See more : SEACOAST SHIPPING SERVICES LIM (SEACOAST.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Bread Financial Holdings, Inc. (ADS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Bread Financial Holdings, Inc., a leading company in the Financial – Credit Services industry within the Financial Services sector.

- Public Joint Stock Company Magnitogorsk Iron & Steel Works (MAGN.ME) Income Statement Analysis – Financial Results

- Truking Technology Limited (300358.SZ) Income Statement Analysis – Financial Results

- CareView Communications, Inc. (CRVW) Income Statement Analysis – Financial Results

- Huber+Suhner AG (0QNH.L) Income Statement Analysis – Financial Results

- Resurs Holding AB (publ) (RESURS.ST) Income Statement Analysis – Financial Results

Bread Financial Holdings, Inc. (ADS)

Industry: Financial - Credit Services

Sector: Financial Services

Website: https://www.breadfinancial.com

About Bread Financial Holdings, Inc.

Bread Financial Holdings Inc. provides tech-forward payment and lending solutions to customers and consumer-based industries in North America. It offers credit card and other loans financing services, including risk management solutions, account origination, and funding services for approximately 130 private label and co-brand credit card programs, as well as through Bread partnerships to approximately 500 small-and medium-sized businesses merchants; and Comenity-branded general purpose cash-back credit. The company also manages and services the loans it originates for private label, co-brand, and general-purpose credit card programs and Bread BNPL (installment loans, split-pay) products; and provides marketing, and data and analytics services. In addition, it offers an enhanced digital suite that includes a unified software development kit, which provides access to its suite of products, as well as promotes credit payment options earlier in the shopping experience. Further, the company through Bread, a digital payments platform and robust suite of application programming interfaces allows merchants and partners to integrate online point-of-sale financing and other digital payment products, including installment and split-pay solutions. The company was formerly known as Alliance Data Systems Corporation and changed its name to Bread Financial Holdings Inc. in March 2022. Bread Financial Holdings Inc. was founded in 1996 and is headquartered in Columbus, Ohio.

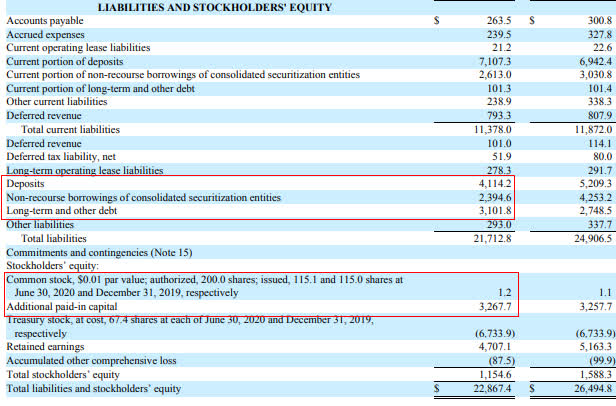

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.06B | 3.87B | 3.27B | 4.52B | 5.58B | 5.67B | 7.72B | 7.14B | 6.44B | 5.30B | 4.32B | 3.64B | 3.17B | 2.79B | 1.96B | 2.04B | 2.30B | 2.01B | 1.55B | 1.26B | 1.05B | 871.45M | 777.35M | 678.20M | 583.08M | 410.91M |

| Cost of Revenue | 0.00 | 0.00 | 1.59B | 2.68B | 3.41B | 3.08B | 5.00B | 4.85B | 4.29B | 3.62B | 2.96B | 2.51B | 2.21B | 1.95B | 144.80M | 1.42B | 1.71B | 1.48B | 1.12B | 916.20M | 787.17M | 668.23M | 603.49M | 547.99M | 466.86M | 0.00 |

| Gross Profit | 3.06B | 3.87B | 1.68B | 1.84B | 2.17B | 2.59B | 2.72B | 2.29B | 2.15B | 1.68B | 1.36B | 1.14B | 967.50M | 841.90M | 1.82B | 619.58M | 590.64M | 523.12M | 427.85M | 341.24M | 261.98M | 203.22M | 173.86M | 130.21M | 116.23M | 410.91M |

| Gross Profit Ratio | 100.00% | 100.00% | 51.31% | 40.79% | 38.95% | 45.66% | 35.22% | 32.08% | 33.44% | 31.72% | 31.38% | 31.17% | 30.49% | 30.16% | 92.63% | 30.36% | 25.66% | 26.09% | 27.56% | 27.14% | 24.97% | 23.32% | 22.37% | 19.20% | 19.93% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 30.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 867.00M | 779.00M | 671.00M | 105.70M | 150.60M | 162.50M | 166.30M | 143.20M | 138.48M | 141.47M | 109.12M | 108.06M | 95.26M | 85.77M | 99.82M | 82.80M | 80.90M | 91.82M | 91.53M | 77.74M | 54.03M | 56.10M | 45.43M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 161.00M | 180.00M | 160.00M | 143.00M | 205.00M | 0.00 | 0.00 | 2.02B | 2.01B | 1.44B | 1.29B | 0.00 | 0.00 | 0.00 | 0.00 | 525.92M | 452.14M | 319.70M | 185.31M | 644.85M | 548.05M | 502.43M | 482.22M | 0.00 | 0.00 | 0.00 |

