See more : Hotel Royal Chihpen (5704.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of The InterGroup Corporation (INTG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The InterGroup Corporation, a leading company in the Travel Lodging industry within the Consumer Cyclical sector.

- First Sensor AG (SIS.DE) Income Statement Analysis – Financial Results

- VBC Ferro Alloys Limited (VBCFERROQ.BO) Income Statement Analysis – Financial Results

- Immobiliere Distri-Land NV (DISL.BR) Income Statement Analysis – Financial Results

- Gillette India Limited (GILLETTE.NS) Income Statement Analysis – Financial Results

- Chain Bridge Bancorp, Inc. (CBNA) Income Statement Analysis – Financial Results

The InterGroup Corporation (INTG)

About The InterGroup Corporation

The InterGroup Corporation, through its subsidiaries, operates a hotel under the Hilton San Francisco Financial District name located in San Francisco, California. It operates through three segments: Hotel Operations, Real Estate Operations, and Investment Transactions. The company's hotel consists of 544 guest rooms and luxury suites with approximately 22,000 square feet of meeting room space, a grand ballroom, 5 levels underground parking garage, a pedestrian bridge, and a Chinese culture center. As of June 30, 2021, it owned, managed, and invested in 16 apartment complexes, 3 single-family houses as strategic investments, and 1 commercial real estate property located in the United States, as well as approximately 2 acres of unimproved land in Maui, Hawaii. Further, the company invests in income-producing instruments, corporate debt and equity securities, publicly traded investment funds, mortgage-backed securities, securities issued by REITs, and other companies that invest primarily in real estate. The InterGroup Corporation was incorporated in 1965 and is based in Los Angeles, California.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 58.14M | 57.61M | 47.22M | 28.66M | 58.02M | 74.75M | 71.58M | 69.01M | 72.90M | 72.74M | 67.30M | 62.04M | 57.00M | 50.21M | 44.84M | 45.61M | 49.05M | 45.01M | 12.01M | 12.97M | 13.76M | 14.15M | 12.80M | 13.15M | 11.82M | 12.76M | 11.88M | 11.56M | 11.14M | 11.00M | 11.80M | 9.40M | 9.90M | 7.90M | 14.70M | 7.70M | 8.00M | 7.20M | 7.00M |

| Cost of Revenue | 45.98M | 44.47M | 36.15M | 25.78M | 45.38M | 52.28M | 47.68M | 47.88M | 54.04M | 55.25M | 49.79M | 47.16M | 41.35M | 36.74M | 33.08M | 33.67M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 12.17M | 13.13M | 11.07M | 2.88M | 12.63M | 22.48M | 23.90M | 21.12M | 18.86M | 17.48M | 17.51M | 14.88M | 15.65M | 13.47M | 11.76M | 11.94M | 49.05M | 45.01M | 12.01M | 12.97M | 13.76M | 14.15M | 12.80M | 13.15M | 11.82M | 12.76M | 11.88M | 11.56M | 11.14M | 11.00M | 11.80M | 9.40M | 9.90M | 7.90M | 14.70M | 7.70M | 8.00M | 7.20M | 7.00M |

