See more : Sinopec Oilfield Service Corporation (YZCFF) Income Statement Analysis – Financial Results

Complete financial analysis of Axonics, Inc. (AXNX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Axonics, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Ginza Renoir Co., Ltd. (9853.T) Income Statement Analysis – Financial Results

- Almondz Global Securities Limited (ALMONDZ.BO) Income Statement Analysis – Financial Results

- Oriental Watch Holdings Limited (0398.HK) Income Statement Analysis – Financial Results

- Hamamatsu Photonics K.K. (HPHTF) Income Statement Analysis – Financial Results

- Yuyu Pharma, Inc. (000220.KS) Income Statement Analysis – Financial Results

Axonics, Inc. (AXNX)

About Axonics, Inc.

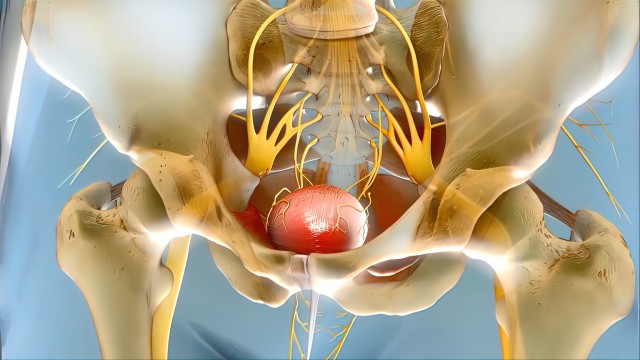

Axonics, Inc., a medical technology company, engages in the development and commercialization of sacral neuromodulation (SNM) systems. The company's SNM systems are used to treat patients with overactive bladder, including urinary urge incontinence and urinary urgency frequency, as well as fecal incontinence and non-obstructive urinary retention. Its proprietary rechargeable SNM System (r-SNM) delivers mild electrical pulses to the targeted sacral nerve to restore normal communication to and from the brain to reduce the symptoms of bladder and bowel dysfunction. The company also offers Bulkamid, a urethral bulking agent to treat female stress urinary incontinence. It sells its products through a direct salesforce and distributors in the United States, the United Kingdom, Germany, the Netherlands, Nordic countries, and internationally. The company was formerly known as Axonics Modulation Technologies, Inc. and changed its name to Axonics, Inc. in March 2021. Axonics, Inc. was incorporated in 2012 and is based in Irvine, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 366.38M | 273.70M | 180.29M | 111.54M | 13.82M | 707.00K | 128.12K | 0.00 |

| Cost of Revenue | 91.83M | 76.04M | 64.57M | 44.44M | 6.49M | 356.00K | 117.94K | 625.12K |

| Gross Profit | 274.55M | 197.67M | 115.72M | 67.09M | 7.33M | 351.00K | 10.17K | -625.12K |

| Gross Profit Ratio | 74.94% | 72.22% | 64.18% | 60.15% | 53.04% | 49.65% | 7.94% | 0.00% |

| Research & Development | 34.89M | 34.41M | 37.30M | 29.17M | 20.18M | 19.40M | 12.33M | 12.51M |

| General & Administrative | 45.75M | 40.24M | 32.79M | 25.55M | 19.08M | 9.36M | 4.82M | 4.46M |

| Selling & Marketing | 189.56M | 156.02M | 105.79M | 66.13M | 48.67M | 3.72M | 1.03M | 516.08K |

| SG&A | 235.32M | 196.26M | 138.57M | 91.68M | 67.75M | 13.09M | 5.85M | 4.97M |

| Other Expenses | 14.96M | 9.38M | 7.24M | -412.15K | 0.00 | 0.00 | -20.82K | -291.00 |

| Operating Expenses | 270.20M | 240.05M | 183.11M | 120.85M | 87.93M | 32.49M | 18.19M | 17.48M |

| Cost & Expenses | 392.44M | 316.09M | 247.68M | 165.30M | 94.42M | 32.84M | 18.30M | 17.48M |

| Interest Income | 17.31M | 5.13M | 40.00K | 761.00K | 2.97M | 998.00K | 200.58K | 84.02K |

| Interest Expense | 0.00 | 2.43M | 7.43M | 1.87M | 2.31M | 1.34M | 22.00K | 0.00 |

| Depreciation & Amortization | 12.49M | 12.72M | 10.13M | 2.64M | 1.59M | 946.00K | 725.39K | 625.12K |

| EBITDA | 7.78M | -47.16M | -61.73M | -51.30M | -78.03M | -31.19M | -17.33M | -16.77M |

| EBITDA Ratio | 2.12% | -10.18% | -33.34% | -47.52% | -561.69% | -4,404.38% | -13,479.81% | 0.00% |

| Operating Income | -26.06M | -42.39M | -67.39M | -53.76M | -80.60M | -32.14M | -18.17M | -17.48M |

| Operating Income Ratio | -7.11% | -15.49% | -37.38% | -48.20% | -583.21% | -4,545.54% | -14,185.62% | 0.00% |

| Total Other Income/Expenses | 17.31M | 2.63M | -7.48M | -1.15M | 665.00K | -345.00K | 114.33K | 82.93K |

| Income Before Tax | -8.74M | -62.32M | -79.29M | -54.91M | -79.93M | -32.48M | -18.06M | -17.40M |

| Income Before Tax Ratio | -2.39% | -22.77% | -43.98% | -49.23% | -578.39% | -4,594.34% | -14,097.05% | 0.00% |

| Income Tax Expense | -2.66M | -2.62M | 782.00K | 1.00K | 1.00K | 1.00K | -20.82K | -291.00 |

| Net Income | -6.09M | -59.70M | -80.07M | -54.92M | -79.94M | -32.48M | -18.06M | -17.40M |

| Net Income Ratio | -1.66% | -21.81% | -44.41% | -49.24% | -578.40% | -4,594.48% | -14,097.05% | 0.00% |

| EPS | -0.12 | -1.28 | -1.86 | -1.48 | -2.80 | -4.64 | -0.97 | -0.95 |

| EPS Diluted | -0.12 | -1.28 | -1.86 | -1.48 | -2.80 | -4.64 | -0.97 | -0.95 |

| Weighted Avg Shares Out | 49.08M | 46.68M | 43.07M | 36.98M | 28.57M | 7.00M | 18.62M | 18.38M |

| Weighted Avg Shares Out (Dil) | 49.08M | 46.68M | 43.07M | 36.98M | 28.57M | 7.00M | 18.62M | 18.38M |

Axonics: Medical Devices Play

Medical Device Maker Announces New Patients, Shoots Past Buy Point

Axonics® Announces First Patient Implants in Canada With New Recharge-Free Sacral Neuromodulation System

Axonics Stock Is A Buy Amid Current Capex Cycle

Medical Stock Shows Strength In A Weakening Market; Nears Buy Point

Are Medical Stocks Lagging Axonics (AXNX) This Year?

Axonics® to Participate in September Investor Conferences

Axonics® Expands Sacral Neuromodulation Intellectual Property Portfolio

Here's Why Axonics Modulation Technologies (AXNX) is a Great Momentum Stock to Buy

Axonics® Announces Closing of Public Stock Offering and Full Exercise of Underwriter's Option to Purchase Additional Stock

Source: https://incomestatements.info

Category: Stock Reports