See more : Trident Limited (TRIDENT.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Evoqua Water Technologies Corp. (AQUA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Evoqua Water Technologies Corp., a leading company in the Industrial – Pollution & Treatment Controls industry within the Industrials sector.

- Teligent, Inc. (TLGT) Income Statement Analysis – Financial Results

- Close Brothers Group plc (CBGPY) Income Statement Analysis – Financial Results

- Mitani Sangyo Co., Ltd. (8285.T) Income Statement Analysis – Financial Results

- AST Groupe (ALAST.PA) Income Statement Analysis – Financial Results

- CETC Acoustic-Optic-Electronic Technology Inc. (600877.SS) Income Statement Analysis – Financial Results

Evoqua Water Technologies Corp. (AQUA)

Industry: Industrial - Pollution & Treatment Controls

Sector: Industrials

Website: https://www.evoqua.com

About Evoqua Water Technologies Corp.

Evoqua Water Technologies Corp. provides water and wastewater treatment systems and technologies, and mobile and emergency water supply solutions and contract services for industrial, commercial, and municipal water treatment markets in the United States and internationally. It operates in two segments, Integrated Solutions and Services, and Applied Product Technologies. The Integrated Solutions and Services segment offers capital systems and related recurring aftermarket services, parts, and consumables, as well as long-term and short-term service contracts, and emergency services for treating process water, utility water, and wastewater. This segment also provides odor and corrosion control services and drinking water treatment systems for municipalities. It serves manufacturing, healthcare, pharmaceuticals, biotech, power, microelectronics, chemical processing, food and beverage, and refining industries. The Applied Product Technologies segment offers advanced filtration and separation products, such as VAF self-cleaning filters, Ionpure electrodeionization systems, and Vortisand filtration systems, as well as filter presses and related consumables, and aftermarket products for customers in the microelectronics, pharmaceutical, and power end markets. It also offers disinfection solutions, including chemical and non-chemical disinfection technologies comprising low and medium pressure ultraviolet, ozone, onsite hypochlorite generation, and chlorine and chlorine dioxide systems for municipal drinking water, industrial, light manufacturing, commercial, and aquatics markets. In addition, this segment offers wastewater technologies, including biological treatment, clarification, filtration, nutrient removal, biosolid, and field-erected biological wastewater treatment plant solutions. Further, it offers aquatics and electrochlorination solutions. The company was incorporated in 2013 and is headquartered in Pittsburgh, Pennsylvania.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 1.74B | 1.46B | 1.43B | 1.44B | 1.34B | 1.25B | 1.14B | 1.06B |

| Cost of Revenue | 1.20B | 1.01B | 979.65M | 1.02B | 934.81M | 847.67M | 804.13M | 768.55M |

| Gross Profit | 535.98M | 457.35M | 449.80M | 425.96M | 404.73M | 399.75M | 333.07M | 292.42M |

| Gross Profit Ratio | 30.86% | 31.23% | 31.47% | 29.49% | 30.21% | 32.05% | 29.29% | 27.56% |

| Research & Development | 15.44M | 13.45M | 13.20M | 15.30M | 15.88M | 19.99M | 22.90M | 25.91M |

| General & Administrative | 260.55M | 206.46M | 192.60M | 217.01M | 193.82M | 169.62M | 144.77M | 147.66M |

| Selling & Marketing | 161.30M | 143.11M | 136.17M | 138.94M | 136.01M | 142.44M | 135.21M | 124.43M |

| SG&A | 421.85M | 349.57M | 328.76M | 355.95M | 329.83M | 312.06M | 279.98M | 272.09M |

| Other Expenses | -5.31M | -4.98M | -60.61M | -4.96M | -7.82M | -1.50M | -6.97M | -74.00K |

| Operating Expenses | 431.99M | 358.04M | 281.36M | 366.29M | 337.89M | 330.55M | 295.91M | 297.93M |

| Cost & Expenses | 1.63B | 1.37B | 1.26B | 1.38B | 1.27B | 1.18B | 1.10B | 1.07B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 34.68M | 37.58M | 46.68M | 58.56M | 57.58M | 55.38M | 42.52M | 34.06M |

