See more : Hindustan Zinc Limited (HINDZINC.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Aeva Technologies, Inc. (AEVA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Aeva Technologies, Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Formula One Group (FWONK) Income Statement Analysis – Financial Results

- Br. Holdings Corporation (1726.T) Income Statement Analysis – Financial Results

- Freeline Therapeutics Holdings plc (FRLN) Income Statement Analysis – Financial Results

- Base Resources Limited (BSE.L) Income Statement Analysis – Financial Results

- AMERCO (UHALB) Income Statement Analysis – Financial Results

Aeva Technologies, Inc. (AEVA)

About Aeva Technologies, Inc.

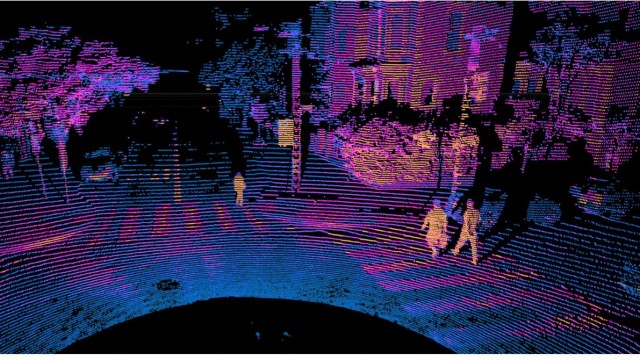

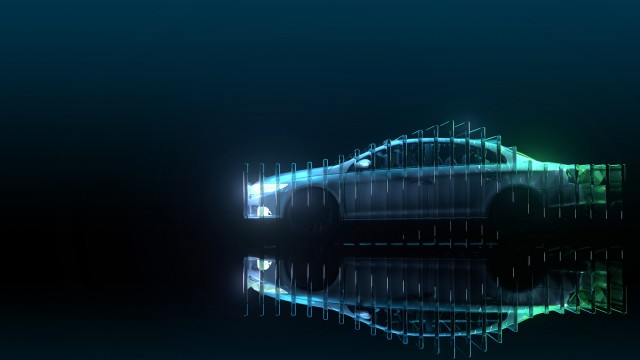

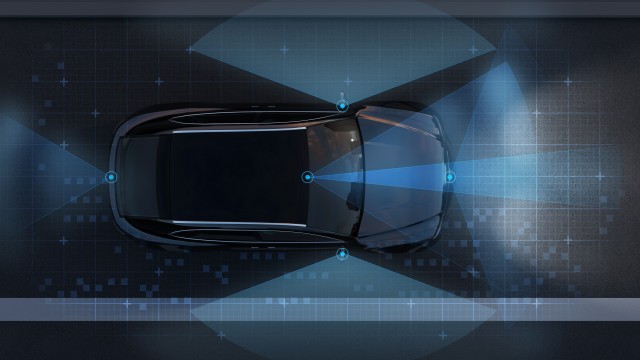

Aeva Technologies, Inc., through its frequency modulated continuous wave (FMCW) sensing technology, designs a 4D LiDAR-on-chip that enables the adoption of LiDAR across various applications. from automated driving to consumer electronics, consumer health, industrial automation, and security application. The company was founded in 2017 is based in Mountain View, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2001 |

|---|---|---|---|---|---|---|---|

| Revenue | 4.31M | 4.19M | 9.27M | 4.84M | 1.38M | 135.00K | -557.93M |

| Cost of Revenue | 10.20M | 8.45M | 5.83M | 2.74M | 815.00K | 57.00K | 0.00 |

| Gross Profit | -5.89M | -4.26M | 3.43M | 2.10M | 569.00K | 78.00K | -557.93M |

| Gross Profit Ratio | -136.50% | -101.50% | 37.04% | 43.40% | 41.11% | 57.78% | 100.00% |

| Research & Development | 102.50M | 109.59M | 74.77M | 20.50M | 15.41M | 8.40M | 0.00 |

| General & Administrative | 31.76M | 31.07M | 28.41M | 5.66M | 4.29M | 2.63M | 0.00 |

| Selling & Marketing | 7.64M | 7.04M | 4.44M | 1.68M | 966.00K | 450.00K | 0.00 |

| SG&A | 39.40M | 38.11M | 32.85M | 7.35M | 5.26M | 3.08M | 0.00 |

| Other Expenses | 0.00 | 943.00K | 1.94M | -24.00K | -17.00K | 0.00 | 0.00 |

| Operating Expenses | 141.90M | 147.70M | 107.62M | 27.84M | 20.66M | 11.48M | 0.00 |

| Cost & Expenses | 152.10M | 156.15M | 113.45M | 30.58M | 21.48M | 11.54M | 0.00 |

| Interest Income | 8.93M | 3.71M | 372.00K | 195.00K | 516.00K | 234.00K | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.71M | 6.15M | 3.05M | 798.00K | 634.00K | 476.00K | 1.15M |

| EBITDA | -140.08M | -145.81M | -101.14M | -24.94M | -19.46M | -10.93M | 1.15M |

| EBITDA Ratio | -3,248.61% | -3,478.24% | -1,091.61% | -515.03% | -1,406.00% | -8,093.33% | -0.21% |

| Operating Income | -147.79M | -151.96M | -104.19M | -25.74M | -20.09M | -11.40M | 0.00 |

| Operating Income Ratio | -3,427.37% | -3,624.88% | -1,124.51% | -531.51% | -1,451.81% | -8,445.93% | 0.00% |

| Total Other Income/Expenses | -1.55M | 4.65M | 2.31M | 171.00K | 499.00K | 234.00K | 0.00 |

| Income Before Tax | -149.33M | -147.31M | -101.88M | -25.57M | -19.59M | -11.17M | -101.88M |

| Income Before Tax Ratio | -3,463.20% | -3,513.96% | -1,099.60% | -527.98% | -1,415.75% | -8,272.59% | 18.26% |

| Income Tax Expense | 0.00 | -4.65M | -372.00K | -195.00K | -516.00K | 0.00 | 101.88M |

| Net Income | -149.33M | -142.66M | -101.51M | -25.38M | -19.08M | -11.17M | -101.88M |

| Net Income Ratio | -3,463.20% | -3,403.03% | -1,095.59% | -523.95% | -1,378.47% | -8,272.59% | 18.26% |

| EPS | -3.29 | -3.28 | -2.53 | -0.60 | -0.45 | -0.26 | -2.41 |

| EPS Diluted | -3.29 | -3.28 | -2.53 | -0.60 | -0.45 | -0.26 | -2.41 |

| Weighted Avg Shares Out | 45.41M | 43.46M | 40.17M | 42.28M | 42.28M | 42.28M | 42.28M |

| Weighted Avg Shares Out (Dil) | 45.41M | 43.46M | 40.17M | 42.28M | 42.28M | 42.28M | 42.28M |

Aeva Technologies, Inc. (AEVA) Reports Q4 Loss, Misses Revenue Estimates

Has the lidar shakeout produced a winning combination?

20 Undervalued Stocks to Buy Under $20

Aeva Technologies: Market Wants Proof, But Coming Orders Will Boost Stock

Aeva Technologies, Inc. (AEVA) Q3 2022 Earnings Call Transcript

Aeva Technologies, Inc. (AEVA) Reports Q3 Loss, Misses Revenue Estimates

Aeva Announces Date for Third Quarter 2022 Results and Conference Call

Aeva Technologies: A Potential Under The Radar Gainer

Aeva Technologies: Optimistic On Market Adoption Of Aeries II

Aeva Technologies, Inc. (AEVA) CEO Soroush Salehian on Q2 2022 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports