See more : Bentley Systems, Incorporated (BSY) Income Statement Analysis – Financial Results

Complete financial analysis of Bar Harbor Bankshares (BHB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Bar Harbor Bankshares, a leading company in the Banks – Regional industry within the Financial Services sector.

- Uday Jewellery Industries Limited (UDAYJEW.BO) Income Statement Analysis – Financial Results

- PT Garuda Maintenance Facility Aero Asia Tbk (GMFI.JK) Income Statement Analysis – Financial Results

- Silver Bull Resources, Inc. (SVBL) Income Statement Analysis – Financial Results

- Fleetwood Limited (FWD.AX) Income Statement Analysis – Financial Results

- Heritage Global Inc. (HGBL) Income Statement Analysis – Financial Results

Bar Harbor Bankshares (BHB)

About Bar Harbor Bankshares

Bar Harbor Bankshares operates as the holding company for Bar Harbor Bank & Trust that provides commercial, lending, retail, and wealth management banking services. It accepts various deposit products, including interest-bearing and non-interest-bearing demand accounts, savings accounts, time deposits, and money market deposit accounts, as well as certificates of deposit. The company also provides commercial real estate loans, such as multi-family, commercial construction and land development, and other commercial real estate classes; commercial and industrial loans, including loans to commercial and agricultural businesses, and tax exempt entities; residential real estate loans consists of mortgages for 1-4 family housing; and consumer loans comprises home equity loans, lines of credit, auto, and other installment lending. In addition, it provides life insurance, annuity, and retirement products, as well as financial planning services; and third-party investment and insurance services. Further, the company offers trust and estate administration, wealth advisory, and investment management services to individuals, businesses, not-for-profit organizations, and municipalities; and 401K plan, financial, estate and charitable planning, investment management, family office, municipal, and tax services. It operates 53 locations across Maine, New Hampshire, and Vermont. The company was founded in 1887 and is based in Bar Harbor, Maine.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 150.41M | 149.00M | 137.83M | 142.14M | 118.88M | 118.82M | 118.14M | 57.23M | 53.81M | 51.57M | 46.65M | 44.68M | 41.18M | 39.17M | 39.30M | 33.62M | 28.83M | 28.57M | 28.27M | 26.95M | 26.84M | 25.99M | 25.66M | 24.78M | 24.00M | 22.90M | 21.80M | 21.20M | 1.01M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 452.00K | 429.00K | 384.00K | 367.00K | -2.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 150.41M | 149.00M | 137.83M | 142.14M | 118.88M | 118.82M | 118.14M | 57.23M | 53.36M | 51.14M | 46.27M | 44.31M | 43.98M | 39.17M | 39.30M | 33.62M | 28.83M | 28.57M | 28.27M | 26.95M | 26.84M | 25.99M | 25.66M | 24.78M | 24.00M | 22.90M | 21.80M | 21.20M | 1.01M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 99.16% | 99.17% | 99.18% | 99.18% | 106.79% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 52.52M | 48.66M | 49.97M | 51.80M | 47.64M | 44.18M | 43.88M | 20.58M | 18.72M | 17.54M | 15.92M | 14.88M | 14.22M | 13.55M | 11.93M | 10.83M | 9.37M | 9.29M | 9.80M | 9.34M | 9.83M | 9.24M | 8.53M | 7.94M | 6.83M | 6.00M | 6.00M | 5.70M | 5.33M |

| Selling & Marketing | 1.70M | 1.56M | 1.54M | 1.39M | 1.87M | 1.74M | 945.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 75.75M | 50.22M | 51.51M | 53.18M | 49.51M | 44.18M | 43.88M | 20.58M | 18.72M | 17.54M | 15.92M | 14.88M | 14.22M | 13.55M | 11.93M | 10.83M | 9.37M | 9.29M | 9.80M | 9.34M | 9.83M | 9.24M | 8.53M | 7.94M | 6.83M | 6.00M | 6.00M | 5.70M | 5.33M |