| Depreciation & Amortization | 127.57M | 113.66M | 107.27M | 98.24M | 85.86M | 77.89M | 69.29M | 58.14M |

| EBITDA | 231.56M | 212.98M | 275.72M | 157.91M | 150.96M | 142.84M | 105.05M | 54.05M |

| EBITDA Ratio | 13.33% | 14.54% | 19.29% | 10.93% | 11.27% | 11.45% | 9.24% | 5.09% |

| Operating Income | 103.99M | 99.32M | 168.45M | 59.67M | 66.85M | 69.20M | 37.16M | -5.51M |

| Operating Income Ratio | 5.99% | 6.78% | 11.78% | 4.13% | 4.99% | 5.55% | 3.27% | -0.52% |

| Total Other Income/Expenses | -103.92M | -99.26M | -168.33M | -58.56M | -57.58M | -55.38M | -42.52M | -32.64M |

| Income Before Tax | 69.31M | 61.74M | 121.77M | 1.12M | 9.27M | 13.83M | -5.36M | -38.15M |

| Income Before Tax Ratio | 3.99% | 4.22% | 8.52% | 0.08% | 0.69% | 1.11% | -0.47% | -3.60% |

| Income Tax Expense | -3.03M | 10.08M | 7.37M | 9.59M | 1.38M | 7.42M | -18.39M | 47.91M |

| Net Income | 72.20M | 51.48M | 113.65M | -8.47M | 6.14M | 2.16M | 11.64M | -86.05M |

| Net Income Ratio | 4.16% | 3.52% | 7.95% | -0.59% | 0.46% | 0.17% | 1.02% | -8.11% |

| EPS | 0.60 | 0.43 | 0.97 | -0.07 | 0.05 | 0.02 | 0.10 | -0.82 |

| EPS Diluted | 0.58 | 0.42 | 0.94 | -0.07 | 0.05 | 0.02 | 0.10 | -0.82 |

| Weighted Avg Shares Out | 121.14M | 119.58M | 116.72M | 119.04M | 120.17M | 113.28M | 112.59M | 104.82M |

| Weighted Avg Shares Out (Dil) | 124.88M | 122.94M | 121.06M | 119.04M | 120.17M | 113.28M | 114.49M | 104.82M |

SHAREHOLDER ALERT: Rigrodsky Law, P.A. Is Investigating Evoqua Water Technologies Corp. Buyout

SHAREHOLDER ALERT: The M&A Class Action Firm Announces the Investigation of Evoqua Water Technologies Corp. - AQUA

EVOQUA WATER INVESTOR ALERT by the Former Attorney General of Louisiana: Kahn Swick & Foti, LLC Investigates Adequacy of Price and Process in Proposed Sale of Evoqua Water Technologies Corp. - AQUA

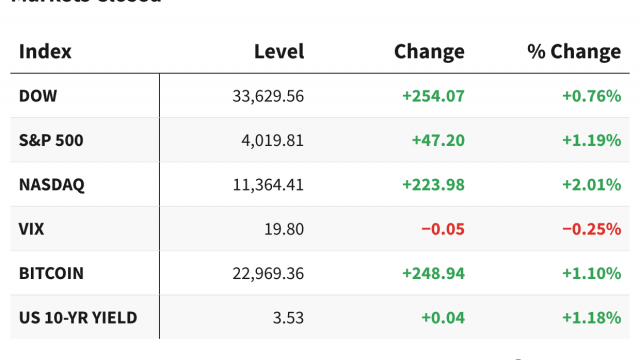

US Markets Rise on Fed Expectations and Earnings

SHAREHOLDER ALERT: Weiss Law Investigates Evoqua Water Technologies Corp.

Why Are Evoqua Water Shares Trading Higher Today?

California Drought Puts A Spotlight On This $7.5 Billion Acquisition

Why Evoqua Water Stock Is Up and Xylem Is Down Today

Shareholder Alert: Ademi LLP investigates whether Evoqua Water Technologies Corp has obtained a Fair Price in its transaction with Xylem

Water Stock Soars On Acquisition News, As The West's Wells Run Dry

Source: https://incomestatements.info

Category: Stock Reports