See more : Sbanken ASA (SBANK.OL) Income Statement Analysis – Financial Results

Complete financial analysis of Allison Transmission Holdings, Inc. (ALSN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Allison Transmission Holdings, Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Cable One, Inc. (CABO) Income Statement Analysis – Financial Results

- Concord New Energy Group Limited (CWPWF) Income Statement Analysis – Financial Results

- Galp Energia, SGPS, S.A. (GLPEF) Income Statement Analysis – Financial Results

- Medibio Limited (MEB.AX) Income Statement Analysis – Financial Results

- Padmalaya Telefilms Limited (PADMALAYAT.BO) Income Statement Analysis – Financial Results

Allison Transmission Holdings, Inc. (ALSN)

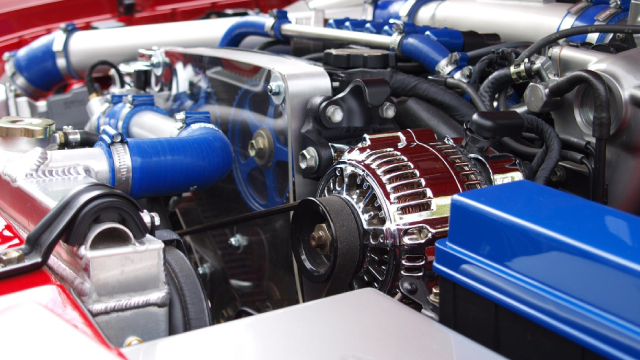

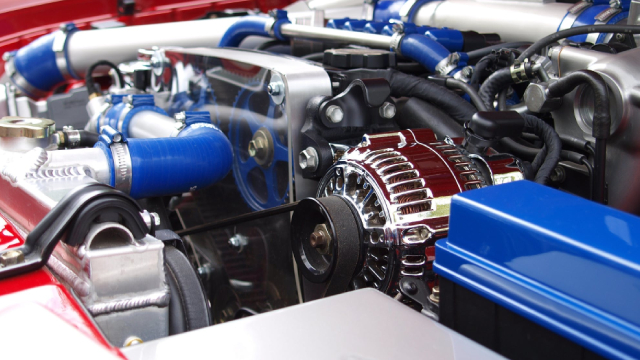

About Allison Transmission Holdings, Inc.

Allison Transmission Holdings, Inc., together with its subsidiaries, designs, manufactures, and sells commercial and defense fully-automatic transmissions for medium-and heavy-duty commercial vehicles, and medium-and heavy-tactical U.S. defense vehicles worldwide. It offers transmissions for various applications, including distribution, refuse, construction, fire, and emergency on-highway trucks; school and transit buses; motor homes; energy, mining, and construction off-highway vehicles and equipment; and wheeled and tracked defense vehicles. The company markets its transmissions under the Allison Transmission brand name; and remanufactured transmissions under the ReTran brand name. It also sells branded replacement parts, support equipment, aluminum die cast components, and other products necessary to service the installed base of vehicles utilizing its transmissions, as well as defense kits, engineering services, and extended transmission coverage services to various original equipment manufacturers, distributors, and the U.S. government. The company serves customers through an independent network of approximately 1,400 independent distributor and dealer locations. The company was formerly known as Clutch Holdings, Inc. Allison Transmission Holdings, Inc. was founded in 1915 and is headquartered in Indianapolis, Indiana.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.04B | 2.77B | 2.40B | 2.08B | 2.70B | 2.71B | 2.26B | 1.84B | 1.99B | 2.13B | 1.93B | 2.14B | 2.16B | 1.93B |

| Cost of Revenue | 1.57B | 1.47B | 1.26B | 1.08B | 1.30B | 1.29B | 1.13B | 976.00M | 1.05B | 1.15B | 1.08B | 1.19B | 1.21B | 1.10B |

| Gross Profit | 1.47B | 1.30B | 1.15B | 998.00M | 1.39B | 1.42B | 1.13B | 864.20M | 933.80M | 975.90M | 841.90M | 954.30M | 954.50M | 828.20M |

| Gross Profit Ratio | 48.43% | 46.84% | 47.67% | 47.96% | 51.67% | 52.41% | 50.00% | 46.96% | 47.02% | 45.87% | 43.69% | 44.56% | 44.13% | 42.99% |

| Research & Development | 194.00M | 185.00M | 171.00M | 147.00M | 154.00M | 131.00M | 105.00M | 88.80M | 92.50M | 103.80M | 97.10M | 115.10M | 116.40M | 101.50M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 342.00M | 323.90M | 317.10M | 344.60M | 334.90M | 419.00M | 409.10M | 384.90M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 357.00M | 328.00M | 305.00M | 317.00M | 354.00M | 364.00M | 342.00M | 323.90M | 317.10M | 344.60M | 334.90M | 419.00M | 409.10M | 384.90M |

| Other Expenses | 0.00 | -21.00M | 19.00M | -4.00M | -8.00M | 3.00M | -22.00M | 2.40M | -300.00K | -5.60M | -10.90M | -52.80M | 0.00 | 800.00K |

| Operating Expenses | 551.00M | 513.00M | 476.00M | 464.00M | 500.00M | 495.00M | 447.00M | 412.70M | 423.60M | 448.40M | 432.00M | 534.10M | 525.50M | 471.00M |

