See more : Delta Corp Limited (DELTACORP.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Adicet Bio, Inc. (ACET) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Adicet Bio, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Energy Transfer LP (ET-PE) Income Statement Analysis – Financial Results

- Redwood Pharma AB (REDW.ST) Income Statement Analysis – Financial Results

- Ginkgo Bioworks Holdings, Inc. (DNA) Income Statement Analysis – Financial Results

- American Resources Corporation (AREC) Income Statement Analysis – Financial Results

- Eastern Media International Corporation (2614.TW) Income Statement Analysis – Financial Results

Adicet Bio, Inc. (ACET)

About Adicet Bio, Inc.

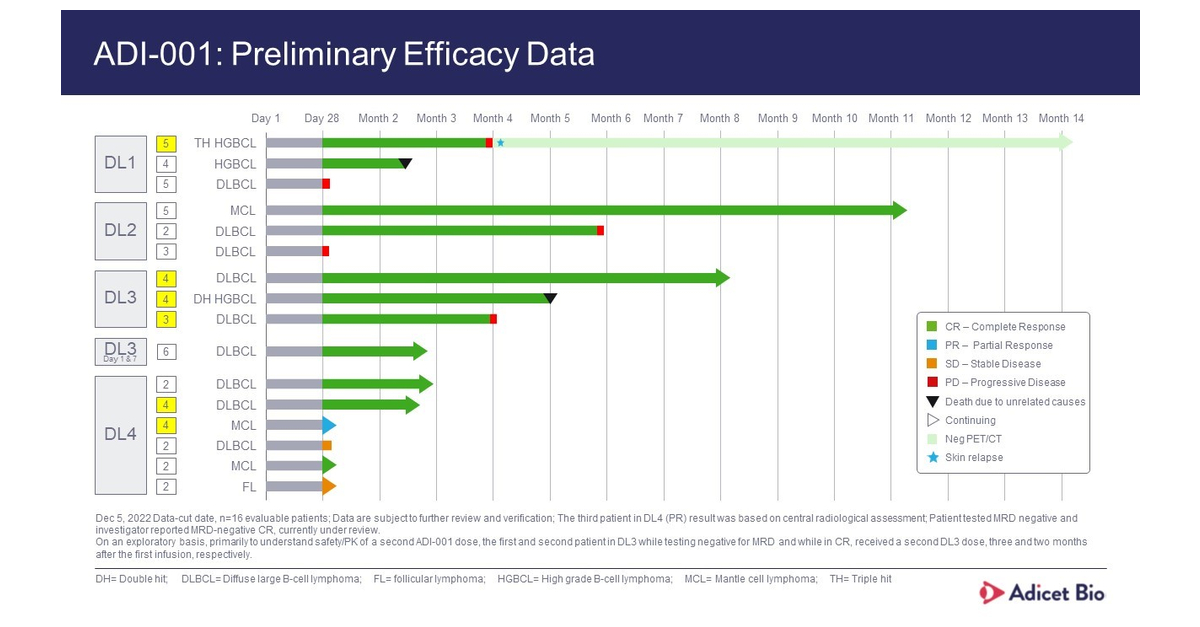

Adicet Bio, Inc., a biotechnology company, discovers and develops allogeneic gamma delta T cell therapies for cancer and other diseases. The company offers gamma delta T cells engineered with chimeric antigen receptors and T cell receptor-like antibodies to enhance selective tumor targeting, facilitate innate and adaptive anti-tumor immune response, and enhance persistence for durable activity in patients. Its lead product in pipeline includes ADI-001, which is in Phase I clinical study for the treatment of non-Hodgkin's lymphoma. The company also engages in the development of ADI-002, which is undergoing preclinical studies for the treatment of various solid tumors. Adicet Bio, Inc. is based in Boston, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 24.99M | 9.73M | 17.90M | 995.00K | 8.18M | 558.52M | 546.95M | 510.18M | 499.69M | 499.69M | 444.39M | 412.43M | 346.63M | 322.65M | 359.59M |

