See more : Beryl Drugs Limited (BERLDRG.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Airbnb, Inc. (ABNB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Airbnb, Inc., a leading company in the Travel Services industry within the Consumer Cyclical sector.

- HMA Agro Industries Limited (HMAAGRO.BO) Income Statement Analysis – Financial Results

- DarkPulse, Inc. (DPLS) Income Statement Analysis – Financial Results

- Ratnabhumi Developers Limited (RATNABHUMI.BO) Income Statement Analysis – Financial Results

- SI6 Metals Limited (BWNAF) Income Statement Analysis – Financial Results

- Yucaipa Acquisition Corporation (YAC) Income Statement Analysis – Financial Results

Airbnb, Inc. (ABNB)

About Airbnb, Inc.

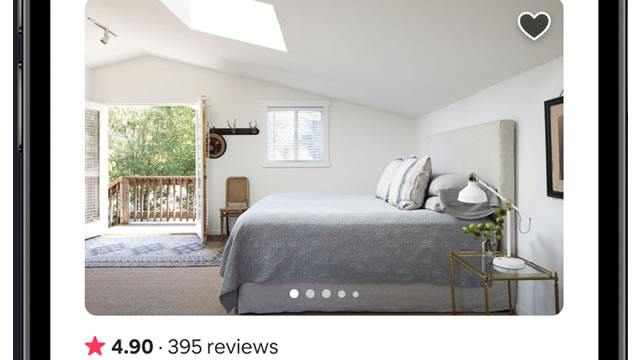

Airbnb, Inc., together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, or vacation homes. The company was formerly known as AirBed & Breakfast, Inc. and changed its name to Airbnb, Inc. in November 2010. Airbnb, Inc. was founded in 2007 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 9.92B | 8.40B | 5.99B | 3.38B | 4.81B | 3.65B | 2.56B |

| Cost of Revenue | 1.70B | 1.50B | 1.16B | 876.04M | 1.20B | 864.03M | 647.69M |

| Gross Profit | 8.21B | 6.90B | 4.84B | 2.50B | 3.61B | 2.79B | 1.91B |

| Gross Profit Ratio | 82.83% | 82.15% | 80.71% | 74.07% | 75.10% | 76.34% | 74.72% |

| Research & Development | 1.72B | 1.50B | 1.43B | 2.75B | 976.70M | 579.19M | 400.75M |

| General & Administrative | 2.03B | 950.00M | 836.00M | 1.13B | 697.18M | 479.49M | 327.16M |

| Selling & Marketing | 1.76B | 1.52B | 1.19B | 1.18B | 1.62B | 1.10B | 871.75M |

| SG&A | 3.79B | 2.47B | 2.02B | 2.31B | 2.32B | 1.58B | 1.20B |

| Other Expenses | 1.19B | 25.00M | -304.00M | -947.22M | 13.91M | -12.36M | 6.56M |

| Operating Expenses | 6.70B | 5.01B | 4.29B | 5.94B | 4.11B | 2.77B | 2.00B |

| Cost & Expenses | 8.40B | 6.51B | 5.45B | 6.82B | 5.31B | 3.63B | 2.64B |

| Interest Income | 721.00M | 186.00M | 13.00M | 27.12M | 85.90M | 66.79M | 32.10M |

| Interest Expense | 83.00M | 24.00M | 438.00M | 171.69M | 9.97M | 26.14M | 16.40M |

| Depreciation & Amortization | 44.00M | 89.30M | 175.50M | 125.88M | 114.16M | 82.40M | 79.34M |

| EBITDA | 2.23B | 2.10B | -64.36M | -4.38B | -287.57M | 155.58M | 36.65M |

| EBITDA Ratio | 22.48% | 25.99% | 6.49% | -125.30% | -5.98% | 4.26% | 1.43% |

| Operating Income | 1.52B | 1.80B | 429.00M | -3.59B | -501.54M | 18.74M | -81.36M |

| Operating Income Ratio | 15.31% | 21.45% | 7.16% | -106.27% | -10.44% | 0.51% | -3.18% |

| Total Other Income/Expenses | 584.00M | 187.00M | -729.00M | -1.09B | 89.84M | 28.29M | 22.26M |

| Income Before Tax | 2.10B | 1.99B | -300.00M | -4.68B | -411.70M | 47.03M | -59.10M |

| Income Before Tax Ratio | 21.20% | 23.68% | -5.01% | -138.59% | -8.57% | 1.29% | -2.31% |

| Income Tax Expense | -2.69B | 96.00M | 52.00M | -97.22M | 262.64M | 63.89M | 10.95M |

| Net Income | 4.79B | 1.89B | -352.00M | -4.58B | -674.34M | -16.86M | -70.05M |

| Net Income Ratio | 48.32% | 22.54% | -5.87% | -135.71% | -14.03% | -0.46% | -2.73% |

| EPS | 7.52 | 2.97 | -0.57 | -16.12 | -1.27 | -0.03 | -0.13 |

| EPS Diluted | 7.24 | 2.79 | -0.57 | -16.12 | -1.27 | -0.03 | -0.13 |

| Weighted Avg Shares Out | 637.00M | 637.00M | 616.00M | 284.36M | 530.95M | 530.95M | 521.71M |

| Weighted Avg Shares Out (Dil) | 662.00M | 680.00M | 616.00M | 284.36M | 530.95M | 530.95M | 521.71M |

1 Monster Stock to Hold for the Next 5 Years

Prediction: 2 Stocks That'll Be Worth More Than Palantir 5 Years From Now

Using AI Integration, Merriby Real Estate LLC Transforms Airbnb Hosting

Investors Heavily Search Airbnb, Inc. (ABNB): Here is What You Need to Know

A Growth Stock With a Hidden Cash Machine

Is Buying Airbnb Stock Below $135 a Smart Idea?

1 Brilliant Growth Stock to Buy Now and Hold for the Long Term

How to Profit From Airbnb's "Stuck" Share Price

CNK or ABNB: Which Is the Better Value Stock Right Now?

3 Stocks That Could Turn $1,000 into $5,000 by 2030

Source: https://incomestatements.info

Category: Stock Reports