See more : Grande Armee Investissement SA (MLGAI.PA) Income Statement Analysis – Financial Results

Complete financial analysis of Avinger, Inc. (AVGR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Avinger, Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- Sema4 Holdings Corp. (SMFR) Income Statement Analysis – Financial Results

- East Japan Railway Company (EJPRY) Income Statement Analysis – Financial Results

- LT Foods Limited (LTFOODS.BO) Income Statement Analysis – Financial Results

- PRAP Japan, Inc. (2449.T) Income Statement Analysis – Financial Results

- Sega Sammy Holdings Inc. (SGAMY) Income Statement Analysis – Financial Results

Avinger, Inc. (AVGR)

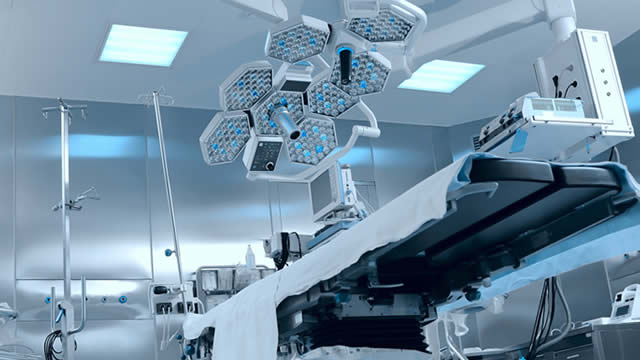

About Avinger, Inc.

Avinger, Inc., a commercial-stage medical device company, designs, manufactures, and sells a suite of image-guided and catheter-based systems used by physicians to treat patients with peripheral arterial disease (PAD) in the United States and internationally. It develops lumivascular platform that integrates optical coherence tomography visualization with interventional catheters to provide real-time intravascular imaging during the treatment portion of PAD procedures. The company's lumivascular products comprise Lightbox imaging consoles, as well as the Ocelot family of catheters, which are designed to allow physicians to penetrate a total blockage in an artery; and Pantheris, an image-guided atherectomy device that allows physicians to precisely remove arterial plaque in PAD patients. In addition, its first-generation chronic total occlusion (CTO)-crossing catheters, Wildcat and Kittycat 2, which employs a proprietary design that uses a rotational spinning technique allowing the physician to switch between passive and active modes when navigating across a CTO. Further, the company develops IMAGE-BTK for the treatment of PAD lesions below-the-knee. It markets and sells its products to interventional cardiologists, vascular surgeons, and interventional radiologists. Avinger, Inc. was incorporated in 2007 and is headquartered in Redwood City, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.65M | 8.27M | 10.13M | 8.76M | 9.13M | 7.92M | 9.93M | 19.21M | 10.71M | 11.21M | 12.96M | 8.56M |

| Cost of Revenue | 5.65M | 5.62M | 6.71M | 6.14M | 6.26M | 6.53M | 13.00M | 14.45M | 6.48M | 6.51M | 8.21M | 4.15M |

| Gross Profit | 2.00M | 2.65M | 3.42M | 2.62M | 2.87M | 1.38M | -3.07M | 4.77M | 4.24M | 4.70M | 4.76M | 4.41M |

| Gross Profit Ratio | 26.18% | 32.08% | 33.80% | 29.88% | 31.40% | 17.49% | -30.88% | 24.82% | 39.53% | 41.92% | 36.71% | 51.51% |

| Research & Development | 4.54M | 4.39M | 5.90M | 5.70M | 5.69M | 6.01M | 11.32M | 15.54M | 15.69M | 11.22M | 15.97M | 15.42M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 17.44M | 25.12M | 39.95M | 29.23M | 18.50M | 25.76M | 22.85M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 515.00K | 720.00K | 321.00K | 732.00K |

| SG&A | 14.10M | 14.22M | 15.63M | 14.33M | 16.53M | 17.44M | 25.12M | 39.95M | 29.23M | 18.50M | 25.76M | 22.85M |

| Other Expenses | 0.00 | -1.00K | 2.34M | 56.00K | 1.10M | -13.00K | 11.00K | -1.05M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 18.64M | 18.61M | 21.53M | 20.02M | 22.23M | 23.45M | 36.44M | 55.49M | 44.93M | 29.73M | 41.73M | 38.26M |

| Cost & Expenses | 24.29M | 24.23M | 28.23M | 26.17M | 28.49M | 29.98M | 49.44M | 69.93M | 51.40M | 36.24M | 49.94M | 42.42M |

