See more : Continental Aktiengesellschaft (CON.DE) Income Statement Analysis – Financial Results

Complete financial analysis of AutoZone, Inc. (AZO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of AutoZone, Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- Beijing Lier High-temperature Materials Co.,Ltd. (002392.SZ) Income Statement Analysis – Financial Results

- SPL Industries Limited (SPLIL.NS) Income Statement Analysis – Financial Results

- Ultramarine & Pigments Limited (ULTRAMAR.BO) Income Statement Analysis – Financial Results

- Park City Group, Inc. (PCYG) Income Statement Analysis – Financial Results

- Super Group (SGHC) Limited (SGHC) Income Statement Analysis – Financial Results

AutoZone, Inc. (AZO)

About AutoZone, Inc.

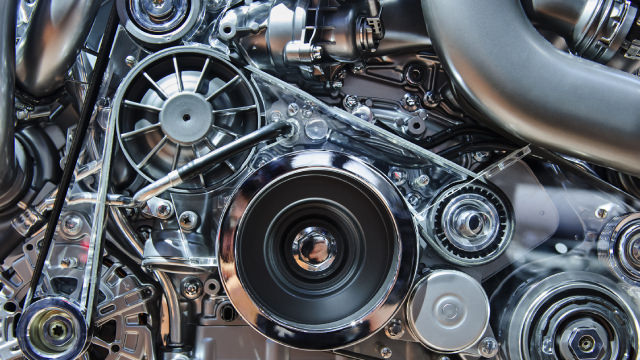

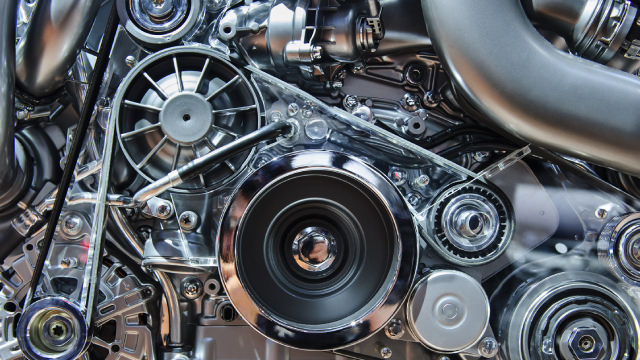

AutoZone, Inc. retails and distributes automotive replacement parts and accessories. The company offers various products for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. Its products include A/C compressors, batteries and accessories, bearings, belts and hoses, calipers, chassis, clutches, CV axles, engines, fuel pumps, fuses, ignition and lighting products, mufflers, radiators, starters and alternators, thermostats, and water pumps, as well as tire repairs. In addition, the company offers maintenance products, such as antifreeze and windshield washer fluids; brake drums, rotors, shoes, and pads; brake and power steering fluids, and oil and fuel additives; oil and transmission fluids; oil, cabin, air, fuel, and transmission filters; oxygen sensors; paints and accessories; refrigerants and accessories; shock absorbers and struts; spark plugs and wires; and windshield wipers. Further, it provides air fresheners, cell phone accessories, drinks and snacks, floor mats and seat covers, interior and exterior accessories, mirrors, performance products, protectants and cleaners, sealants and adhesives, steering wheel covers, stereos and radios, tools, and wash and wax products, as well as towing services. Additionally, the company provides a sales program that offers commercial credit and delivery of parts and other products; sells automotive diagnostic and repair software under the ALLDATA brand through alldata.com and alldatadiy.com; and automotive hard parts, maintenance items, accessories, and non-automotive products through autozone.com. As of November 20, 2021, it operated 6,066 stores in the United States; 666 stores in Mexico; and 53 stores in Brazil. The company was founded in 1979 and is based in Memphis, Tennessee.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 18.49B | 17.46B | 16.25B | 14.63B | 12.63B | 11.86B | 11.22B | 10.89B | 10.64B | 10.19B | 9.48B | 9.15B | 8.60B | 8.07B | 7.36B | 6.82B | 6.52B | 6.17B | 5.95B | 5.71B | 5.64B | 5.46B | 5.33B | 4.82B | 4.48B | 4.12B | 3.24B | 2.69B | 2.24B | 1.81B | 1.51B | 1.22B | 1.00B | 818.00M | 671.70M |