| Other Expenses | 0.00 | -22.99M | -140.72M | -153.67M | -141.56M | 70.82M | 55.12M | 28.42M | 24.28M | 23.47M | 24.08M | 26.12M | 2.80M | 30.45M | 34.07M | 38.17M | 38.63M | 33.71M | 25.21M | -16.88M | -18.50M | -16.14M | -13.27M | -7.89M | -7.80M | -7.20M | -6.70M | -6.00M | 12.78M |

| Operating Expenses | 75.75M | 1.56M | -89.21M | -100.49M | -92.05M | 115.00M | 99.00M | 49.00M | 43.00M | 41.00M | 40.00M | 41.00M | 17.02M | 44.00M | 46.00M | 49.00M | 48.00M | 43.00M | 35.00M | -7.55M | -8.67M | -6.91M | -4.74M | 49.00K | -970.00K | -1.20M | -700.00K | -300.00K | 18.11M |

| Cost & Expenses | 75.75M | 1.56M | -89.21M | -100.49M | -92.05M | 115.00M | 99.00M | 49.00M | 43.45M | 41.43M | 40.38M | 41.37M | 14.22M | 44.00M | 46.00M | 49.00M | 48.00M | 43.00M | 35.00M | -7.55M | -8.67M | -6.91M | -4.74M | 49.00K | -970.00K | -1.20M | -700.00K | -300.00K | 18.11M |

| Interest Income | 174.18M | 126.53M | 110.80M | 126.10M | 135.39M | 127.45M | 116.07M | 56.62M | 55.22M | 53.72M | 50.75M | 50.84M | 50.91M | 51.14M | 54.37M | 53.59M | 51.81M | 46.15M | 37.20M | 31.92M | 30.58M | 32.35M | 33.89M | 35.33M | 31.95M | 29.20M | 28.50M | 27.50M | 26.15M |

| Interest Expense | 56.51M | 12.85M | 15.23M | 26.92M | 45.58M | 36.57M | 23.91M | 12.11M | 10.39M | 9.91M | 11.66M | 13.87M | 16.52M | 19.43M | 21.09M | 26.40M | 28.91M | 24.45M | 15.34M | 11.55M | 11.08M | 12.78M | 15.75M | 17.62M | 13.80M | 12.00M | 11.70M | 11.30M | 10.62M |

| Depreciation & Amortization | 0.00 | 5.18M | 5.54M | 5.80M | 5.00M | 4.53M | 4.37M | 1.64M | 1.80M | 1.72M | 1.60M | 1.33M | 2.82M | 1.08M | 981.00K | 323.00K | 1.37M | 1.63M | 2.32M | 2.88M | 1.40M | 1.13M | 1.39M | 1.29M | 980.00K | 1.20M | 1.00M | 0.00 | 588.15K |

| EBITDA | 0.00 | 61.22M | 55.23M | 47.45M | 31.84M | 45.03M | 43.09M | 22.45M | 22.92M | 22.25M | 19.97M | 0.00 | 0.00 | 17.07M | 15.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 48.90% | 35.96% | 30.02% | 23.29% | 68.68% | 60.02% | 60.40% | 61.90% | 62.35% | 67.81% | 72.97% | 84.60% | 90.14% | 92.64% | 112.54% | 140.30% | 125.44% | 94.30% | 82.66% | 72.93% | 77.78% | 86.93% | 105.41% | 100.04% | 100.00% | 101.38% | 98.58% | 1,952.56% |

| Operating Income | 74.66M | 71.93M | 48.63M | 41.65M | 26.83M | 77.07M | 70.18M | 32.92M | 31.51M | 30.43M | 30.04M | 31.28M | 32.02M | 34.23M | 35.43M | 37.52M | 39.08M | 34.21M | 24.34M | 19.40M | 18.17M | 19.08M | 20.92M | 24.83M | 23.03M | 21.70M | 21.10M | 20.90M | 19.12M |

| Operating Income Ratio | 49.64% | 48.28% | 35.28% | 29.30% | 22.57% | 64.86% | 59.41% | 57.53% | 58.55% | 59.01% | 64.39% | 70.00% | 77.76% | 87.38% | 90.14% | 111.58% | 135.55% | 119.74% | 86.09% | 71.99% | 67.70% | 73.42% | 81.54% | 100.20% | 95.96% | 94.76% | 96.79% | 98.58% | 1,894.28% |