| Cost of Revenue | 6.10M | 5.01M | 0.00 | 0.00 | 125.00K | 80.00K | 5.00K | 411.52M | 395.48M | 401.42M | 401.42M | 362.36M | 346.59M | 292.48M | 267.03M | 292.29M |

| Gross Profit | -6.10M | 19.98M | 9.73M | 17.90M | 870.00K | 8.10M | 558.52M | 135.43M | 114.70M | 98.27M | 98.27M | 82.03M | 65.84M | 54.16M | 55.62M | 67.31M |

| Gross Profit Ratio | 0.00% | 79.96% | 100.00% | 100.00% | 87.44% | 99.02% | 100.00% | 24.76% | 22.48% | 19.67% | 19.67% | 18.46% | 15.96% | 15.62% | 17.24% | 18.72% |

| Research & Development | 106.04M | 71.25M | 48.94M | 34.33M | 23.69M | 14.72M | 16.84M | 5.94M | 5.22M | 2.83M | 0.00 | 0.00 | 0.00 | 0.00 | 153.00K | 506.00K |

| General & Administrative | 26.53M | 26.30M | 22.22M | 22.76M | 8.69M | 8.43M | 76.82M | 73.16M | 65.21M | 61.02M | 63.86M | 56.67M | 49.29M | 44.72M | 43.57M | 45.42M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -74.78M | -73.16M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 26.53M | 26.30M | 22.22M | 22.76M | 8.69M | 8.43M | 2.04M | 1.00K | 65.21M | 61.02M | 63.86M | 56.67M | 49.29M | 44.72M | 43.57M | 45.42M |

| Other Expenses | 19.46M | -919.00K | -606.00K | -953.00K | 2.33M | 4.53M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 152.04M | 97.54M | 71.16M | 57.09M | 32.38M | 23.15M | 18.88M | 1.00K | 70.43M | 63.86M | 63.86M | 56.67M | 49.29M | 44.72M | 43.73M | 45.93M |

| Cost & Expenses | 152.04M | 97.54M | 71.16M | 57.09M | 32.38M | 23.15M | 18.88M | 1.00K | 465.91M | 465.27M | 465.27M | 419.02M | 395.88M | 337.19M | 310.75M | 338.21M |

| Interest Income | 9.95M | 3.76M | 91.00K | 785.00K | 938.00K | 543.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 80.00K | 176.00K | 134.00K | 0.00 | 0.00 | 7.00M | 3.95M | 2.10M | 2.12M | 2.12M | 2.63M | 1.57M | 230.00K | 98.00K | 145.00K |

| Depreciation & Amortization | 6.10M | 5.01M | 4.07M | 1.95M | 1.24M | 80.00K | 5.00K | 11.85M | 8.09M | 6.94M | 6.94M | 6.94M | 5.50M | 2.80M | 1.87M | 2.38M |

| EBITDA | -136.54M | -64.70M | -60.41M | -37.41M | -26.88M | -13.74M | -33.77M | -1.00K | 54.87M | 43.62M | 43.62M | 34.31M | 24.03M | 13.23M | 14.70M | 24.71M |

| EBITDA Ratio | 0.00% | -278.95% | -636.67% | -219.85% | -2,701.61% | -105.93% | -3.38% | 0.00% | 10.75% | 8.73% | 8.73% | 7.72% | 5.83% | 3.82% | 4.55% | 6.87% |

| Operating Income | -152.04M | -72.55M | -61.43M | -39.19M | -31.39M | -14.96M | -18.88M | -1.00K | 44.27M | 34.42M | 34.42M | 25.37M | 16.55M | 9.44M | 11.89M | 21.38M |

| Operating Income Ratio | 0.00% | -290.32% | -631.38% | -218.91% | -3,154.57% | -182.91% | -3.38% | 0.00% | 8.68% | 6.89% | 6.89% | 5.71% | 4.01% | 2.72% | 3.69% | 5.94% |

