See more : EarthFirst Technologies, Incorporated (EFTI) Income Statement Analysis – Financial Results

Complete financial analysis of Ambow Education Holding Ltd. (AMBO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ambow Education Holding Ltd., a leading company in the Education & Training Services industry within the Consumer Defensive sector.

- Global Technology Acquisition Corp. I (GTACW) Income Statement Analysis – Financial Results

- ITM Semiconductor Co., Ltd. (084850.KQ) Income Statement Analysis – Financial Results

- Newland Digital Technology Co.,Ltd. (000997.SZ) Income Statement Analysis – Financial Results

- Techno Medical Public Company Limited (TM.BK) Income Statement Analysis – Financial Results

- BM Technologies, Inc. (BMTX) Income Statement Analysis – Financial Results

Ambow Education Holding Ltd. (AMBO)

About Ambow Education Holding Ltd.

Ambow Education Holding Ltd. provides a range of educational and career enhancement services and products to students, recent graduates, and corporate employees and management professionals in the People's Republic of China. The company operates through two segments, K-12 Schools and CP&CE Programs. The K-12 Schools segment provides educational services covering K-12 programs and tutoring services; and international education programs. The CP&CE Programs segment operates tutoring centers that provide classroom instruction, small class, and one-on-one tutoring services for students to perform better in school and prepare for important tests, primarily high school and university entrance exams; and educational curriculum through its web-based applications. This segment also offers educational software products include eBoPo, which offers full subjects, online practice tests, and instructions for K-12 level students; career enhancement services and products focusing on improving educational opportunities for primary and advanced degree school students, and employment opportunities for university graduates; and outbound and in-house management trainings for corporate clients. In addition, this segment provides students with training for professional skills, such as case studies, job environment simulation, and technical skills; soft skills, including time management, presentation, leadership, and interview techniques; and intellectualized operational services to corporate clients, colleges, and universities. As of December 31, 2021, the company had 18 centers and schools comprising 5 tutoring centers, 2 K-12 schools, 3 career enhancement centers, and 8 training offices. The company was founded in 2000 and is headquartered in Beijing, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 9.16M | 14.84M | 17.82M | 18.39M |

