Complete financial analysis of Anixa Biosciences, Inc. (ANIX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Anixa Biosciences, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Silver Predator Corp. (SVROF) Income Statement Analysis – Financial Results

- China Life Insurance Company Limited (2628.HK) Income Statement Analysis – Financial Results

- Unison Co., Ltd. (018000.KQ) Income Statement Analysis – Financial Results

- Synaptics Incorporated (SYNA) Income Statement Analysis – Financial Results

- Playgon Games Inc. (PLGNF) Income Statement Analysis – Financial Results

Anixa Biosciences, Inc. (ANIX)

About Anixa Biosciences, Inc.

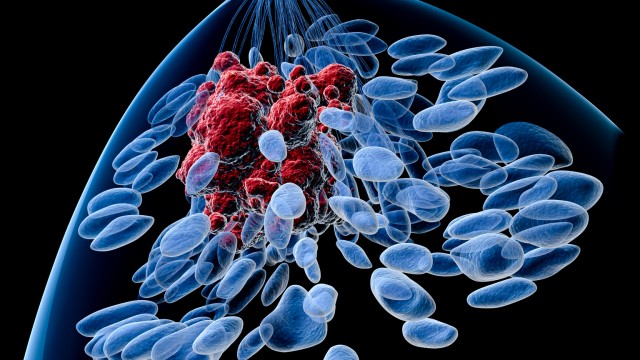

Anixa Biosciences, Inc., a biotechnology company, develops therapies and vaccines focusing on critical unmet needs in oncology and infectious diseases. The company's therapeutics programs include the development of a chimeric endocrine receptor T-cell technology, a novel form of chimeric antigen receptor T-cell (CAR-T) technology focusing on the treatment of ovarian cancer; and the discovery and development of anti-viral drug candidates for the treatment of COVID-19 focused on inhibiting certain protein functions of the virus. Its vaccine programs comprise the development of a vaccine against triple negative breast cancer; and a preventative vaccine against ovarian cancer. The company is also developing immuno-therapy drugs against cancer. It has a collaboration agreement with MolGenie GmbH to discover and develop anti-viral drug candidates against COVID-19. The company was formerly known as ITUS Corporation and changed its name to Anixa Biosciences, Inc. in October 2018. Anixa Biosciences, Inc. was incorporated in 1982 and is based in San Jose, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 210.00K | 2.47B | 512.50K | 0.00 | 250.00K | 1.11M | 362.50K | 300.00K | 9.26M | 3.67M | 388.85K | 940.01K | 1.00M | 730.68K | 1.06M | 2.06M | 486.85K | 508.65K | 439.79K | 494.46K | 244.22K | 5.19M | 1.69M | 1.47M | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 300.00K |

| Cost of Revenue | 161.00K | 42.00K | 385.00K | 90.16K | 166.25K | 768.41K | 104.56K | 217.42K | 3.65M | 1.99M | 316.66K | 3.87K | 34.08K | 82.31K | 65.69K | 95.59K | 160.36K | 156.45K | 719.63K | 176.11K | 175.94K | 1.87M | 697.64K | 463.63K | -300.00K | -300.00K | -300.00K | -100.00K | -100.00K | -100.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 49.00K | 2.47B | 127.50K | -90.16K | 83.75K | 344.09K | 257.94K | 82.58K | 5.61M | 1.68M | 72.19K | 936.14K | 969.11K | 648.37K | 990.11K | 1.97M | 326.49K | 352.21K | -279.84K | 318.35K | 68.28K | 3.32M | 993.13K | 1.01M | 400.00K | 400.00K | 400.00K | 200.00K | 200.00K | 200.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 300.00K |