| Gross Profit Ratio | 20.92% | 22.80% | 23.45% | 10.04% | 21.77% | 30.07% | 33.39% | 30.61% | 25.87% | 24.04% | 26.02% | 23.98% | 27.45% | 26.83% | 26.22% | 26.18% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -0.03 | -0.25 | 0.49 | -0.14 | 0.03 | 0.12 | -0.02 | -0.18 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.39M | 3.33M | 2.65M | 3.11M | 2.87M | 2.35M | 3.05M | 2.82M | 2.72M | 2.86M | 2.17M | 1.95M | 1.84M | 1.88M | 1.81M | 1.66M | 1.82M | 1.75M | 1.66M | 1.46M | 1.89M | 1.85M | 1.93M | 1.62M | 1.87M | 1.64M | 1.91M | 824.78K | 1.03M | 1.56M | 1.40M | 1.30M | 1.50M | 1.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 130.00K | 61.00K | 110.00K | 176.00K | 282.00K | 302.00K | 294.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.39M | 3.33M | 2.65M | 3.11M | 2.87M | 2.35M | 3.05M | 2.82M | 2.72M | 2.86M | 2.17M | 1.95M | 1.84M | 1.88M | 1.81M | 1.66M | 1.82M | 1.75M | 1.66M | 1.46M | 1.89M | 1.85M | 1.93M | 1.62M | 1.87M | 1.64M | 1.91M | 824.78K | 1.03M | 1.56M | 1.40M | 1.30M | 1.50M | 1.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 6.32M | -3.33M | 4.75M | 4.64M | 4.87M | 4.94M | 5.05M | 5.31M | 5.15M | 458.00K | 4.72M | 4.58M | 4.45M | 6.31M | 6.91M | 7.46M | 49.82M | 33.91M | 9.51M | 9.41M | 13.56M | 13.35M | 11.99M | 11.37M | 9.21M | 10.33M | 10.63M | 9.82M | 9.63M | 9.19M | -8.80M | -8.00M | -6.40M | -6.60M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Operating Expenses | 10.71M | 8.80M | 7.40M | 7.75M | 7.74M | 7.28M | 8.11M | 8.13M | 7.87M | 7.80M | 6.89M | 6.53M | 6.29M | 8.19M | 8.72M | 9.12M | 51.64M | 35.66M | 11.17M | 10.87M | 15.45M | 15.20M | 13.92M | 12.99M | 11.07M | 11.96M | 12.54M | 10.65M | 10.65M | 10.75M | -7.40M | -6.70M | -4.90M | -5.10M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Cost & Expenses | 56.69M | 53.27M | 43.55M | 33.53M | 53.13M | 59.56M | 55.79M | 56.01M | 61.90M | 63.06M | 56.68M | 53.69M | 47.64M | 44.93M | 41.80M | 42.79M | 51.64M | 35.66M | 11.17M | 10.87M | 15.45M | 15.20M | 13.92M | 12.99M | 11.07M | 11.96M | 12.54M | 10.65M | 10.65M | 10.75M | -7.40M | -6.70M | -4.90M | -5.10M | -8.20M | -5.80M | -7.20M | -7.10M | -5.10M |

| Interest Income | 0.00 | 485.00K | 980.00K | 519.00K | 363.00K | 484.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.25M | 1.54M | 425.00K | 205.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 13.56M | 10.14M | 10.31M | 10.25M | 10.32M | 10.94M | 10.95M | 10.76M | 10.84M | 11.89M | 10.11M | 7.88M | 7.87M | 7.94M | 7.49M | 7.44M | 4.48M | 0.00 | 3.48M | 10.97M | 0.00 | 0.00 | 21.54M | 922.00K | 0.00 | 3.30M | 0.00 | 0.00 | 0.00 | 1.23M | 700.00K | 0.00 | 0.00 | 0.00 | 5.30M | 6.90M | 7.20M | 7.10M | 4.20M |

| Depreciation & Amortization | 6.32M | 53.27M | 43.55M | 33.53M | 62.90M | 69.92M | 65.56M | 65.61M | 71.80M | 4.94M | 4.72M | 4.58M | 4.47M | 6.31M | 6.91M | 6.78M | 6.71M | 6.85M | 2.36M | 3.46M | 2.83M | 2.72M | 2.49M | 2.42M | 1.99M | 2.23M | 1.94M | 1.65M | 1.59M | 1.67M | 1.80M | 1.60M | 1.40M | 300.00K | -5.30M | -6.90M | -8.50M | -8.20M | -4.20M |

| EBITDA | 7.77M | 9.80M | 8.43M | -231.00K | 9.76M | 20.13M | 24.88M | 18.39M | 16.22M | 14.49M | 5.83M | 12.93M | 5.96M | 3.65M | 2.46M | 2.84M | 5.12M | -667.00K | 1.88M | 6.29M | 1.13M | 1.68M | 1.38M | 8.99M | 2.74M | 10.16M | -171.00K | 2.56M | 2.08M | 1.93M | 21.00M | 17.70M | 16.20M | 13.30M | 22.90M | 13.50M | 15.20M | 14.30M | 12.10M |

| EBITDA Ratio | 13.37% | 17.01% | 17.84% | -0.81% | 16.83% | 26.93% | 29.12% | 26.64% | 22.14% | 20.74% | 22.80% | 20.84% | 26.46% | 26.16% | 23.12% | 21.48% | 10.04% | 41.16% | 23.46% | 109.69% | -36.77% | -22.63% | 31.14% | 68.39% | -157.24% | 79.57% | -1.44% | 9.36% | 16.20% | 31.98% | 177.97% | 188.30% | 148.48% | 168.35% | 155.78% | 175.32% | 190.00% | 198.61% | 172.86% |