| Cost of Revenue | 6.67M | 14.56M | 15.39M | 16.15M |

| Gross Profit | 2.49M | 284.00K | 2.42M | 2.24M |

| Gross Profit Ratio | 27.22% | 1.91% | 13.60% | 12.19% |

| Research & Development | 484.00K | 0.00 | 0.00 | 872.91K |

| General & Administrative | 5.26M | 7.63M | 7.92M | 6.21M |

| Selling & Marketing | 1.05M | 1.49M | 3.13M | 2.87M |

| SG&A | 6.32M | 9.12M | 11.06M | 9.08M |

| Other Expenses | 0.00 | 657.00K | 0.00 | 137.14K |

| Operating Expenses | 6.80M | 9.77M | 11.06M | 10.09M |

| Cost & Expenses | 13.47M | 24.33M | 26.45M | 26.24M |

| Interest Income | 0.00 | 0.00 | 1.41M | 1.45M |

| Interest Expense | 0.00 | 0.00 | 1.17M | 1.31M |

| Depreciation & Amortization | 2.09M | 3.75M | 3.77M | 3.79M |

| EBITDA | -2.21M | -5.09M | -4.86M | -3.04M |

| EBITDA Ratio | -24.13% | -34.27% | -27.30% | -16.51% |

| Operating Income | -4.31M | -9.49M | -8.63M | -7.84M |

| Operating Income Ratio | -46.98% | -63.94% | -48.45% | -42.63% |

| Total Other Income/Expenses | 1.14M | 236.00K | 1.44M | 6.11M |

| Income Before Tax | -3.16M | -9.25M | -7.19M | -1.73M |

| Income Before Tax Ratio | -34.50% | -62.35% | -40.38% | -9.42% |

| Income Tax Expense | 14.00K | 0.00 | -505.00K | -557.76K |

| Net Income | -3.18M | -14.07M | 470.00K | -9.60M |

| Net Income Ratio | -34.65% | -94.83% | 2.64% | -52.18% |

| EPS | -1.13 | -77.94 | 0.00 | 0.00 |

| EPS Diluted | -1.13 | 0.00 | 0.00 | |

| Weighted Avg Shares Out | 2.82M | 180.57K | 0.00 | 0.00 |

| Weighted Avg Shares Out (Dil) | 2.82M | 0.00 | 0.00 | 0.00 |

Leicester locals blame lockdown on those who ignored social distancing

Closure of gyms and swimming pools as pubs reopen ‘defies all logic’

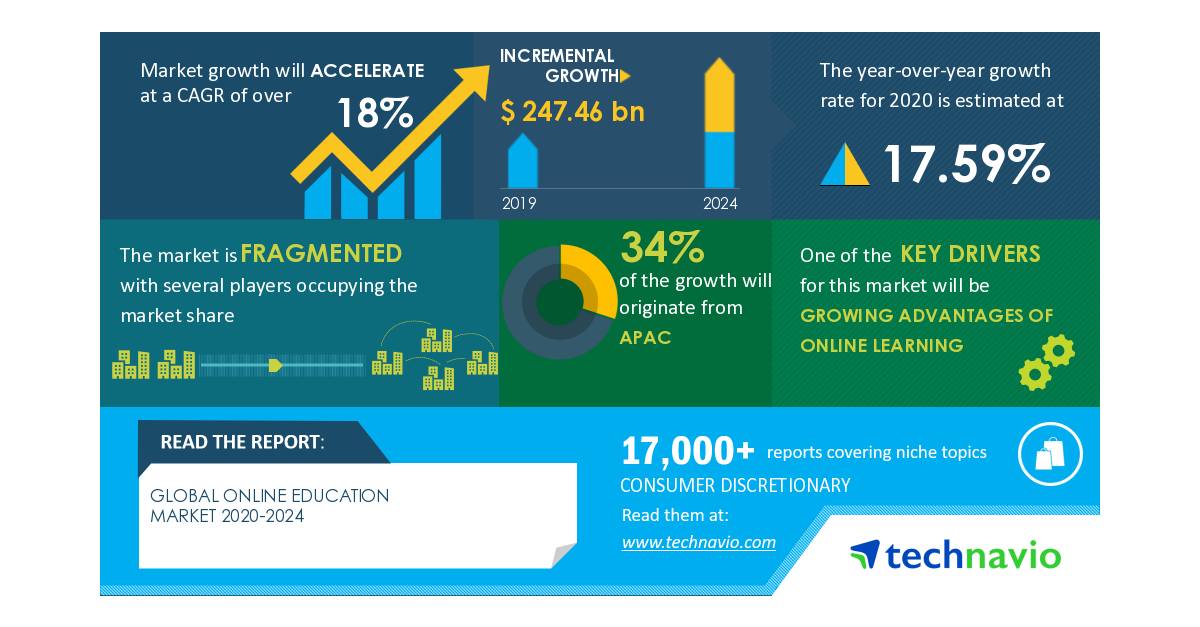

COVID-19 Impact and Recovery Analysis - Online Education Market 2020-2024 | Growing Advantages of Online Learning to Boost Growth | Technavio

COVID-19 Impact and Recovery Analysis- Academic E-Learning Market 2020-2024 | Demand of Online Microlearning to Boost Growth | Technavio

Here's how the pandemic is reshaping career planning for college students

Should you go with a Dell XPS 13 or Surface Laptop 3? Read our comparison.

New Post From Your Neighbor

2020 HW Rising Star: Sarah Pierce - HousingWire

New Post From Your Neighbor

Source: https://incomestatements.info

Category: Stock Reports