| Total Other Income/Expenses | 9.38M | 2.76M | -691.00K | -302.00K | 3.27M | 5.08M | -14.90M | 0.00 | 402.00K | 134.00K | 134.00K | -626.00K | 412.00K | 765.00K | 839.00K | 812.00K |

| Income Before Tax | -142.66M | -69.79M | -62.12M | -39.49M | -28.12M | -9.89M | -33.78M | -1.00K | 44.67M | 34.55M | 34.55M | 24.74M | 16.96M | 10.20M | 12.73M | 22.19M |

| Income Before Tax Ratio | 0.00% | -279.27% | -638.48% | -220.59% | -2,826.03% | -120.87% | -6.05% | 0.00% | 8.76% | 6.91% | 6.91% | 5.57% | 4.11% | 2.94% | 3.95% | 6.17% |

| Income Tax Expense | 0.00 | -2.76M | -125.00K | -2.82M | 19.00K | -589.00K | 19.09M | 20.38M | 15.67M | 12.22M | 12.22M | 7.76M | 7.99M | 3.62M | 4.10M | 8.72M |

| Net Income | -142.66M | -67.03M | -62.00M | -36.68M | -28.14M | -9.30M | -33.78M | -1.00K | 29.00M | 22.33M | 22.33M | 16.98M | 8.97M | 6.58M | 8.63M | 13.47M |

| Net Income Ratio | 0.00% | -268.22% | -637.19% | -204.87% | -2,827.94% | -113.67% | -6.05% | 0.00% | 5.68% | 4.47% | 4.47% | 3.82% | 2.17% | 1.90% | 2.67% | 3.75% |

| EPS | -3.31 | -1.63 | -2.00 | -5.01 | -1.52 | -0.31 | -1.26 | 0.00 | 1.18 | 0.94 | 0.94 | 0.73 | 0.40 | 0.30 | 0.40 | 0.63 |

| EPS Diluted | -3.31 | -1.63 | -2.00 | -5.01 | -1.52 | -0.31 | -1.25 | 0.00 | 1.16 | 0.93 | 0.93 | 0.72 | 0.39 | 0.30 | 0.39 | 0.62 |

| Weighted Avg Shares Out | 43.04M | 41.08M | 30.95M | 7.32M | 18.56M | 29.80M | 26.77M | 28.05M | 24.50M | 23.67M | 23.67M | 23.26M | 22.67M | 21.86M | 21.43M | 21.30M |

| Weighted Avg Shares Out (Dil) | 43.04M | 41.08M | 30.95M | 7.32M | 18.56M | 29.80M | 26.97M | 28.05M | 24.99M | 24.02M | 24.02M | 23.46M | 22.84M | 22.07M | 21.86M | 21.70M |

Are Medical Stocks Lagging Adicet Bio (ACET) This Year?

Down -53.98% in 4 Weeks, Here's Why You Should You Buy the Dip in Adicet Bio, Inc. (ACET)

5 Stocks to Pop Surprise Returns From Secret Santa

Adicet Bio, Inc. (ACET) Loses 47% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

Why The Adicet Bio (ACET) Stock Plummeted Over 35%

Adicet Bio shares fall as it shares clinical data about its CAR-T treatment candidate

Adicet Bio Reports Positive Data from Ongoing ADI-001 Phase 1 Trial in Patients with Relapsed or Refractory Aggressive B-Cell Non-Hodgkin’s Lymphoma (NHL)

Is Adicet Bio (ACET) Stock Outpacing Its Medical Peers This Year?

What Makes Adicet Bio, Inc. (ACET) a Good Fit for 'Trend Investing'

Adicet Bio to Host Investor Webcast to Discuss Updated Clinical Data from Ongoing ADI-001 Phase 1 Trial in Patients with Relapsed or Refractory Aggressive B-Cell Non-Hodgkin's Lymphoma (NHL)

Source: https://incomestatements.info

Category: Stock Reports