| SG&A | 1.03B | 959.00M | 831.00M | 105.70M | 150.60M | 162.50M | 166.30M | 143.20M | 138.48M | 141.47M | 109.12M | 108.06M | 95.26M | 85.77M | 99.82M | 82.80M | 80.90M | 91.82M | 91.53M | 77.74M | 54.03M | 56.10M | 45.43M | 32.20M | 35.97M | 17.59M |

| Other Expenses | 0.00 | -1.07B | 187.00M | 1.34B | 1.21B | 1.50B | 1.64B | 1.45B | 1.16B | 844.23M | 561.88M | 452.36M | 453.47M | 531.05M | 125.29M | 135.82M | 166.63M | 125.04M | 102.71M | 91.40M | 74.56M | 66.48M | 74.20M | 76.14M | 77.80M | 387.84M |

| Operating Expenses | 1.47B | 180.00M | 1.02B | 1.45B | 1.36B | 1.37B | 1.64B | 1.45B | 1.16B | 844.20M | 561.90M | 452.40M | 453.40M | 531.00M | 1.56B | 218.62M | 247.53M | 216.86M | 194.24M | 169.14M | 128.59M | 122.57M | 119.64M | 108.35M | 113.77M | 405.43M |

| Cost & Expenses | 1.47B | 180.00M | 2.61B | 4.13B | 4.77B | 4.45B | 6.64B | 6.30B | 5.45B | 4.47B | 3.53B | 2.96B | 2.66B | 2.48B | 1.70B | 1.64B | 1.96B | 1.70B | 1.32B | 1.09B | 915.76M | 790.80M | 723.13M | 656.33M | 580.63M | 405.43M |

| Interest Income | 5.15B | 4.68B | 3.87B | 3.95B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 15.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 879.00M | 503.00M | 383.00M | 108.50M | 130.00M | 156.40M | 282.70M | 218.20M | 179.50M | 131.90M | 181.10M | 173.50M | 148.80M | 133.80M | 144.80M | 79.25M | 0.00 | 0.00 | 14.48M | 6.97M | 17.28M | 21.22M | 30.10M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 116.00M | 113.00M | 92.00M | 106.00M | 188.00M | 203.40M | 497.60M | 512.10M | 492.10M | 313.10M | 216.10M | 166.90M | 153.10M | 143.20M | 125.41M | 143.81M | 166.63M | 125.04M | 99.71M | 91.40M | 74.56M | 66.48M | 74.20M | 76.14M | 0.00 | 43.77M |

| EBITDA | 0.00 | 0.00 | 1.14B | 407.00M | 1.50B | 1.96B | 2.14B | 1.78B | 1.75B | 1.15B | 1.32B | 849.78M | 997.56M | 781.17M | 365.69M | 528.07M | 598.30M | 478.90M | 336.32M | 262.69M | 205.35M | 140.97M | 124.80M | 98.01M | 2.46M | 49.25M |

| EBITDA Ratio | 0.00% | 23.64% | 35.67% | 12.79% | 20.27% | 30.04% | 20.45% | 18.90% | 24.06% | 21.71% | 23.37% | 23.33% | 21.03% | 16.27% | 13.38% | 26.89% | 25.11% | 21.51% | 21.47% | 18.64% | -10.03% | -8.09% | -4.68% | -10.97% | 0.42% | 11.99% |

| Operating Income | 1.59B | 802.00M | 1.04B | 394.50M | 882.20M | 1.76B | 1.65B | 1.27B | 1.26B | 1.10B | 1.10B | 974.30M | 812.70M | 629.20M | 407.70M | 460.50M | 344.28M | 347.27M | 233.61M | 172.10M | 133.39M | 80.65M | 54.22M | 21.87M | 2.46M | 5.48M |

| Operating Income Ratio | 52.06% | 20.72% | 31.91% | 8.73% | 15.81% | 31.01% | 21.32% | 17.73% | 19.54% | 20.71% | 25.44% | 26.76% | 25.61% | 22.54% | 20.76% | 22.56% | 14.96% | 17.32% | 15.05% | 13.69% | 12.71% | 9.25% | 6.98% | 3.22% | 0.42% | 1.33% |

| Total Other Income/Expenses | -625.00M | 76.00M | -519.00M | -587.40M | -569.00M | -679.30M | -564.40M | -428.50M | -330.26M | -260.57M | -305.50M | -291.46M | -298.59M | -318.33M | -144.81M | -63.65M | 7.57M | -41.00M | -14.48M | -7.78M | -24.41M | -32.78M | -54.89M | -41.35M | -42.79M | -5.48M |

