See more : Aegis Logistics Limited (AEGISCHEM.NS) Income Statement Analysis – Financial Results

Complete financial analysis of American Vanguard Corporation (AVD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of American Vanguard Corporation, a leading company in the Agricultural Inputs industry within the Basic Materials sector.

- Pininfarina S.p.A. (PINF.MI) Income Statement Analysis – Financial Results

- Wineco Productions, Inc. (WNCP) Income Statement Analysis – Financial Results

- DCM Financial Services Limited (DCMFINSERV.NS) Income Statement Analysis – Financial Results

- Podium Minerals Limited (POD.AX) Income Statement Analysis – Financial Results

- Kiduja India Limited (KIDUJA.BO) Income Statement Analysis – Financial Results

American Vanguard Corporation (AVD)

About American Vanguard Corporation

American Vanguard Corporation, through its subsidiaries, develops, manufactures, and markets specialty chemicals for agricultural, commercial, and consumer uses in the United States and internationally. It manufactures and formulates chemicals, including insecticides, fungicides, herbicides, molluscicides, soil health, plant nutrition, growth regulators, and soil fumigants in liquid, powder, and granular forms for crops, turf and ornamental plants, and human and animal health protection. The company also markets, sells, and distributes end-use chemical and biological products for crop applications; and distributes chemicals for turf and ornamental markets. It distributes its products through national distribution companies, and buying groups or co-operatives; and through sales offices, sales force executives, sales agents, and wholly owned distributors. The company was incorporated in 1969 and is headquartered in Newport Beach, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 579.37M | 609.62M | 556.87M | 458.70M | 468.19M | 454.27M | 355.05M | 312.11M | 289.38M | 298.63M | 381.02M | 366.19M | 304.43M | 229.62M | 209.33M | 237.54M | 216.66M | 193.77M | 189.80M | 150.86M | 124.86M | 100.67M | 87.02M | 77.98M | 69.21M | 67.00M | 67.70M | 48.60M | 55.40M | 45.10M | 45.50M | 38.70M | 29.30M | 22.30M | 19.00M | 17.90M | 18.90M | 15.90M |

| Cost of Revenue | 400.21M | 368.26M | 343.63M | 286.11M | 290.83M | 271.64M | 207.66M | 183.83M | 177.48M | 184.14M | 209.67M | 205.07M | 181.36M | 140.54M | 148.90M | 136.41M | 120.93M | 111.41M | 104.12M | 78.60M | 65.99M | 56.80M | 45.20M | 38.46M | 32.73M | 36.80M | 37.60M | 26.00M | 27.30M | 21.90M | 20.90M | 17.80M | 14.30M | 12.70M | 10.10M | 10.20M | 10.70M | 9.00M |

| Gross Profit | 179.16M | 241.35M | 213.24M | 172.59M | 177.35M | 182.63M | 147.39M | 128.29M | 111.90M | 114.50M | 171.35M | 161.13M | 123.07M | 89.08M | 60.43M | 101.13M | 95.73M | 82.36M | 85.68M | 72.26M | 58.87M | 43.88M | 41.82M | 39.52M | 36.48M | 30.20M | 30.10M | 22.60M | 28.10M | 23.20M | 24.60M | 20.90M | 15.00M | 9.60M | 8.90M | 7.70M | 8.20M | 6.90M |

| Gross Profit Ratio | 30.92% | 39.59% | 38.29% | 37.63% | 37.88% | 40.20% | 41.51% | 41.10% | 38.67% | 38.34% | 44.97% | 44.00% | 40.43% | 38.80% | 28.87% | 42.57% | 44.18% | 42.50% | 45.14% | 47.90% | 47.15% | 43.58% | 48.06% | 50.68% | 52.70% | 45.07% | 44.46% | 46.50% | 50.72% | 51.44% | 54.07% | 54.01% | 51.19% | 43.05% | 46.84% | 43.02% | 43.39% | 43.40% |

| Research & Development | 38.03M | 31.82M | 28.86M | 26.31M | 24.07M | 26.43M | 26.08M | 21.30M | 18.81M | 21.21M | 21.64M | 20.75M | 18.04M | 12.64M | 10.63M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 112.11M | 53.46M | 61.69M | 48.83M | 46.59M | 42.98M | 37.66M | 32.13M | 28.52M | 27.06M | 33.54M | 29.72M | 42.48M | 34.84M | 34.07M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 5.74M | 101.48M | 91.93M | 79.20M | 80.47M | 74.20M | 56.86M | 54.32M | 53.05M | 59.52M | 60.43M | 51.34M | 23.32M | 22.41M | 22.06M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 117.84M | 154.93M | 153.61M | 128.03M | 127.06M | 117.18M | 94.52M | 86.45M | 81.57M | 86.58M | 93.97M | 81.05M | 65.80M | 57.26M | 56.13M | 64.99M | 59.72M | 53.14M | 53.41M | 47.30M | 42.33M | 32.00M | 32.21M | 27.75M | 26.28M | 23.00M | 22.60M | 16.80M | 18.70M | 16.20M | 17.00M | 13.90M | 10.30M | 8.50M | 5.80M | 5.30M | 4.90M | 4.40M |

