See more : HilleVax, Inc. (HLVX) Income Statement Analysis – Financial Results

Complete financial analysis of Allient Inc. (ALNT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Allient Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- BF Utilities Limited (BFUTILITIE.BO) Income Statement Analysis – Financial Results

- Appian Corporation (APPN) Income Statement Analysis – Financial Results

- Banco do Estado de Sergipe S.A. (BGIP4.SA) Income Statement Analysis – Financial Results

- Dixons Carphone plc (DC.L) Income Statement Analysis – Financial Results

- Hirose Electric Co.,Ltd. (HRSEF) Income Statement Analysis – Financial Results

Allient Inc. (ALNT)

About Allient Inc.

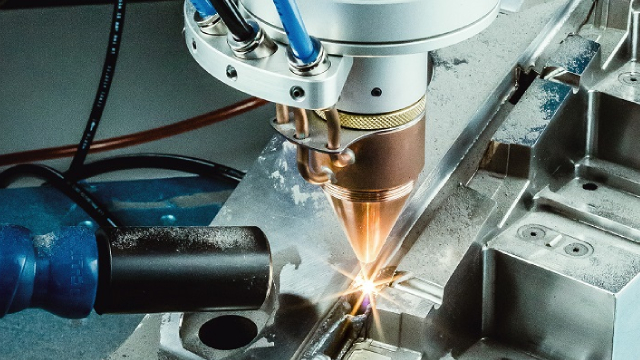

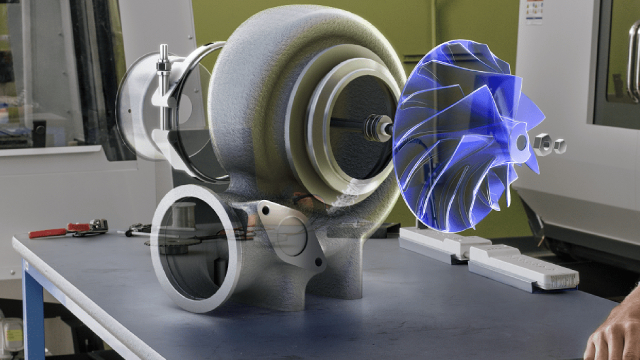

Allient Inc., together with its subsidiaries, designs, manufactures, and sells precision and specialty controlled motion components and systems for various industries worldwide. It offers brush and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor-drives, gearmotors, gearing, modular digital servo drives, motion controllers, optical encoders, active and passive filters, input/output modules, industrial communications gateways, light-weighting technologies, and other controlled motion-related products. The company sells its products to end customers and original equipment manufacturers in vehicle, medical, aerospace and defense, and industrial markets through direct sales force, authorized manufacturers' representatives, and distributors. The company was formerly known as Allied Motion Technologies Inc. and changed its name to Allient Inc. in August 2023. Allient Inc. was incorporated in 1962 and is headquartered in Amherst, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 578.63M | 502.99M | 403.52M | 366.69M | 371.08M | 310.61M | 252.01M | 245.89M | 232.43M | 249.68M | 125.50M | 101.97M | 110.94M | 80.59M | 61.24M | 85.97M | 84.56M | 82.77M | 74.30M | 62.74M | 39.43M | 42.06M | 48.39M | 45.13M | 41.70M | 41.30M | 39.90M | 35.40M | 39.80M | 43.00M | 45.70M | 69.20M | 51.60M | 51.30M | 49.30M | 46.00M | 45.80M | 42.00M |

| Cost of Revenue | 407.26M | 345.73M | 282.46M | 258.12M | 258.50M | 222.86M | 179.55M | 176.23M | 166.16M | 176.26M | 88.98M | 72.33M | 77.41M | 57.90M | 48.11M | 63.80M | 63.95M | 63.21M | 58.12M | 46.28M | 29.17M | 25.55M | 29.73M | 27.37M | 25.80M | 25.60M | 24.80M | 21.10M | 22.00M | 22.00M | 23.50M | 25.30M | 15.60M | 13.30M | 14.10M | 14.50M | 11.50M | 16.10M |

| Gross Profit | 171.37M | 157.26M | 121.06M | 108.58M | 112.58M | 87.75M | 72.46M | 69.66M | 66.27M | 73.43M | 36.52M | 29.64M | 33.53M | 22.69M | 13.13M | 22.17M | 20.61M | 19.56M | 16.18M | 16.46M | 10.27M | 16.51M | 18.65M | 17.77M | 15.90M | 15.70M | 15.10M | 14.30M | 17.80M | 21.00M | 22.20M | 43.90M | 36.00M | 38.00M | 35.20M | 31.50M | 34.30M | 25.90M |

