See more : Haria Apparels Limited (HARIAAPL.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Adams Diversified Equity Fund, Inc. (ADX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Adams Diversified Equity Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- JB Financial Group Co., Ltd. (175330.KS) Income Statement Analysis – Financial Results

- CF Bankshares Inc. (CFBK) Income Statement Analysis – Financial Results

- Kindred Group plc (KNDGF) Income Statement Analysis – Financial Results

- Unity Opto Technology Co., Ltd. (2499.TW) Income Statement Analysis – Financial Results

- Yang Guang Co.,Ltd. (000608.SZ) Income Statement Analysis – Financial Results

Adams Diversified Equity Fund, Inc. (ADX)

Industry: Asset Management

Sector: Financial Services

Website: https://www.adamsfunds.com/funds/diversified-equity

About Adams Diversified Equity Fund, Inc.

Adams Diversified Equity Fund, Inc. is a publicly owned investment manager. The firm provides its services to investment companies. The firm invests in the public equity markets of the United States. It invests in stocks of large-cap companies across diversified sectors to make its investments. The firm employs a fundamental, technical and quantitative analysis with a bottom-up stock picking approach, while focusing on earnings growth prospects, financial strength, cash flow generation, macro-economics, capital allocation, market competition, profitability. It obtains external research to complement its in-house research to make its investments. The firm benchmarks the performance of its portfolios against the S&P 500 Index. It was formerly known as The Adams Express Company. Adams Diversified Equity Fund, Inc. was founded in 1840 and is based in Baltimore, Maryland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 173.82M | -458.78M | 638.99M | 361.70M | 490.69M | -51.61M | 382.90M | 106.20M | 101.43M | 27.71M | 27.53M | 24.94M | 19.94M | 19.41M | 19.61M | 26.66M | 32.12M | 26.23M | 23.97M | 24.34M | 20.69M | 20.80M | 24.16M | 26.17M | 24.82M | 25.95M | 25.79M | 27.79M |

| Cost of Revenue | 1.52M | 1.53M | 1.51M | 1.36M | 1.25M | 1.16M | 1.09M | 1.07M | 3.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 172.30M | -460.32M | 637.48M | 360.34M | 489.44M | -52.77M | 381.81M | 105.13M | 98.03M | 27.71M | 27.53M | 24.94M | 19.94M | 19.41M | 19.61M | 26.66M | 32.12M | 26.23M | 23.97M | 24.34M | 20.69M | 20.80M | 24.16M | 26.17M | 24.82M | 25.95M | 25.79M | 27.79M |

| Gross Profit Ratio | 99.12% | 100.33% | 99.76% | 99.62% | 99.74% | 102.25% | 99.72% | 98.99% | 96.65% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -3.40 | 1.83 | 2.81 | 3.00 | -0.29 | 2.58 | 1.11 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.43M | 4.63M | 5.64M | 4.88M | 4.40M | 4.52M | 4.14M | 8.48M | 8.64M | 8.24M | 8.61M | 7.13M | 5.89M | 5.86M | 7.85M | 5.40M | 5.97M | 6.32M | 5.50M | 5.11M | 4.90M | 3.86M | 2.79M | 4.99M | 5.43M | 2.66M | 4.26M | 2.72M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -8.48M | 1.25M | 348.40K | 262.58K | 263.51K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.43M | 4.63M | 5.64M | 4.88M | 4.40M | 4.52M | 4.14M | 1.11 | 9.88M | 8.59M | 8.87M | 7.39M | 5.89M | 5.86M | 7.85M | 5.40M | 5.97M | 6.32M | 5.50M | 5.11M | 4.90M | 3.86M | 2.79M | 4.99M | 5.43M | 2.66M | 4.26M | 2.72M |

| Other Expenses | 0.00 | 7.71M | 8.26M | 6.87M | 7.53M | 5.54M | 5.23M | 99.44M | -81.72M | 77.33K | 30.00K | 340.00K | 790.00K | 10.00K | -3.67M | 4.23M | 430.00K | 220.00K | 180.00K | 230.00K | 180.00K | 200.00K | 280.00K | 240.00K | 250.00K | 710.00K | 740.00K | 830.00K |

| Operating Expenses | 517.78M | 12.34M | 13.90M | 11.75M | 11.94M | 10.06M | 9.37M | 89.33M | 81.72M | 160.84M | 299.28M | 121.16M | 6.68M | 5.87M | 4.18M | 9.63M | 6.40M | 6.54M | 5.68M | 5.34M | 5.08M | 4.06M | 3.07M | 5.23M | 5.68M | 3.37M | 5.00M | 3.55M |

