See more : Two Harbors Investment Corp. (TWO) Income Statement Analysis – Financial Results

Complete financial analysis of The InterGroup Corporation (INTG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The InterGroup Corporation, a leading company in the Travel Lodging industry within the Consumer Cyclical sector.

- Huntington Bancshares Incorporated (0J72.L) Income Statement Analysis – Financial Results

- Nanalysis Scientific Corp. (NSCIF) Income Statement Analysis – Financial Results

- Al Meera Consumer Goods Company Q.P.S.C. (MERS.QA) Income Statement Analysis – Financial Results

- Boliden AB (publ) (BOLIF) Income Statement Analysis – Financial Results

- Ormat Technologies, Inc. (ORA) Income Statement Analysis – Financial Results

The InterGroup Corporation (INTG)

About The InterGroup Corporation

The InterGroup Corporation, through its subsidiaries, operates a hotel under the Hilton San Francisco Financial District name located in San Francisco, California. It operates through three segments: Hotel Operations, Real Estate Operations, and Investment Transactions. The company's hotel consists of 544 guest rooms and luxury suites with approximately 22,000 square feet of meeting room space, a grand ballroom, 5 levels underground parking garage, a pedestrian bridge, and a Chinese culture center. As of June 30, 2021, it owned, managed, and invested in 16 apartment complexes, 3 single-family houses as strategic investments, and 1 commercial real estate property located in the United States, as well as approximately 2 acres of unimproved land in Maui, Hawaii. Further, the company invests in income-producing instruments, corporate debt and equity securities, publicly traded investment funds, mortgage-backed securities, securities issued by REITs, and other companies that invest primarily in real estate. The InterGroup Corporation was incorporated in 1965 and is based in Los Angeles, California.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 58.14M | 57.61M | 47.22M | 28.66M | 58.02M | 74.75M | 71.58M | 69.01M | 72.90M | 72.74M | 67.30M | 62.04M | 57.00M | 50.21M | 44.84M | 45.61M | 49.05M | 45.01M | 12.01M | 12.97M | 13.76M | 14.15M | 12.80M | 13.15M | 11.82M | 12.76M | 11.88M | 11.56M | 11.14M | 11.00M | 11.80M | 9.40M | 9.90M | 7.90M | 14.70M | 7.70M | 8.00M | 7.20M | 7.00M |

| Cost of Revenue | 45.98M | 44.47M | 36.15M | 25.78M | 45.38M | 52.28M | 47.68M | 47.88M | 54.04M | 55.25M | 49.79M | 47.16M | 41.35M | 36.74M | 33.08M | 33.67M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 12.17M | 13.13M | 11.07M | 2.88M | 12.63M | 22.48M | 23.90M | 21.12M | 18.86M | 17.48M | 17.51M | 14.88M | 15.65M | 13.47M | 11.76M | 11.94M | 49.05M | 45.01M | 12.01M | 12.97M | 13.76M | 14.15M | 12.80M | 13.15M | 11.82M | 12.76M | 11.88M | 11.56M | 11.14M | 11.00M | 11.80M | 9.40M | 9.90M | 7.90M | 14.70M | 7.70M | 8.00M | 7.20M | 7.00M |

