See more : Exelixis, Inc. (EX9.DE) Income Statement Analysis – Financial Results

Complete financial analysis of Astro Aerospace Ltd. (ASDN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Astro Aerospace Ltd., a leading company in the Aerospace & Defense industry within the Industrials sector.

- Horizon Space Acquisition I Corp. Ordinary Shares (HSPO) Income Statement Analysis – Financial Results

- Power Corporation of Canada (PWCDF) Income Statement Analysis – Financial Results

- FLJ Group Limited (QK) Income Statement Analysis – Financial Results

- WAAREE RENEWABLE TECHNOLOGIES (WAAREERTL.BO) Income Statement Analysis – Financial Results

- Wheels India Limited (WHEELS.NS) Income Statement Analysis – Financial Results

Astro Aerospace Ltd. (ASDN)

About Astro Aerospace Ltd.

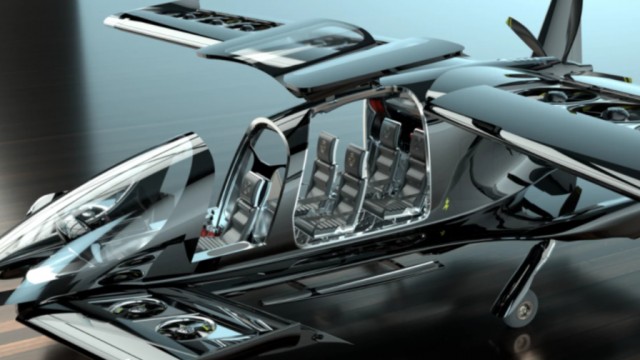

Astro Aerospace Ltd. develops self-piloted and autonomous, manned and unmanned, and electric vertical take-off and landing aerial vehicles. It intends to provide the market with aerial transportation for humans and cargo. The company was formerly known as CPSM, Inc. and changed its name to Astro Aerospace Ltd. in March 2018. Astro Aerospace Ltd. was incorporated in 2007 and is headquartered in Lewisville, Texas. Astro Aerospace Ltd. operates as a subsidiary of MAAB Global Limited.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 5.10M | 5.22M | 4.21M | 3.40M | 0.00 | 0.00 | 11.45K | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 3.91M | 4.05M | 3.09M | 2.46M | 0.00 | 0.00 | 73.42K | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | 1.19M | 1.17M | 1.12M | 937.70K | 0.00 | 0.00 | -61.97K | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 23.33% | 22.34% | 26.58% | 27.56% | 0.00% | 0.00% | -541.49% | 0.00% | 0.00% |

| Research & Development | 146.47K | 545.64K | 901.86K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.93K | 0.00 | 0.00 |

| General & Administrative | 296.28K | 369.54K | 188.79K | 1.00M | 837.58K | 737.98K | 635.95K | 0.00 | 0.00 | 32.48K | 25.84K | 0.00 |

| Selling & Marketing | 115.83K | 232.08K | 60.49K | 41.43K | 64.20K | 49.71K | 66.46K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 412.11K | 601.62K | 249.28K | 1.05M | 901.78K | 787.69K | 702.41K | 0.00 | 0.00 | 32.48K | 25.84K | 0.00 |

| Other Expenses | 0.00 | 178.39K | 6.29M | 143.15K | 101.82K | 75.58K | 57.71K | 0.00 | 0.00 | 50.45K | 0.00 | 0.00 |

| Operating Expenses | 558.58K | 1.15M | 1.15M | 1.19M | 1.00M | 863.27K | 760.12K | 0.00 | 0.00 | 84.86K | 25.84K | 0.00 |

| Cost & Expenses | 558.58K | 1.15M | 1.15M | 5.10M | 5.06M | 3.96M | 3.22M | 0.00 | 0.00 | 84.86K | 25.84K | 0.00 |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 617.19K | 1.32M | 318.04K | 35.90K | 40.16K | 29.11K | 24.31K | 0.00 | 0.00 | 5.70K | 0.00 | 0.00 |

| Depreciation & Amortization | -10.08K | 158.60K | 127.79K | 143.15K | 101.82K | 75.58K | 57.71K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | -568.66K | -988.67K | -7.31M | 168.47K | 341.08K | 333.46K | 240.76K | 0.00 | 0.00 | -73.42K | -25.84K | 0.00 |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 3.31% | 6.54% | 7.91% | 7.08% | 0.00% | 0.00% | -641.49% | 0.00% | 0.00% |

| Operating Income | -558.58K | -1.15M | -7.44M | -134.00 | 162.45K | 256.92K | 177.58K | 0.00 | 0.00 | -73.42K | -25.84K | 0.00 |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 3.11% | 6.10% | 5.22% | 0.00% | 0.00% | -641.49% | 0.00% | 0.00% |

| Total Other Income/Expenses | -627.27K | -1.16M | -331.19K | -10.44K | 36.65K | -28.15K | -18.84K | 0.00 | 0.00 | 15.34K | 0.00 | 0.00 |

| Income Before Tax | -1.19M | -2.31M | -7.77M | -10.58K | 199.10K | 228.77K | 158.74K | 0.00 | 0.00 | -79.12K | -25.84K | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | -0.21% | 3.81% | 5.43% | 4.67% | 0.00% | 0.00% | -691.30% | 0.00% | 0.00% |

| Income Tax Expense | 627.27K | 1.34M | -140.93K | -26.49K | 65.90K | 91.22K | 42.12K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -1.81M | -3.64M | -7.63M | 15.91K | 133.20K | 137.55K | 116.63K | 0.00 | 0.00 | -79.12K | -25.84K | 0.00 |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.31% | 2.55% | 3.26% | 3.43% | 0.00% | 0.00% | -691.30% | 0.00% | 0.00% |

| EPS | -0.34 | -0.77 | -1.55 | 0.00 | 0.02 | 0.03 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -0.34 | -0.77 | -1.55 | 0.00 | 0.02 | 0.03 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 5.32M | 4.75M | 4.92M | 5.53M | 5.54M | 5.44M | 4.80M | 16.59M | 16.59M | 16.59M | 16.59M | 16.59M |

| Weighted Avg Shares Out (Dil) | 5.32M | 4.75M | 4.92M | 5.70M | 5.71M | 5.44M | 4.80M | 16.59M | 16.59M | 16.59M | 16.59M | 16.59M |

Astro Aerospace Selected for AFWERX HSVTOL Challenge

Astro Aerospace to Complete eVTOL 1:2 Scale Prototype by Q1 2022 – Full-Sized eVTOL Vehicle Expected Q1 2024

Astro Aerospace to Present at the 2021 LD Micro Invitational

Astro Aerospace completes acquistion of air taxi peer Horizon Aircraft

Astro Aerospace Announces Definitive Agreement to Acquire Horizon Aircraft

Parsec Capital Acquisitions Corp. Gains Sponsorship from Astro Aerospace

Astro Aerospace Sponsors Leading SPAC Parsec Capital Acquisitions Corp.

Astro Aerospace Sponsors Leading SPAC, Parsec Capital Acquisitions Corp.

Source: https://incomestatements.info

Category: Stock Reports