| Cost & Expenses | 2.12B | 1.99B | 1.73B | 1.55B | 1.80B | 1.79B | 1.58B | 1.39B | 1.48B | 1.60B | 1.52B | 1.72B | 1.73B | 1.57B |

| Interest Income | 0.00 | 118.00M | 116.00M | 137.00M | 134.00M | 0.00 | 0.00 | 700.00K | 700.00K | 900.00K | 800.00K | 900.00K | 900.00K | 3.50M |

| Interest Expense | 119.00M | 118.00M | 116.00M | 137.00M | 134.00M | 121.00M | 103.00M | 100.90M | 139.80M | 138.40M | 132.90M | 151.20M | 218.20M | 281.00M |

| Depreciation & Amortization | 154.00M | 155.00M | 150.00M | 148.00M | 167.00M | 164.00M | 170.00M | 175.90M | 185.40M | 192.60M | 204.00M | 252.50M | 255.70M | 253.80M |

| EBITDA | 1.08B | 948.00M | 828.00M | 696.00M | 1.07B | 1.11B | 854.00M | 618.50M | 509.90M | 720.80M | 613.90M | 646.30M | 617.50M | 589.30M |

| EBITDA Ratio | 35.62% | 27.56% | 28.64% | 25.47% | 33.51% | 34.28% | 29.27% | 24.03% | 25.68% | 24.53% | 20.71% | 17.15% | 31.70% | 31.94% |

| Operating Income | 919.00M | 608.00M | 669.00M | 382.00M | 892.00M | 923.00M | 652.00M | 451.50M | 428.90M | 512.10M | 409.90M | 420.20M | 429.00M | 341.80M |

| Operating Income Ratio | 30.28% | 21.96% | 27.85% | 18.36% | 33.06% | 34.02% | 28.82% | 24.54% | 21.60% | 24.07% | 21.27% | 19.62% | 19.84% | 17.74% |

| Total Other Income/Expenses | -92.00M | -139.00M | -97.00M | -141.00M | -124.00M | -118.00M | -125.00M | -110.20M | -140.20M | -144.00M | -143.80M | -204.00M | -278.40M | -258.50M |

| Income Before Tax | 827.00M | 645.00M | 572.00M | 393.00M | 768.00M | 805.00M | 527.00M | 341.30M | 288.80M | 368.10M | 266.10M | 216.20M | 150.60M | 83.30M |

| Income Before Tax Ratio | 27.25% | 23.29% | 23.81% | 18.89% | 28.47% | 29.67% | 23.30% | 18.55% | 14.54% | 17.30% | 13.81% | 10.09% | 6.96% | 4.32% |

| Income Tax Expense | 154.00M | 114.00M | 130.00M | 94.00M | 164.00M | 166.00M | 23.00M | 126.40M | 106.50M | 139.50M | 100.70M | -298.00M | 47.60M | 53.70M |

| Net Income | 673.00M | 531.00M | 442.00M | 299.00M | 604.00M | 639.00M | 504.00M | 214.90M | 182.30M | 228.60M | 165.40M | 514.20M | 103.00M | 29.60M |

| Net Income Ratio | 22.17% | 19.18% | 18.40% | 14.37% | 22.39% | 23.55% | 22.28% | 11.68% | 9.18% | 10.75% | 8.58% | 24.01% | 4.76% | 1.54% |

| EPS | 7.48 | 5.53 | 4.13 | 2.62 | 4.95 | 4.81 | 3.38 | 1.28 | 1.03 | 1.27 | 0.90 | 2.83 | 0.57 | 0.16 |

| EPS Diluted | 7.40 | 5.53 | 4.13 | 2.62 | 4.91 | 4.78 | 3.36 | 1.27 | 1.03 | 1.25 | 0.88 | 2.76 | 0.57 | 0.16 |

| Weighted Avg Shares Out | 90.00M | 96.00M | 107.00M | 114.00M | 122.00M | 132.85M | 149.11M | 167.89M | 175.90M | 180.00M | 183.78M | 181.70M | 181.38M | 181.40M |

| Weighted Avg Shares Out (Dil) | 91.00M | 96.00M | 107.00M | 114.00M | 123.00M | 133.68M | 150.00M | 169.21M | 176.99M | 182.88M | 187.95M | 186.30M | 181.38M | 181.40M |

Allison Partners With Cummins on Low-Emission Hybrid Transit Solution

Allison Transmission Partners with Cummins on New Electric Hybrid Drivetrain to Serve Transit Market Starting in 2027

Why Allison Transmission (ALSN) is a Top Momentum Stock for the Long-Term

Why Allison Transmission (ALSN) is a Top Value Stock for the Long-Term

Cummins Initiates Comprehensive Vehicle Testing at Allison Transmission's Vehicle Electrification + Environmental Test Center

Leading German Parcel Service Successfully Deploys Allison Transmission-Equipped Hyundai Hydrogen Fuel Cell Truck

Allison Transmission Declares Quarterly Dividend

All You Need to Know About Allison Transmission (ALSN) Rating Upgrade to Buy

Is Allison Transmission Holdings (ALSN) Stock Outpacing Its Auto-Tires-Trucks Peers This Year?

Allison Transmission: Great Results, But No Skin In The Game

Source: https://incomestatements.info

Category: Stock Reports