| Gross Profit Ratio | 20.92% | 22.80% | 23.45% | 10.04% | 21.77% | 30.07% | 33.39% | 30.61% | 25.87% | 24.04% | 26.02% | 23.98% | 27.45% | 26.83% | 26.22% | 26.18% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -0.03 | -0.25 | 0.49 | -0.14 | 0.03 | 0.12 | -0.02 | -0.18 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.39M | 3.33M | 2.65M | 3.11M | 2.87M | 2.35M | 3.05M | 2.82M | 2.72M | 2.86M | 2.17M | 1.95M | 1.84M | 1.88M | 1.81M | 1.66M | 1.82M | 1.75M | 1.66M | 1.46M | 1.89M | 1.85M | 1.93M | 1.62M | 1.87M | 1.64M | 1.91M | 824.78K | 1.03M | 1.56M | 1.40M | 1.30M | 1.50M | 1.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 130.00K | 61.00K | 110.00K | 176.00K | 282.00K | 302.00K | 294.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.39M | 3.33M | 2.65M | 3.11M | 2.87M | 2.35M | 3.05M | 2.82M | 2.72M | 2.86M | 2.17M | 1.95M | 1.84M | 1.88M | 1.81M | 1.66M | 1.82M | 1.75M | 1.66M | 1.46M | 1.89M | 1.85M | 1.93M | 1.62M | 1.87M | 1.64M | 1.91M | 824.78K | 1.03M | 1.56M | 1.40M | 1.30M | 1.50M | 1.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 6.32M | -3.33M | 4.75M | 4.64M | 4.87M | 4.94M | 5.05M | 5.31M | 5.15M | 458.00K | 4.72M | 4.58M | 4.45M | 6.31M | 6.91M | 7.46M | 49.82M | 33.91M | 9.51M | 9.41M | 13.56M | 13.35M | 11.99M | 11.37M | 9.21M | 10.33M | 10.63M | 9.82M | 9.63M | 9.19M | -8.80M | -8.00M | -6.40M | -6.60M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Operating Expenses | 10.71M | 8.80M | 7.40M | 7.75M | 7.74M | 7.28M | 8.11M | 8.13M | 7.87M | 7.80M | 6.89M | 6.53M | 6.29M | 8.19M | 8.72M | 9.12M | 51.64M | 35.66M | 11.17M | 10.87M | 15.45M | 15.20M | 13.92M | 12.99M | 11.07M | 11.96M | 12.54M | 10.65M | 10.65M | 10.75M | -7.40M | -6.70M | -4.90M | -5.10M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Cost & Expenses | 56.69M | 53.27M | 43.55M | 33.53M | 53.13M | 59.56M | 55.79M | 56.01M | 61.90M | 63.06M | 56.68M | 53.69M | 47.64M | 44.93M | 41.80M | 42.79M | 51.64M | 35.66M | 11.17M | 10.87M | 15.45M | 15.20M | 13.92M | 12.99M | 11.07M | 11.96M | 12.54M | 10.65M | 10.65M | 10.75M | -7.40M | -6.70M | -4.90M | -5.10M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Interest Income | 0.00 | 485.00K | 980.00K | 519.00K | 363.00K | 484.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.25M | 1.54M | 425.00K | 205.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 13.56M | 10.14M | 10.31M | 10.25M | 10.32M | 10.94M | 10.95M | 10.76M | 10.84M | 11.89M | 10.11M | 7.88M | 7.87M | 7.94M | 7.49M | 7.44M | 4.48M | 0.00 | 3.48M | 10.97M | 0.00 | 0.00 | 21.54M | 922.00K | 0.00 | 3.30M | 0.00 | 0.00 | 0.00 | 1.23M | 700.00K | 0.00 | 0.00 | 0.00 | 5.30M | 6.90M | 7.20M | 7.10M | 4.20M |

| Depreciation & Amortization | 6.32M | 53.27M | 43.55M | 33.53M | 62.90M | 69.92M | 65.56M | 65.61M | 71.80M | 4.94M | 4.72M | 4.58M | 4.47M | 6.31M | 6.91M | 6.78M | 6.71M | 6.85M | 2.36M | 3.46M | 2.83M | 2.72M | 2.49M | 2.42M | 1.99M | 2.23M | 1.94M | 1.65M | 1.59M | 1.67M | 1.80M | 1.60M | 1.40M | 300.00K | -5.30M | -6.90M | -8.50M | -8.20M | -4.20M |

| EBITDA | 7.77M | 9.80M | 8.43M | -231.00K | 9.76M | 20.13M | 24.88M | 18.39M | 16.22M | 14.49M | 5.83M | 12.93M | 5.96M | 3.65M | 2.46M | 2.84M | 5.12M | -667.00K | 1.88M | 6.29M | 1.13M | 1.68M | 1.38M | 8.99M | 2.74M | 10.16M | -171.00K | 2.56M | 2.08M | 1.93M | 21.00M | 17.70M | 16.20M | 13.30M | 22.90M | 13.50M | 15.20M | 14.30M | 12.10M |

| EBITDA Ratio | 13.37% | 17.01% | 17.84% | -0.81% | 16.83% | 26.93% | 29.12% | 26.64% | 22.14% | 20.74% | 22.80% | 20.84% | 26.46% | 26.16% | 23.12% | 21.48% | 10.04% | 41.16% | 23.46% | 109.69% | -36.77% | -22.63% | 31.14% | 68.39% | -157.24% | 79.57% | -1.44% | 9.36% | 16.20% | 31.98% | 177.97% | 188.30% | 148.48% | 168.35% | 155.78% | 175.32% | 190.00% | 198.61% | 172.86% |