| Gross Profit Ratio | 23.33% | 100.00% | 24.88% | 0.00% | 33.50% | 30.93% | 71.16% | 27.53% | 60.58% | 45.79% | 18.57% | 99.59% | 96.60% | 88.74% | 93.78% | 95.37% | 67.06% | 69.24% | -63.63% | 64.38% | 27.96% | 63.93% | 58.74% | 68.50% | 400.00% | 400.00% | 400.00% | 200.00% | 200.00% | 200.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 4.77M | 6.70M | 6.19M | 4.38M | 5.47M | 6.81M | 1.60M | 1.56M | 711.39K | 1.19M | 0.00 | 2.21M | 3.12M | 3.01M | 4.12M | 4.13M | 3.40M | 4.61M | 2.27M | 2.16M | 1.81M | 1.63M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.90M | 2.40M | 2.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.29M | 7.17M | 7.07M | 5.60M | 5.66M | 6.91M | 4.41M | 2.71M | 5.51M | 6.41M | 7.99M | 2.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.29M | 7.17M | 7.07M | 5.60M | 5.66M | 6.91M | 4.41M | 2.71M | 5.51M | 6.41M | 7.99M | 2.86M | 2.87M | 2.89M | 4.19M | 3.83M | 2.41M | 3.37M | 1.92M | 1.52M | 1.38M | 2.18M | 4.60M | 5.83M | 8.30M | 7.20M | 6.40M | 2.20M | 1.00M | 1.00M | 2.90M | 2.00M | 1.50M | 1.40M | 1.20M | 1.30M | 1.30M | 1.90M | 2.00M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 418.75K | 0.00 | -13.10K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 47.49K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 11.06M | 13.88M | 13.26M | 9.98M | 11.56M | 14.05M | 6.33M | 4.59M | 6.55M | 6.72M | 7.99M | 5.07M | 6.00M | 5.90M | 8.31M | 7.96M | 5.53M | 7.98M | 4.19M | 3.68M | 3.19M | 6.62M | 4.60M | 6.09M | 8.60M | 7.50M | 6.70M | 6.20M | 3.50M | 3.80M | 2.90M | 2.00M | 1.50M | 1.50M | 1.30M | 1.40M | 1.40M | 1.90M | 2.00M |

| Cost & Expenses | 11.22M | 13.88M | 13.65M | 9.98M | 11.72M | 14.82M | 6.44M | 4.81M | 10.20M | 8.71M | 8.31M | 5.07M | 6.03M | 5.98M | 8.38M | 8.05M | 5.69M | 8.14M | 4.91M | 3.86M | 3.36M | 8.50M | 5.30M | 6.56M | 8.30M | 7.20M | 6.40M | 6.10M | 3.40M | 3.70M | 2.90M | 2.00M | 1.50M | 1.50M | 1.30M | 1.40M | 1.40M | 1.90M | 2.00M |

| Interest Income | 1.08M | 104.00K | 2.32K | 33.92K | 71.35K | 45.97K | 19.44K | 12.53K | 17.62K | 8.60K | 125.00 | 3.46K | 2.52K | 4.88K | 20.81K | 37.03K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 104.00K | 322.00 | 0.00 | 0.00 | 0.00 | 500.46K | 519.95K | 451.91K | 1.26M | 1.11M | 7.66K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 46.00K | 42.00K | 59.86K | 90.16K | 466.31K | 343.73K | 368.51K | 358.63K | 337.81K | 314.45K | 125.00 | 7.23K | 7.98K | 8.36K | 10.61K | 10.67K | 9.89K | 15.07K | 14.71K | 17.00K | 33.08K | 86.47K | 166.50K | 261.80K | 300.00K | 300.00K | 300.00K | 100.00K | 100.00K | 100.00K | -200.00K | -200.00K | -200.00K | 100.00K | 100.00K | 100.00K | 100.00K | 0.00 | 0.00 |

| EBITDA | -10.97M | -13.73M | -13.08M | -10.00M | -11.00M | -13.36M | -4.14M | -4.14M | -601.85K | -8.03M | -8.97M | -4.24M | -6.77M | -5.25M | -7.32M | -5.98M | -5.45M | -7.61M | -4.45M | -3.35M | -3.09M | -3.22M | -3.44M | -4.82M | -7.90M | -6.80M | -6.00M | -5.90M | -3.20M | -3.50M | -3.00M | -2.10M | -1.60M | -1.30M | -1.10M | -1.20M | -1.20M | -1.80M | -1.70M |

| EBITDA Ratio | -5,221.43% | -0.56% | -2,552.44% | 0.00% | -4,234.48% | -1,148.71% | -1,569.00% | -1,379.28% | -6.37% | -128.73% | -2,036.14% | -439.47% | -500.18% | -726.46% | 178.05% | -296.14% | -1,065.76% | -1,496.61% | -1,012.10% | -677.10% | -1,263.61% | -7.74% | -203.32% | -327.67% | -7,600.00% | -6,900.00% | -6,600.00% | -6,500.00% | -3,600.00% | -3,700.00% | -3,000.00% | -2,100.00% | -1,600.00% | -1,600.00% | -1,300.00% | -1,300.00% | -1,200.00% | -1,800.00% | -566.67% |

