See more : PTT Public Company Limited (PUTRY) Income Statement Analysis – Financial Results

Complete financial analysis of Antofagasta plc (ANFGF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Antofagasta plc, a leading company in the Copper industry within the Basic Materials sector.

- Chalet Hotels Limited (CHALET.BO) Income Statement Analysis – Financial Results

- OnKure Therapeutics, Inc. (OKUR) Income Statement Analysis – Financial Results

- Elspec Engineering Ltd (ELSPC.TA) Income Statement Analysis – Financial Results

- SiTime Corporation (SITM) Income Statement Analysis – Financial Results

- Axfood AB (publ) (AXFO.ST) Income Statement Analysis – Financial Results

Antofagasta plc (ANFGF)

About Antofagasta plc

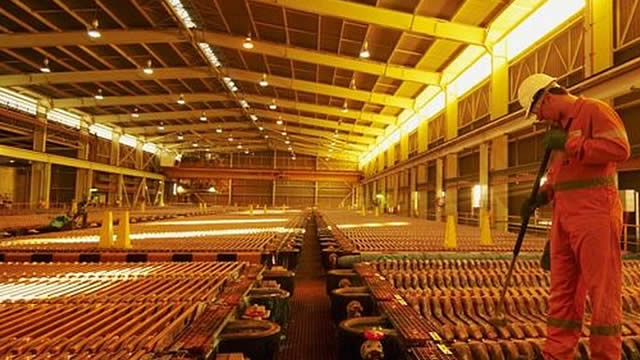

Antofagasta plc operates as a mining company. It operates through Los Pelambres, Centinela, Antucoya, Zaldívar, Exploration and Evaluation, and Transport Division segments. The company holds a 60% interest in the Los Pelambres mine, a 70% interest in the Centinela mine, a 70% interest in the Antucoya mine, and a 50% interest in the Zaldívar mine located in Chile. Its mines produce copper cathodes and copper concentrates, as well as molybdenum, gold, and silver by-products. The company also has exploration projects in various countries. In addition, it provides rail and road cargo services to mining customers in northern Chile. The company was founded in 1888 and is headquartered in London, the United Kingdom. Antofagasta plc is a subsidiary of Metalinvest Establishment.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 6.32B | 5.86B | 7.47B | 5.13B | 4.96B | 4.73B | 4.75B | 3.62B | 3.39B | 5.29B | 5.97B | 6.74B | 6.08B | 4.58B | 2.96B | 3.37B | 3.83B | 3.87B | 2.45B | 1.94B | 978.00M | 863.53M | 777.62M | 505.40M | 89.80M | 111.40M | 152.80M | 180.40M | 178.30M | 90.60M | 86.70M | 72.13M | 57.10M | 56.86M | 49.20M | 40.81M | 33.86M | 13.78M | 15.24M |

| Cost of Revenue | 3.92B | 3.43B | 3.30B | 2.86B | 2.96B | 2.81B | 2.36B | 2.09B | 2.48B | 2.93B | 2.86B | 2.46B | 2.14B | 1.48B | 1.17B | 1.50B | 966.50M | 805.10M | 685.60M | 0.00 | 490.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.41B | 2.43B | 4.17B | 2.27B | 2.00B | 1.93B | 2.39B | 1.53B | 915.70M | 2.36B | 3.11B | 4.28B | 3.94B | 3.10B | 1.80B | 1.88B | 2.86B | 3.06B | 1.76B | 1.94B | 487.80M | 863.53M | 777.62M | 505.40M | 89.80M | 111.40M | 152.80M | 180.40M | 178.30M | 90.60M | 86.70M | 72.13M | 57.10M | 56.86M | 49.20M | 40.81M | 33.86M | 13.78M | 15.24M |