| Operating Income | 1.45M | 4.34M | 3.67M | -4.87M | 4.89M | 15.20M | 16.07M | 13.00M | 5.60M | 9.68M | 2.66M | 8.35M | 9.36M | 5.28M | 3.04M | 2.82M | 2.18M | -6.95M | -2.16M | -1.72M | -1.70M | -1.05M | 9.16M | 166.00K | 744.00K | 803.00K | -662.00K | 1.54M | 483.41K | 250.69K | 700.00K | -800.00K | 1.40M | -1.10M | 8.20M | 5.80M | 7.20M | 7.10M | 5.10M |

| Operating Income Ratio | 2.50% | 7.53% | 7.77% | -16.99% | 8.43% | 20.33% | 22.45% | 18.83% | 7.68% | 13.31% | 3.95% | 13.46% | 16.42% | 10.52% | 6.77% | 6.17% | 4.44% | -15.45% | -17.96% | -13.29% | -12.32% | -7.41% | 71.58% | 1.26% | 6.30% | 6.29% | -5.57% | 13.33% | 4.34% | 2.28% | 5.93% | -8.51% | 14.14% | -13.92% | 55.78% | 75.32% | 90.00% | 98.61% | 72.86% |

| Total Other Income/Expenses | -14.09M | -5.84M | -15.32M | 19.02M | -12.77M | -12.68M | -7.20M | -14.15M | -18.81M | -4.88M | -12.97M | -7.97M | -12.41M | 6.86M | -9.43M | -2.40M | -3.48M | 662.00K | -3.48M | -10.97M | 16.11M | 6.62M | -21.54M | -2.99M | 35.31M | -3.20M | 2.06M | 1.77M | 422.42K | -1.23M | -19.20M | -16.90M | -13.40M | -14.10M | -20.00M | -14.60M | -15.20M | -14.30M | -11.20M |

| Income Before Tax | -12.64M | -1.50M | -11.65M | 14.15M | -7.88M | 2.51M | 8.87M | -1.16M | -13.21M | 4.80M | -10.32M | 378.00K | -3.05M | 12.14M | -6.40M | 413.00K | -6.07M | -6.29M | -5.64M | -12.69M | 8.41M | 5.57M | -12.37M | -756.00K | 36.05M | -2.50M | 1.87M | 3.31M | 905.83K | -976.02K | 700.00K | -800.00K | 1.40M | -1.10M | 2.90M | -1.10M | -1.30M | -1.10M | 900.00K |

| Income Before Tax Ratio | -21.74% | -2.60% | -24.66% | 49.37% | -13.59% | 3.36% | 12.39% | -1.67% | -18.12% | 6.60% | -15.33% | 0.61% | -5.36% | 24.18% | -14.27% | 0.91% | -12.37% | -13.98% | -46.95% | -97.90% | 61.11% | 39.36% | -96.66% | -5.75% | 305.07% | -19.55% | 15.74% | 28.62% | 8.13% | -8.87% | 5.93% | -8.51% | 14.14% | -13.92% | 19.73% | -14.29% | -16.25% | -15.28% | 12.86% |

| Income Tax Expense | -83.00K | 8.43M | -1.03M | 3.60M | -2.79M | -301.00K | 3.06M | 521.00K | -3.94M | 2.75M | -3.57M | -247.00K | -1.48M | 3.80M | -1.71M | 827.00K | -2.01M | -1.44M | -2.65M | -2.67M | 3.52M | 2.20M | -5.09M | 308.00K | 15.93M | -1.01M | 934.00K | 1.44M | 358.83K | -436.88K | -700.00K | 100.00K | 400.00K | -100.00K | 100.00K | 400.00K | 1.30M | 1.10M | 400.00K |

| Net Income | -9.80M | -6.72M | -10.62M | 10.41M | -5.09M | 2.81M | 5.81M | -1.65M | -7.14M | 2.94M | -4.69M | -715.00K | -2.33M | 8.75M | -2.55M | 389.00K | -301.00K | -3.59M | -1.92M | -3.13M | 3.07M | 2.57M | -4.20M | -2.51M | 17.25M | -1.74M | 154.00K | 1.87M | 547.00K | 491.30K | 700.00K | -900.00K | 1.00M | -1.00M | 2.80M | -1.50M | -1.30M | -1.10M | 500.00K |