| Gross Profit Ratio | 29.62% | 31.26% | 30.00% | 29.61% | 30.34% | 28.25% | 28.75% | 28.33% | 28.51% | 29.41% | 29.10% | 29.07% | 30.22% | 28.16% | 21.44% | 25.78% | 24.37% | 23.63% | 21.78% | 26.23% | 26.04% | 39.25% | 38.55% | 39.36% | 38.13% | 38.01% | 37.84% | 40.40% | 44.72% | 48.84% | 48.58% | 63.44% | 69.77% | 74.07% | 71.40% | 68.48% | 74.89% | 61.67% |

| Research & Development | 41.67M | 41.88M | 29.12M | 25.96M | 23.20M | 19.91M | 17.54M | 16.17M | 14.23M | 13.88M | 7.93M | 6.06M | 5.98M | 4.04M | 3.92M | 4.01M | 3.96M | 3.82M | 3.53M | 2.90M | 1.85M | 4.49M | 4.81M | 4.27M | 4.50M | 4.40M | 3.60M | 3.70M | 3.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 58.40M | 50.68M | 42.42M | 38.30M | 37.69M | 32.80M | 25.14M | 24.76M | 22.82M | 23.97M | 15.20M | 10.81M | 12.64M | 9.94M | 6.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.60M | 0.00 | 5.55M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 24.71M | 21.88M | 17.25M | 15.39M | 16.54M | 11.81M | 10.98M | 9.99M | 8.15M | 8.71M | 5.51M | 5.09M | 5.63M | 3.87M | 3.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.02M | 0.00 | 6.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 83.12M | 72.55M | 59.67M | 53.69M | 54.22M | 43.84M | 35.91M | 34.32M | 30.40M | 32.68M | 20.71M | 15.90M | 18.27M | 13.81M | 10.08M | 12.80M | 11.39M | 11.01M | 9.22M | 8.78M | 6.62M | 11.90M | 11.73M | 11.63M | 11.80M | 12.10M | 12.40M | 11.00M | 11.90M | 17.80M | 18.20M | 38.20M | 35.30M | 33.10M | 31.60M | 29.60M | 27.60M | 20.50M |

| Other Expenses | 0.00 | -283.00K | 323.00K | -502.00K | -468.00K | 3.66M | 3.22M | 138.00K | -142.00K | 2.71M | 825.00K | 548.00K | -369.00K | 551.00K | 851.00K | 895.00K | 1.03M | 1.01M | 1.01M | 647.00K | 315.00K | 1.43M | 57.00K | 890.00K | 1.20M | 1.50M | 1.20M | 1.00M | 1.00M | 1.60M | 2.20M | 3.20M | 3.90M | 4.00M | 4.10M | 3.90M | 3.00M | 3.20M |

| Operating Expenses | 141.37M | 125.60M | 95.03M | 85.58M | 83.14M | 63.76M | 53.45M | 50.35M | 44.77M | 49.28M | 29.46M | 22.51M | 23.88M | 18.41M | 14.86M | 17.70M | 16.38M | 15.84M | 13.75M | 12.33M | 8.79M | 17.82M | 16.59M | 16.79M | 17.50M | 18.00M | 17.20M | 15.70M | 16.50M | 19.40M | 20.40M | 41.40M | 39.20M | 37.10M | 35.70M | 33.50M | 30.60M | 23.70M |

| Cost & Expenses | 532.04M | 471.33M | 377.49M | 343.70M | 341.64M | 286.62M | 233.00M | 226.58M | 210.94M | 225.53M | 118.44M | 94.84M | 101.29M | 76.30M | 62.96M | 81.50M | 80.34M | 79.05M | 71.87M | 58.61M | 37.95M | 43.37M | 46.32M | 44.16M | 43.30M | 43.60M | 42.00M | 36.80M | 38.50M | 41.40M | 43.90M | 66.70M | 54.80M | 50.40M | 49.80M | 48.00M | 42.10M | 39.80M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 77.00K | 90.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 12.38M | 7.69M | 3.24M | 3.72M | 5.13M | 2.70M | 2.47M | 6.45M | 6.02M | 6.44M | 1.45M | 13.00K | 84.00K | 3.00K | 55.00K | 177.00K | 699.00K | 983.00K | 1.08M | 687.00K | 226.00K | 0.00 | 82.00K | 0.00 | 0.00 | 0.00 | 200.00K | 200.00K | 200.00K | 700.00K | 500.00K | 1.10M | 1.10M | 1.20M | 1.40M | 1.40M | 0.00 | 1.00M |

| Depreciation & Amortization | 25.07M | 23.85M | 18.11M | 15.99M | 14.86M | 11.58M | 10.27M | 9.75M | 7.47M | 7.27M | 2.91M | 1.80M | 2.17M | 1.82M | 2.92M | 3.51M | 3.47M | 3.28M | 3.23M | 2.33M | 1.36M | 754.00K | 831.00K | 890.00K | 1.20M | 1.50M | 1.20M | 1.00M | 1.00M | 1.60M | 2.20M | 3.20M | 3.90M | 4.00M | 4.10M | 3.90M | 3.00M | 3.20M |