| Other Expenses | 0.00 | 13.95M | 672.00K | -717.00K | 0.00 | 0.00 | 0.00 | 0.00 | -1.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -761.90K | 2.95M | 3.21M | 3.10M | 2.70M | 2.30M | 3.40M | 3.50M | 3.50M | 3.20M | 2.90M | 1.40M | 1.00M | 700.00K | 600.00K | 500.00K |

| Operating Expenses | 155.87M | 200.70M | 182.47M | 153.62M | 151.13M | 143.61M | 120.60M | 107.75M | 100.38M | 107.79M | 115.61M | 101.80M | 83.84M | 69.89M | 66.76M | 64.99M | 59.72M | 53.14M | 53.41M | 47.30M | 42.33M | 32.00M | 31.45M | 30.69M | 29.50M | 26.10M | 25.30M | 19.10M | 22.10M | 19.70M | 20.50M | 17.10M | 13.20M | 9.90M | 6.80M | 6.00M | 5.50M | 4.90M |

| Cost & Expenses | 556.08M | 568.96M | 526.10M | 439.74M | 441.97M | 415.25M | 328.25M | 291.57M | 277.86M | 291.92M | 325.29M | 306.87M | 265.20M | 210.43M | 215.66M | 201.39M | 180.65M | 164.56M | 157.53M | 125.90M | 108.32M | 88.79M | 76.65M | 69.15M | 62.23M | 62.90M | 62.90M | 45.10M | 49.40M | 41.60M | 41.40M | 34.90M | 27.50M | 22.60M | 16.90M | 16.20M | 16.20M | 13.90M |

| Interest Income | 368.00K | 167.00K | 65.00K | 89.00K | 182.00K | 174.00K | 41.00K | 7.00K | 0.00 | 19.00K | 1.00K | 1.00K | 3.00K | 0.00 | 44.00K | 75.00K | 214.00K | 30.00K | 392.00K | 85.00K | 626.00K | 371.40K | 18.90K | 38.60K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 13.01M | 3.95M | 3.69M | 5.18M | 6.71M | 3.57M | 1.61M | 1.34M | 2.14M | 2.44M | 1.56M | 1.74M | 3.46M | 3.02M | 3.25M | 4.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 21.78M | 22.14M | 22.52M | 20.21M | 18.66M | 18.89M | 16.96M | 16.33M | 16.47M | 16.33M | 14.85M | 13.49M | 13.55M | 14.38M | 13.49M | 11.61M | 10.09M | 6.67M | 7.02M | 5.80M | 4.05M | 2.34M | 2.14M | 2.95M | 3.21M | 3.10M | 2.70M | 2.30M | 3.40M | 3.50M | 3.50M | 3.20M | 2.90M | 1.40M | 1.00M | 700.00K | 600.00K | 500.00K |

| EBITDA | 45.08M | 66.36M | 53.41M | 38.87M | 48.85M | 62.56M | 48.97M | 36.87M | 27.93M | 22.46M | 69.87M | 72.09M | 52.23M | 19.19M | 7.16M | 47.83M | 46.10M | 35.89M | 39.28M | 30.76M | 20.60M | 14.22M | 12.51M | 11.78M | 10.19M | 7.20M | 7.50M | 5.80M | 9.40M | 7.00M | 7.60M | 7.00M | 4.70M | 1.10M | 3.10M | 2.40M | 3.30M | 2.50M |

| EBITDA Ratio | 7.78% | 10.30% | 9.64% | 8.47% | 9.48% | 12.65% | 12.23% | 11.72% | 9.53% | 7.50% | 18.43% | 19.68% | 17.34% | 14.62% | 3.44% | 20.10% | 21.28% | 18.52% | 20.70% | 20.39% | 16.49% | 14.12% | 13.50% | 15.10% | 14.86% | 9.10% | 11.08% | 11.93% | 16.97% | 17.96% | 16.70% | 18.09% | 16.04% | 4.93% | 15.26% | 10.61% | 15.34% | 14.47% |