| Gross Profit Ratio | 38.09% | 41.44% | 55.85% | 44.28% | 40.30% | 40.68% | 50.39% | 42.38% | 26.98% | 44.56% | 52.12% | 63.44% | 64.78% | 67.76% | 60.62% | 55.62% | 74.74% | 79.20% | 71.96% | 100.00% | 49.88% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 215.40M | 99.00M | 67.10M | 54.90M | 38.10M | 21.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 618.50M | 558.90M | 550.40M | 484.60M | 445.90M | 417.80M | 414.10M | 479.10M | 455.70M | 485.80M | 563.00M | 606.10M | 487.40M | 421.90M | 240.00M | 85.80M | 183.10M | 152.60M | 132.00M | 0.00 | 88.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 618.50M | 558.90M | 550.40M | 484.60M | 445.90M | 417.80M | 414.10M | 479.10M | 455.70M | 485.80M | 563.00M | 606.10M | 487.40M | 421.90M | 240.00M | 85.80M | 183.10M | 152.60M | 132.00M | 0.00 | 88.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | -100.00K | -100.00K | -100.00K | -100.00K | -100.00K | -100.00K | -100.00K | -200.00K | -200.00K | -200.00K | -200.00K | -48.20M | 5.00M | -9.20M | 2.10M | 1.20M | -2.40M | -78.70M | 0.00 | 31.10M | 33.92M | 3.49M | 2.70M | 0.00 | 600.00K | 0.00 | 600.00K | 10.80M | 16.40M | 1.80M | 0.00 | 8.72M | 17.64M | 14.71M | 15.60M | 0.00 | 6.12M | 5.82M |

| Operating Expenses | 875.30M | 775.90M | 751.00M | 662.30M | 600.30M | 580.40M | 551.90M | 1.07B | 611.30M | 700.70M | 924.00M | 1.42B | 847.80M | 606.60M | 332.60M | 156.20M | 210.50M | 252.60M | 213.60M | 719.60M | 100.30M | 642.42M | 613.16M | 343.70M | 83.60M | 99.50M | 255.60M | 149.70M | 134.20M | 98.90M | 83.80M | 62.12M | 57.10M | 56.86M | 49.20M | 40.81M | 33.86M | 13.78M | 15.24M |

| Cost & Expenses | 4.54B | 4.21B | 4.05B | 3.52B | 3.56B | 3.39B | 2.91B | 3.15B | 3.09B | 3.63B | 3.78B | 3.88B | 2.99B | 2.08B | 1.50B | 1.65B | 1.18B | 1.06B | 899.20M | 719.60M | 590.50M | 642.42M | 613.16M | 343.70M | 83.60M | 99.50M | 255.60M | 149.70M | 134.20M | 98.90M | 83.80M | 62.12M | 57.10M | 56.86M | 49.20M | 40.81M | 33.86M | 13.78M | 15.24M |

| Interest Income | 43.10M | 19.80M | 33.40M | 3.40M | 9.80M | 9.90M | 9.20M | 20.40M | 16.70M | 15.80M | 9.00M | 19.60M | 23.30M | 16.50M | 13.20M | 78.90M | 113.40M | 78.30M | 39.70M | 19.20M | 4.60M | 6.40M | 13.39M | 13.90M | 9.30M | 14.70M | 6.70M | 4.10M | 7.60M | 1.80M | 1.50M | 2.10M | 2.20M | 3.73M | 3.98M | 2.47M | 1.18M | 712.00K | 713.00K |

| Interest Expense | 121.40M | 95.50M | 68.80M | 93.80M | 133.80M | 126.20M | 103.00M | 96.00M | 42.60M | 53.50M | 76.00M | 98.10M | 93.00M | 16.40M | 23.40M | 13.10M | 19.80M | 24.60M | 23.80M | 24.10M | 35.90M | 40.32M | 69.13M | 52.30M | 400.00K | 600.00K | 4.00M | 5.70M | 4.30M | 1.80M | 800.00K | 939.00K | 1.10M | 1.96M | 1.60M | 1.94M | 2.42M | 542.00K | 1.09M |

| Depreciation & Amortization | 1.26B | 1.14B | 1.07B | 1.17B | 946.52M | 740.53M | 652.20M | 538.20M | 576.10M | 606.00M | 517.70M | 494.20M | 431.70M | 277.00M | 217.50M | 180.20M | 162.20M | 145.00M | 128.00M | 134.20M | 136.80M | 128.76M | 118.03M | 69.70M | 13.90M | 11.90M | 17.50M | 17.80M | 18.30M | 9.10M | 6.80M | 6.47M | 3.10M | 3.36M | 2.80M | 1.69M | 557.00K | 536.00K | 527.00K |