| Cost of Revenue | 8.67B | 8.39B | 7.78B | 6.91B | 5.86B | 5.50B | 5.25B | 5.15B | 5.03B | 4.86B | 4.54B | 4.41B | 4.17B | 3.95B | 3.65B | 3.40B | 3.25B | 3.11B | 3.01B | 2.92B | 2.88B | 2.94B | 2.95B | 2.80B | 2.48B | 2.26B | 1.79B | 1.48B | 1.24B | 1.01B | 853.00M | 710.60M | 589.30M | 481.80M | 408.50M |

| Gross Profit | 9.82B | 9.07B | 8.47B | 7.72B | 6.77B | 6.37B | 5.97B | 5.74B | 5.61B | 5.33B | 4.93B | 4.74B | 4.43B | 4.12B | 3.71B | 3.42B | 3.27B | 3.06B | 2.94B | 2.79B | 2.76B | 2.52B | 2.38B | 2.01B | 2.01B | 1.86B | 1.45B | 1.21B | 998.50M | 799.40M | 655.00M | 506.20M | 413.00M | 336.20M | 263.20M |

| Gross Profit Ratio | 53.09% | 51.96% | 52.13% | 52.75% | 53.60% | 53.65% | 53.24% | 52.71% | 52.74% | 52.29% | 52.08% | 51.83% | 51.51% | 51.03% | 50.41% | 50.12% | 50.10% | 49.67% | 49.40% | 48.90% | 48.90% | 46.09% | 44.60% | 41.79% | 44.77% | 45.19% | 44.71% | 44.95% | 44.52% | 44.21% | 43.44% | 41.60% | 41.21% | 41.10% | 39.18% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.03B | 5.60B | 5.20B | 4.77B | 4.35B | 4.15B | 4.16B | 3.66B | 3.55B | 3.37B | 3.10B | 2.97B | 2.80B | 2.62B | 2.39B | 2.24B | 2.14B | 2.01B | 1.93B | 1.82B | 1.76B | 1.60B | 1.60B | 1.50B | 1.37B | 1.30B | 970.80M | 810.80M | 666.10M | 523.40M | 431.20M | 344.10M | 295.70M | 247.40M | 205.60M |

| Other Expenses | 0.00 | 5.60B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 126.80M | 128.50M | 96.60M | 77.80M | 63.50M | 48.30M | 33.10M | 21.30M | 13.70M | 9.50M | 8.30M |

| Operating Expenses | 6.03B | 5.60B | 5.20B | 4.77B | 4.35B | 4.15B | 4.16B | 3.66B | 3.55B | 3.37B | 3.10B | 2.97B | 2.80B | 2.62B | 2.39B | 2.24B | 2.14B | 2.01B | 1.93B | 1.82B | 1.76B | 1.60B | 1.60B | 1.50B | 1.50B | 1.43B | 1.07B | 888.60M | 729.60M | 571.70M | 464.30M | 365.40M | 309.40M | 256.90M | 213.90M |

| Cost & Expenses | 14.70B | 13.98B | 12.98B | 11.69B | 10.21B | 9.65B | 9.41B | 8.81B | 8.58B | 8.23B | 7.65B | 7.37B | 6.97B | 6.58B | 6.04B | 5.64B | 5.40B | 5.11B | 4.94B | 4.74B | 4.64B | 4.54B | 4.55B | 4.30B | 3.97B | 3.68B | 2.86B | 2.37B | 1.97B | 1.58B | 1.32B | 1.08B | 898.70M | 738.70M | 622.40M |

| Interest Income | 11.31M | 12.05M | 6.05M | 5.42M | 5.69M | 7.40M | 5.64M | 3.50M | 2.37M | 1.61M | 1.85M | 1.61M | 1.40M | 2.06M | 2.63M | 3.89M | 3.79M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 462.89M | 306.37M | 191.64M | 195.34M | 201.17M | 184.80M | 174.53M | 154.58M | 147.68M | 150.44M | 167.51M | 185.42M | 175.91M | 170.56M | 158.91M | 146.20M | 116.75M | 119.12M | 107.89M | 102.44M | 92.80M | 84.79M | 79.86M | 354.04M | 76.83M | 45.40M | 18.30M | 8.80M | 3.80M | 0.00 | 0.00 | 0.00 | 0.00 | 7.20M | 11.00M |

| Depreciation & Amortization | 549.76M | 497.58M | 442.22M | 407.68M | 397.47M | 369.96M | 345.08M | 323.05M | 297.40M | 269.92M | 251.27M | 227.25M | 211.83M | 196.21M | 192.08M | 184.32M | 169.51M | 161.13M | 141.02M | 137.94M | 111.12M | 109.75M | 118.26M | 131.33M | 126.80M | 128.50M | 96.60M | 77.80M | 65.40M | 47.70M | 30.90M | 18.80M | 12.90M | 9.50M | 8.30M |

