See more : PGT Innovations, Inc. (PGTI) Income Statement Analysis – Financial Results

Complete financial analysis of Nova Ltd. (NVMI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nova Ltd., a leading company in the Semiconductors industry within the Technology sector.

- TATA Health International Holdings Limited (1255.HK) Income Statement Analysis – Financial Results

- Yokogawa Bridge Holdings Corp. (5911.T) Income Statement Analysis – Financial Results

- Asante Gold Corporation (ASE.CN) Income Statement Analysis – Financial Results

- Gujarat Ambuja Exports Limited (GAEL.NS) Income Statement Analysis – Financial Results

- Barloworld Limited (BRRAF) Income Statement Analysis – Financial Results

Nova Ltd. (NVMI)

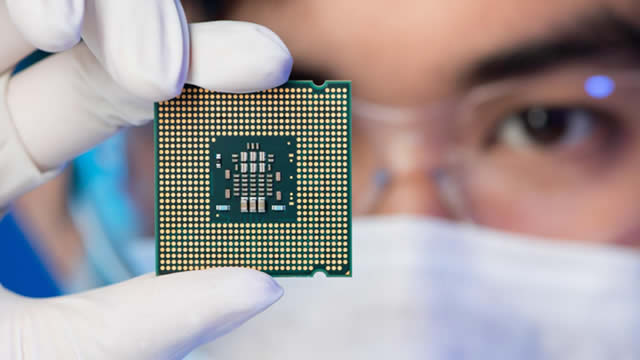

About Nova Ltd.

Nova Ltd. designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally. Its product portfolio includes a set of metrology platforms for dimensional, films, and materials and chemical metrology measurements for process control for various semiconductor manufacturing process steps, including lithography, etch, chemical mechanical planarization, deposition, electrochemical plating, and advanced packaging. The company serves various sectors of the integrated circuit manufacturing industry, including logic, foundries, and memory manufacturers, as well as process equipment manufacturers. Nova Ltd. was formerly known as Nova Measuring Instruments Ltd. and changed its name to Nova Ltd. in July 2021. The company was incorporated in 1993 and is headquartered in Rehovot, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 517.92M | 570.73M | 416.11M | 269.40M | 224.91M | 251.13M | 221.99M | 163.90M | 148.51M | 120.62M | 111.51M | 96.17M | 102.83M | 86.62M | 39.32M | 38.97M | 58.08M | 48.29M | 30.14M | 40.88M | 26.69M | 20.37M | 21.17M | 48.46M | 27.58M |

| Cost of Revenue | 224.75M | 248.33M | 178.75M | 116.47M | 103.09M | 105.90M | 90.81M | 88.62M | 71.43M | 57.01M | 52.44M | 45.01M | 44.83M | 39.20M | 21.73M | 25.99M | 33.25M | 27.74M | 19.31M | 22.08M | 16.54M | 13.35M | 16.47M | 23.48M | 16.67M |

| Gross Profit | 293.18M | 322.40M | 237.36M | 152.92M | 121.82M | 145.23M | 131.19M | 75.28M | 77.08M | 63.61M | 59.07M | 51.15M | 58.00M | 47.42M | 17.59M | 12.98M | 24.83M | 20.55M | 10.84M | 18.80M | 10.15M | 7.02M | 4.70M | 24.99M | 10.91M |

| Gross Profit Ratio | 56.61% | 56.49% | 57.04% | 56.77% | 54.16% | 57.83% | 59.10% | 45.93% | 51.90% | 52.74% | 52.97% | 53.19% | 56.40% | 54.74% | 44.73% | 33.32% | 42.75% | 42.55% | 35.95% | 46.00% | 38.04% | 34.45% | 22.20% | 51.55% | 39.56% |

| Research & Development | 88.04M | 90.46M | 65.86M | 53.02M | 44.51M | 45.45M | 38.96M | 35.00M | 39.70M | 29.50M | 29.58M | 24.59M | 18.68M | 12.45M | 6.87M | 8.61M | 9.14M | 9.17M | 9.30M | 8.67M | 8.56M | 9.89M | 13.25M | 13.88M | 8.57M |

