Complete financial analysis of Aura Biosciences, Inc. (AURA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Aura Biosciences, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Ivanhoe Mines Ltd. (IVN.TO) Income Statement Analysis – Financial Results

- Universal Microelectronics Co., Ltd. (2413.TW) Income Statement Analysis – Financial Results

- Epiroc AB (publ) (0YSU.L) Income Statement Analysis – Financial Results

- The Boeing Company (BA) Income Statement Analysis – Financial Results

- Federal Home Loan Mortgage Corporation (FMCKP) Income Statement Analysis – Financial Results

Aura Biosciences, Inc. (AURA)

About Aura Biosciences, Inc.

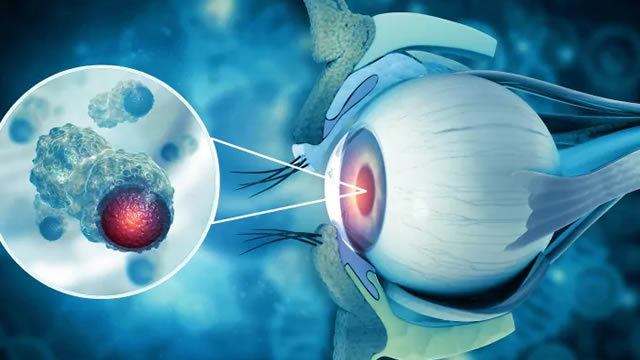

Aura Biosciences, Inc. operates as a biotechnology company that develops therapies to treat cancer. The company develops virus-like drug conjugates (VDC) technology platform for the treat tumors of high unmet need in ocular and urologic oncology. It develops AU-011, a VDC candidate for the treatment of primary choroidal melanoma. It also develops AU-011 in additional ocular oncology indications, including choroidal metastases. The company was incorporated in 2009 and is headquartered in Cambridge, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 1.30M | 1.18M | 835.00K | 831.00K | 509.00K |

| Gross Profit | -1.30M | -1.18M | -835.00K | -831.00K | -509.00K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 65.23M | 42.24M | 25.16M | 18.04M | 19.62M |

| General & Administrative | 19.76M | 18.06M | 10.09M | 4.16M | 4.52M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 19.76M | 18.06M | 10.09M | 4.16M | 4.52M |

| Other Expenses | 0.00 | -5.00K | -11.00K | 3.00K | -44.00K |

| Operating Expenses | 84.99M | 60.30M | 35.25M | 22.21M | 24.14M |

| Cost & Expenses | 84.99M | 60.30M | 35.25M | 22.21M | 24.14M |

| Interest Income | 0.00 | 1.86M | 13.00K | 3.00 | 5.00 |

| Interest Expense | 0.00 | 0.00 | 13.00K | 3.00K | 5.00K |

| Depreciation & Amortization | 1.30M | 1.18M | 835.00K | 831.00K | 509.00K |

| EBITDA | -83.70M | -59.12M | -34.42M | -21.38M | -23.63M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -84.99M | -60.30M | -35.25M | -22.21M | -24.14M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 8.72M | 1.53M | -1.00K | 0.00 | -60.00K |

| Income Before Tax | -76.27M | -58.76M | -35.25M | -22.21M | -24.20M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 137.00K | -1.53M | -830.00K | 3.00K | 5.00K |

| Net Income | -76.41M | -57.23M | -34.42M | -22.21M | -24.21M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -1.93 | -1.91 | -1.18 | -0.76 | -0.83 |

| EPS Diluted | -1.93 | -1.91 | -1.18 | -0.76 | -0.83 |

| Weighted Avg Shares Out | 39.62M | 29.94M | 29.21M | 29.22M | 29.22M |

| Weighted Avg Shares Out (Dil) | 39.62M | 29.94M | 29.21M | 29.22M | 29.22M |

Aura Biosciences to Present Belzupacap Sarotalocan (AU-011) Data from Multiple Studies at the 22nd EURETINA Congress

Aura Biosciences Reports Second Quarter 2022 Financial Results and Provides Clinical Development and Operational Highlights

Aura Biosciences Reports Second Quarter 2022 Financial Results and Provides Clinical Development and Operational Highlights

Aura Biosciences to Participate at the 2022 BTIG Biotechnology Conference

Aura Biosciences to Participate at the 2022 BTIG Biotechnology Conference

JMP Is Bullish On This Cancer Stock "Sees New Way to Treat Cancer"

Aura Biosciences Receives FDA Fast Track Designation for Belzupacap Sarotalocan (AU-011) for the Treatment of Non-Muscle Invasive Bladder Cancer

Aura Biosciences Receives FDA Fast Track Designation for Belzupacap Sarotalocan (AU-011) for the Treatment of Non-Muscle Invasive Bladder Cancer

Aura Biosciences' Belzupacap Sarotalocan At Par With Plaque Radiotherapy In Eye Cancer

Aura Biosciences Reports Topline Data from a Retrospective Study of Belzupacap Sarotalocan (AU-011) versus Plaque Radiotherapy Supporting the Value of a Vision Preserving Therapy for the Treatment of Patients with Early-Stage Choroidal Melanoma

Source: https://incomestatements.info

Category: Stock Reports