| EBITDA | 3.39B | 2.85B | 4.63B | 2.75B | 2.44B | 2.02B | 2.61B | 856.25M | 860.90M | 2.17B | 2.68B | 3.35B | 3.57B | 2.83B | 1.70B | 1.97B | 2.92B | 3.03B | 1.60B | 1.38B | 526.34M | 352.20M | 301.85M | 268.80M | 22.40M | 48.90M | 167.50M | 68.10M | 100.80M | 49.20M | 30.70M | 30.89M | 23.35M | 34.60M | 29.94M | 25.44M | 15.18M | 10.16M | 9.10M |

| EBITDA Ratio | 53.63% | 48.61% | 62.15% | 51.45% | 48.04% | 44.77% | 52.81% | 26.27% | 25.85% | 43.08% | 45.27% | 50.08% | 58.76% | 60.94% | 57.25% | 58.55% | 76.51% | 78.46% | 70.58% | 70.85% | 54.09% | 40.89% | 38.52% | 53.05% | 37.75% | 49.46% | 35.67% | 38.91% | 52.22% | 36.31% | 33.33% | 42.83% | 40.90% | 60.85% | 60.85% | 62.33% | 44.83% | 73.70% | 59.67% |

| Operating Income | 1.78B | 2.63B | 3.46B | 1.52B | 1.40B | 1.37B | 1.90B | 355.70M | 298.60M | 1.64B | 2.16B | 2.85B | 3.07B | 2.59B | 1.46B | 2.55B | 2.65B | 2.80B | 1.51B | 1.20B | 387.30M | 214.00M | 166.79M | 162.40M | -5.30M | 5.70M | 10.20M | 28.60M | 51.80M | 8.00M | 4.70M | 10.01M | 20.25M | 31.24M | 27.14M | 23.75M | 14.62M | 9.62M | 8.57M |

| Operating Income Ratio | 28.19% | 44.82% | 46.33% | 29.57% | 28.20% | 28.89% | 40.02% | 9.82% | 8.80% | 30.92% | 36.13% | 42.21% | 50.58% | 56.68% | 49.25% | 75.70% | 69.38% | 72.46% | 61.64% | 61.96% | 39.60% | 24.78% | 21.45% | 32.13% | -5.90% | 5.12% | 6.68% | 15.85% | 29.05% | 8.83% | 5.42% | 13.88% | 35.47% | 54.93% | 55.16% | 58.19% | 43.19% | 69.81% | 56.22% |

| Total Other Income/Expenses | 182.70M | -68.20M | 16.00M | -103.40M | -51.00M | -114.50M | -70.00M | -629.00M | -37.70M | -59.10M | -161.40M | -90.90M | -21.20M | -21.30M | -21.40M | 1.08B | 95.40M | 54.90M | 29.00M | -4.95M | -32.50M | -37.21M | -52.10M | -15.60M | 13.40M | 30.70M | 135.80M | 16.00M | 26.40M | 30.30M | 18.40M | 13.46M | -1.10M | -1.96M | -1.60M | -1.94M | -2.42M | -542.00K | -1.09M |

| Income Before Tax | 1.97B | 2.56B | 3.48B | 1.41B | 1.35B | 1.25B | 1.83B | 284.60M | 259.40M | 1.57B | 2.08B | 2.75B | 3.08B | 2.57B | 1.44B | 2.61B | 2.75B | 2.86B | 1.54B | 1.20B | 357.20M | 176.89M | 114.69M | 146.80M | 8.10M | 36.40M | 146.00M | 44.60M | 78.20M | 38.30M | 23.10M | 23.48M | 19.16M | 29.28M | 25.54M | 21.81M | 12.20M | 9.08M | 7.48M |

| Income Before Tax Ratio | 31.08% | 43.65% | 46.55% | 27.55% | 27.18% | 26.47% | 38.55% | 7.86% | 7.64% | 29.74% | 34.89% | 40.86% | 50.63% | 56.22% | 48.52% | 77.37% | 71.87% | 73.88% | 62.83% | 61.71% | 36.52% | 20.48% | 14.75% | 29.05% | 9.02% | 32.68% | 95.55% | 24.72% | 43.86% | 42.27% | 26.64% | 32.55% | 33.55% | 51.49% | 51.91% | 53.44% | 36.04% | 65.88% | 49.07% |