| Operating Income | 23.30M | 40.65M | 30.95M | 23.63M | 26.22M | 39.02M | 26.79M | 20.54M | 11.52M | 6.71M | 55.74M | 59.32M | 39.23M | 19.19M | -6.33M | 36.14M | 36.01M | 29.22M | 32.27M | 24.96M | 16.54M | 11.88M | 10.37M | 8.83M | 6.98M | 4.10M | 4.80M | 3.50M | 6.00M | 3.50M | 4.10M | 3.80M | 1.80M | -300.00K | 2.10M | 1.70M | 2.70M | 2.00M |

| Operating Income Ratio | 4.02% | 6.67% | 5.56% | 5.15% | 5.60% | 8.59% | 7.55% | 6.58% | 3.98% | 2.25% | 14.63% | 16.20% | 12.89% | 8.36% | -3.02% | 15.22% | 16.62% | 15.08% | 17.00% | 16.54% | 13.25% | 11.80% | 11.91% | 11.32% | 10.08% | 6.12% | 7.09% | 7.20% | 10.83% | 7.76% | 9.01% | 9.82% | 6.14% | -1.35% | 11.05% | 9.50% | 14.29% | 12.58% |

| Total Other Income/Expenses | -13.00M | -4.69M | -3.81M | -5.18M | -7.21M | -5.43M | -1.94M | -1.62M | -2.56M | -3.07M | -1.90M | -2.47M | -4.00M | -3.02M | -3.21M | -3.97M | -5.49M | -2.69M | -1.33M | -1.23M | -360.00K | -602.00K | -1.34M | -1.43M | -1.76M | -900.00K | -1.50M | -900.00K | -1.00M | -2.00M | -800.00K | -800.00K | -1.30M | -700.00K | 0.00 | 400.00K | 100.00K | -100.00K |

| Income Before Tax | 10.30M | 35.97M | 27.14M | 18.45M | 19.01M | 33.60M | 24.85M | 18.92M | 8.96M | 3.64M | 53.83M | 56.85M | 35.22M | 16.17M | -9.54M | 32.17M | 30.53M | 26.55M | 30.94M | 23.73M | 16.18M | 11.28M | 9.02M | 7.19M | 5.22M | 3.20M | 3.30M | 2.60M | 5.00M | 1.50M | 3.30M | 3.00M | 500.00K | -1.00M | 2.10M | 2.10M | 2.80M | 1.90M |

| Income Before Tax Ratio | 1.78% | 5.90% | 4.87% | 4.02% | 4.06% | 7.40% | 7.00% | 6.06% | 3.10% | 1.22% | 14.13% | 15.53% | 11.57% | 7.04% | -4.56% | 13.54% | 14.09% | 13.70% | 16.30% | 15.73% | 12.96% | 11.20% | 10.37% | 9.21% | 7.55% | 4.78% | 4.87% | 5.35% | 9.03% | 3.33% | 7.25% | 7.75% | 1.71% | -4.48% | 11.05% | 11.73% | 14.81% | 11.95% |

| Income Tax Expense | 2.78M | 8.56M | 8.17M | 3.08M | 5.20M | 9.15M | 4.44M | 5.54M | 2.01M | -451.00K | 18.92M | 20.03M | 13.16M | 5.19M | -3.75M | 12.15M | 11.80M | 11.07M | 11.94M | 9.26M | 5.92M | 4.23M | 3.38M | 2.87M | 1.99M | 1.10M | 1.30M | 1.00M | 1.90M | 300.00K | 1.10M | 1.10M | 200.00K | -100.00K | 800.00K | 700.00K | 1.20M | 900.00K |

| Net Income | 7.52M | 27.40M | 18.59M | 15.24M | 13.60M | 24.20M | 20.27M | 12.79M | 6.59M | 4.84M | 34.45M | 36.87M | 22.07M | 10.98M | -5.79M | 20.02M | 18.73M | 15.45M | 19.00M | 14.48M | 10.26M | 7.05M | 5.64M | 4.31M | 3.24M | 2.10M | 2.00M | 1.60M | 3.10M | 1.20M | 2.20M | 1.90M | 300.00K | -900.00K | 1.40M | 1.40M | 1.60M | 1.00M |

| Net Income Ratio | 1.30% | 4.50% | 3.34% | 3.32% | 2.91% | 5.33% | 5.71% | 4.10% | 2.28% | 1.62% | 9.04% | 10.07% | 7.25% | 4.78% | -2.77% | 8.43% | 8.64% | 7.97% | 10.01% | 9.60% | 8.22% | 7.00% | 6.48% | 5.53% | 4.67% | 3.13% | 2.95% | 3.29% | 5.60% | 2.66% | 4.84% | 4.91% | 1.02% | -4.04% | 7.37% | 7.82% | 8.47% | 6.29% |

