Complete financial analysis of ACME Lithium Inc. (ACLHF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ACME Lithium Inc., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Far Eastern Department Stores, Ltd. (2903.TW) Income Statement Analysis – Financial Results

- Medicover AB (publ) (MCVEY) Income Statement Analysis – Financial Results

- Komatsu Ltd. (KMTUF) Income Statement Analysis – Financial Results

- Alcon Inc. (ALC) Income Statement Analysis – Financial Results

- Cadillac Ventures Inc. (CADIF) Income Statement Analysis – Financial Results

ACME Lithium Inc. (ACLHF)

About ACME Lithium Inc.

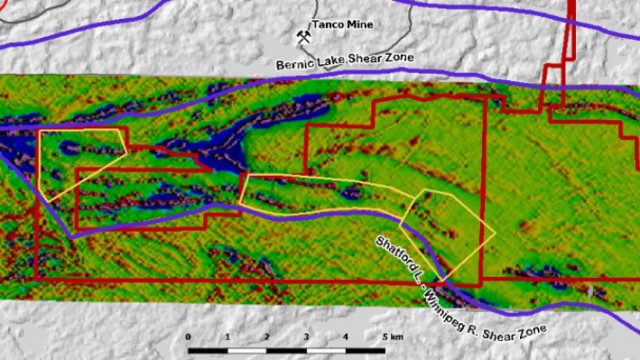

ACME Lithium Inc., a mineral exploration company, engages in acquiring, exploring, and evaluating lithium properties in the United States. It holds a 100% interest under an option agreement in 64 mining claims totaling 1,280 acres; and owns 100% interest in 58 claims totaling 1,160 acres in Clayton Valley in Esmeralda County, Nevada. The company also owns a 100% interest in 81 lode mining claims totaling 1,620 acres in Fish Lake Valley, located in Esmeralda County, Nevada. In addition, it has an option to acquire the Cat-Euclid Lake Project that consists of 6 claims totaling approximately 2,930 acres; and the Shatford Lake Project comprising 21 claims totaling approximately 8,883 acres located in southeastern Manitoba, Canada. The company was incorporated in 2017 and is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 54.16K | 86.07K | 0.00 | 798.28K | 693.25K |

| Cost of Revenue | 103.46K | 17.50K | 0.00 | 0.00 | 9.47 | 25.00K | 0.00 | 16.13K | 14.57K |

| Gross Profit | -103.46K | -17.50K | 0.00 | 0.00 | 54.15K | 61.07K | 0.00 | 782.16K | 678.68K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 99.98% | 70.96% | 0.00% | 97.98% | 97.90% |

| Research & Development | 215.17K | 87.79K | 0.00 | 0.00 | 0.00 | 30.26K | 0.00 | 0.00 | 0.00 |

| General & Administrative | 338.05K | 2.67M | 1.10M | 247.73K | 374.32K | 135.44K | 0.00 | 73.09K | 73.87K |

| Selling & Marketing | 514.14K | 1.06M | 122.28K | 30.69K | 57.48K | 96.90K | 0.00 | 802.56K | 727.51K |

| SG&A | 852.20K | 3.73M | 1.23M | 278.42K | 431.80K | 232.34K | 62.00 | 875.64K | 801.38K |

| Other Expenses | 609.62K | 841.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.70M | 4.17M | 1.36M | 278.42K | 431.80K | 262.60K | 77.22K | 925.41K | 791.15K |

| Cost & Expenses | 1.48M | 4.17M | 1.36M | 278.42K | 431.80K | 262.60K | 77.22K | 941.54K | 805.72K |

| Interest Income | 130.74K | 61.87K | 2.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 30.20K | 927.00 | 6.82K | 20.13K | 19.85K | 15.55K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 103.46K | 17.50K | 1.23M | 273.69K | 368.96K | 170.39K | 62.00 | 1.53K | 1.18K |

| EBITDA | -1.80M | -3.98M | 0.00 | 0.00 | 0.00 | 0.00 | -77.16K | -93.49K | -122.70K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -697.26% | -205.11% | 0.00% | -11.71% | -17.70% |

| Operating Income | -1.48M | -3.27M | -1.36M | -278.42K | -377.64K | -176.53K | -62.00 | -95.02K | -123.88K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -697.26% | -205.11% | 0.00% | -11.90% | -17.87% |

| Total Other Income/Expenses | -228.88K | 453.05K | -211.25K | -24.86K | -19.85K | -21.69K | -77.16K | -49.77K | 10.23K |

| Income Before Tax | -1.70M | -3.52M | -1.44M | -298.55K | -397.49K | -192.08K | -77.22K | -143.25K | -112.47K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -733.92% | -223.17% | 0.00% | -17.95% | -16.22% |

| Income Tax Expense | 0.00 | 842.33K | -820.46K | -35.84K | -368.96 | -161.14K | -77.16K | 0.00 | 0.00 |

| Net Income | -1.70M | -3.52M | -617.46K | -262.71K | -397.49K | -192.08K | -77.22K | -143.25K | -112.47K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -733.92% | -223.17% | 0.00% | -17.95% | -16.22% |

| EPS | -0.03 | -0.08 | -0.02 | -0.43 | -0.01 | -0.01 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -0.03 | -0.08 | -0.02 | -0.43 | -0.01 | -0.01 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 56.82M | 45.99M | 36.33M | 613.65K | 36.25M | 20.34M | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out (Dil) | 58.23M | 45.99M | 36.33M | 613.65K | 36.25M | 20.34M | 0.00 | 0.00 | 0.00 |

ACME Lithium expands its lithium project at Fish Lake Valley in Nevada by securing key land position

ACME Lithium says hole DH-1A extends potential lithium zone at Clayton Valley lithium brine project in Nevada

ACME Lithium receives highest lithium values to date at Fish Lake Valley, confirming lithium extension

ACME Lithium provides geophysics update on Manitoba Canada lithium projects

Lithium Junior Miners News For The Month Of February 2023

ACME Lithium begins Phase Two sampling program at promising Fish Lake Valley project in Nevada

ACME Lithium commences Phase 2 drill program at Clayton Valley lithium brine project in Nevada

ACME Lithium teams up with Israel-based satellite technology company to precisely identify lithium targets

ACME Lithium samples high surface lithium values at Fish Lake Valley in Nevada

ACME Lithium starts drilling at Shatford Lake project in Manitoba

Source: https://incomestatements.info

Category: Stock Reports