See more : A2Z Infra Engineering Limited (A2ZINFRA.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Alcon Inc. (ALC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Alcon Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- Sino Agro Food, Inc. (SIAF) Income Statement Analysis – Financial Results

- Integrated Business Systems & Services, Inc. (IBSS) Income Statement Analysis – Financial Results

- Morgan Stanley (MS-PL) Income Statement Analysis – Financial Results

- DEN Networks Limited (DEN.NS) Income Statement Analysis – Financial Results

- Ekter SA (EKTER.AT) Income Statement Analysis – Financial Results

Alcon Inc. (ALC)

About Alcon Inc.

Alcon Inc., an eye care company, researches, develops, manufactures, distributes, and sells eye care products for eye care professionals and their patients worldwide. The company's Surgical segment offers equipment, instrumentation and diagnostics, intraocular lenses (IOLs), and other implantables; and consumables, including viscoelastics, surgical solutions, incisional instruments, surgical custom packs, and other products for use in surgical procedures. Its cataract products include centurion vision system, LenSx femtosecond laser, LuxOR surgical ophthalmic microscope, NGENUITY 3D visualization system, and ORA system for intra-operative measurements; custom pak surgical procedure packs; vitreoretinal products comprising constellation vision systems, procedure packs, lasers and hand-held microsurgical instruments, and grieshaber and MIVS instruments, as well as scissors, forceps and micro-instruments, medical grade vitreous tamponades, and Hypervit vitrectomy probes; refractive surgery products, including WaveLight lasers and Contoura Vision used for LASIK treatment; EX-PRESS glaucoma filtration device; and implantables products, including AcrySof IQ IOLs products include monofocal IOLs and advanced technology IOLs under the PanOptix and ReSTOR brands for the correction of presbyopia and astigmatism at the time of cataract surgery. Its Vision Care segment provides daily disposable, reusable, and color-enhancing contact lenses; ocular health products, such as dry eye, glaucoma, contact lens care, and ocular allergies; and ocular vitamins and redness relievers under the TOTAL, PRECISION, DAILIES AquaComfort PLUS, Air Optix, Opti-Free, Clear Care, Tears Naturale, Genteal, ICAPS, and Vitalux brands. The company was formerly known as Alcon Universal S.A. and changed the name to Alcon Inc. in December 2001. Alcon Inc. was founded in 1945 and is headquartered in Geneva, Switzerland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 9.46B | 8.72B | 8.29B | 6.83B | 7.51B | 7.15B | 6.79B | 6.60B | 6.52B |

| Cost of Revenue | 4.21B | 3.97B | 3.64B | 3.89B | 3.85B | 3.96B | 3.59B | 3.49B | 3.39B |

| Gross Profit | 5.25B | 4.75B | 4.65B | 2.94B | 3.66B | 3.19B | 3.20B | 3.11B | 3.12B |

| Gross Profit Ratio | 55.49% | 54.47% | 56.11% | 43.03% | 48.77% | 44.62% | 47.17% | 47.16% | 47.92% |

| Research & Development | 859.00M | 702.00M | 842.00M | 673.00M | 656.00M | 587.00M | 584.00M | 499.00M | 440.56M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 2.85B | 2.80B | 2.60B | 2.53B | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.21B | 3.07B | 3.08B | 2.69B | 2.85B | 2.80B | 2.60B | 2.53B | 2.25B |

| Other Expenses | 140.00M | -181.77M | -69.15M | -55.00M | -346.00M | -52.00M | -101.00M | -76.00M | -33.67M |

| Operating Expenses | 4.21B | 4.08B | 4.07B | 3.42B | 3.85B | 3.44B | 3.28B | 3.10B | 2.72B |

| Cost & Expenses | 8.42B | 8.05B | 7.71B | 7.32B | 7.70B | 7.40B | 6.87B | 6.59B | 6.12B |

| Interest Income | 34.00M | 16.00M | 3.00M | 6.00M | 8.00M | 2.00M | 0.00 | 1.00M | 17.00M |

| Interest Expense | 189.00M | 134.00M | 120.00M | 124.00M | 113.00M | 24.00M | 27.00M | 31.00M | 0.00 |

