See more : Nissen Inc. (6543.T) Income Statement Analysis – Financial Results

Complete financial analysis of Nova Ltd. (NVMI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nova Ltd., a leading company in the Semiconductors industry within the Technology sector.

- Autodesk, Inc. (ADSK) Income Statement Analysis – Financial Results

- INTEGRA SWITCHGEAR LTD. (INTEGSW.BO) Income Statement Analysis – Financial Results

- African Equity Empowerment Investments Limited (AEE.JO) Income Statement Analysis – Financial Results

- MCAP Inc. (MCAP) Income Statement Analysis – Financial Results

- UltraTech Cement Limited (UCLQF) Income Statement Analysis – Financial Results

Nova Ltd. (NVMI)

About Nova Ltd.

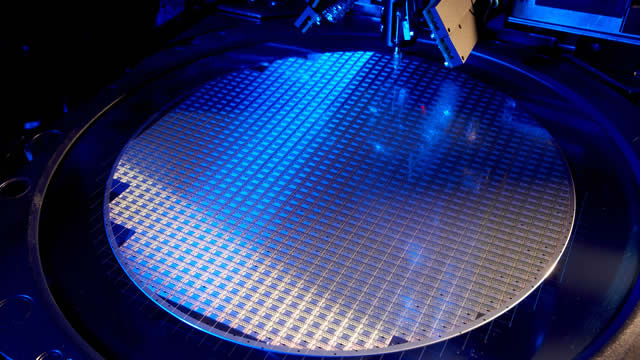

Nova Ltd. designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally. Its product portfolio includes a set of metrology platforms for dimensional, films, and materials and chemical metrology measurements for process control for various semiconductor manufacturing process steps, including lithography, etch, chemical mechanical planarization, deposition, electrochemical plating, and advanced packaging. The company serves various sectors of the integrated circuit manufacturing industry, including logic, foundries, and memory manufacturers, as well as process equipment manufacturers. Nova Ltd. was formerly known as Nova Measuring Instruments Ltd. and changed its name to Nova Ltd. in July 2021. The company was incorporated in 1993 and is headquartered in Rehovot, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 517.92M | 570.73M | 416.11M | 269.40M | 224.91M | 251.13M | 221.99M | 163.90M | 148.51M | 120.62M | 111.51M | 96.17M | 102.83M | 86.62M | 39.32M | 38.97M | 58.08M | 48.29M | 30.14M | 40.88M | 26.69M | 20.37M | 21.17M | 48.46M | 27.58M |

| Cost of Revenue | 224.75M | 248.33M | 178.75M | 116.47M | 103.09M | 105.90M | 90.81M | 88.62M | 71.43M | 57.01M | 52.44M | 45.01M | 44.83M | 39.20M | 21.73M | 25.99M | 33.25M | 27.74M | 19.31M | 22.08M | 16.54M | 13.35M | 16.47M | 23.48M | 16.67M |

| Gross Profit | 293.18M | 322.40M | 237.36M | 152.92M | 121.82M | 145.23M | 131.19M | 75.28M | 77.08M | 63.61M | 59.07M | 51.15M | 58.00M | 47.42M | 17.59M | 12.98M | 24.83M | 20.55M | 10.84M | 18.80M | 10.15M | 7.02M | 4.70M | 24.99M | 10.91M |

| Gross Profit Ratio | 56.61% | 56.49% | 57.04% | 56.77% | 54.16% | 57.83% | 59.10% | 45.93% | 51.90% | 52.74% | 52.97% | 53.19% | 56.40% | 54.74% | 44.73% | 33.32% | 42.75% | 42.55% | 35.95% | 46.00% | 38.04% | 34.45% | 22.20% | 51.55% | 39.56% |

| Research & Development | 88.04M | 90.46M | 65.86M | 53.02M | 44.51M | 45.45M | 38.96M | 35.00M | 39.70M | 29.50M | 29.58M | 24.59M | 18.68M | 12.45M | 6.87M | 8.61M | 9.14M | 9.17M | 9.30M | 8.67M | 8.56M | 9.89M | 13.25M | 13.88M | 8.57M |