| Cost & Expenses | -379.10M | 12.34M | 13.90M | 11.75M | 11.94M | 10.06M | 9.37M | 105.13M | 85.12M | 160.84M | 299.28M | 121.16M | 6.68M | 5.87M | 4.18M | 9.63M | 6.40M | 6.54M | 5.68M | 5.34M | 5.08M | 4.06M | 3.07M | 5.23M | 5.68M | 3.37M | 5.00M | 3.55M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 413.75K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 97.10M | 168.44M | 308.15M | 128.55M | 0.00 | 95.40M | 225.70M | 0.00 | 52.13M | 158.83M | 26.63M | 116.27M | 236.65M | -285.88M | -508.79M | -123.10M | 526.34M | 296.90M | 314.43M | 171.21M | |

| Depreciation & Amortization | -21.02M | -22.54M | -19.06M | -21.78M | -21.60M | -20.64M | -21.74M | -18.91M | -16.79M | -19.12M | -18.66M | -17.55M | -101.43M | 190.80M | 451.40M | -978.94M | 104.25M | 317.66M | 53.26M | 232.54M | 473.30M | -571.76M | -1.02B | -246.20M | 1.05B | 593.80M | 628.85M | 342.42M |

| EBITDA | 531.91M | -471.12M | 625.09M | 349.95M | 478.76M | -61.67M | 373.53M | -11.40M | -5.20M | 169.43M | 308.15M | 128.55M | -88.17M | 204.34M | 466.83M | -961.91M | 129.98M | 337.35M | 71.55M | 251.55M | 488.91M | -555.02M | -996.49M | -225.26M | 1.07B | 616.38M | 649.64M | 366.66M |

| EBITDA Ratio | 306.00% | 102.69% | 97.82% | 96.75% | 97.57% | 119.50% | 97.55% | -10.74% | 16.09% | 611.40% | 1,119.34% | 515.44% | -442.18% | 1,052.76% | 2,380.57% | -3,608.06% | 404.67% | 1,286.12% | 298.50% | 1,033.48% | 2,363.03% | -2,668.37% | -4,124.54% | -860.76% | 4,318.41% | 2,375.26% | 2,518.96% | 1,319.40% |

| Operating Income | 552.92M | -471.12M | 625.09M | 349.95M | 478.76M | -61.67M | 373.53M | 18.91M | 16.32M | 19.12M | 18.66M | 17.55M | 13.26M | 13.54M | 15.43M | 17.03M | 25.73M | 19.69M | 18.29M | 19.01M | 15.61M | 16.74M | 21.09M | 20.94M | 19.14M | 22.58M | 20.79M | 24.24M |

| Operating Income Ratio | 318.09% | 102.69% | 97.82% | 96.75% | 97.57% | 119.50% | 97.55% | 17.80% | 16.09% | 69.00% | 67.77% | 70.36% | 66.50% | 69.76% | 78.68% | 63.88% | 80.11% | 75.07% | 76.30% | 78.10% | 75.45% | 80.48% | 87.29% | 80.02% | 77.12% | 87.01% | 80.61% | 87.23% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 98.69M | -4.72M | 0.00 | 0.00 | 0.00 | -50.72M | 95.40M | 225.70M | -489.47M | 52.12M | 158.83M | 26.63M | 116.27M | 236.65M | -285.88M | -508.79M | -123.10M | 526.35M | 296.90M | 314.42M | 171.21M |

| Income Before Tax | 552.92M | -471.12M | 625.09M | 349.95M | 478.76M | -61.67M | 373.53M | 117.60M | 11.59M | 188.55M | 326.81M | 146.10M | -37.46M | 108.94M | 241.13M | -472.44M | 77.85M | 178.52M | 44.92M | 135.28M | 252.26M | -269.14M | -487.70M | -102.16M | 545.49M | 319.48M | 335.21M | 195.45M |

| Income Before Tax Ratio | 318.09% | 102.69% | 97.82% | 96.75% | 97.57% | 119.50% | 97.55% | 110.74% | 11.43% | 680.40% | 1,187.11% | 585.80% | -187.86% | 561.26% | 1,229.63% | -1,772.09% | 242.37% | 680.59% | 187.40% | 555.79% | 1,219.24% | -1,293.94% | -2,018.63% | -390.37% | 2,197.78% | 1,231.14% | 1,299.77% | 703.31% |

| Income Tax Expense | 0.00 | 22.54M | 19.06M | 21.78M | 478.76M | -161.14K | 373.53M | 117.60M | 16.79M | 169.43M | 308.15M | 128.55M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 552.92M | -471.12M | 625.09M | 349.95M | 478.76M | -61.67M | 373.53M | 117.60M | 11.59M | 188.55M | 326.81M | 146.10M | -37.46M | 108.94M | 241.13M | -472.44M | 77.85M | 178.52M | 44.92M | 135.28M | 252.26M | -269.14M | -487.70M | -102.16M | 545.49M | 319.48M | 335.21M | 195.45M |