| EPS | 0.27 | 0.94 | 0.62 | 0.52 | 0.47 | 0.83 | 0.70 | 0.44 | 0.23 | 0.17 | 1.22 | 1.32 | 0.80 | 0.40 | -0.21 | 0.75 | 0.71 | 0.60 | 0.78 | 0.61 | 0.44 | 0.30 | 0.25 | 0.18 | 0.14 | 0.09 | 0.09 | 0.07 | 0.13 | 0.05 | 0.10 | 0.09 | 0.02 | -0.04 | 0.06 | 0.06 | 0.07 | 0.05 |

| EPS Diluted | 0.26 | 0.92 | 0.61 | 0.51 | 0.46 | 0.81 | 0.68 | 0.44 | 0.23 | 0.17 | 1.19 | 1.28 | 0.79 | 0.40 | -0.21 | 0.73 | 0.68 | 0.57 | 0.74 | 0.57 | 0.41 | 0.29 | 0.24 | 0.18 | 0.14 | 0.09 | 0.09 | 0.07 | 0.13 | 0.05 | 0.10 | 0.09 | 0.02 | -0.04 | 0.06 | 0.06 | 0.07 | 0.05 |

| Weighted Avg Shares Out | 28.13M | 29.23M | 29.81M | 29.45M | 29.03M | 29.33M | 29.10M | 28.86M | 28.67M | 28.44M | 28.30M | 27.91M | 27.56M | 27.39M | 27.12M | 26.64M | 26.31M | 25.93M | 24.34M | 23.95M | 23.50M | 23.12M | 22.95M | 23.67M | 23.96M | 24.22M | 20.04M | 23.94M | 24.65M | 22.30M | 21.71M | 22.33M | 18.44M | 23.20M | 22.38M | 22.38M | 21.67M | 21.03M |

| Weighted Avg Shares Out (Dil) | 28.53M | 29.87M | 30.41M | 29.99M | 29.66M | 30.05M | 29.70M | 29.39M | 29.24M | 28.91M | 28.90M | 28.76M | 27.88M | 27.65M | 27.12M | 27.47M | 27.44M | 27.19M | 25.76M | 25.56M | 24.84M | 24.24M | 23.66M | 24.06M | 23.96M | 24.22M | 20.04M | 23.94M | 24.65M | 22.30M | 21.71M | 22.33M | 18.44M | 23.20M | 22.38M | 22.38M | 21.67M | 21.03M |

American Vanguard Reports Q1 2023 Results

American Vanguard Schedules 2023 First Quarter Earnings Release and Conference Call for Tuesday, May 9th

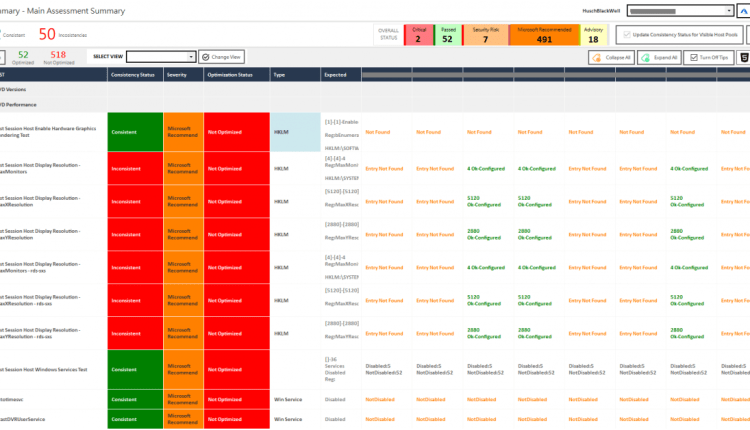

SmartProfiler for Azure Virtual Desktop (AVD) Assessment has been released to perform a technical assessment of AVD

American Vanguard Announces 2023 Annual Meeting of Stockholders

American Vanguard's (AVD) Unit Inks Supply Deal With NewLeaf

American Vanguard (AVD) Earnings and Sales Beat Estimates in Q4

American Vanguard Corporation (AVD) Q4 2022 Earnings Call Transcript

American Vanguard Reports Full Year 2022 Results

American Vanguard Declares Quarterly Dividend

American Vanguard: Mixed Agriculture Outlook, Don't Gamble

Source: https://incomestatements.info

Category: Stock Reports