| General & Administrative | 20.40M | 23.85M | 17.32M | 12.51M | 10.07M | 8.74M | 8.10M | 6.84M | 5.86M | 4.46M | 5.20M | 3.98M | 3.23M | 2.97M | 2.24M | 3.20M | 15.01M | 13.89M | 10.58M | 0.00 | 6.23M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 52.47M | 52.12M | 39.34M | 29.32M | 28.21M | 27.99M | 23.75M | 20.74M | 15.77M | 12.75M | 11.96M | 12.00M | 11.37M | 10.13M | 6.01M | 7.50M | 0.00 | 0.00 | 0.00 | 0.00 | 6.95M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 72.87M | 75.97M | 56.66M | 41.84M | 38.28M | 36.73M | 31.85M | 27.57M | 21.62M | 17.20M | 17.16M | 15.98M | 14.60M | 13.10M | 8.25M | 10.70M | 15.01M | 13.89M | 10.58M | 9.20M | 6.23M | 8.75M | 9.88M | 11.18M | 5.74M |

| Other Expenses | 0.00 | 6.03M | 2.46M | 2.50M | 2.63M | 1.76M | 1.76M | 1.76M | 1.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.83M | 0.00 | 0.00 | 0.00 | 1.48M | 0.00 | 1.03M | 0.00 | 2.00M |

| Operating Expenses | 160.91M | 172.47M | 124.98M | 97.35M | 85.41M | 84.79M | 73.37M | 65.11M | 62.84M | 46.70M | 46.74M | 40.57M | 33.28M | 25.55M | 15.12M | 19.31M | 27.98M | 23.06M | 19.88M | 17.86M | 14.79M | 18.64M | 24.16M | 25.06M | 16.31M |

| Cost & Expenses | 385.66M | 420.80M | 303.73M | 213.83M | 188.50M | 190.69M | 164.17M | 153.74M | 134.28M | 103.71M | 99.18M | 85.58M | 78.11M | 64.75M | 36.85M | 45.29M | 61.23M | 50.80M | 39.18M | 39.94M | 31.33M | 31.99M | 40.63M | 48.54M | 32.98M |

| Interest Income | 22.64M | 6.48M | 2.19M | 4.06M | 3.08M | 2.98M | 2.28M | 1.22M | 643.00K | 563.00K | 693.00K | 1.37M | 901.00K | 305.00K | 163.00K | 171.00K | 602.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.51M | 1.28M | 4.23M | 868.00K | 99.00K | 87.00K | 112.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.20M | 0.00 | 0.00 | 0.00 | 0.00 | 1.48M | 1.03M | 0.00 | 150.00K |

| Depreciation & Amortization | 16.20M | 14.65M | 8.93M | 8.38M | 10.40M | 7.68M | 6.18M | 6.59M | 9.62M | 3.95M | 3.52M | 2.78M | 1.70M | 1.26M | 1.25M | 1.32M | 2.80M | 2.08M | 894.00K | 670.00K | 1.26M | 1.88M | 2.71M | 3.05M | 2.00M |

| EBITDA | 172.41M | 164.59M | 121.32M | 63.95M | 46.81M | 68.13M | 64.00M | 16.76M | 21.20M | 20.86M | 15.86M | 13.37M | 26.42M | 23.13M | 3.72M | -5.01M | -2.17M | -432.00K | -8.15M | -1.28M | -3.38M | -9.75M | -16.75M | 2.97M | -3.40M |

| EBITDA Ratio | 33.29% | 28.84% | 29.16% | 24.24% | 20.81% | 27.13% | 28.83% | 10.36% | 17.85% | 17.30% | 14.22% | 13.90% | 25.69% | 26.70% | 9.47% | -11.22% | 8.33% | -0.89% | -27.03% | 3.94% | -12.67% | -40.60% | -74.26% | 6.12% | -11.77% |

| Operating Income | 132.26M | 149.93M | 112.39M | 55.57M | 36.41M | 60.44M | 57.82M | 10.17M | 11.58M | 16.91M | 12.33M | 10.58M | 24.72M | 21.87M | 2.47M | -6.96M | -3.15M | -2.51M | -9.04M | 939.00K | -4.64M | -13.10M | -19.46M | -77.00K | -5.39M |

| Operating Income Ratio | 25.54% | 26.27% | 27.01% | 20.63% | 16.19% | 24.07% | 26.05% | 6.20% | 7.80% | 14.02% | 11.06% | 11.01% | 24.04% | 25.25% | 6.28% | -17.86% | -5.43% | -5.19% | -29.99% | 2.30% | -17.37% | -64.31% | -91.92% | -0.16% | -19.56% |

| Total Other Income/Expenses | 22.44M | 8.48M | -3.13M | 926.00K | 3.08M | 2.98M | 2.28M | 1.22M | 643.00K | 563.00K | 693.00K | 1.37M | 901.00K | 305.00K | 163.00K | 1.37M | -764.00K | 573.00K | 627.00K | 528.00K | 4.78M | 0.00 | -1.03M | 0.00 | -150.00K |

