See more : Shiny Brands Group Co., Ltd. (6703.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Acreage Holdings, Inc. (ACRDF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Acreage Holdings, Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- JITF Infralogistics Limited (JITFINFRA.NS) Income Statement Analysis – Financial Results

- NEOJAPAN Inc. (3921.T) Income Statement Analysis – Financial Results

- Redwood Scientific Technologies, Inc. (RSCI) Income Statement Analysis – Financial Results

- Pulmuone Co., Ltd. (017810.KS) Income Statement Analysis – Financial Results

- Gear Energy Ltd. (GENGF) Income Statement Analysis – Financial Results

Acreage Holdings, Inc. (ACRDF)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.acreageholdings.com

About Acreage Holdings, Inc.

Acreage Holdings, Inc., formerly High Street Capital Partners, is a principal investment firm specializing in cannabis industry. Acreage Holdings, Inc. was founded in 2014 and is based in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 223.38M | 237.14M | 188.86M | 114.55M | 74.11M | 21.12M | 7.74M | 3.77M |

| Cost of Revenue | 137.73M | 135.39M | 92.98M | 65.39M | 43.67M | 11.70M | 4.31M | 2.61M |

| Gross Profit | 85.65M | 101.75M | 95.88M | 49.16M | 30.44M | 9.42M | 3.44M | 1.16M |

| Gross Profit Ratio | 38.34% | 42.91% | 50.77% | 42.92% | 41.08% | 44.59% | 44.36% | 30.84% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 84.46M | 104.29M | 97.74M | 184.24M | 195.82M | 88.78M | 10.25M | 1.60M |

| Selling & Marketing | 2.62M | 3.20M | 1.64M | 1.82M | 5.01M | 1.57M | 212.00K | 144.00K |

| SG&A | 87.08M | 107.50M | 99.38M | 186.06M | 200.83M | 90.35M | 10.46M | 3.06M |

| Other Expenses | 29.69M | 7.88M | 11.12M | 6.17M | 7.59M | -7.93M | -1.04M | 0.00 |

| Operating Expenses | 116.77M | 115.37M | 110.50M | 192.23M | 208.43M | 94.10M | 10.48M | 3.32M |

| Cost & Expenses | 254.50M | 250.77M | 203.48M | 257.61M | 252.09M | 89.81M | 14.79M | 5.93M |

| Interest Income | 10.00K | 1.62M | 4.82M | 6.70M | 3.98M | 1.18M | 330.00K | 160.00K |

| Interest Expense | 34.74M | 24.04M | 19.96M | 15.85M | 1.19M | 6.36M | 1.22M | 0.00 |

| Depreciation & Amortization | 12.76M | 14.07M | 14.62M | 6.29M | 7.59M | 3.75M | 20.00K | 37.00K |

| EBITDA | -5.32M | -120.57M | -20.77M | -355.21M | -181.39M | -22.36M | -7.03M | -1.89M |

| EBITDA Ratio | -2.38% | 3.48% | 7.88% | -117.64% | -224.59% | -339.36% | -96.62% | -50.23% |

| Operating Income | -31.13M | -5.41M | 614.00K | -143.07M | -177.98M | -68.68M | -7.05M | -1.93M |

| Operating Income Ratio | -13.93% | -2.28% | 0.33% | -124.90% | -240.16% | -325.14% | -91.01% | -51.21% |

| Total Other Income/Expenses | -21.70M | -15.58M | -8.28M | -12.55M | -12.19M | 10.41M | -1.52M | -68.00K |

| Income Before Tax | -52.82M | -158.67M | -55.35M | -377.36M | -190.17M | -217.68M | -8.57M | -2.00M |

| Income Before Tax Ratio | -23.65% | -66.91% | -29.31% | -329.44% | -256.61% | -1,030.51% | -110.63% | -53.01% |

| Income Tax Expense | 25.14M | 10.02M | 17.81M | -17.24M | 4.99M | 2.00M | 970.00K | 409.00K |

| Net Income | -69.09M | -168.70M | -73.16M | -360.12M | -195.16M | -205.66M | -8.54M | -1.95M |

| Net Income Ratio | -30.93% | -71.14% | -38.74% | -314.39% | -263.34% | -973.60% | -110.33% | -51.60% |

| EPS | -0.61 | -1.54 | -0.70 | -3.60 | -2.26 | -3.08 | -0.13 | -0.05 |

| EPS Diluted | -0.61 | -1.54 | -0.70 | -3.60 | -2.26 | -3.08 | -0.13 | -0.05 |

| Weighted Avg Shares Out | 113.87M | 109.69M | 105.09M | 99.98M | 86.19M | 66.70M | 66.67M | 40.00M |

| Weighted Avg Shares Out (Dil) | 113.87M | 109.69M | 105.09M | 99.98M | 86.19M | 66.70M | 66.67M | 40.00M |

Acreage Holdings, Inc. (ACRGF) CEO Peter Caldini on Q4 2020 Results - Earnings Call Transcript

New York cannabis retailer Acreage Holdings quietly laid off 11 senior employees, sources say

Acreage Announces Annual Shareholder Meeting Date and Record Date

Acreage Announces Management Change

Acreage Announces Fourth Quarter And Full Year 2020 Earnings Date

Cannabis industry trends that could fuel investment over the next 6 to 12 months

Ring Energy, Inc. Terminates Purchase and Sale Agreement of Its Delaware Basin Acreage

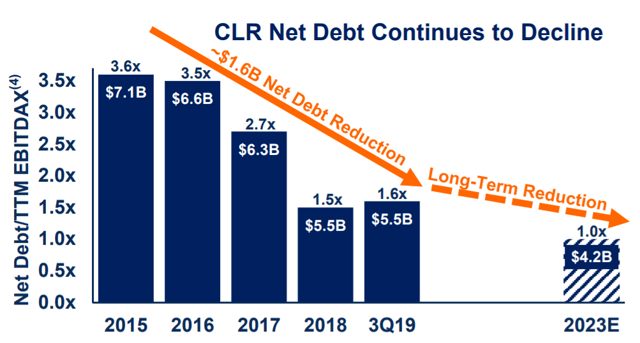

Continental Resources Still Has Some Decent Acreage But It Comes With An Unsustainable Debt Load

Source: https://incomestatements.info

Category: Stock Reports