| Depreciation & Amortization | 1.22B | 1.16B | 1.22B | 1.72B | 1.46B | 1.63B | 1.32B | 1.25B | 1.21B |

| EBITDA | 2.24B | 1.78B | 1.76B | 1.11B | 1.26B | 1.35B | 1.22B | 1.17B | 1.57B |

| EBITDA Ratio | 23.71% | 20.45% | 21.54% | 16.60% | 16.33% | 19.18% | 18.04% | 19.54% | 24.75% |

| Operating Income | 1.04B | 672.00M | 580.00M | -482.00M | -187.00M | -248.00M | -77.00M | 10.00M | 401.12M |

| Operating Income Ratio | 10.99% | 7.71% | 7.00% | -7.05% | -2.49% | -3.47% | -1.13% | 0.15% | 6.15% |

| Total Other Income/Expenses | -207.00M | -209.00M | -162.00M | -153.00M | -145.00M | -52.00M | -50.00M | -123.00M | -63.49M |

| Income Before Tax | 832.00M | 463.00M | 418.00M | -635.00M | -332.00M | -300.00M | -127.00M | -113.00M | 337.63M |

| Income Before Tax Ratio | 8.80% | 5.31% | 5.04% | -9.29% | -4.42% | -4.19% | -1.87% | -1.71% | 5.18% |

| Income Tax Expense | -142.00M | 128.00M | 42.00M | -104.00M | 324.00M | -73.00M | -383.00M | 57.00M | 41.36M |

| Net Income | 974.00M | 335.00M | 376.00M | -531.00M | -656.00M | -227.00M | 256.00M | -170.00M | 296.27M |

| Net Income Ratio | 10.30% | 3.84% | 4.54% | -7.77% | -8.74% | -3.17% | 3.77% | -2.58% | 4.55% |

| EPS | 1.98 | 0.70 | 0.77 | -1.09 | -1.34 | -0.46 | 0.52 | -0.35 | 0.61 |

| EPS Diluted | 1.96 | 0.70 | 0.76 | -1.09 | -1.34 | -0.46 | 0.52 | -0.35 | 0.61 |

| Weighted Avg Shares Out | 493.00M | 491.40M | 490.00M | 489.00M | 488.20M | 488.70M | 488.70M | 488.70M | 488.70M |

| Weighted Avg Shares Out (Dil) | 496.50M | 494.40M | 493.40M | 489.00M | 488.20M | 488.70M | 488.70M | 488.70M | 488.70M |

Is Alcon (ALC) Outperforming Other Medical Stocks This Year?

Air Lease Corporation Announces Delivery of First of 19 New Airbus Aircraft to Condor, Germany

Here's Why Alcon (ALC) is a Strong Momentum Stock

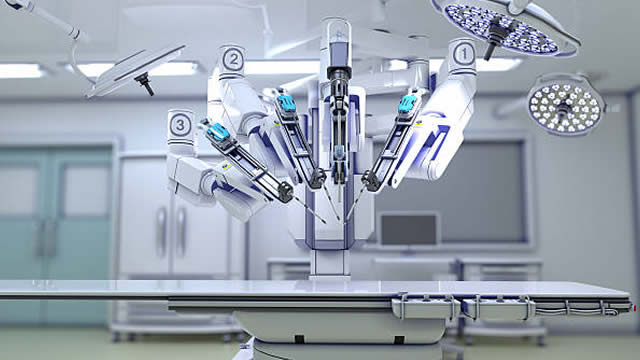

The Zacks Analyst Blog DexCom, Hologic, Alcon Intuitive Surgical and Thermo Fisher Scientific

Alcon (ALC) Rides on Innovation, Balanced Segmental Sales

Buy 5 Medical Devices Stocks to Enhance Your Portfolio in 2H

Alcon (ALC) Inks Buyout Deal to Expand Its Glaucoma Portfolio

Alcon (ALC) Achieves FDA 510(k) Clearance for Unity VCS and Unity CS

Alcon's Latest Equipment Breakthrough Technologies, Unity VCS and Unity CS, Receive U.S. FDA 510(k) Clearance

Alcon's Latest Equipment Breakthrough Technologies, Unity VCS and Unity CS, Receive U.S. FDA 510(k) Clearance

Source: https://incomestatements.info

Category: Stock Reports