| Income Tax Expense | 666.10M | 603.60M | 1.24B | 526.50M | 506.10M | 423.70M | 633.60M | 108.60M | 160.40M | 722.80M | 843.70M | 1.02B | 946.20M | 752.50M | 317.70M | 519.70M | 638.40M | 664.90M | 308.10M | 241.90M | 64.40M | 29.92M | 21.39M | 19.10M | 1.20M | 2.70M | 3.20M | 7.70M | 11.20M | 2.90M | 2.00M | 2.94M | 2.28M | 1.41M | 41.00K | 1.76M | 384.00K | 829.00K | 466.00K |

| Net Income | 835.10M | 1.53B | 1.29B | 506.40M | 501.40M | 543.70M | 750.60M | 158.00M | 608.20M | 459.80M | 659.60M | 1.04B | 1.24B | 1.05B | 667.70M | 1.71B | 1.38B | 1.35B | 725.80M | 584.91M | 179.49M | 96.80M | 62.58M | 90.70M | 9.70M | 33.80M | 140.90M | 31.20M | 56.90M | 33.60M | 22.30M | 18.06M | 15.14M | 22.86M | 21.72M | 28.96M | 10.33M | 8.25M | 7.01M |

| Net Income Ratio | 13.20% | 26.15% | 17.27% | 9.87% | 10.10% | 11.49% | 15.80% | 4.36% | 17.92% | 8.69% | 11.05% | 15.39% | 20.35% | 22.98% | 22.54% | 50.60% | 36.12% | 34.99% | 29.68% | 30.12% | 18.35% | 11.21% | 8.05% | 17.95% | 10.80% | 30.34% | 92.21% | 17.29% | 31.91% | 37.09% | 25.72% | 25.04% | 26.52% | 40.19% | 44.16% | 70.95% | 30.52% | 59.86% | 46.01% |

| EPS | 0.85 | 1.53 | 1.29 | 0.54 | 0.53 | 0.55 | 0.76 | 0.16 | 0.62 | 0.47 | 0.67 | 1.05 | 1.25 | 1.07 | 0.68 | 1.73 | 1.40 | 1.37 | 0.15 | 58.78 | 18.30 | 0.10 | 0.06 | 0.09 | 0.01 | 0.04 | 0.17 | 0.04 | 0.07 | 0.04 | 0.03 | 0.02 | 0.02 | 0.03 | 0.03 | 0.04 | 0.01 | 0.01 | 0.00 |

| EPS Diluted | 0.85 | 1.53 | 1.29 | 0.54 | 0.53 | 0.55 | 0.76 | 0.16 | 0.62 | 0.47 | 0.67 | 1.05 | 1.25 | 1.07 | 0.68 | 1.73 | 1.40 | 1.37 | 0.15 | 58.78 | 18.30 | 0.10 | 0.06 | 0.09 | 0.01 | 0.04 | 0.17 | 0.04 | 0.07 | 0.04 | 0.03 | 0.02 | 0.02 | 0.03 | 0.03 | 0.04 | 0.01 | 0.01 | 0.00 |

| Weighted Avg Shares Out | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 966.39M | 950.86M | 827.42M | 810.99M | 810.99M | 797.40M | 760.19M | 754.42M | 754.42M | 754.42M | 754.40M | 754.37M | 754.37M | 700.50M | 2.59B |

| Weighted Avg Shares Out (Dil) | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 985.86M | 966.39M | 950.86M | 827.42M | 810.99M | 810.99M | 797.40M | 760.19M | 754.42M | 754.42M | 754.42M | 754.40M | 754.37M | 754.37M | 700.50M | 2.59B |

Halcones Precious Metals Announces Option Agreement to Acquire 100% Interest in the Polaris Gold Project in Antofagasta Region, Chile

Antofagasta points to 'lower end' copper production this year

Antofagasta still London's best way to play copper story - broker

Antofagasta plc (ANFGF) Q2 2024 Earnings Call Transcript

Antofagasta slashes dividend after copper price reteats

Antofagasta's H1 Profit Tops Forecasts Thanks To Strong Copper Prices

Antofagasta not helped by recession talk as interims approach

Copper giant Antofagasta falls as production guidance trimmed

Goldman sees little near-term impact of LME decision; mining stocks hot to trot

Kenorland Minerals Announces Termination of Tanacross Project Earn-in Agreement with Antofagasta PLC and Highlights Exploration Upside at South Taurus

Source: https://incomestatements.info

Category: Stock Reports