| EBITDA | 67.15M | 48.06M | 43.53M | 37.84M | 43.72M | 34.96M | 28.57M | 29.11M | 29.10M | 32.55M | 10.10M | 9.31M | 11.77M | 6.98M | -15.14M | 8.01M | 7.75M | 7.17M | 5.79M | 6.46M | 2.55M | 608.00K | 3.52M | 1.86M | -400.00K | -800.00K | -900.00K | -400.00K | 2.30M | 3.20M | 4.00M | 5.70M | 700.00K | 4.90M | 3.60M | 1.90M | 6.70M | 5.40M |

| EBITDA Ratio | 11.61% | 11.30% | 11.02% | 10.49% | 11.81% | 11.45% | 11.62% | 11.82% | 12.46% | 12.95% | 8.08% | 9.13% | 10.61% | 8.67% | -24.87% | 9.31% | 9.17% | 8.66% | 7.79% | 10.24% | 6.47% | 0.40% | 7.20% | 5.53% | -0.24% | -1.69% | -2.01% | -0.56% | 6.28% | 19.77% | 8.97% | 9.54% | 13.76% | 9.36% | 7.91% | 0.22% | 10.70% | 8.57% |

| Operating Income | 46.59M | 31.66M | 26.03M | 22.99M | 29.44M | 23.99M | 19.01M | 19.31M | 21.50M | 24.15M | 7.06M | 7.13M | 9.65M | 4.97M | -17.99M | 4.46M | 4.22M | 3.72M | 2.43M | 4.12M | 1.27M | -1.31M | 1.48M | 974.00K | -1.60M | -2.30M | -2.10M | -1.40M | 1.30M | 1.60M | 1.80M | 2.50M | -3.20M | 900.00K | -500.00K | -2.00M | 3.70M | 2.20M |

| Operating Income Ratio | 8.05% | 6.29% | 6.45% | 6.27% | 7.93% | 7.72% | 7.54% | 7.85% | 9.25% | 9.67% | 5.62% | 6.99% | 8.70% | 6.17% | -29.37% | 5.19% | 5.00% | 4.49% | 3.27% | 6.57% | 3.22% | -3.12% | 3.05% | 2.16% | -3.84% | -5.57% | -5.26% | -3.95% | 3.27% | 3.72% | 3.94% | 3.61% | -6.20% | 1.75% | -1.01% | -4.35% | 8.08% | 5.24% |

| Total Other Income/Expenses | -16.89M | -7.98M | -2.91M | -4.22M | -5.60M | -2.55M | -2.66M | -6.51M | -6.08M | -5.53M | -1.28M | 370.00K | -133.00K | 194.00K | -214.00K | -147.00K | -641.00K | -817.00K | -950.00K | -713.00K | -303.00K | 1.24M | 1.10M | 630.00K | 300.00K | 100.00K | -100.00K | 0.00 | 0.00 | -300.00K | -1.40M | -200.00K | 5.30M | -800.00K | 300.00K | -3.20M | -1.80M | -2.80M |

| Income Before Tax | 29.70M | 23.68M | 23.11M | 18.78M | 23.84M | 20.68M | 16.14M | 12.80M | 15.42M | 18.62M | 5.78M | 7.50M | 9.52M | 5.17M | -18.20M | 4.32M | 3.58M | 2.90M | 1.48M | 3.41M | 967.00K | -586.00K | 2.57M | 1.60M | -1.30M | -2.20M | -2.20M | -1.40M | 1.30M | 1.30M | 400.00K | 2.30M | 2.10M | 100.00K | -200.00K | -5.20M | 1.90M | -600.00K |

| Income Before Tax Ratio | 5.13% | 4.71% | 5.73% | 5.12% | 6.42% | 6.66% | 6.40% | 5.21% | 6.63% | 7.46% | 4.61% | 7.35% | 8.58% | 6.41% | -29.72% | 5.02% | 4.24% | 3.50% | 1.99% | 5.43% | 2.45% | -1.39% | 5.32% | 3.55% | -3.12% | -5.33% | -5.51% | -3.95% | 3.27% | 3.02% | 0.88% | 3.32% | 4.07% | 0.19% | -0.41% | -11.30% | 4.15% | -1.43% |