| Net Income Ratio | -16.85% | -11.66% | -22.48% | 36.32% | -8.77% | 3.76% | 8.12% | -2.40% | -9.79% | 4.04% | -6.97% | -1.15% | -4.08% | 17.43% | -5.69% | 0.85% | -0.61% | -7.98% | -16.01% | -24.12% | 22.32% | 18.14% | -32.84% | -19.09% | 146.01% | -13.61% | 1.30% | 16.17% | 4.91% | 4.47% | 5.93% | -9.57% | 10.10% | -12.66% | 19.05% | -19.48% | -16.25% | -15.28% | 7.14% |

| EPS | -4.46 | -3.03 | -4.77 | 4.68 | -2.21 | 1.21 | 2.18 | -0.70 | -2.99 | 1.23 | -1.98 | -0.30 | -0.97 | 3.63 | -1.07 | 0.16 | -0.13 | -1.53 | -0.81 | -1.27 | 1.23 | 0.95 | -1.51 | -0.87 | 5.83 | -0.57 | 0.05 | 0.58 | 0.19 | 0.17 | 0.23 | -0.31 | 0.33 | -0.33 | 0.89 | -0.45 | -0.33 | -0.27 | 0.14 |

| EPS Diluted | -4.46 | -3.03 | -4.77 | 4.07 | -2.21 | 1.06 | 2.18 | -0.70 | -2.99 | 1.21 | -1.98 | -0.30 | -0.97 | 3.49 | -1.07 | 0.16 | -0.13 | -1.32 | -0.70 | -1.10 | 1.23 | 0.86 | -1.51 | -0.87 | 5.42 | -0.57 | 0.05 | 0.58 | 0.19 | 0.17 | 0.23 | -0.31 | 0.33 | -0.33 | 0.89 | -0.45 | -0.33 | -0.27 | 0.14 |

| Weighted Avg Shares Out | 2.20M | 2.22M | 2.22M | 2.22M | 2.30M | 2.33M | 2.67M | 2.36M | 2.38M | 2.38M | 2.37M | 2.35M | 2.39M | 2.41M | 2.38M | 2.36M | 2.35M | 2.35M | 2.39M | 2.47M | 2.53M | 2.71M | 2.79M | 2.88M | 2.96M | 3.07M | 3.17M | 3.24M | 2.85M | 2.98M | 3.09M | 2.87M | 3.06M | 3.06M | 3.16M | 3.36M | 3.98M | 4.12M | 3.57M |

| Weighted Avg Shares Out (Dil) | 2.20M | 2.22M | 2.22M | 2.56M | 2.30M | 2.66M | 2.67M | 2.37M | 2.38M | 2.43M | 2.37M | 2.41M | 2.39M | 2.51M | 2.38M | 2.36M | 2.35M | 2.72M | 2.75M | 2.83M | 2.86M | 3.00M | 2.79M | 2.88M | 3.18M | 3.07M | 3.17M | 3.24M | 3.10M | 2.98M | 3.09M | 2.87M | 3.06M | 3.06M | 3.16M | 3.36M | 3.98M | 4.12M | 3.57M |