| Total Other Income/Expenses | -17.55M | -19.38M | -20.51M | -22.90M | -23.80M | -15.76M | 592.00K | -8.46M | -6.22M | -8.07M | -7.66M | -853.00K | -2.22M | -898.00K | -2.74M | -1.12M | -330.00K | 0.00 | -19.00K | 87.00K | -11.08M | -12.53M | -15.75M | -17.62M | -13.80M | -12.00M | -11.70M | -11.30M | -10.62M |

| Income Before Tax | 57.12M | 54.85M | 48.63M | 41.65M | 26.83M | 40.50M | 42.62M | 20.81M | 21.12M | 20.53M | 18.37M | 17.41M | 15.51M | 14.79M | 14.34M | 11.12M | 10.18M | 9.76M | 9.01M | 7.86M | 7.10M | 6.55M | 5.17M | 7.22M | 9.23M | 9.70M | 9.40M | 9.60M | 8.49M |

| Income Before Tax Ratio | 37.97% | 36.81% | 35.28% | 29.30% | 22.57% | 34.08% | 36.08% | 36.36% | 39.25% | 39.80% | 39.39% | 38.97% | 37.65% | 37.77% | 36.49% | 33.06% | 35.29% | 34.17% | 31.85% | 29.15% | 26.45% | 25.22% | 20.16% | 29.12% | 38.46% | 42.36% | 43.12% | 45.28% | 841.63% |

| Income Tax Expense | 12.27M | 11.29M | 9.33M | 8.41M | 4.21M | 7.56M | 16.63M | 5.88M | 5.97M | 5.91M | 5.19M | 4.94M | 4.46M | 4.13M | 3.99M | 3.38M | 3.02M | 2.89M | 2.58M | 2.12M | 1.89M | 1.74M | 1.66M | 2.42M | 3.01M | 3.10M | 3.00M | 2.90M | 2.62M |

| Net Income | 44.85M | 43.56M | 39.30M | 33.24M | 22.62M | 32.94M | 25.99M | 14.93M | 15.15M | 14.61M | 13.18M | 12.47M | 11.04M | 10.66M | 10.35M | 7.73M | 7.16M | 6.88M | 6.42M | 5.73M | 5.21M | 4.57M | 3.51M | 4.80M | 6.23M | 6.60M | 6.40M | 6.70M | 5.88M |

| Net Income Ratio | 29.82% | 29.23% | 28.51% | 23.39% | 19.03% | 27.72% | 22.00% | 26.09% | 28.16% | 28.34% | 28.26% | 27.90% | 26.82% | 27.22% | 26.33% | 22.99% | 24.82% | 24.08% | 22.72% | 21.27% | 19.40% | 17.56% | 13.68% | 19.36% | 25.93% | 28.82% | 29.36% | 31.60% | 582.45% |

| EPS | 2.96 | 2.90 | 2.63 | 2.18 | 1.46 | 2.13 | 1.71 | 1.65 | 1.69 | 1.65 | 1.49 | 1.42 | 1.27 | 1.18 | 1.42 | 1.17 | 1.05 | 1.00 | 0.93 | 0.82 | 0.74 | 0.63 | 0.48 | 0.64 | 0.80 | 0.43 | 0.42 | 0.43 | 0.76 |

| EPS Diluted | 2.95 | 2.88 | 2.61 | 2.18 | 1.45 | 2.12 | 1.70 | 1.63 | 1.67 | 1.63 | 1.48 | 1.41 | 1.27 | 1.16 | 1.39 | 1.14 | 1.02 | 0.98 | 0.90 | 0.80 | 0.72 | 0.62 | 0.47 | 0.64 | 0.80 | 0.43 | 0.42 | 0.43 | 0.76 |