| Income Tax Expense | 5.60M | 6.29M | -981.00K | 5.13M | 6.82M | 4.76M | 8.10M | 3.73M | 4.35M | 4.76M | 1.83M | 2.10M | 2.55M | 1.58M | -5.75M | 1.41M | 1.19M | 969.00K | 558.00K | 1.16M | 19.00K | -320.00K | 576.00K | 129.00K | 200.00K | -200.00K | -800.00K | -400.00K | 500.00K | 300.00K | 300.00K | 600.00K | 1.00M | 100.00K | 1.70M | -1.60M | 600.00K | -700.00K |

| Net Income | 24.10M | 17.39M | 24.09M | 13.64M | 17.02M | 15.93M | 8.04M | 9.08M | 11.07M | 13.86M | 3.95M | 5.40M | 6.97M | 3.59M | -12.45M | 2.91M | 2.40M | 1.93M | 923.00K | 2.25M | 948.00K | -266.00K | 2.00M | 1.48M | -1.50M | -2.00M | -1.40M | -1.00M | 800.00K | 5.90M | 1.10M | 1.70M | 1.10M | -500.00K | -1.60M | -3.60M | 1.30M | 100.00K |

| Net Income Ratio | 4.16% | 3.46% | 5.97% | 3.72% | 4.59% | 5.13% | 3.19% | 3.69% | 4.76% | 5.55% | 3.15% | 5.29% | 6.28% | 4.45% | -20.33% | 3.38% | 2.83% | 2.33% | 1.24% | 3.59% | 2.40% | -0.63% | 4.13% | 3.27% | -3.60% | -4.84% | -3.51% | -2.82% | 2.01% | 13.72% | 2.41% | 2.46% | 2.13% | -0.97% | -3.25% | -7.83% | 2.84% | 0.24% |

| EPS | 1.51 | 1.13 | 1.67 | 0.96 | 1.21 | 1.15 | 0.59 | 0.67 | 0.80 | 1.00 | 0.29 | 0.42 | 0.55 | 0.30 | -1.11 | 0.27 | 0.24 | 0.20 | 0.10 | 0.27 | 0.13 | -0.04 | 0.30 | 0.23 | -0.23 | -0.31 | -0.22 | -0.16 | 0.13 | 0.80 | 0.14 | 0.26 | 0.17 | -0.07 | -0.26 | -0.60 | 0.23 | 0.02 |

| EPS Diluted | 1.48 | 1.09 | 1.66 | 0.95 | 1.20 | 1.13 | 0.58 | 0.66 | 0.80 | 1.00 | 0.29 | 0.42 | 0.54 | 0.30 | -1.10 | 0.26 | 0.22 | 0.19 | 0.09 | 0.24 | 0.12 | -0.04 | 0.28 | 0.21 | -0.23 | -0.31 | -0.22 | -0.16 | 0.13 | 0.79 | 0.14 | 0.25 | 0.17 | -0.07 | -0.26 | -0.60 | 0.23 | 0.02 |

| Weighted Avg Shares Out | 15.96M | 15.45M | 14.41M | 14.24M | 14.10M | 13.90M | 13.73M | 13.52M | 13.84M | 13.82M | 13.64M | 12.95M | 12.66M | 11.84M | 11.26M | 10.90M | 10.04M | 9.69M | 9.37M | 8.37M | 7.39M | 6.97M | 6.74M | 6.51M | 6.42M | 6.43M | 6.36M | 6.25M | 6.32M | 7.38M | 7.86M | 6.54M | 6.60M | 6.82M | 6.15M | 6.00M | 5.74M | 5.76M |

| Weighted Avg Shares Out (Dil) | 16.27M | 15.95M | 14.52M | 14.33M | 14.19M | 14.05M | 13.91M | 13.66M | 13.86M | 13.82M | 13.64M | 12.95M | 12.86M | 12.06M | 11.29M | 11.05M | 10.87M | 10.31M | 10.30M | 9.28M | 7.59M | 6.97M | 7.25M | 7.18M | 6.42M | 6.43M | 6.36M | 6.25M | 6.32M | 7.50M | 7.86M | 6.71M | 6.60M | 6.82M | 6.15M | 6.00M | 5.74M | 5.76M |

Allient (ALNT) Is Attractively Priced Despite Fast-paced Momentum

5 Relative Price Strength Options Available for Investors

Best Value Stocks to Buy for November 14th

How Much Upside is Left in Allient (ALNT)? Wall Street Analysts Think 25.99%

Allient (ALNT) Shows Fast-paced Momentum But Is Still a Bargain Stock

Allient Inc. (ALNT) Q3 2024 Earnings Call Transcript

Allient (ALNT) Q3 Earnings and Revenues Surpass Estimates

Allient Reports Third Quarter 2024 Results; Simplify to Accelerate NOW Initiatives Drive Sequential Margin Expansion

Allient Declares Quarterly Cash Dividend

Allient Inc. Announces Third Quarter 2024 Financial Results Conference Call and Webcast

Source: https://incomestatements.info

Category: Stock Reports