Complete financial analysis of Atento S.A. (ATTO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Atento S.A., a leading company in the Specialty Business Services industry within the Industrials sector.

- Stayble Therapeutics AB (publ) (STABL.ST) Income Statement Analysis – Financial Results

- VPC Impact Acquisition Holdings (VIHAU) Income Statement Analysis – Financial Results

- Whispir Limited (WHSPF) Income Statement Analysis – Financial Results

- JSW Steel Limited (JSWSTEEL.NS) Income Statement Analysis – Financial Results

- Standard Foods Corporation (1227.TW) Income Statement Analysis – Financial Results

Atento S.A. (ATTO)

About Atento S.A.

Atento S.A., together with its subsidiaries, provides customer relationship management business process outsourcing services and solutions in Brazil, the Americas, Europe, the Middle East, and Africa. It offers a range of front and back-end services, including sales, customer care, technical support, collections, and back office. The company serves clients primarily in the telecommunications, financial services, consumer goods, retail, public administration, healthcare, travel, transportation, logistics, and technology and media sectors. It provides its services and solutions through digital channels, which include SMS, email, chats, social media and apps, and others, as well as through voice. The company was formerly known as Atento Floatco S.A. Atento S.A. was founded in 1999 and is based in Luxembourg.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.45B | 1.41B | 1.71B | 1.82B | 1.92B | 1.76B | 1.97B | 2.30B | 2.34B | 2.29B |

| Cost of Revenue | 93.80M | 72.30M | 66.40M | 70.80M | 74.90M | 65.60M | 78.45M | 104.81M | 115.34M | 1.56B |

| Gross Profit | 1.36B | 1.34B | 1.64B | 1.75B | 1.85B | 1.69B | 1.89B | 2.19B | 2.23B | 725.54M |

| Gross Profit Ratio | 93.53% | 94.88% | 96.11% | 96.11% | 96.10% | 96.27% | 96.01% | 95.44% | 95.07% | 31.68% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.12B | 1.06B | 1.30B | 1.37B | 1.43B | 1.31B | 1.42B | 1.64B | 1.79B | 28.06M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.45M |

| SG&A | 1.12B | 1.06B | 1.30B | 1.37B | 1.43B | 1.31B | 1.42B | 1.64B | 1.79B | 33.50M |

| Other Expenses | 220.30M | 239.30M | 306.80M | 200.00K | 400.00K | 41.84M | 6.00K | 35.57M | 948.00K | 0.00 |

| Operating Expenses | 1.34B | 1.30B | 1.61B | 1.66B | 1.75B | 1.62B | 1.77B | 2.11B | 2.04B | -1.23B |

| Cost & Expenses | 1.43B | 1.37B | 1.67B | 1.73B | 1.83B | 1.68B | 1.85B | 2.21B | 2.15B | 330.36M |

| Interest Income | 15.50M | 15.70M | 20.00M | 18.80M | 7.90M | 7.19M | 15.46M | 58.29M | 10.83M | 0.00 |

| Interest Expense | 91.90M | 69.90M | 68.10M | 45.60M | 78.10M | 59.15M | 75.68M | 135.69M | 117.69M | -72.80M |

| Depreciation & Amortization | 133.20M | 120.90M | 140.80M | 95.20M | 104.40M | 97.36M | 102.86M | 119.82M | 128.98M | -90.00M |

| EBITDA | 205.70M | 176.90M | 204.40M | 203.60M | 204.70M | 220.90M | 237.92M | 297.05M | 326.68M | 380.44M |

| EBITDA Ratio | 14.19% | 12.53% | 11.97% | 11.20% | 10.65% | 12.57% | 12.10% | 12.92% | 13.95% | 16.61% |

| Operating Income | 72.50M | 56.00M | 63.60M | 89.50M | 92.40M | 116.35M | 119.60M | 87.15M | 104.97M | 470.44M |

| Operating Income Ratio | 5.00% | 3.97% | 3.73% | 4.92% | 4.81% | 6.62% | 6.08% | 3.79% | 4.48% | 20.54% |

| Total Other Income/Expenses | -156.90M | -82.00M | -57.10M | -55.60M | -93.40M | -107.78M | -46.67M | -110.77M | -100.67M | -1.05B |

| Income Before Tax | -84.40M | -41.70M | -44.50M | 33.90M | -1.00M | 8.56M | 72.93M | -23.62M | 4.31M | -581.86M |

| Income Before Tax Ratio | -5.82% | -2.95% | -2.61% | 1.86% | -0.05% | 0.49% | 3.71% | -1.03% | 0.18% | -25.40% |

| Income Tax Expense | 5.80M | 5.10M | 36.20M | 13.40M | 12.50M | 5.21M | 23.79M | 18.53M | 8.35M | 97.58M |

| Net Income | -90.20M | -46.80M | -80.70M | 18.50M | -16.80M | 65.00K | 49.15M | -42.15M | -4.04M | -679.44M |

| Net Income Ratio | -6.22% | -3.31% | -4.73% | 1.02% | -0.87% | 0.00% | 2.50% | -1.83% | -0.17% | -29.66% |

| EPS | -6.41 | -3.32 | -5.59 | 1.24 | -1.14 | 0.05 | 3.37 | -3.04 | -0.28 | -49.65 |

| EPS Diluted | -6.41 | -3.32 | -5.59 | 1.24 | -1.14 | 0.05 | 3.32 | -3.04 | -0.28 | -49.65 |

| Weighted Avg Shares Out | 14.06M | 14.08M | 14.45M | 14.69M | 14.70M | 14.68M | 14.65M | 13.85M | 14.49M | 13.69M |

| Weighted Avg Shares Out (Dil) | 14.06M | 14.08M | 14.45M | 14.88M | 14.70M | 14.74M | 14.85M | 13.85M | 14.49M | 13.69M |

Atento: Turnaround In Progress With 100%+ Potential Upside And A Catalyst

Atento's Innovation Hub Launches Startup Accelerator Program and Open Innovation Platform

Atento's (ATTO) CEO Carlos López-Abadía on Q3 2020 Results - Earnings Call Transcript

Atento (ATTO) Reports Q3 Loss, Tops Revenue Estimates

Atento Reports Fiscal 2020 Third Quarter Results

Atento is the clear leader in the Latin American market

Atento: Deeply Undervalued With Significant Potential

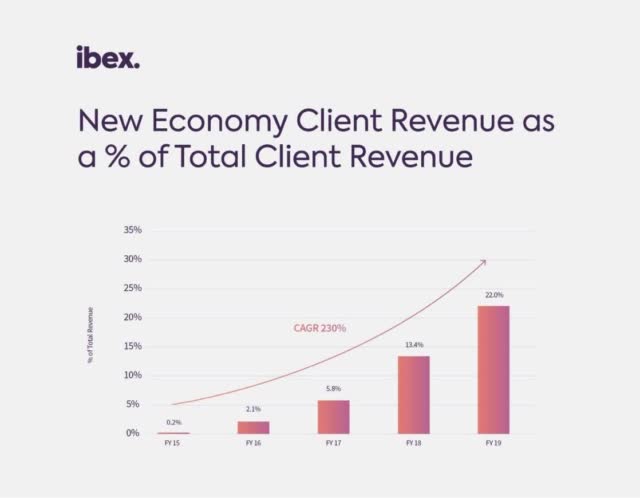

IBEX Proposes Terms For $100 Million U.S. IPO

Top Ranked Value Stocks to Buy for April 29th

ATTO vs. ADP: Which Stock Is the Better Value Option?

Source: https://incomestatements.info

Category: Stock Reports