See more : Dexter Studios Co.,Ltd. (206560.KQ) Income Statement Analysis – Financial Results

Complete financial analysis of Arway Corporation (ARWYF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Arway Corporation, a leading company in the Software – Application industry within the Technology sector.

- Niu Technologies (NIU) Income Statement Analysis – Financial Results

- Trustco Group Holdings Limited (TSCHY) Income Statement Analysis – Financial Results

- Hanryu Holdings, Inc. (HRYU) Income Statement Analysis – Financial Results

- Colbún S.A. (COLBUN.SN) Income Statement Analysis – Financial Results

- Synel M.L.L Payway Ltd (SNELF) Income Statement Analysis – Financial Results

Arway Corporation (ARWYF)

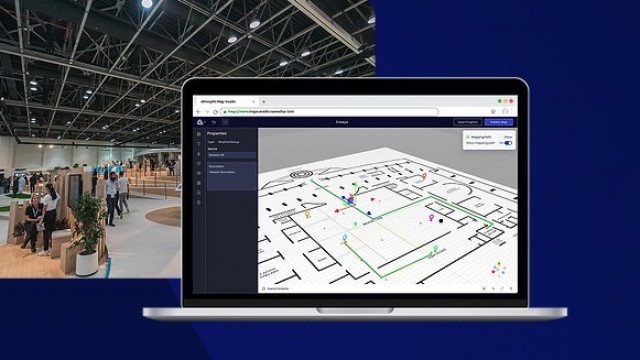

About Arway Corporation

Arway Corporation engages in developing and operating ARway application. It offers ARway, a mobile app, all in-one no code Metaverse creation tool, with self-generating AR mapping solutions for consumers and brands. The ARway offering paired with a no code web-based Creator Portal and SDK to form the metaverse experience builder platform that enables creators map, author, and publish various Metaverse experiences ranging from wayfinding to an array of AR experiences for branded activations. The company was incorporated in 2022 and is headquartered in Toronto, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 59.73K | 6.20K | 9.30K | 25.77K |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 59.73K | 6.20K | 9.30K | 25.77K |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 391.75K | 550.99K | 221.75K | 73.58K |

| General & Administrative | 2.35M | 14.95K | 13.67K | 17.45K |

| Selling & Marketing | 401.77K | 0.00 | 4.39K | 233.00 |

| SG&A | 2.75M | 14.95K | 31.46K | 17.68K |

| Other Expenses | 5.02M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 8.17M | 565.94K | 266.87K | 91.26K |

| Cost & Expenses | 8.17M | 565.94K | 266.87K | 91.26K |

| Interest Income | 14.84K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.39M | 13.66K | 13.66K | 65.49K |

| EBITDA | -3.11M | -546.08K | -243.91K | 0.00 |

| EBITDA Ratio | -5,207.62% | -8,809.13% | -2,622.09% | 0.00% |

| Operating Income | -8.11M | -559.74K | -257.57K | -65.49K |

| Operating Income Ratio | -13,581.61% | -9,029.47% | -2,768.93% | -254.17% |

| Total Other Income/Expenses | -43.06K | 0.00 | -13.66K | 0.00 |

| Income Before Tax | -8.15M | -559.74K | -257.57K | -65.49K |

| Income Before Tax Ratio | -13,653.71% | -9,029.47% | -2,768.93% | -254.17% |

| Income Tax Expense | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -8.15M | -559.74K | -257.57K | -65.49K |

| Net Income Ratio | -13,653.71% | -9,029.47% | -2,768.93% | -254.17% |

| EPS | -0.36 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -0.36 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 22.75M | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out (Dil) | 22.75M | 0.00 | 0.00 | 0.00 |

Apple's Vision Pro Release Driving Demand For ARway.ai's Spatial Computing Platform As it Signs New Deal with F3Geomatic

ARway.ai inks deal with F3 Geomatic

ARway.ai's Spatial Computing Platform Continues to See Increased Demand Ahead of Apple Vision Pro Release, Signs New Deal with F3 Geomatic

ARway.ai Seeing Apple Vision Pro Launch Stoking Demand As It Signs Multiple New Contracts For its Augmented Reality Navigation Platform

ARway.ai says pending Apple Vision Pro launch stokes demand for AR navigation platform

ARway.ai Seeing Increase in Global Deals As Apple Vision Pro Launch Stokes Demand For Its Augmented Reality Navigation Platform

Nextech3D.ai Launches AI Powered Search Engine To Scale The Production of 3D Models

Nextech3D.ai Announces Investment and Partnership In Its 3D Modelling Business

ARway.ai Launches Large Scale AI-Powered 3D Spatial Navigation Mapping

ARway.ai launches large-scale AI-powered 3D spatial navigation mapping

Source: https://incomestatements.info

Category: Stock Reports