| General & Administrative | 20.40M | 23.85M | 17.32M | 12.51M | 10.07M | 8.74M | 8.10M | 6.84M | 5.86M | 4.46M | 5.20M | 3.98M | 3.23M | 2.97M | 2.24M | 3.20M | 15.01M | 13.89M | 10.58M | 0.00 | 6.23M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 52.47M | 52.12M | 39.34M | 29.32M | 28.21M | 27.99M | 23.75M | 20.74M | 15.77M | 12.75M | 11.96M | 12.00M | 11.37M | 10.13M | 6.01M | 7.50M | 0.00 | 0.00 | 0.00 | 0.00 | 6.95M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 72.87M | 75.97M | 56.66M | 41.84M | 38.28M | 36.73M | 31.85M | 27.57M | 21.62M | 17.20M | 17.16M | 15.98M | 14.60M | 13.10M | 8.25M | 10.70M | 15.01M | 13.89M | 10.58M | 9.20M | 6.23M | 8.75M | 9.88M | 11.18M | 5.74M |

| Other Expenses | 0.00 | 6.03M | 2.46M | 2.50M | 2.63M | 1.76M | 1.76M | 1.76M | 1.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.83M | 0.00 | 0.00 | 0.00 | 1.48M | 0.00 | 1.03M | 0.00 | 2.00M |

| Operating Expenses | 160.91M | 172.47M | 124.98M | 97.35M | 85.41M | 84.79M | 73.37M | 65.11M | 62.84M | 46.70M | 46.74M | 40.57M | 33.28M | 25.55M | 15.12M | 19.31M | 27.98M | 23.06M | 19.88M | 17.86M | 14.79M | 18.64M | 24.16M | 25.06M | 16.31M |

| Cost & Expenses | 385.66M | 420.80M | 303.73M | 213.83M | 188.50M | 190.69M | 164.17M | 153.74M | 134.28M | 103.71M | 99.18M | 85.58M | 78.11M | 64.75M | 36.85M | 45.29M | 61.23M | 50.80M | 39.18M | 39.94M | 31.33M | 31.99M | 40.63M | 48.54M | 32.98M |

| Interest Income | 22.64M | 6.48M | 2.19M | 4.06M | 3.08M | 2.98M | 2.28M | 1.22M | 643.00K | 563.00K | 693.00K | 1.37M | 901.00K | 305.00K | 163.00K | 171.00K | 602.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.51M | 1.28M | 4.23M | 868.00K | 99.00K | 87.00K | 112.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.20M | 0.00 | 0.00 | 0.00 | 0.00 | 1.48M | 1.03M | 0.00 | 150.00K |

| Depreciation & Amortization | 16.20M | 14.65M | 8.93M | 8.38M | 10.40M | 7.68M | 6.18M | 6.59M | 9.62M | 3.95M | 3.52M | 2.78M | 1.70M | 1.26M | 1.25M | 1.32M | 2.80M | 2.08M | 894.00K | 670.00K | 1.26M | 1.88M | 2.71M | 3.05M | 2.00M |

| EBITDA | 172.41M | 164.59M | 121.32M | 63.95M | 46.81M | 68.13M | 64.00M | 16.76M | 21.20M | 20.86M | 15.86M | 13.37M | 26.42M | 23.13M | 3.72M | -5.01M | -2.17M | -432.00K | -8.15M | -1.28M | -3.38M | -9.75M | -16.75M | 2.97M | -3.40M |

| EBITDA Ratio | 33.29% | 28.84% | 29.16% | 24.24% | 20.81% | 27.13% | 28.83% | 10.36% | 17.85% | 17.30% | 14.22% | 13.90% | 25.69% | 26.70% | 9.47% | -11.22% | 8.33% | -0.89% | -27.03% | 3.94% | -12.67% | -40.60% | -74.26% | 6.12% | -11.77% |

| Operating Income | 132.26M | 149.93M | 112.39M | 55.57M | 36.41M | 60.44M | 57.82M | 10.17M | 11.58M | 16.91M | 12.33M | 10.58M | 24.72M | 21.87M | 2.47M | -6.96M | -3.15M | -2.51M | -9.04M | 939.00K | -4.64M | -13.10M | -19.46M | -77.00K | -5.39M |

| Operating Income Ratio | 25.54% | 26.27% | 27.01% | 20.63% | 16.19% | 24.07% | 26.05% | 6.20% | 7.80% | 14.02% | 11.06% | 11.01% | 24.04% | 25.25% | 6.28% | -17.86% | -5.43% | -5.19% | -29.99% | 2.30% | -17.37% | -64.31% | -91.92% | -0.16% | -19.56% |

| Total Other Income/Expenses | 22.44M | 8.48M | -3.13M | 926.00K | 3.08M | 2.98M | 2.28M | 1.22M | 643.00K | 563.00K | 693.00K | 1.37M | 901.00K | 305.00K | 163.00K | 1.37M | -764.00K | 573.00K | 627.00K | 528.00K | 4.78M | 0.00 | -1.03M | 0.00 | -150.00K |

