- 2 Unstoppable Dividend Stocks to Buy If There’s a Stock Market Sell-Off

- The Stock Market Is Historically Pricey: Here’s How I’m Positioning My Portfolio for 2025

- What Is a Bottom Line in Accounting, and Why Does It Matter?

- Research and Development (R&D) Expenses: Definition and Example

- FASB Seeks Feedback on Clarification to Interim Effective Date for Disaggregation of Income Statement Expenses Standard

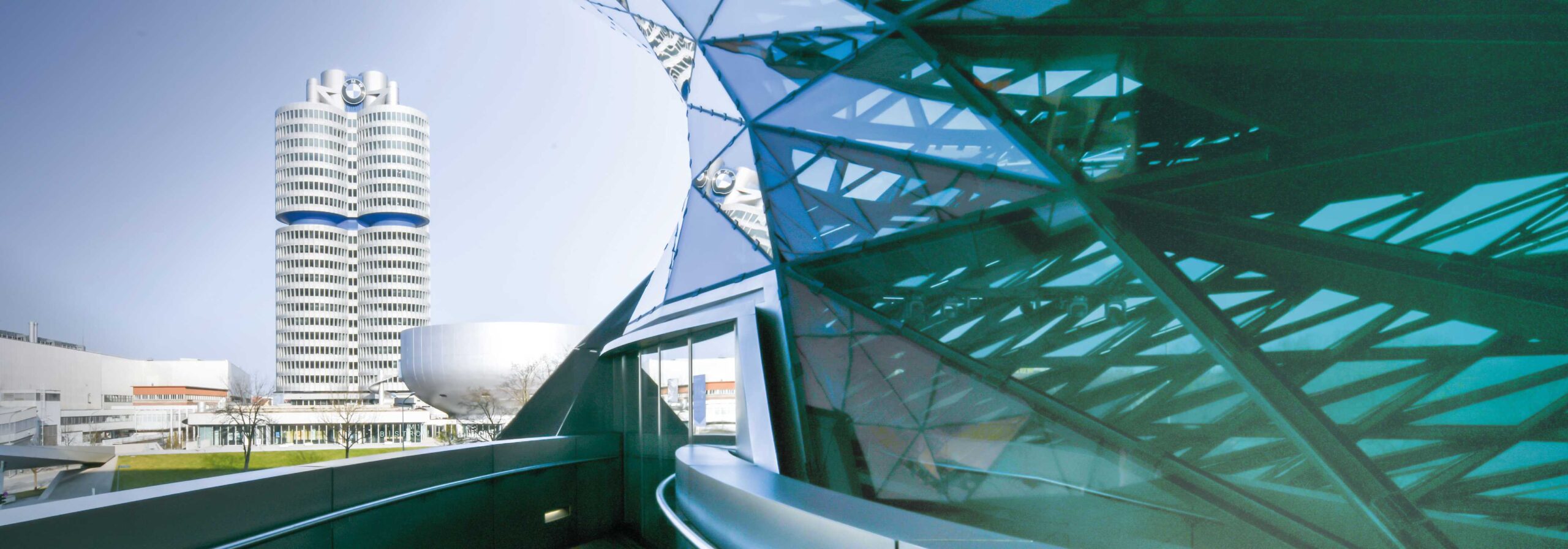

M

unich. The Board of Management of BMW AG adjusted the

guidance for the 2024 financial year today.

This was triggered in part by additional headwinds in the Automotive

Segment resulting from delivery stops and technical actions linked to

the Integrated Braking System (IBS) that is provided by a supplier.

The delivery stops for vehicles that are not already in customers

hands will have a negative worldwide sales effect in the second half

of the year. The IBS-related technical actions impact over 1.5 million

vehicles and result in additional warranty costs in a high three-digit

million amount in the third quarter.

In parallel to this effect, the ongoing muted demand in China is

affecting sales volumes. Despite stimulus measures from the

government, consumer sentiment remains weak.

Considering these developments in the Automotive

Segment outlined above, the BMW Group has adjusted the

guidance for the 2024 financial year as follows:

- A slight decrease in deliveries versus previous year (previously:

slight increase). - An EBIT margin for 2024 in a corridor from 6% to 7% (previously:

8% to 10%). - Return on Capital Employed (RoCE) between 11% and 13% (previously:

15% to 20%).

Free-Cash-Flow in the Automotive Segment is estimated to be above

€4bn for the 2024 Financial year.

As of today, the described earnings together with additional

inventory will impact the third quarter much more than the fourth quarter.

In the Motorcycles Segment, the ongoing competitive

situation across core markets – including China and the USA – is

having a major impact on volume and price realization. Deliveries to

customers are now expected at prior year’s level (previously: slight

increase). Accordingly, the EBIT margin for 2024 is expected to be in

a corridor of 6% to 7% (previously: 8% to 10%) and Return on Capital

Employed (RoCE) is anticipated to be between 14% and 16% (previously:

21% to 26%).

Group Earnings before Tax will, therefore, decrease

significantly (previously: slight decrease).

The full quarterly results and the adjusted outlook report will be

published on 6 November 2024 in the BMW Group Quarterly Statement to

30 September 2024.

The definitions of the KPIs can be found in the Glossary of the BMW

Group Report 2023 on pages 338 to 343.

If you have any questions, please contact:

You are watching: BMW Group adjusts guidance for 2024 financial year

BMW Group Corporate Communications

Dr Britta Ullrich, Finance Communications

Telephone: +49 89 382-18364

See more : The Stock Market Is Historically Pricey: Here’s How I’m Positioning My Portfolio for 2025

Email: [email protected]

Eckhard Wannieck, head of Communications BMW Group, Finance, Sales

Telephone: +49 89 382-24544

See more : The Stock Market Flashed a Worrying Signal That 2025 Will Be a Bad Year

Email: [email protected]

Media website: www.press.bmwgroup.com/deutschland

Email: [email protected]

Source link https://www.press.bmwgroup.com/global/article/detail/T0444971EN/bmw-group-adjusts-guidance-for-2024-financial-year?language=en

Source: https://incomestatements.info

Category: News