| Interest Income | 0.00 | 1.67M | 3.00K | 34.00K | 288.00K | 214.00K | 108.00K | 125.00K | 40.00K | 2.00K | 11.00K | 25.00K |

| Interest Expense | 1.72M | 1.67M | 1.65M | 1.66M | 1.48M | 5.48M | 6.30M | 5.52M | 5.17M | 6.02M | 2.93M | 6.00K |

| Depreciation & Amortization | 289.00K | 1.30M | 1.69M | 1.86M | 1.57M | 1.28M | 1.48M | 1.51M | 1.30M | 1.45M | 1.50M | 772.00K |

| EBITDA | -16.35M | -15.76M | -17.41M | -16.42M | -16.40M | -20.59M | -40.96M | -49.10M | -40.88M | -24.48M | -35.46M | -33.08M |

| EBITDA Ratio | -213.62% | -192.89% | -155.62% | -198.01% | -212.01% | -278.96% | -396.61% | -263.31% | -379.45% | -223.18% | -273.53% | -386.19% |

| Operating Income | -16.64M | -15.96M | -18.10M | -17.40M | -19.36M | -22.07M | -42.55M | -50.72M | -40.69M | -25.03M | -36.97M | -33.86M |

| Operating Income Ratio | -217.39% | -192.88% | -178.69% | -198.65% | -212.01% | -278.80% | -428.35% | -263.96% | -379.82% | -223.20% | -285.19% | -395.50% |

| Total Other Income/Expenses | -1.69M | -1.67M | 689.00K | -1.60M | -91.00K | -5.49M | -6.18M | -5.41M | -6.65M | -6.92M | -2.92M | 0.00 |

| Income Before Tax | -18.32M | -17.62M | -17.41M | -19.01M | -19.45M | -27.56M | -48.73M | -56.13M | -47.34M | -31.95M | -39.89M | -33.86M |

| Income Before Tax Ratio | -239.41% | -213.02% | -171.89% | -216.94% | -213.01% | -348.17% | -490.56% | -292.12% | -441.93% | -284.94% | -307.70% | -395.50% |

| Income Tax Expense | 0.00 | -196.00K | 3.30M | 817.00K | 302.00K | 201.00K | 4.82M | 4.02M | 2.38M | 14.00K | 11.00K | 9.00K |

| Net Income | -18.32M | -17.43M | -20.71M | -19.82M | -19.75M | -27.56M | -48.73M | -56.13M | -47.34M | -31.96M | -39.90M | -33.86M |

| Net Income Ratio | -239.41% | -210.65% | -204.44% | -226.26% | -216.32% | -348.17% | -490.56% | -292.12% | -441.93% | -285.06% | -307.78% | -395.61% |

| EPS | -23.31 | -41.83 | -65.79 | -120.80 | -818.60 | -7.74K | -175.93K | -283.47K | -450.90K | -389.80K | -486.60K | -412.98K |

| EPS Diluted | -23.31 | -41.83 | -65.79 | -120.80 | -818.60 | -7.74K | -175.93K | -283.47K | -450.90K | -389.80K | -486.60K | -412.98K |

| Weighted Avg Shares Out | 786.00K | 416.60K | 314.80K | 164.10K | 24.13K | 3.56K | 277.00 | 198.00 | 105.00 | 82.00 | 82.00 | 82.00 |

| Weighted Avg Shares Out (Dil) | 786.00K | 416.60K | 314.80K | 164.10K | 24.13K | 3.56K | 277.00 | 198.00 | 105.00 | 82.00 | 82.00 | 82.00 |

Avinger to Announce First Quarter 2021 Results on May 6, 2021

Hot Penny Stocks To Watch In April 2021 If Biotech Is A Focus

New Publications Highlight Clinical Benefits of Avinger PAD Therapies

Avinger Provides Update on Tigereye(TM) Commercial Launch

Target Top-Line Growth and Compelling Patient Outcomes with Avinger

Avinger, Inc. (AVGR) CEO Jeff Soinski on Q4 2020 Results - Earnings Call Transcript

Avinger: Q4 Earnings Insights

Avinger Reports Fourth Quarter 2020 Financial Results

Avinger, Inc. to Present at the Q1 Virtual Investor Summit

Earnings Outlook For Avinger

Source: https://incomestatements.info

Category: Stock Reports