- Stock market plummets after Fed forecasts fewer rate cuts in 2025

- Jim Cramer’s top 10 things to watch in the stock market Friday

- Asian shares track Wall Street’s selloff after Fed hints at 2 rate cuts in 2025

- ExxonMobil announces third-quarter 2024 results

- FASB issues new, long-anticipated income statement expense rules

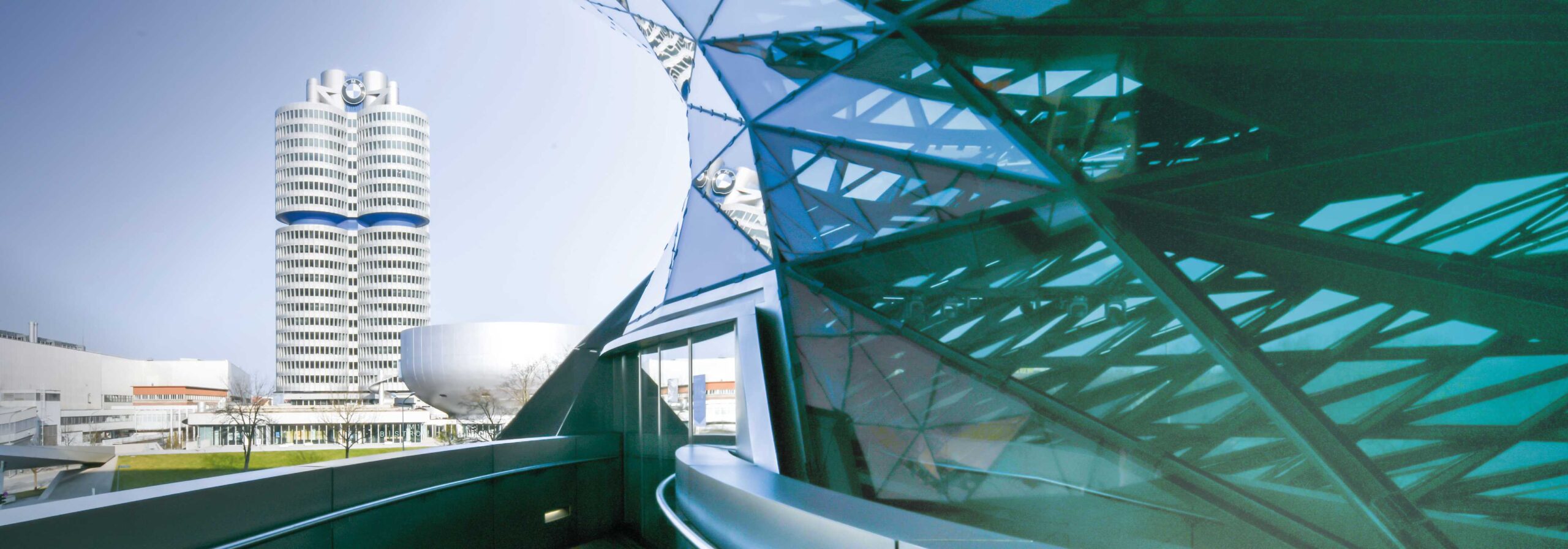

M

unich. The Board of Management of BMW AG adjusted the

guidance for the 2024 financial year today.

This was triggered in part by additional headwinds in the Automotive

Segment resulting from delivery stops and technical actions linked to

the Integrated Braking System (IBS) that is provided by a supplier.

The delivery stops for vehicles that are not already in customers

hands will have a negative worldwide sales effect in the second half

of the year. The IBS-related technical actions impact over 1.5 million

vehicles and result in additional warranty costs in a high three-digit

million amount in the third quarter.

In parallel to this effect, the ongoing muted demand in China is

affecting sales volumes. Despite stimulus measures from the

government, consumer sentiment remains weak.

Considering these developments in the Automotive

Segment outlined above, the BMW Group has adjusted the

guidance for the 2024 financial year as follows:

- A slight decrease in deliveries versus previous year (previously:

slight increase). - An EBIT margin for 2024 in a corridor from 6% to 7% (previously:

8% to 10%). - Return on Capital Employed (RoCE) between 11% and 13% (previously:

15% to 20%).

Free-Cash-Flow in the Automotive Segment is estimated to be above

€4bn for the 2024 Financial year.

As of today, the described earnings together with additional

inventory will impact the third quarter much more than the fourth quarter.

In the Motorcycles Segment, the ongoing competitive

situation across core markets – including China and the USA – is

having a major impact on volume and price realization. Deliveries to

customers are now expected at prior year’s level (previously: slight

increase). Accordingly, the EBIT margin for 2024 is expected to be in

a corridor of 6% to 7% (previously: 8% to 10%) and Return on Capital

Employed (RoCE) is anticipated to be between 14% and 16% (previously:

21% to 26%).

Group Earnings before Tax will, therefore, decrease

significantly (previously: slight decrease).

The full quarterly results and the adjusted outlook report will be

published on 6 November 2024 in the BMW Group Quarterly Statement to

30 September 2024.

The definitions of the KPIs can be found in the Glossary of the BMW

Group Report 2023 on pages 338 to 343.

If you have any questions, please contact:

You are watching: BMW Group adjusts guidance for 2024 financial year

BMW Group Corporate Communications

Dr Britta Ullrich, Finance Communications

Telephone: +49 89 382-18364

See more : US stock market down for 10th straight day: What insiders are saying

Email: [email protected]

Eckhard Wannieck, head of Communications BMW Group, Finance, Sales

Telephone: +49 89 382-24544

See more : 4 Stock Market Sectors Wall Street Thinks Will Surge in 2025

Email: [email protected]

Media website: www.press.bmwgroup.com/deutschland

Email: [email protected]

Source link https://www.press.bmwgroup.com/global/article/detail/T0444971EN/bmw-group-adjusts-guidance-for-2024-financial-year?language=en

Source: https://incomestatements.info

Category: News