See more : Capcom Co., Ltd. (CCOEF) Income Statement Analysis – Financial Results

Complete financial analysis of Ardagh Group S.A. (ARD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ardagh Group S.A., a leading company in the Packaging & Containers industry within the Consumer Cyclical sector.

- S & U PLC 6% CUM PRF #1 (46IE.L) Income Statement Analysis – Financial Results

- QVC, Inc. 6.250% Senior Secured (QVCC) Income Statement Analysis – Financial Results

- The Howard Hughes Corporation (HHC) Income Statement Analysis – Financial Results

- Intercos S.p.A. (ICOS.MI) Income Statement Analysis – Financial Results

- AB Electrolux (publ) (0MDT.IL) Income Statement Analysis – Financial Results

Ardagh Group S.A. (ARD)

About Ardagh Group S.A.

Ardagh Group S.A., together with its subsidiaries, manufactures and supplies rigid packaging solutions primarily for the food and beverage markets worldwide. The company operates through four segments: Metal Beverage Packaging Europe, Metal Beverage Packaging Americas, Glass Packaging Europe, and Glass Packaging North America. Its products include metal beverage cans and glass containers. The company is also involved in glass engineering, business, which include design and supply of glass packaging machinery and spare parts; and the provision of technical assistance to third party users. The company was formerly known as Ardagh Finance Holdings S.A. and changed its name to Ardagh Group S.A. in February 2017. The company was founded in 1932 and is based in Luxembourg City, Luxembourg. Ardagh Group S.A. is a subsidiary of ARD Finance S.A.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Revenue | 6.73B | 6.66B | 9.10B | 9.17B | 6.67B | 5.68B | 5.76B |

| Cost of Revenue | 5.70B | 5.60B | 7.78B | 7.69B | 5.49B | 4.73B | 4.98B |

| Gross Profit | 1.03B | 1.06B | 1.32B | 1.49B | 1.18B | 958.83M | 779.46M |

| Gross Profit Ratio | 15.35% | 15.96% | 14.50% | 16.20% | 17.73% | 16.87% | 13.54% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 362.00M | 433.00M | 482.28M | 437.51M | 347.67M | 341.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 362.00M | 433.00M | 482.28M | 437.51M | 347.67M | 341.70M |

| Other Expenses | 624.00M | 233.00M | 451.00M | 281.93M | 181.94M | 119.17M | 147.14M |

| Operating Expenses | 624.00M | 595.00M | 884.00M | 764.21M | 619.45M | 466.84M | 488.84M |

| Cost & Expenses | 6.32B | 6.19B | 8.66B | 8.45B | 6.11B | 5.19B | 5.46B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 82.03M | 0.00 | 1.22M |

| Interest Expense | 316.00M | 425.00M | 466.00M | 500.28M | 497.45M | 475.59M | 501.00M |

| Depreciation & Amortization | 688.00M | 652.00M | 714.00M | 733.02M | 516.39M | 440.60M | 441.41M |

| EBITDA | 1.05B | 2.58B | 1.13B | 1.26B | 1.01B | 832.00M | 307.65M |

| EBITDA Ratio | 15.58% | 38.72% | 12.42% | 13.70% | 15.18% | 14.64% | 5.35% |

| Operating Income | 409.00M | 468.00M | 435.00M | 721.02M | 563.71M | 491.99M | 290.63M |

| Operating Income Ratio | 6.08% | 7.03% | 4.78% | 7.86% | 8.45% | 8.66% | 5.05% |

| Total Other Income/Expenses | -386.00M | -708.00M | -485.00M | -698.23M | -564.76M | -576.17M | -925.39M |

| Income Before Tax | 23.00M | -240.00M | -50.00M | 22.79M | -1.05M | -84.18M | -634.76M |

| Income Before Tax Ratio | 0.34% | -3.60% | -0.55% | 0.25% | -0.02% | -1.48% | -11.03% |

| Income Tax Expense | 10.00M | 44.00M | 44.00M | -41.99M | 56.79M | 68.88M | -17.02M |

| Net Income | 35.00M | 1.46B | -94.00M | 64.78M | -57.84M | -153.06M | -617.73M |

| Net Income Ratio | 0.52% | 21.89% | -1.03% | 0.71% | -0.87% | -2.69% | -10.73% |

| EPS | 0.15 | 6.17 | -0.40 | 0.28 | -0.27 | -0.70 | -2.84 |

| EPS Diluted | 0.15 | 6.17 | -0.40 | 0.28 | -0.27 | -0.70 | -2.84 |

| Weighted Avg Shares Out | 236.40M | 236.40M | 236.30M | 229.60M | 217.70M | 217.70M | 217.70M |

| Weighted Avg Shares Out (Dil) | 236.40M | 236.40M | 236.30M | 229.60M | 217.70M | 217.70M | 217.70M |

Ardagh Group (NYSE:ARD) Cut to "Hold" at Zacks Investment Research

Ardagh Group (ARD) Scheduled to Post Quarterly Earnings on Thursday

Ardagh Group SA (NYSE:ARD) Given Consensus Rating of "Hold" by Brokerages

Ardagh Group (NYSE:ARD) Upgraded at Zacks Investment Research

Franklin Resources Inc. Sells 274,287 Shares of Ardagh Group SA (NYSE:ARD)

Janus Henderson Group PLC Buys 170,790 Shares of Ardagh Group SA (NYSE:ARD)

Ardagh Group SA (NYSE:ARD) Shares Sold by Credit Suisse AG

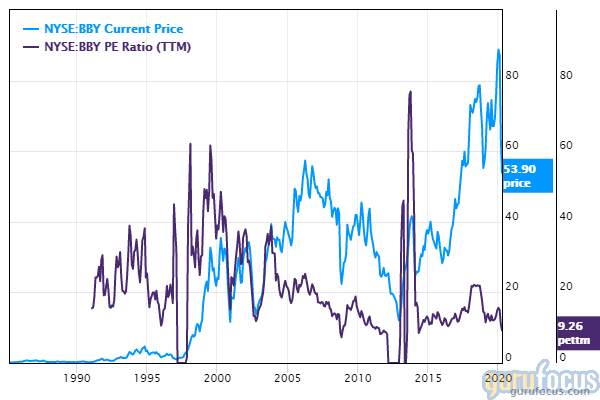

6 Retailers Trading With Low Price-Earnings Ratios

Citigroup Inc. Has $92,000 Stake in Ardagh Group SA (NYSE:ARD)

Ardagh Group (NYSE:ARD) Rating Lowered to Hold at Zacks Investment Research

Source: https://incomestatements.info

Category: Stock Reports