See more : OAR Resources Limited (OAR.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Adaptive Biotechnologies Corporation (ADPT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Adaptive Biotechnologies Corporation, a leading company in the Biotechnology industry within the Healthcare sector.

- BYD Electronic (International) Company Limited (BYDIF) Income Statement Analysis – Financial Results

- Viridis Mining and Minerals Limited (VMM.AX) Income Statement Analysis – Financial Results

- Ecovyst Inc. (ECVT) Income Statement Analysis – Financial Results

- First Seismic Corp. (FSEI) Income Statement Analysis – Financial Results

- China Medical & HealthCare Group Limited (0383.HK) Income Statement Analysis – Financial Results

Adaptive Biotechnologies Corporation (ADPT)

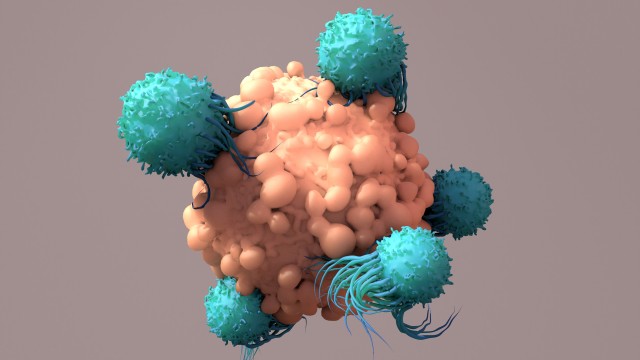

About Adaptive Biotechnologies Corporation

Adaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunoSEQ, a platform and core immunosequencing product that is used to answer translational research questions, as well as to discover new prognostic and diagnostic signals; and T-Detect COVID for the confirmation of past COVID-19 infection. It also provides clonoSEQ, a clinical diagnostic product for the detection and monitoring of minimal residual disease in patients with multiple myeloma, B cell acute lymphoblastic leukemia, and chronic lymphocytic leukemia, as well as available as a CLIA-validated laboratory developed test for patients with other lymphoid cancers; and immunoSEQ T-MAP COVID for vaccine developers and researchers to measure the T-cell immune response to vaccines. In addition, the company offers a pipeline of clinical products and services that are used for the diagnosing, monitoring, and treatment of diseases, such as cancer, autoimmune conditions, and infectious diseases. It serves the life sciences research, clinical diagnostics, and drug discovery applications. Adaptive Biotechnologies Corporation has strategic collaborations with Genentech, Inc. for the development, manufacture, and commercialization of neoantigen directed T cell therapies for the treatment of a range of cancers; and Microsoft Corporation to develop diagnostic tests for the early detection of various diseases from a single blood test. The company was formerly known as Adaptive TCR Corporation and changed its name to Adaptive Biotechnologies Corporation in December 2011. Adaptive Biotechnologies Corporation was incorporated in 2009 and is headquartered in Seattle, Washington.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 170.28M | 185.31M | 154.34M | 98.38M | 85.07M | 55.66M | 38.45M |

| Cost of Revenue | 75.55M | 57.91M | 49.30M | 22.53M | 22.27M | 19.67M | 15.68M |

| Gross Profit | 94.72M | 127.40M | 105.04M | 75.85M | 62.80M | 36.00M | 22.77M |

| Gross Profit Ratio | 55.63% | 68.75% | 68.06% | 77.10% | 73.82% | 64.67% | 59.22% |

| Research & Development | 122.12M | 141.76M | 142.34M | 116.07M | 70.71M | 39.16M | 32.00M |

| General & Administrative | 83.93M | 88.53M | 74.50M | 49.54M | 30.33M | 20.41M | 15.95M |

| Selling & Marketing | 88.58M | 95.60M | 95.47M | 61.36M | 38.45M | 24.49M | 16.77M |

| SG&A | 172.51M | 184.13M | 169.97M | 110.89M | 68.79M | 44.90M | 32.71M |

| Other Expenses | 27.13M | 1.70M | 1.70M | 1.70M | 1.70M | 1.70M | 1.69M |

| Operating Expenses | 321.76M | 327.59M | 314.01M | 228.67M | 141.19M | 85.75M | 66.40M |

| Cost & Expenses | 397.31M | 385.49M | 363.31M | 251.20M | 163.46M | 105.42M | 82.08M |

| Interest Income | 15.53M | 4.06M | 1.67M | 6.59M | 9.79M | 3.31M | 1.64M |

| Interest Expense | 13.80M | 4.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 22.23M | 28.15M | 20.98M | 11.74M | 7.79M | 6.00M | 5.80M |

| EBITDA | -189.27M | -167.98M | -193.35M | -144.35M | -70.60M | -43.76M | -37.84M |

| EBITDA Ratio | -111.16% | -104.92% | -134.29% | -153.60% | -90.15% | -78.61% | -96.23% |

| Operating Income | -227.04M | -200.19M | -208.97M | -152.82M | -78.39M | -49.76M | -44.48M |

| Operating Income Ratio | -133.33% | -108.03% | -135.39% | -155.33% | -92.15% | -89.39% | -115.68% |

| Total Other Income/Expenses | 1.73M | -182.00K | 1.67M | 6.59M | 9.79M | 3.31M | 1.64M |

| Income Before Tax | -225.30M | -200.37M | -207.30M | -146.23M | -68.61M | -46.45M | -42.83M |

| Income Before Tax Ratio | -132.32% | -108.13% | -134.31% | -148.63% | -80.65% | -83.44% | -111.40% |

| Income Tax Expense | 0.00 | -57.90M | -1.69M | -6.59M | -9.79M | 3.31M | -804.00K |

| Net Income | -225.25M | -142.46M | -205.61M | -139.64M | -58.82M | -46.45M | -42.83M |

| Net Income Ratio | -132.29% | -76.88% | -133.22% | -141.93% | -69.14% | -83.44% | -111.40% |

| EPS | -1.56 | -1.00 | -1.46 | -1.06 | -0.85 | -0.44 | -0.41 |

| EPS Diluted | -1.56 | -1.00 | -1.46 | -1.06 | -0.85 | -0.44 | -0.41 |

| Weighted Avg Shares Out | 144.38M | 142.52M | 140.35M | 131.22M | 69.17M | 105.43M | 105.43M |

| Weighted Avg Shares Out (Dil) | 144.38M | 142.52M | 140.35M | 131.22M | 69.17M | 105.43M | 105.43M |

Adaptive Biotechnologies to Report Second Quarter of 2022 Financial Results on August 3, 2022

Why Adaptive Biotechnologies Shares Are Rising

Adaptive Biotechnologies launches T cell-based test for Lyme disease

Adaptive Biotechnologies to Participate in Upcoming June Investor Conferences

Adaptive Biotechnologies (ADPT) Reports Q1 Loss, Lags Revenue Estimates

Adaptive Biotechnologies Corporation (ADPT) CEO Chad Robins on Q1 2022 Results - Earnings Call Transcript

Adaptive Biotechnologies reports $38.6M in Q1 revenue as it repositions following job cuts

Adaptive Biotechnologies to Present at the BofA Securities 2022 Healthcare Conference

Adaptive Biotechnologies: Becoming The Next Big Thing In The Biotech Industry

Adaptive Biotechnologies: Good Buy For Long-Term Investors

Source: https://incomestatements.info

Category: Stock Reports