| Income Before Tax | 968.00M | 300.00M | 1.04B | 394.50M | 738.40M | 1.22B | 1.08B | 837.00M | 928.30M | 837.90M | 793.40M | 682.80M | 514.10M | 310.90M | 262.90M | 396.85M | 274.75M | 306.27M | 222.13M | 164.32M | 108.98M | 47.42M | 4.00M | -19.48M | -40.33M | 0.00 |

| Income Before Tax Ratio | 31.63% | 7.75% | 31.91% | 8.73% | 13.23% | 21.44% | 14.00% | 11.73% | 14.42% | 15.80% | 18.37% | 18.75% | 16.20% | 11.14% | 13.38% | 19.45% | 11.94% | 15.27% | 14.31% | 13.07% | 10.39% | 5.44% | 0.51% | -2.87% | -6.92% | 0.00% |

| Income Tax Expense | 231.00M | 76.00M | 247.00M | 99.50M | 165.80M | 269.50M | 292.40M | 319.40M | 325.10M | 321.80M | 297.20M | 260.60M | 198.80M | 115.30M | 86.20M | 153.45M | 110.69M | 116.66M | 83.38M | 61.95M | 41.68M | 20.67M | 11.61M | 1.84M | -10.49M | 0.00 |

| Net Income | 718.00M | 223.00M | 801.00M | 295.00M | 572.60M | 963.10M | 788.70M | 515.80M | 594.30M | 506.30M | 496.20M | 422.20M | 315.30M | 193.70M | 143.70M | 217.39M | 164.06M | 189.61M | 138.75M | 102.37M | 67.30M | 26.20M | -8.23M | -21.32M | -29.84M | 0.00 |

| Net Income Ratio | 23.46% | 5.76% | 24.48% | 6.52% | 10.26% | 17.00% | 10.22% | 7.23% | 9.23% | 9.55% | 11.49% | 11.59% | 9.94% | 6.94% | 7.32% | 10.65% | 7.13% | 9.46% | 8.94% | 8.14% | 6.41% | 3.01% | -1.06% | -3.14% | -5.12% | 0.00% |

| EPS | 14.42 | 4.47 | 16.12 | 6.17 | 11.45 | 17.54 | 14.17 | 7.37 | 8.91 | 8.72 | 10.09 | 8.44 | 6.22 | 3.69 | 2.58 | 2.88 | 2.09 | 2.38 | 1.69 | 1.27 | 0.86 | 0.32 | -0.13 | -0.45 | -0.70 | -0.43 |

| EPS Diluted | 14.36 | 4.46 | 16.02 | 6.16 | 11.45 | 17.48 | 14.10 | 7.34 | 8.85 | 7.87 | 7.42 | 6.58 | 5.45 | 3.48 | 2.49 | 2.80 | 2.03 | 2.32 | 1.64 | 1.22 | 0.84 | 0.31 | -0.13 | -0.45 | -0.70 | -0.43 |

| Weighted Avg Shares Out | 49.80M | 49.90M | 49.70M | 47.80M | 50.00M | 54.90M | 55.70M | 58.60M | 61.90M | 56.40M | 49.19M | 50.01M | 50.69M | 52.53M | 55.77M | 71.50M | 78.40M | 79.74M | 82.21M | 80.61M | 78.25M | 73.93M | 64.58M | 47.54M | 42.63M | 41.73M |

| Weighted Avg Shares Out (Dil) | 50.00M | 50.00M | 50.00M | 47.90M | 50.00M | 55.10M | 55.90M | 58.90M | 62.30M | 62.40M | 66.87M | 64.14M | 57.80M | 55.71M | 57.71M | 73.64M | 80.81M | 81.69M | 84.64M | 84.04M | 80.12M | 76.32M | 64.58M | 47.54M | 42.63M | 41.73M |

Alliance Data Declares Dividend on Common Stock

Alliance Data Systems: Short-Term And Long-Term Prospects

The Never Coming Stock Market Crash - Smart Money Is Still Waiting, Here's What I Do

SG Americas Securities LLC Purchases 11,440 Shares of Alliance Data Systems Co. (NYSE:ADS)

Alliance Data Systems Corporation (ADS) CEO Ralph Andretta on Q2 2020 Results - Earnings Call Transcript

Alliance Data Systems Corporation 2020 Q2 - Results - Earnings Call Presentation

Harbor Investment Advisory LLC Has $128,000 Stock Holdings in Alliance Data Systems Co. (NYSE:ADS)

This Credit Card Rewards And Financing Company May Be Down, But Not Out

MERIAN GLOBAL INVESTORS UK Ltd Takes $1.19 Million Position in Alliance Data Systems Co. (NYSE:ADS)

Advisor Group Holdings Inc. Takes Position in Alliance Data Systems Co. (NYSE:ADS)

Source: https://incomestatements.info

Category: Stock Reports