| Income Before Tax | 154.70M | 158.41M | 109.25M | 56.50M | 39.49M | 63.43M | 60.10M | 11.38M | 12.22M | 17.47M | 13.03M | 11.95M | 25.62M | 22.18M | 2.63M | -5.59M | -8.35M | 0.00 | 0.00 | 0.00 | 144.00K | -13.10M | -20.49M | 0.00 | -5.54M |

| Income Before Tax Ratio | 29.87% | 27.76% | 26.26% | 20.97% | 17.56% | 25.26% | 27.07% | 6.94% | 8.23% | 14.49% | 11.68% | 12.43% | 24.91% | 25.60% | 6.69% | -14.35% | -14.38% | 0.00% | 0.00% | 0.00% | 0.54% | -64.31% | -96.76% | 0.00% | -20.10% |

| Income Tax Expense | 18.39M | 18.20M | 16.15M | 8.59M | 4.32M | 9.05M | 13.64M | 1.74M | -3.50M | -1.18M | 2.51M | 124.00K | -2.50M | -305.00K | -163.00K | -904.00K | 764.00K | -573.00K | -627.00K | -528.00K | -425.00K | 1.33M | -2.59M | -2.86M | -359.00K |

| Net Income | 136.31M | 140.21M | 93.10M | 47.91M | 35.17M | 54.38M | 46.46M | 9.64M | 15.73M | 18.65M | 10.52M | 11.83M | 28.12M | 22.18M | 2.63M | -5.42M | -3.92M | -1.93M | -8.41M | 1.47M | -4.21M | -12.96M | -16.87M | 2.78M | -5.04M |

| Net Income Ratio | 26.32% | 24.57% | 22.37% | 17.78% | 15.64% | 21.65% | 20.93% | 5.88% | 10.59% | 15.46% | 9.43% | 12.30% | 27.34% | 25.60% | 6.69% | -13.91% | -6.74% | -4.00% | -27.91% | 3.59% | -15.78% | -63.61% | -79.70% | 5.74% | -18.26% |

| EPS | 4.77 | 4.89 | 3.28 | 1.71 | 1.26 | 1.94 | 1.68 | 0.35 | 0.58 | 0.68 | 0.39 | 0.44 | 1.07 | 0.91 | 0.14 | -0.28 | -0.21 | -0.12 | -0.55 | -0.09 | -0.28 | -0.88 | -1.16 | 0.20 | -0.49 |

| EPS Diluted | 4.28 | 4.40 | 3.12 | 1.65 | 1.23 | 1.89 | 1.63 | 0.35 | 0.57 | 0.67 | 0.38 | 0.43 | 1.04 | 0.86 | 0.13 | -0.28 | -0.21 | -0.12 | -0.55 | -0.09 | -0.28 | -0.87 | -1.12 | 0.19 | -0.49 |

| Weighted Avg Shares Out | 28.83M | 28.70M | 28.37M | 28.10M | 27.90M | 28.02M | 27.70M | 27.18M | 27.19M | 27.45M | 27.09M | 26.62M | 26.23M | 24.45M | 19.47M | 19.37M | 18.61M | 15.98M | 15.44M | 15.26M | 14.99M | 14.79M | 14.58M | 13.58M | 10.33M |

| Weighted Avg Shares Out (Dil) | 32.09M | 31.87M | 29.82M | 28.95M | 28.57M | 28.77M | 28.52M | 27.50M | 27.51M | 27.81M | 27.37M | 27.28M | 26.93M | 25.69M | 20.09M | 19.37M | 18.61M | 15.98M | 15.44M | 15.26M | 14.99M | 14.90M | 15.13M | 14.69M | 10.33M |

Signal Gold Receives Mineral Lease for the Goldboro Project From the Government of Nova Scotia

Quarterly Activities and Cashflow Report – 30 June 2024

Nova Minerals Announces the Formal Appointment of New Independent Chairman

Calidi Biotherapeutics Announces Launch of Nova Cell Subsidiary and $3 Million Aggregate Investment from Dr. Ronald Rigor

Cardiff Lexington Opens 12th Nova Ortho and Spine Location in Orlando, Florida

Nova Minerals Limited Announces Closing of Initial Public Offering

Nova Pacific Files NI 43-101 Technical Report on the Lara Property Including a Mineral Resource Estimate

Nova Pacific Applies for Lara VMS Deposit Drill Permit and Announces Marketing Agreement

ASX or NVMI: Which Is the Better Value Stock Right Now?

Elcora Announces Possible Late Filing of Annual Financial Statements and Management Cease Trade Order

Source: https://incomestatements.info

Category: Stock Reports