| Operating Income | 1.45M | 4.34M | 3.67M | -4.87M | 4.89M | 15.20M | 16.07M | 13.00M | 5.60M | 9.68M | 2.66M | 8.35M | 9.36M | 5.28M | 3.04M | 2.82M | 2.18M | -6.95M | -2.16M | -1.72M | -1.70M | -1.05M | 9.16M | 166.00K | 744.00K | 803.00K | -662.00K | 1.54M | 483.41K | 250.69K | 700.00K | -800.00K | 1.40M | -1.10M | 8.20M | 5.80M | 7.20M | 7.10M | 5.10M |

| Operating Income Ratio | 2.50% | 7.53% | 7.77% | -16.99% | 8.43% | 20.33% | 22.45% | 18.83% | 7.68% | 13.31% | 3.95% | 13.46% | 16.42% | 10.52% | 6.77% | 6.17% | 4.44% | -15.45% | -17.96% | -13.29% | -12.32% | -7.41% | 71.58% | 1.26% | 6.30% | 6.29% | -5.57% | 13.33% | 4.34% | 2.28% | 5.93% | -8.51% | 14.14% | -13.92% | 55.78% | 75.32% | 90.00% | 98.61% | 72.86% |

| Total Other Income/Expenses | -14.09M | -5.84M | -15.32M | 19.02M | -12.77M | -12.68M | -7.20M | -14.15M | -18.81M | -4.88M | -12.97M | -7.97M | -12.41M | 6.86M | -9.43M | -2.40M | -3.48M | 662.00K | -3.48M | -10.97M | 16.11M | 6.62M | -21.54M | -2.99M | 35.31M | -3.20M | 2.06M | 1.77M | 422.42K | -1.23M | -19.20M | -16.90M | -13.40M | -14.10M | -20.00M | -14.60M | -15.20M | -14.30M | -11.20M |

| Income Before Tax | -12.64M | -1.50M | -11.65M | 14.15M | -7.88M | 2.51M | 8.87M | -1.16M | -13.21M | 4.80M | -10.32M | 378.00K | -3.05M | 12.14M | -6.40M | 413.00K | -6.07M | -6.29M | -5.64M | -12.69M | 8.41M | 5.57M | -12.37M | -756.00K | 36.05M | -2.50M | 1.87M | 3.31M | 905.83K | -976.02K | 700.00K | -800.00K | 1.40M | -1.10M | 2.90M | -1.10M | -1.30M | -1.10M | 900.00K |

| Income Before Tax Ratio | -21.74% | -2.60% | -24.66% | 49.37% | -13.59% | 3.36% | 12.39% | -1.67% | -18.12% | 6.60% | -15.33% | 0.61% | -5.36% | 24.18% | -14.27% | 0.91% | -12.37% | -13.98% | -46.95% | -97.90% | 61.11% | 39.36% | -96.66% | -5.75% | 305.07% | -19.55% | 15.74% | 28.62% | 8.13% | -8.87% | 5.93% | -8.51% | 14.14% | -13.92% | 19.73% | -14.29% | -16.25% | -15.28% | 12.86% |

| Income Tax Expense | -83.00K | 8.43M | -1.03M | 3.60M | -2.79M | -301.00K | 3.06M | 521.00K | -3.94M | 2.75M | -3.57M | -247.00K | -1.48M | 3.80M | -1.71M | 827.00K | -2.01M | -1.44M | -2.65M | -2.67M | 3.52M | 2.20M | -5.09M | 308.00K | 15.93M | -1.01M | 934.00K | 1.44M | 358.83K | -436.88K | -700.00K | 100.00K | 400.00K | -100.00K | 100.00K | 400.00K | 1.30M | 1.10M | 400.00K |

| Net Income | -9.80M | -6.72M | -10.62M | 10.41M | -5.09M | 2.81M | 5.81M | -1.65M | -7.14M | 2.94M | -4.69M | -715.00K | -2.33M | 8.75M | -2.55M | 389.00K | -301.00K | -3.59M | -1.92M | -3.13M | 3.07M | 2.57M | -4.20M | -2.51M | 17.25M | -1.74M | 154.00K | 1.87M | 547.00K | 491.30K | 700.00K | -900.00K | 1.00M | -1.00M | 2.80M | -1.50M | -1.30M | -1.10M | 500.00K |