| Operating Income | -11.01M | -13.88M | -13.14M | -9.98M | -11.47M | -14.29M | -6.08M | -4.51M | -944.76K | -5.04M | -7.92M | -4.13M | -5.03M | -5.25M | -7.32M | -5.99M | -5.49M | -7.63M | -4.47M | -3.36M | -3.12M | -3.31M | -3.60M | -5.09M | -8.20M | -7.10M | -6.30M | -6.00M | -3.30M | -3.60M | -2.80M | -1.90M | -1.40M | -1.40M | -1.20M | -1.30M | -1.30M | -1.80M | -1.70M |

| Operating Income Ratio | -5,243.33% | -0.56% | -2,563.06% | 0.00% | -4,588.50% | -1,284.41% | -1,676.02% | -1,503.00% | -10.21% | -137.54% | -2,036.17% | -439.84% | -501.23% | -718.27% | -693.35% | -290.31% | -1,128.14% | -1,499.58% | -1,015.44% | -680.54% | -1,277.15% | -63.79% | -213.17% | -345.46% | -8,200.00% | -7,100.00% | -6,300.00% | -6,000.00% | -3,300.00% | -3,600.00% | -2,800.00% | -1,900.00% | -1,400.00% | -1,400.00% | -1,200.00% | -1,300.00% | -1,300.00% | -1,800.00% | -566.67% |

| Total Other Income/Expenses | 1.08M | 104.00K | 7.69K | -114.16K | 71.35K | 45.97K | 1.07M | -507.42K | -434.28K | -4.56M | -2.16M | -118.24K | -1.75M | 73.09K | -9.17M | 167.91K | 34.15K | 26.72K | 14.51K | 4.33K | 0.00 | -2.82M | 0.00 | 0.00 | -300.00K | 100.00K | 600.00K | 600.00K | 400.00K | 200.00K | 200.00K | 200.00K | 200.00K | 300.00K | 200.00K | 100.00K | 0.00 | 1.80M | 1.70M |

| Income Before Tax | -9.93M | -13.77M | -13.13M | -10.09M | -11.82M | -14.24M | -5.01M | -5.02M | -1.38M | -9.61M | -10.08M | -4.25M | -6.78M | -5.18M | -16.49M | -5.82M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -6.13M | 0.00 | 0.00 | -8.50M | -7.00M | -5.70M | -5.40M | -2.90M | -3.40M | -2.60M | -1.70M | -1.20M | -1.10M | -1.00M | -1.20M | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -4,728.57% | -0.56% | -2,561.55% | 0.00% | -4,727.46% | -1,280.28% | -1,381.79% | -1,672.14% | -14.90% | -261.94% | -2,592.28% | -452.42% | -675.65% | -708.27% | -1,561.76% | -282.17% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -118.18% | 0.00% | 0.00% | -8,500.00% | -7,000.00% | -5,700.00% | -5,400.00% | -2,900.00% | -3,400.00% | -2,600.00% | -1,700.00% | -1,200.00% | -1,100.00% | -1,000.00% | -1,200.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -280.00K | -181.29K | 40.15K | 175.80K | 289.95K | 500.46K | 12.53K | 17.62K | 1.26M | 1.11M | 430.00 | 600.00K | -73.09K | 9.17M | -167.91K | 259.65K | -26.72K | -14.51K | -4.33K | -4.67K | -23.51K | -32.28K | -120.98K | 300.00K | 0.00 | -500.00K | -600.00K | -300.00K | -200.00K | 200.00K | 100.00K | 100.00K | -300.00K | -100.00K | 0.00 | 100.00K | 1.80M | 1.70M |

| Net Income | -9.81M | -13.49M | -12.95M | -10.13M | -11.99M | -14.00M | -5.01M | -5.02M | -1.38M | -9.61M | -10.08M | -4.25M | -7.38M | -5.18M | -16.49M | -5.82M | -5.46M | -7.60M | -4.45M | -3.36M | -3.11M | -3.29M | -3.57M | -4.96M | -8.50M | -7.10M | -5.80M | -5.40M | -3.00M | -3.40M | -2.80M | -1.80M | -1.30M | -1.10M | -1.10M | -1.30M | -1.40M | -1.80M | -1.70M |

