See more : Citychamp Watch & Jewellery Group Limited (CEBTF) Income Statement Analysis – Financial Results

Complete financial analysis of GE Vernova Inc. (GEV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of GE Vernova Inc., a leading company in the Renewable Utilities industry within the Utilities sector.

- Teract S.A. (TRACT.PA) Income Statement Analysis – Financial Results

- Montero Mining and Exploration Ltd. (MXTRF) Income Statement Analysis – Financial Results

- Sygnia Limited (SYG.JO) Income Statement Analysis – Financial Results

- SergeFerrari Group SA (0QVG.L) Income Statement Analysis – Financial Results

- Molecular Pharmacology (USA), Ltd. (MLPH) Income Statement Analysis – Financial Results

GE Vernova Inc. (GEV)

About GE Vernova Inc.

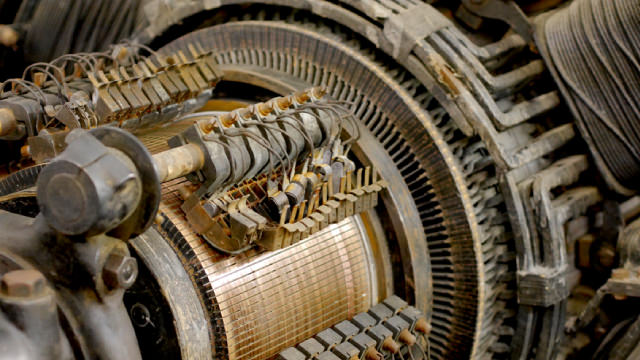

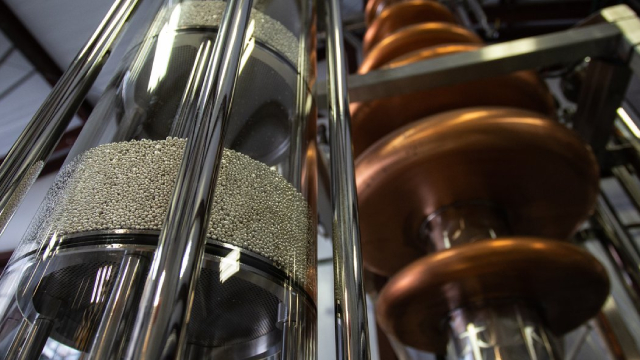

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions. The company was incorporated in 2023 and is based in Cambridge, Massachusetts.

| Metric | 2023 | 2022 | 2021 |

|---|---|---|---|

| Revenue | 33.24B | 29.65B | 33.01B |

| Cost of Revenue | 28.27B | 26.00B | 27.69B |

| Gross Profit | 4.97B | 3.65B | 5.31B |

| Gross Profit Ratio | 14.94% | 12.31% | 16.10% |

| Research & Development | 896.00M | 979.00M | 1.01B |

| General & Administrative | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 |

| SG&A | 4.85B | 4.41B | 4.68B |

| Other Expenses | 0.00 | 387.00M | 396.00M |

| Operating Expenses | 5.89B | 5.39B | 5.69B |

| Cost & Expenses | 34.16B | 31.40B | 33.38B |

| Interest Income | 0.00 | 42.00M | 71.00M |

| Interest Expense | 71.00M | 151.00M | 172.00M |

| Depreciation & Amortization | 964.00M | 991.00M | 1.18B |

| EBITDA | 932.00M | -1.33B | 484.00M |

| EBITDA Ratio | 2.80% | -2.54% | 2.42% |

| Operating Income | -923.00M | -1.74B | -378.00M |

| Operating Income Ratio | -2.78% | -5.88% | -1.15% |

| Total Other Income/Expenses | 793.00M | 407.00M | 20.00M |

| Income Before Tax | -130.00M | -2.47B | -864.00M |

| Income Before Tax Ratio | -0.39% | -8.34% | -2.62% |

| Income Tax Expense | 344.00M | 248.00M | -140.00M |

| Net Income | -438.00M | -2.74B | -633.00M |

| Net Income Ratio | -1.32% | -9.23% | -1.92% |

| EPS | -1.98 | -10.06 | -2.33 |

| EPS Diluted | -1.98 | -10.06 | -2.33 |

| Weighted Avg Shares Out | 272.08M | 272.08M | 272.08M |

| Weighted Avg Shares Out (Dil) | 272.08M | 272.08M | 272.08M |

Why the Market Dipped But GE Vernova (GEV) Gained Today

Hunting For Magnificent Growth Next Year? Check Out These 7 Stocks.

Is GEV The Best Utility Stock to Buy This December?

How GE Vernova plans to deploy small nuclear reactors across the developed world

GE Vernova (GEV) Stock Declines While Market Improves: Some Information for Investors

GE Vernova: Leading Energy Transition, Initiate With A Buy

GE Vernova Stock Is an AI Winner. The Case to Buy.

Cramer's Mad Dash: GE Vernova

GEV: Room For Multiple Expansion

GE Vernova, AWS Enhance Strategic Alliance: Time to Buy the GEV Stock?

Source: https://incomestatements.info

Category: Stock Reports