See more : Veken Technology Co., Ltd. (600152.SS) Income Statement Analysis – Financial Results

Complete financial analysis of GE Vernova Inc. (GEV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of GE Vernova Inc., a leading company in the Renewable Utilities industry within the Utilities sector.

- XP Inc. (XPVVV) Income Statement Analysis – Financial Results

- Alfa Financial Software Holdings PLC (ALFA.L) Income Statement Analysis – Financial Results

- FBR Limited (FBR.AX) Income Statement Analysis – Financial Results

- Dana Incorporated (DAN) Income Statement Analysis – Financial Results

- Tetra Bio-Pharma Inc. (TBPMF) Income Statement Analysis – Financial Results

GE Vernova Inc. (GEV)

About GE Vernova Inc.

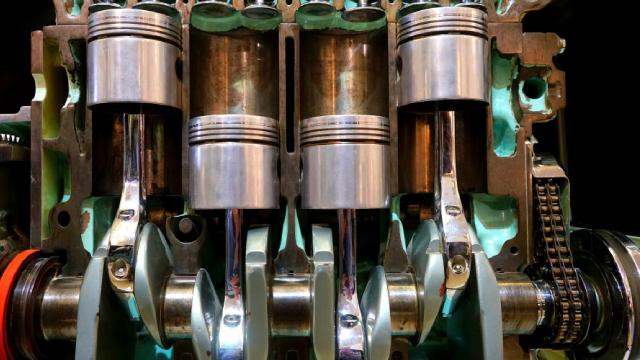

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions. The company was incorporated in 2023 and is based in Cambridge, Massachusetts.

| Metric | 2023 | 2022 | 2021 |

|---|---|---|---|

| Revenue | 33.24B | 29.65B | 33.01B |

| Cost of Revenue | 28.27B | 26.00B | 27.69B |

| Gross Profit | 4.97B | 3.65B | 5.31B |

| Gross Profit Ratio | 14.94% | 12.31% | 16.10% |

| Research & Development | 896.00M | 979.00M | 1.01B |

| General & Administrative | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 |

| SG&A | 4.85B | 4.41B | 4.68B |

| Other Expenses | 0.00 | 387.00M | 396.00M |

| Operating Expenses | 5.89B | 5.39B | 5.69B |

| Cost & Expenses | 34.16B | 31.40B | 33.38B |

| Interest Income | 0.00 | 42.00M | 71.00M |

| Interest Expense | 71.00M | 151.00M | 172.00M |

| Depreciation & Amortization | 964.00M | 991.00M | 1.18B |

| EBITDA | 932.00M | -1.33B | 484.00M |

| EBITDA Ratio | 2.80% | -2.54% | 2.42% |

| Operating Income | -923.00M | -1.74B | -378.00M |

| Operating Income Ratio | -2.78% | -5.88% | -1.15% |

| Total Other Income/Expenses | 793.00M | 407.00M | 20.00M |

| Income Before Tax | -130.00M | -2.47B | -864.00M |

| Income Before Tax Ratio | -0.39% | -8.34% | -2.62% |

| Income Tax Expense | 344.00M | 248.00M | -140.00M |

| Net Income | -438.00M | -2.74B | -633.00M |

| Net Income Ratio | -1.32% | -9.23% | -1.92% |

| EPS | -1.98 | -10.06 | -2.33 |

| EPS Diluted | -1.98 | -10.06 | -2.33 |

| Weighted Avg Shares Out | 272.08M | 272.08M | 272.08M |

| Weighted Avg Shares Out (Dil) | 272.08M | 272.08M | 272.08M |

3 Stocks to Buy, Now That Reality Has Come to the Clean-Energy Revolution

Hunting For Magnificent Growth Next Year? Check Out These 7 Stocks.

GE Vernova (GEV) Suffers a Larger Drop Than the General Market: Key Insights

GE Vernova Set to Supply Turbines for Australian Wind Farm: Buy Now?

GE Vernova stock is firing on all cylinders: analysts see an 8% retreat

Vanguard Group Inc's Strategic Acquisition in GE Vernova Inc

Stocks on the Move: Vistra, GE Vernova, Exxon and Apollo

GE Vernova Stock Is Slipping. A Bull Has Left the ‘Crowded Trade.

Jim Cramer analyzes the top performers of Q3

GE Vernova (GEV) Rises As Market Takes a Dip: Key Facts

Source: https://incomestatements.info

Category: Stock Reports