| Net Income Ratio | -4,671.90% | -0.55% | -2,526.17% | 0.00% | -4,797.78% | -1,258.07% | -1,381.79% | -1,672.14% | -14.90% | -261.94% | -2,592.28% | -452.42% | -735.46% | -708.27% | -1,561.76% | -282.17% | -1,121.12% | -1,494.33% | -1,012.14% | -679.66% | -1,275.24% | -63.34% | -211.26% | -337.24% | -8,500.00% | -7,100.00% | -5,800.00% | -5,400.00% | -3,000.00% | -3,400.00% | -2,800.00% | -1,800.00% | -1,300.00% | -1,100.00% | -1,100.00% | -1,300.00% | -1,400.00% | -1,800.00% | -566.67% |

| EPS | -0.32 | -0.44 | -0.45 | -0.46 | -0.61 | -0.79 | -0.41 | -0.57 | -0.14 | -1.00 | -1.17 | -0.53 | -1.01 | -0.79 | -2.70 | -1.02 | -1.20 | -1.81 | -1.14 | -0.92 | -0.94 | -1.10 | -1.26 | -1.81 | -3.29 | -2.79 | -2.29 | -2.24 | -1.35 | -1.59 | -1.37 | -0.91 | -0.68 | -0.68 | -0.68 | -0.68 | -0.91 | -1.14 | -1.14 |

| EPS Diluted | -0.32 | -0.44 | -0.45 | -0.46 | -0.61 | -0.79 | -0.41 | -0.57 | -0.14 | -1.00 | -1.17 | -0.53 | -1.01 | -0.79 | -2.70 | -1.02 | -1.20 | -1.81 | -1.14 | -0.92 | -0.94 | -1.10 | -1.26 | -1.81 | -3.16 | -2.69 | -2.29 | -2.17 | -1.30 | -1.59 | -1.37 | -0.91 | -0.68 | -0.68 | -0.68 | -0.68 | -0.91 | -1.14 | -1.14 |

| Weighted Avg Shares Out | 30.98M | 30.37M | 28.58M | 22.23M | 19.79M | 17.62M | 12.20M | 8.74M | 9.63M | 9.57M | 8.64M | 7.98M | 7.33M | 6.53M | 6.10M | 5.69M | 4.55M | 4.19M | 3.89M | 3.65M | 3.30M | 2.99M | 2.84M | 2.74M | 2.58M | 2.54M | 2.53M | 2.41M | 2.22M | 2.13M | 2.05M | 1.98M | 1.90M | 1.61M | 1.61M | 1.90M | 1.54M | 1.58M | 1.49M |

| Weighted Avg Shares Out (Dil) | 30.98M | 30.37M | 28.58M | 22.23M | 19.79M | 17.62M | 12.20M | 8.74M | 9.63M | 9.57M | 8.64M | 7.98M | 7.33M | 6.53M | 6.10M | 5.69M | 4.55M | 4.19M | 3.89M | 3.65M | 3.30M | 2.99M | 2.84M | 2.74M | 2.69M | 2.64M | 2.53M | 2.49M | 2.31M | 2.13M | 2.05M | 1.98M | 1.90M | 1.61M | 1.61M | 1.90M | 1.54M | 1.58M | 1.49M |

Anixa Biosciences Completes Treatment of First Patient Cohort in Ovarian Cancer CAR-T Clinical Trial

Anixa Biosciences Announces Issuance of Additional U.S. Patent for Ovarian Cancer Vaccine Technology

ANIXA BIOSCIENCES INC (ANIX) Upgraded to Buy: What Does It Mean for the Stock?

Anixa Biosciences Establishes Cancer Business Advisory Board

The 3 Most Undervalued Cheap Stocks to Buy in September 2023

Anixa Biosciences to Participate in September Investor Conferences

Anixa Biosciences Announces Treatment of Third Patient in Ovarian Cancer CAR-T Clinical Trial

Anixa Biosciences: Early Stage, Low Cash. Does It Matter?

Anixa Biosciences Announces Invited Presentation on Ovarian Cancer CAR-T Therapy at the 8th Annual CAR-TCR Summit

Could Anixa Biosciences (NASDAQ:ANIX) Be Developing The Vaccine To End One Of The Deadliest Types Of Breast Cancer?

Source: https://incomestatements.info

Category: Stock Reports