| Income Before Tax | 154.70M | 158.41M | 109.25M | 56.50M | 39.49M | 63.43M | 60.10M | 11.38M | 12.22M | 17.47M | 13.03M | 11.95M | 25.62M | 22.18M | 2.63M | -5.59M | -8.35M | 0.00 | 0.00 | 0.00 | 144.00K | -13.10M | -20.49M | 0.00 | -5.54M |

| Income Before Tax Ratio | 29.87% | 27.76% | 26.26% | 20.97% | 17.56% | 25.26% | 27.07% | 6.94% | 8.23% | 14.49% | 11.68% | 12.43% | 24.91% | 25.60% | 6.69% | -14.35% | -14.38% | 0.00% | 0.00% | 0.00% | 0.54% | -64.31% | -96.76% | 0.00% | -20.10% |

| Income Tax Expense | 18.39M | 18.20M | 16.15M | 8.59M | 4.32M | 9.05M | 13.64M | 1.74M | -3.50M | -1.18M | 2.51M | 124.00K | -2.50M | -305.00K | -163.00K | -904.00K | 764.00K | -573.00K | -627.00K | -528.00K | -425.00K | 1.33M | -2.59M | -2.86M | -359.00K |

| Net Income | 136.31M | 140.21M | 93.10M | 47.91M | 35.17M | 54.38M | 46.46M | 9.64M | 15.73M | 18.65M | 10.52M | 11.83M | 28.12M | 22.18M | 2.63M | -5.42M | -3.92M | -1.93M | -8.41M | 1.47M | -4.21M | -12.96M | -16.87M | 2.78M | -5.04M |

| Net Income Ratio | 26.32% | 24.57% | 22.37% | 17.78% | 15.64% | 21.65% | 20.93% | 5.88% | 10.59% | 15.46% | 9.43% | 12.30% | 27.34% | 25.60% | 6.69% | -13.91% | -6.74% | -4.00% | -27.91% | 3.59% | -15.78% | -63.61% | -79.70% | 5.74% | -18.26% |

| EPS | 4.77 | 4.89 | 3.28 | 1.71 | 1.26 | 1.94 | 1.68 | 0.35 | 0.58 | 0.68 | 0.39 | 0.44 | 1.07 | 0.91 | 0.14 | -0.28 | -0.21 | -0.12 | -0.55 | -0.09 | -0.28 | -0.88 | -1.16 | 0.20 | -0.49 |

| EPS Diluted | 4.28 | 4.40 | 3.12 | 1.65 | 1.23 | 1.89 | 1.63 | 0.35 | 0.57 | 0.67 | 0.38 | 0.43 | 1.04 | 0.86 | 0.13 | -0.28 | -0.21 | -0.12 | -0.55 | -0.09 | -0.28 | -0.87 | -1.12 | 0.19 | -0.49 |

| Weighted Avg Shares Out | 28.83M | 28.70M | 28.37M | 28.10M | 27.90M | 28.02M | 27.70M | 27.18M | 27.19M | 27.45M | 27.09M | 26.62M | 26.23M | 24.45M | 19.47M | 19.37M | 18.61M | 15.98M | 15.44M | 15.26M | 14.99M | 14.79M | 14.58M | 13.58M | 10.33M |

| Weighted Avg Shares Out (Dil) | 32.09M | 31.87M | 29.82M | 28.95M | 28.57M | 28.77M | 28.52M | 27.50M | 27.51M | 27.81M | 27.37M | 27.28M | 26.93M | 25.69M | 20.09M | 19.37M | 18.61M | 15.98M | 15.44M | 15.26M | 14.99M | 14.90M | 15.13M | 14.69M | 10.33M |

Amazon Launches Nova AI Models for Business, Sweetens Anthropic Deal

Amazon unveils new Nova AI suite of products

Introducing Amazon Nova: A New Generation of Foundation Models

Amazon announces Nova, a new family of multimodal AI models

Wall Street Analysts See a 27.45% Upside in Nova Ltd. (NVMI): Can the Stock Really Move This High?

Nova Acquires Sentronics Metrology to Expand its Dimensional Metrology Portfolio

Nova Pacific Drilling Confirms Significance of High-Grade Historical Trench Results

Nova Leap Health Corp. enters into Term Sheet to amend its Credit Agreement for up to an Additional $7 million to Support Continued Growth

Nova Ltd. Expands Innovative Nova Fit® Machine Learning Capabilities to Enhance VeraFlex® Platform

Nova Minerals 2024 Sampling Finds up to 54.1% Antimony at the Styx Prospect on its Estelle Gold and Critical Minerals Project in Alaska

Source: https://incomestatements.info

Category: Stock Reports