See more : Aquafil S.p.A. (ECNL.MI) Income Statement Analysis – Financial Results

Complete financial analysis of Acumen Pharmaceuticals, Inc. (ABOS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Acumen Pharmaceuticals, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Komatsu Ltd. (KMTUF) Income Statement Analysis – Financial Results

- TCC CONCEPT LIMITED (TCC.BO) Income Statement Analysis – Financial Results

- Rio Tinto Group (RIO) Income Statement Analysis – Financial Results

- PwrCor, Inc. (PWCO) Income Statement Analysis – Financial Results

- VEON Ltd. (VEON) Income Statement Analysis – Financial Results

Acumen Pharmaceuticals, Inc. (ABOS)

About Acumen Pharmaceuticals, Inc.

Acumen Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, discovers and develops therapies for the treatment of Alzheimer's disease. The company focuses on advancing a targeted immunotherapy drug candidate ACU193, a humanized monoclonal antibody that is in Phase I clinical-stage to target soluble amyloid-beta oligomers. Acumen Pharmaceuticals, Inc. was incorporated in 1996 and is headquartered in Charlottesville, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 1.44M | 1.70M |

| Cost of Revenue | 42.32M | 169.00K | 4.00K | 8.00K | 8.58K |

| Gross Profit | -42.32M | -169.00K | -4.00K | 1.43M | 1.69M |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 99.44% | 99.49% |

| Research & Development | 42.32M | 32.36M | 12.31M | 8.00M | 8.58M |

| General & Administrative | 18.82M | 12.88M | 7.28M | 1.35M | 926.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 18.82M | 12.88M | 7.28M | 1.35M | 926.00K |

| Other Expenses | 0.00 | -11.00K | 51.00K | 0.00 | 0.00 |

| Operating Expenses | 61.14M | 45.24M | 19.58M | 9.35M | 9.50M |

| Cost & Expenses | 61.14M | 45.24M | 19.58M | 9.35M | 9.50M |

| Interest Income | 10.21M | 2.39M | 84.00K | 1.00K | 45.00K |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | |

| Depreciation & Amortization | 184.00K | 169.00K | 4.00K | 7.91M | 7.81M |

| EBITDA | -51.61M | -42.69M | 61.58M | 587.00K | 119.00K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | -591.78% | -451.27% |

| Operating Income | -61.14M | -45.24M | 61.57M | -7.91M | -7.81M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | -550.97% | -459.93% |

| Total Other Income/Expenses | 8.77M | 2.38M | -81.02M | 587.00K | -102.00K |

| Income Before Tax | -52.37M | -42.86M | -100.61M | -7.33M | -7.91M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | -510.10% | -465.94% |

| Income Tax Expense | 0.00 | -2.38M | 81.07M | -1.00K | -45.00K |

| Net Income | -52.37M | -40.48M | -181.68M | -7.32M | -7.86M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | -510.03% | -463.29% |

| EPS | -1.08 | -1.00 | -4.49 | -0.18 | -0.20 |

| EPS Diluted | -1.08 | -1.00 | -4.49 | -0.18 | -0.20 |

| Weighted Avg Shares Out | 48.49M | 40.60M | 40.47M | 40.15M | 40.15M |

| Weighted Avg Shares Out (Dil) | 48.61M | 40.60M | 40.47M | 40.15M | 40.15M |

Calldorado übernimmt das auf Nutzerakquise spezialisierte Unternehmen Appvestor

Acumen Pharmaceuticals Reports Financial Results for Second Quarter 2021 and Business Highlights

Comcast gibt die Aufnahme von Peacock in Sky bekannt

5 Stocks With High Insider Cluster Buys During July

The 5 biggest insider stock buys of last week

AANA-VirtaMed Collaboration Results in Better Surgical Training

Acumen Pharmaceuticals Announces Pricing of Upsized Initial Public Offering

Acumen Pharmaceuticals Pursues $125 Million IPO

Druva startet das branchenweit erste MSP-Programm mit der Einfachheit, Sicherheit und Skalierbarkeit einer SaaS-Plattform

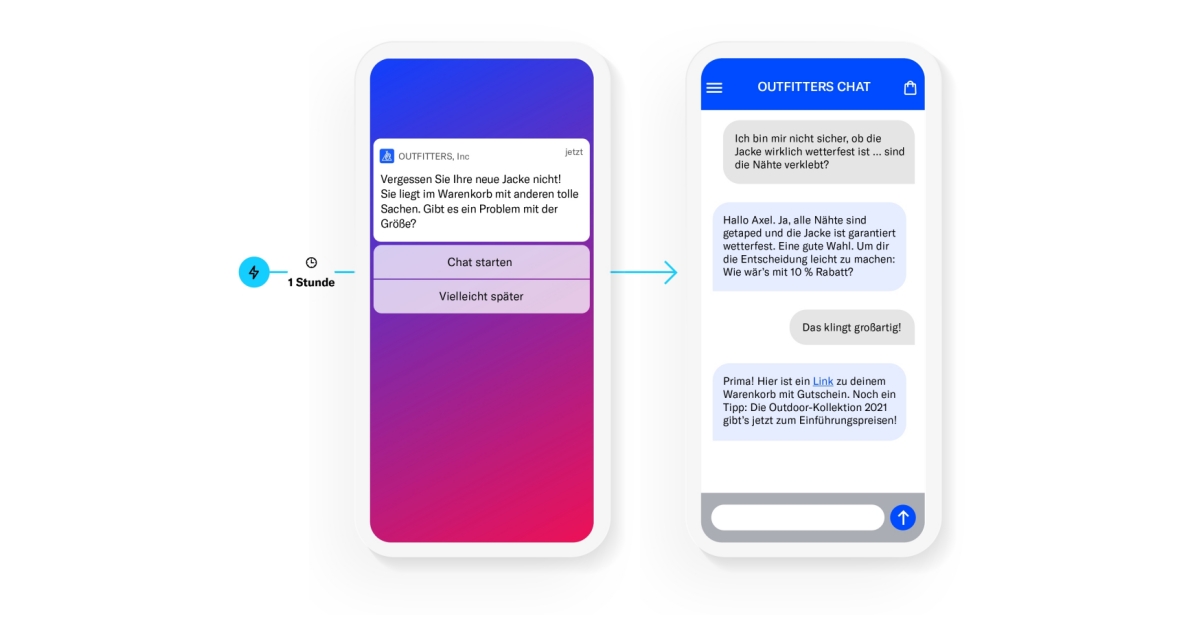

Airship erweitert seine Plattform, um Live-Chat Funktion

Source: https://incomestatements.info

Category: Stock Reports