| Net Income Ratio | -16.85% | -11.66% | -22.48% | 36.32% | -8.77% | 3.76% | 8.12% | -2.40% | -9.79% | 4.04% | -6.97% | -1.15% | -4.08% | 17.43% | -5.69% | 0.85% | -0.61% | -7.98% | -16.01% | -24.12% | 22.32% | 18.14% | -32.84% | -19.09% | 146.01% | -13.61% | 1.30% | 16.17% | 4.91% | 4.47% | 5.93% | -9.57% | 10.10% | -12.66% | 19.05% | -19.48% | -16.25% | -15.28% | 7.14% |

| EPS | -4.46 | -3.03 | -4.77 | 4.68 | -2.21 | 1.21 | 2.18 | -0.70 | -2.99 | 1.23 | -1.98 | -0.30 | -0.97 | 3.63 | -1.07 | 0.16 | -0.13 | -1.53 | -0.81 | -1.27 | 1.23 | 0.95 | -1.51 | -0.87 | 5.83 | -0.57 | 0.05 | 0.58 | 0.19 | 0.17 | 0.23 | -0.31 | 0.33 | -0.33 | 0.89 | -0.45 | -0.33 | -0.27 | 0.14 |

| EPS Diluted | -4.46 | -3.03 | -4.77 | 4.07 | -2.21 | 1.06 | 2.18 | -0.70 | -2.99 | 1.21 | -1.98 | -0.30 | -0.97 | 3.49 | -1.07 | 0.16 | -0.13 | -1.32 | -0.70 | -1.10 | 1.23 | 0.86 | -1.51 | -0.87 | 5.42 | -0.57 | 0.05 | 0.58 | 0.19 | 0.17 | 0.23 | -0.31 | 0.33 | -0.33 | 0.89 | -0.45 | -0.33 | -0.27 | 0.14 |

| Weighted Avg Shares Out | 2.20M | 2.22M | 2.22M | 2.22M | 2.30M | 2.33M | 2.67M | 2.36M | 2.38M | 2.38M | 2.37M | 2.35M | 2.39M | 2.41M | 2.38M | 2.36M | 2.35M | 2.35M | 2.39M | 2.47M | 2.53M | 2.71M | 2.79M | 2.88M | 2.96M | 3.07M | 3.17M | 3.24M | 2.85M | 2.98M | 3.09M | 2.87M | 3.06M | 3.06M | 3.16M | 3.36M | 3.98M | 4.12M | 3.57M |

| Weighted Avg Shares Out (Dil) | 2.20M | 2.22M | 2.22M | 2.56M | 2.30M | 2.66M | 2.67M | 2.37M | 2.38M | 2.43M | 2.37M | 2.41M | 2.39M | 2.51M | 2.38M | 2.36M | 2.35M | 2.72M | 2.75M | 2.83M | 2.86M | 3.00M | 2.79M | 2.88M | 3.18M | 3.07M | 3.17M | 3.24M | 3.10M | 2.98M | 3.09M | 2.87M | 3.06M | 3.06M | 3.16M | 3.36M | 3.98M | 4.12M | 3.57M |

Portsmouth Square: Small, Overlooked, And Cheap

Portsmouth Square Is Way Too Cheap

InterGroup (NASDAQ:INTG) Shares Gap Down to $32.70

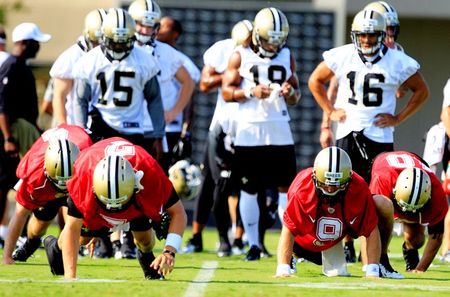

NFL: Dozens of players positive for COVID-19 since training camps open, opt-out deadline looms

Head-To-Head Review: InterGroup (NASDAQ:INTG) versus Phoenix Tree (NASDAQ:DNK)

Phoenix Tree (NYSE:DNK) versus InterGroup (NYSE:INTG) Financial Analysis

Riassunto: XSignals di XCHG, che offre indici di mercato e insight fruibili in materia di ambiente, società e governance (ESG), acquisisce i suoi primi utenti

Comparing Phoenix Tree (NYSE:DNK) and InterGroup (NYSE:INTG)

Contrasting InterGroup (NASDAQ:INTG) and Phoenix Tree (NASDAQ:DNK)

Head-To-Head Review: Phoenix Tree (NYSE:DNK) & InterGroup (NYSE:INTG)

Source: https://incomestatements.info

Category: Stock Reports