| Net Income Ratio | 318.09% | 102.69% | 97.82% | 96.75% | 97.57% | 119.50% | 97.55% | 110.74% | 11.43% | 680.40% | 1,187.11% | 585.80% | -187.86% | 561.26% | 1,229.63% | -1,772.09% | 242.37% | 680.59% | 187.40% | 555.79% | 1,219.24% | -1,293.94% | -2,018.63% | -390.37% | 2,197.78% | 1,231.14% | 1,299.77% | 703.31% |

| EPS | 4.46 | -3.99 | 5.59 | 3.21 | 4.40 | -0.67 | 3.77 | 1.00 | 0.12 | 1.96 | 3.47 | 1.57 | -0.41 | 1.23 | 2.76 | -5.40 | 0.89 | 2.06 | 0.52 | 1.57 | 2.97 | -3.18 | -5.72 | -1.24 | 6.75 | 4.24 | 4.73 | 2.80 |

| EPS Diluted | 4.46 | -3.99 | 5.59 | 3.21 | 4.40 | -0.67 | 3.77 | 99.44M | 0.12 | 1.96 | 3.47 | 1.57 | -0.41 | 1.23 | 2.76 | -5.40 | 0.89 | 2.06 | 0.52 | 1.57 | 2.97 | -3.18 | -5.72 | -1.24 | 6.75 | 4.24 | 4.73 | 2.80 |

| Weighted Avg Shares Out | 124.05M | 118.08M | 111.82M | 109.02M | 108.87M | 92.04M | 99.08M | 117.60M | 97.91M | 96.29M | 94.22M | 93.03M | 91.07M | 88.89M | 87.42M | 87.41M | 87.67M | 86.84M | 86.10M | 86.14M | 84.89M | 84.54M | 85.23M | 82.29M | 80.84M | 75.27M | 70.86M | 69.91M |

| Weighted Avg Shares Out (Dil) | 124.05M | 118.08M | 111.82M | 109.02M | 108.87M | 92.04M | 99.08M | 1.18 | 97.91M | 96.29M | 94.22M | 93.03M | 91.07M | 88.89M | 87.42M | 87.41M | 87.67M | 86.84M | 86.10M | 86.14M | 84.89M | 84.54M | 85.23M | 82.29M | 80.84M | 75.27M | 70.86M | 69.91M |

ADX: Equity Exposure With A Fund Dating Back To 1929

Citigroup Inc. Grows Stock Holdings in Adams Diversified Equity Fund Inc (NYSE:ADX)

Portfolio Positioning For A Recovery Scenario

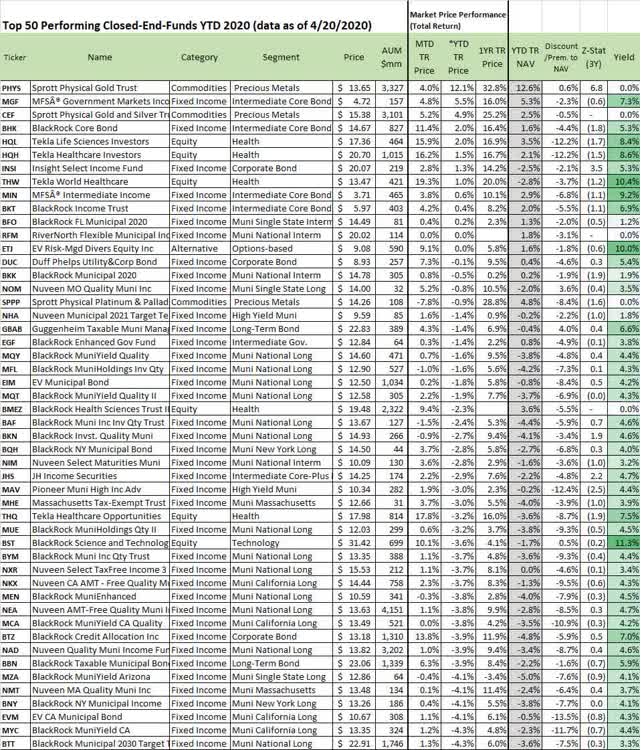

The Best And Worst-Performing CEFs YTD, And 5 To Buy Now: April 2020

Adams Diversified Equity Fund Inc (NYSE:ADX) Short Interest Down 19.3% in March

Adams Diversified Equity Fund (NYSE:ADX) Shares Up 7%

Source: https://incomestatements.info

Category: Stock Reports