| EBITDA | 4.35B | 3.97B | 3.71B | 3.40B | 2.90B | 2.59B | 2.48B | 2.40B | 2.36B | 2.22B | 1.83B | 2.00B | 1.84B | 1.69B | 1.51B | 1.36B | 1.30B | 1.22B | 1.15B | 1.12B | 1.11B | 1.03B | 771.01M | 645.71M | 638.82M | 561.70M | 479.00M | 399.10M | 334.30M | 275.40M | 221.60M | 159.60M | 116.50M | 88.80M | 57.60M |

| EBITDA Ratio | 23.51% | 19.90% | 20.12% | 20.13% | 19.14% | 18.68% | 19.21% | 22.07% | 22.17% | 21.82% | 21.97% | 21.87% | 18.93% | 18.52% | 17.92% | 19.96% | 19.83% | 19.72% | 19.35% | 19.50% | 19.69% | 18.83% | 16.70% | 16.03% | 14.25% | 13.65% | 14.77% | 14.83% | 14.91% | 15.23% | 14.69% | 13.12% | 11.62% | 10.86% | 8.58% |

| Operating Income | 3.79B | 3.47B | 3.27B | 2.94B | 2.42B | 2.22B | 1.81B | 2.08B | 1.92B | 1.80B | 1.83B | 1.77B | 1.63B | 1.49B | 1.32B | 1.18B | 1.12B | 1.06B | 1.01B | 975.66M | 998.71M | 833.01M | 771.01M | 641.07M | 512.02M | 433.20M | 382.40M | 321.30M | 268.90M | 227.70M | 190.70M | 140.80M | 103.60M | 79.30M | 49.30M |

| Operating Income Ratio | 20.49% | 19.90% | 20.12% | 20.13% | 19.14% | 18.68% | 16.14% | 19.10% | 18.01% | 17.71% | 19.32% | 19.38% | 18.93% | 18.52% | 17.92% | 17.25% | 17.23% | 17.10% | 16.98% | 17.08% | 17.72% | 15.26% | 14.48% | 13.31% | 11.42% | 10.52% | 11.79% | 11.94% | 11.99% | 12.59% | 12.65% | 11.57% | 10.34% | 9.69% | 7.34% |

| Total Other Income/Expenses | -451.58M | -306.37M | -191.64M | -195.34M | -201.17M | -184.80M | -174.53M | -154.58M | -147.68M | -150.44M | -167.51M | -185.42M | -175.91M | -170.56M | -158.91M | -142.32M | -116.75M | -119.12M | -107.89M | -102.44M | -92.80M | -84.79M | -79.86M | -100.67M | -76.83M | -45.40M | -18.30M | -8.80M | -1.90M | 600.00K | 2.30M | 2.40M | 900.00K | -7.20M | -11.00M |

| Income Before Tax | 3.34B | 3.17B | 3.08B | 2.75B | 2.22B | 2.03B | 1.64B | 1.93B | 1.91B | 1.80B | 1.66B | 1.59B | 1.45B | 1.32B | 1.16B | 1.03B | 1.01B | 936.15M | 902.04M | 873.22M | 905.90M | 833.01M | 691.15M | 287.03M | 435.19M | 387.80M | 364.10M | 312.50M | 267.00M | 228.30M | 193.00M | 143.20M | 104.50M | 72.10M | 38.30M |

| Income Before Tax Ratio | 18.05% | 18.15% | 18.95% | 18.79% | 17.55% | 17.12% | 14.58% | 17.68% | 17.98% | 17.69% | 17.55% | 17.36% | 16.89% | 16.40% | 15.76% | 15.16% | 15.44% | 15.17% | 15.16% | 15.29% | 16.07% | 15.26% | 12.98% | 5.96% | 9.71% | 9.42% | 11.23% | 11.61% | 11.91% | 12.63% | 12.80% | 11.77% | 10.43% | 8.81% | 5.70% |

| Income Tax Expense | 674.70M | 639.19M | 649.49M | 578.88M | 483.54M | 414.11M | 298.79M | 644.62M | 671.71M | 642.37M | 592.97M | 571.20M | 522.61M | 475.27M | 422.19M | 376.70M | 365.78M | 340.48M | 332.76M | 302.20M | 339.70M | 315.40M | 263.00M | 111.50M | 167.60M | 143.00M | 136.20M | 117.50M | 99.80M | 89.50M | 76.60M | 56.30M | 41.20M | 28.10M | 15.00M |