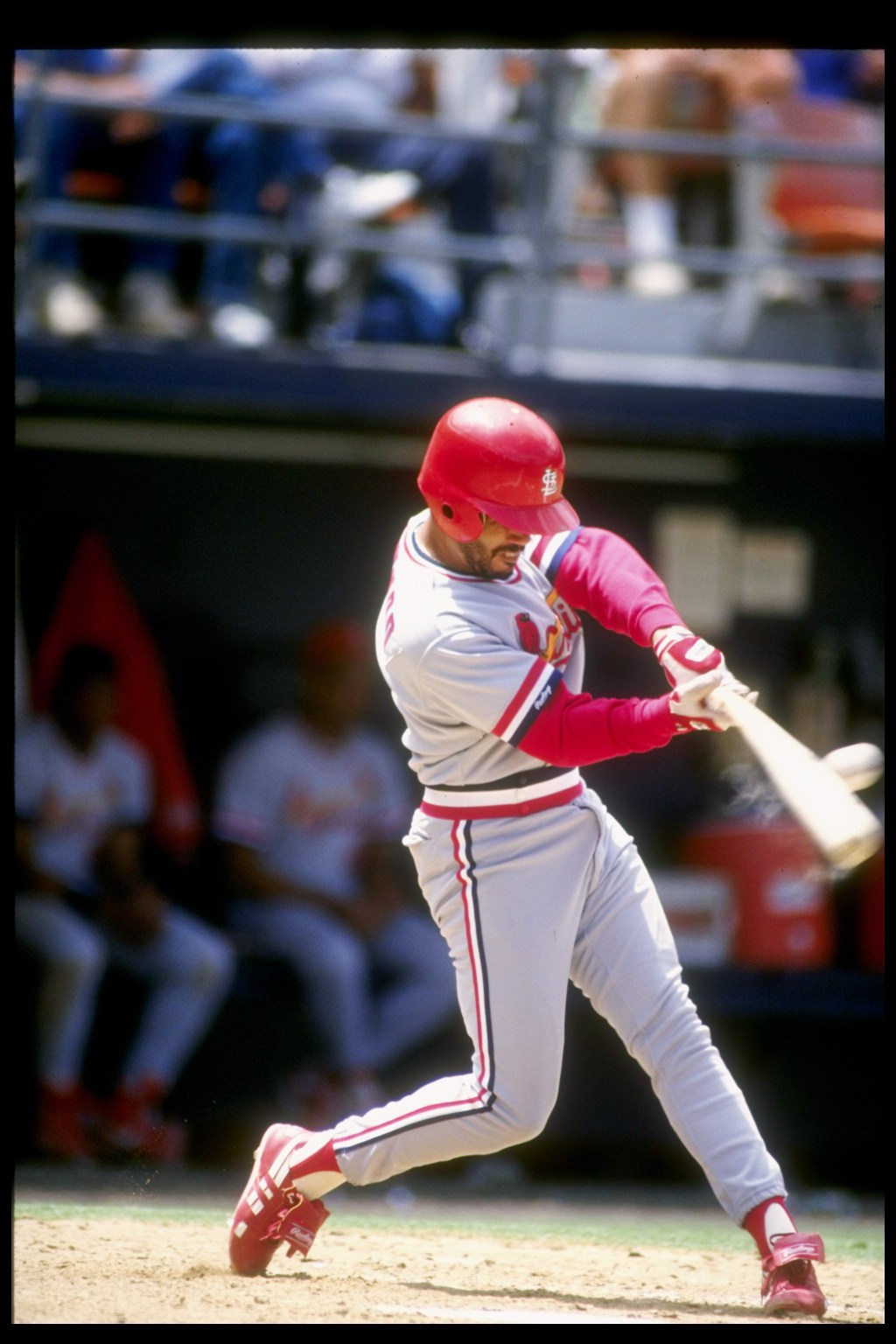

Simulation: Can Giants beat Cards in replay of 1987 NLCS?

