 | 0.00 | -5.02M | 0.00 |

| SG&A | 41.60M | 48.33M | 35.64M | 12.32M | 384.86K | 2.46M |

| Other Expenses | 0.00 | 4.71M | 2.91M | 887.00K | 384.86K | 0.00 |

| Operating Expenses | 167.90M | 152.88M | 91.59M | 27.30M | 384.86K | 4.77M |

| Cost & Expenses | 222.37M | 159.59M | 99.15M | 30.32M | 384.86K | 4.93M |

| Interest Income | 0.00 | 2.40M | 0.00 | 71.00K | 1.20M | 4.00K |

| Interest Expense | 2.68M | 71.47M | 0.00 | 10.00K | 484.02K | 0.00 |

| Depreciation & Amortization | 54.47M | 5.43M | 3.49M | 1.11M | 188.00K | 32.00K |

| EBITDA | -166.53M | -141.05M | -83.83M | -23.47M | -2.22M | -4.55M |

| EBITDA Ratio | -684.11% | -1,158.53% | -802.89% | -391.77% | -27.22% | -1,277.25% |

| Operating Income | -222.37M | -164.88M | -102.51M | -24.26M | -384.86K | -4.58M |

| Operating Income Ratio | -913.51% | -1,192.61% | -826.38% | -406.64% | -27.22% | -1,286.24% |

| Total Other Income/Expenses | 1.37M | 36.55M | 10.90M | -804.00K | -2.32M | 5.00K |

| Income Before Tax | -221.00M | -102.50M | -72.93M | -24.27M | -2.71M | -4.57M |

| Income Before Tax Ratio | -907.88% | -741.38% | -587.91% | -406.80% | -191.45% | -1,284.83% |

| Income Tax Expense | 1.68M | 617.00K | 331.00K | 131.00K | 174.30K | 15.00K |

| Net Income | -87.56M | -103.11M | -73.26M | -24.41M | -2.88M | -4.44M |

| Net Income Ratio | -359.71% | -745.84% | -590.58% | -409.00% | -203.77% | -1,246.63% |

| EPS | -1.07 | -1.89 | -1.42 | -0.47 | -0.10 | 0.00 |

| EPS Diluted | -1.07 | -1.89 | -1.42 | -0.47 | -0.10 | 0.00 |

| Weighted Avg Shares Out | 81.82M | 54.44M | 51.73M | 51.73M | 28.75M | 25.95B |

| Weighted Avg Shares Out (Dil) | 81.82M | 54.44M | 51.73M | 51.73M | 28.75M | 25.95B |

CDNS & ASTS Partner to Boost Space-Based Cellular Broadband Network

Green Stock News for December 4, 2024: $ASTS $NXE $EVGO $GM $RVSN

Brokers Suggest Investing in AST SpaceMobile (ASTS): Read This Before Placing a Bet

Is AST SpaceMobile Stock a Buy Now?

Should ASTS Be in Your Portfolio Post Lackluster Q3 Earnings?

AST SpaceMobile Announces Participation in Upcoming Conferences

Space stocks saw big gains this week in part due to 'Trump-Elon trade' rally, analysts say

Why AST SpaceMobile Stock Just Crashed 12%

AST SpaceMobile Is Plummeting Today. Is It Time to Buy the Stock?

AST SpaceMobile Surpasses Q3 Earnings Estimates, Misses on Revenues

Source: https://incomestatements.info

Category: Stock Reports