| Net Income | 2.66B | 2.53B | 2.43B | 2.17B | 1.73B | 1.62B | 1.34B | 1.28B | 1.24B | 1.16B | 1.07B | 1.02B | 930.37M | 848.97M | 738.31M | 657.05M | 641.61M | 595.67M | 569.28M | 571.02M | 566.20M | 517.60M | 428.15M | 175.53M | 267.59M | 244.80M | 227.90M | 195.00M | 167.20M | 138.80M | 116.40M | 86.90M | 63.30M | 44.00M | 23.30M |

| Net Income Ratio | 14.40% | 14.48% | 14.95% | 14.84% | 13.72% | 13.63% | 11.92% | 11.76% | 11.67% | 11.39% | 11.29% | 11.11% | 10.81% | 10.52% | 10.03% | 9.64% | 9.84% | 9.65% | 9.57% | 10.00% | 10.04% | 9.48% | 8.04% | 3.64% | 5.97% | 5.95% | 7.03% | 7.25% | 7.46% | 7.68% | 7.72% | 7.14% | 6.32% | 5.38% | 3.47% |

| EPS | 153.82 | 136.60 | 120.83 | 97.60 | 73.62 | 64.78 | 49.59 | 45.05 | 41.52 | 36.76 | 32.16 | 28.28 | 24.04 | 19.91 | 15.23 | 11.89 | 10.14 | 8.62 | 7.57 | 7.27 | 7.11 | 5.83 | 4.10 | 1.56 | 2.20 | 1.64 | 1.50 | 1.29 | 1.13 | 0.93 | 0.78 | 0.59 | 0.43 | 0.33 | 0.19 |

| EPS Diluted | 149.55 | 132.36 | 117.19 | 95.19 | 71.93 | 63.43 | 48.77 | 44.07 | 40.70 | 36.03 | 31.57 | 27.79 | 23.48 | 19.47 | 14.97 | 11.73 | 10.04 | 8.53 | 7.50 | 7.18 | 6.56 | 5.34 | 4.00 | 1.54 | 2.00 | 1.63 | 1.48 | 1.28 | 1.11 | 0.93 | 0.78 | 0.59 | 0.43 | 0.33 | 0.19 |

| Weighted Avg Shares Out | 17.31M | 18.51M | 20.11M | 22.24M | 23.54M | 24.97M | 26.97M | 28.43M | 29.89M | 31.56M | 33.27M | 35.94M | 38.70M | 42.63M | 48.49M | 55.28M | 63.30M | 69.10M | 75.24M | 78.53M | 86.43M | 97.31M | 104.45M | 112.83M | 137.86M | 149.27M | 151.93M | 151.16M | 147.96M | 149.25M | 149.23M | 147.29M | 147.21M | 133.33M | 122.63M |

| Weighted Avg Shares Out (Dil) | 17.80M | 19.10M | 20.73M | 22.80M | 24.09M | 25.50M | 27.42M | 29.07M | 30.49M | 32.21M | 33.88M | 36.58M | 39.63M | 43.60M | 49.30M | 55.99M | 63.88M | 69.84M | 75.86M | 79.51M | 86.43M | 97.31M | 107.11M | 113.80M | 137.86M | 150.18M | 153.99M | 152.34M | 150.63M | 149.25M | 149.23M | 147.29M | 147.21M | 133.33M | 122.63M |

AutoZone Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Stocks to watch next week: Micron, Accenture, Costco, AutoZone

Unveiling AutoZone (AZO) Q4 Outlook: Wall Street Estimates for Key Metrics

AutoZone (AZO) Stock Declines While Market Improves: Some Information for Investors

AutoZone (AZO) Stock Dips While Market Gains: Key Facts

Tradepulse Power Inflow Alert: Autozone Inc. Has Power Inflow Signal At 10:29 AM EDT

3 Stocks That Could See Rising Demand Based on Latest Jobs Data

AutoZone, Inc. (AZO) Is a Trending Stock: Facts to Know Before Betting on It

AutoZone (AZO) Ascends But Remains Behind Market: Some Facts to Note

AutoZone (AZO) Is Considered a Good Investment by Brokers: Is That True?

Source: https://incomestatements.info

Category: Stock Reports