Phoenix Tree (NYSE:DNK) versus InterGroup (NYSE:INTG) Financial Analysis

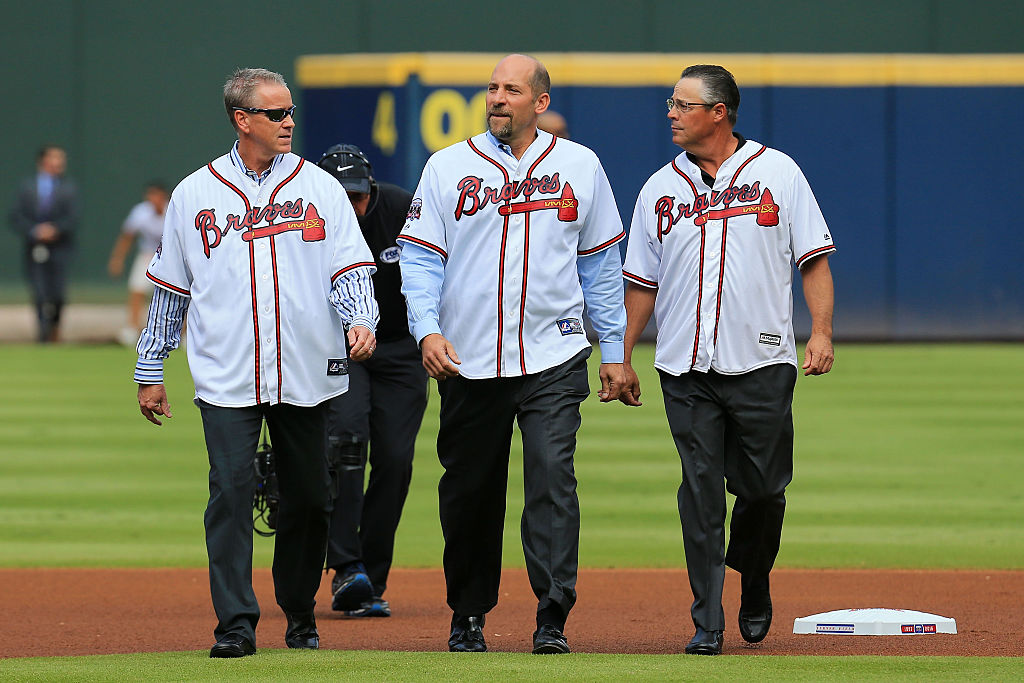

Simulation: Giants face Braves in virtual 1997 NL Championship

Can Giants get revenge on Marlins?

InterGroup (NASDAQ:INTG) Share Price Crosses Below Two Hundred Day Moving Average of $32.02

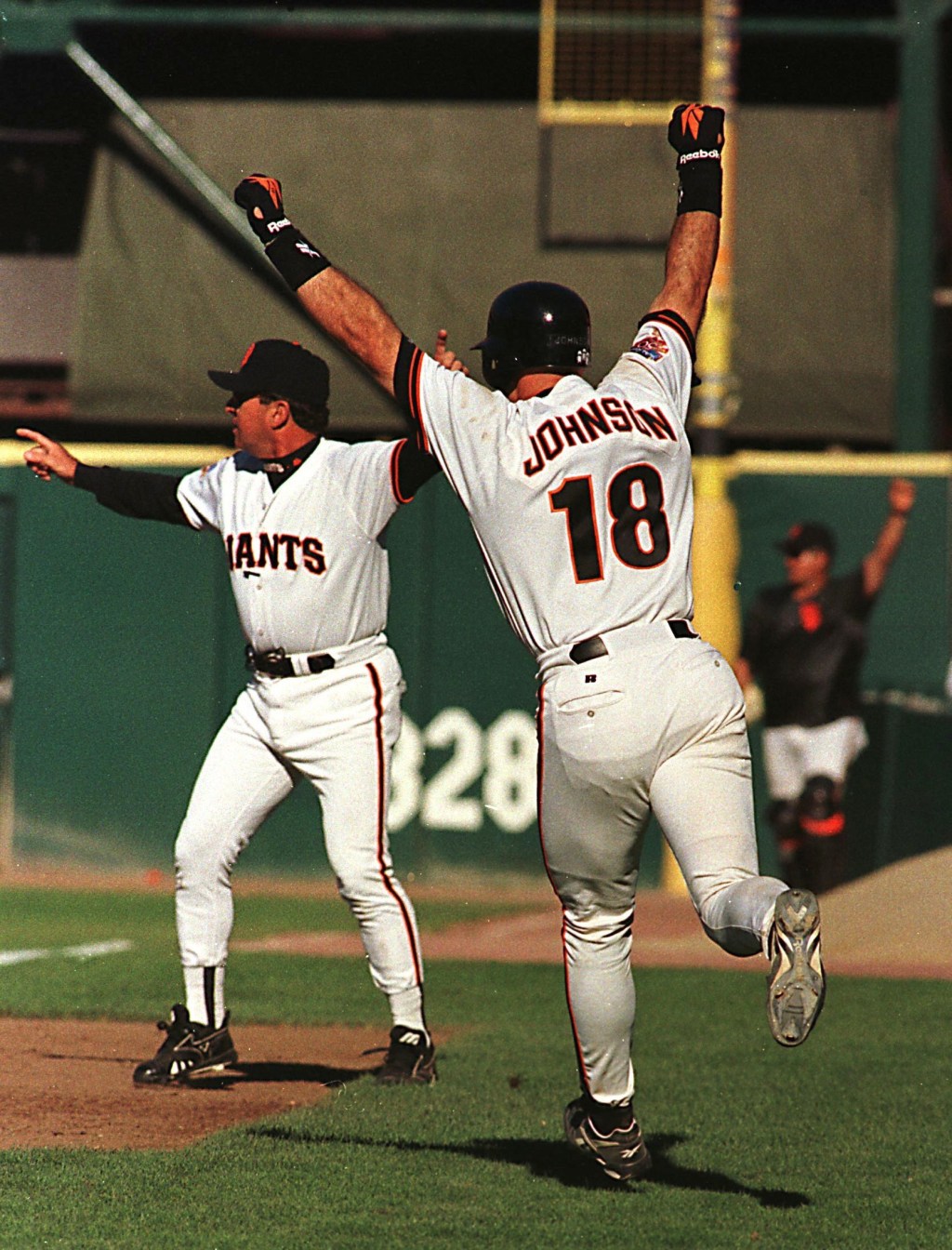

Simulation: As in real life, Giants take 3-2 lead in 2002 World Series

The Government can't let our beloved zoos go under - they're vital for conservation