| Weighted Avg Shares Out | 15.14M | 15.04M | 14.97M | 15.25M | 15.54M | 15.49M | 15.18M | 9.07M | 8.97M | 8.89M | 8.85M | 8.78M | 8.69M | 8.51M | 6.56M | 6.62M | 6.83M | 6.86M | 6.92M | 6.97M | 7.03M | 7.23M | 7.38M | 7.56M | 7.74M | 15.50M | 7.74M | 8.18M | 7.71M |

| Weighted Avg Shares Out (Dil) | 15.20M | 15.11M | 15.05M | 15.27M | 15.59M | 15.56M | 15.29M | 9.14M | 9.09M | 8.96M | 8.89M | 8.82M | 8.73M | 8.61M | 6.71M | 6.77M | 7.00M | 7.02M | 7.13M | 7.22M | 7.21M | 7.34M | 7.45M | 7.56M | 7.78M | 15.50M | 7.74M | 8.18M | 7.71M |

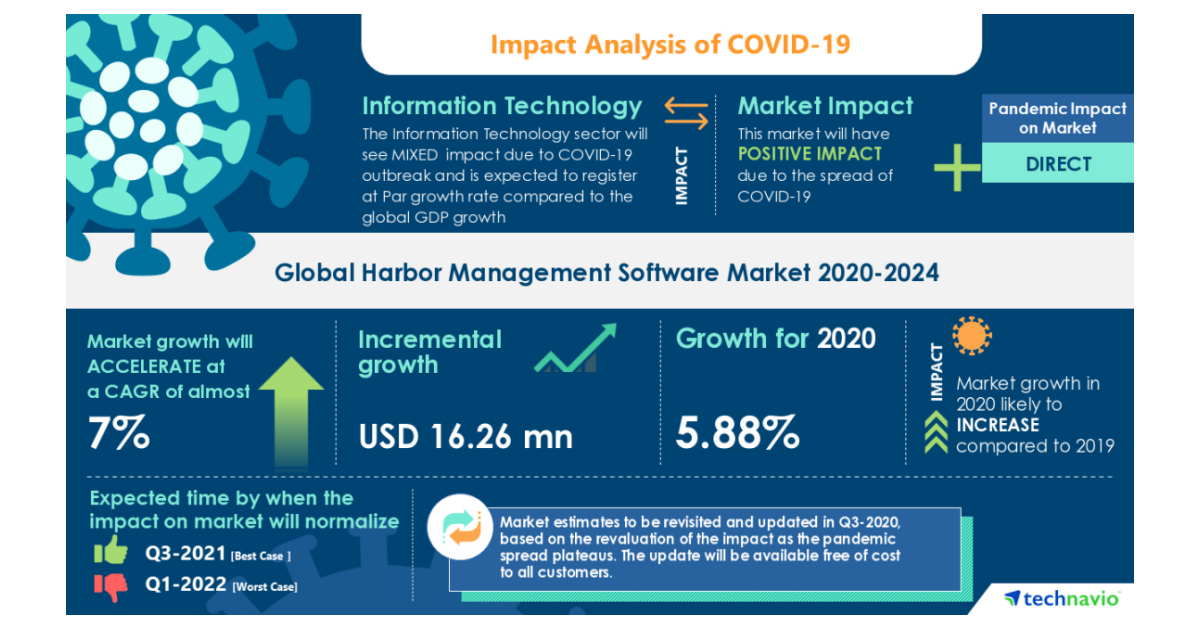

Harbor Management Software Market- Roadmap for Recovery from COVID-19|Need to Improve Business Efficiency to Boost the Market Growth | Technavio

New Post From Your Neighbor

New Post From Your Neighbor

Harbor Custom Development, Inc. Signs Purchase and Sale Agreement for 9.6 Acres Designated for 144 Unit Multi-Family Rental Project

New Post From Your Neighbor

New Post From Your Neighbor

Head-To-Head Review: Harbor Custom Development (NASDAQ:HCDI) versus Toll Brothers (NASDAQ:TOL)

New Post From Your Neighbor

New Post From Your Neighbor

Harbor Custom Development, Inc. Enters First-Time Home Buyer Market in Bremerton, Washington

Source: https://incomestatements.info

Category: Stock Reports