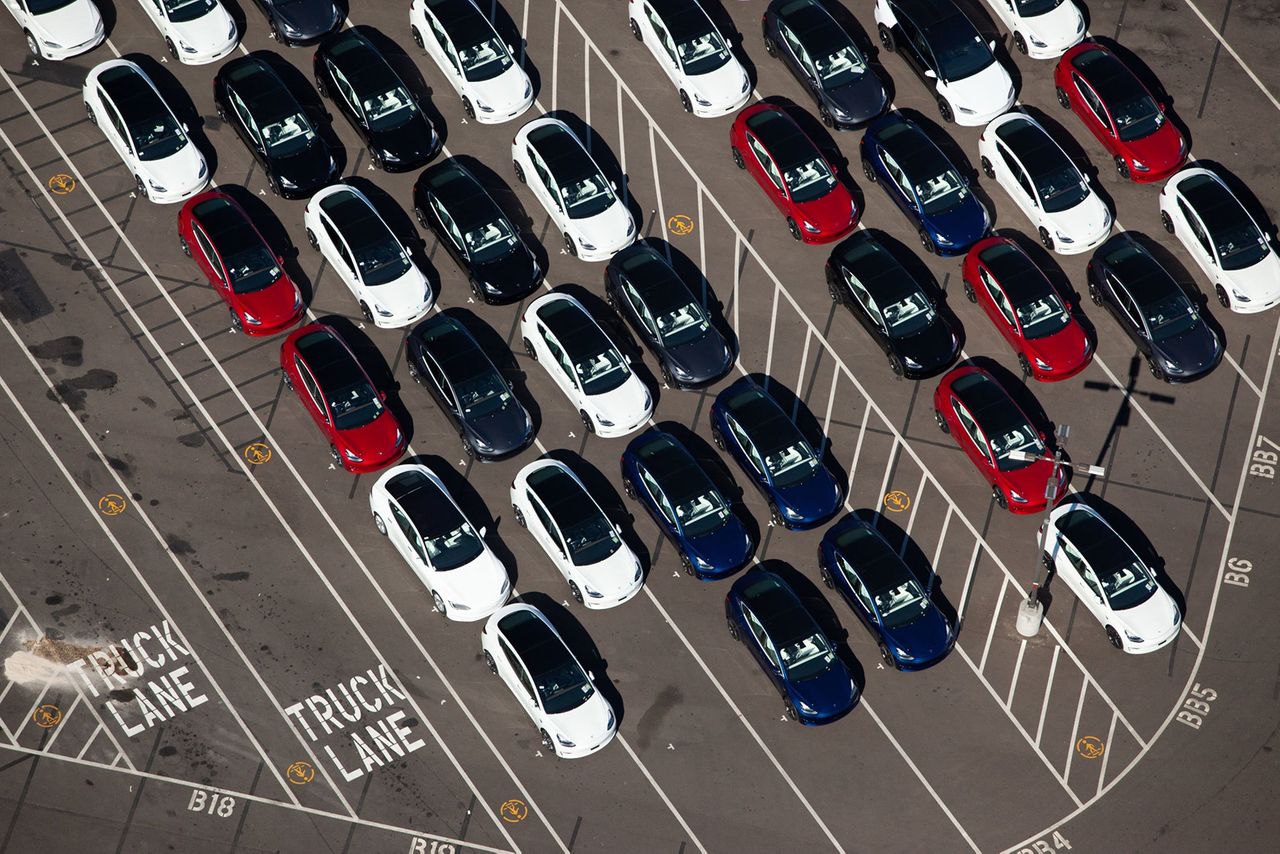

Tesla Plans to Restart Its California Factory. Here’s Why That Might Not Happen Soon.

San Francisco gets alcohol, tobacco for addicts in hotels

Michael McClure, a famed San Francisco Beat poet, dies at age 87

Source: https://incomestatements.info

Category: Stock Reports